Market Background

The six month period under review started against a backdrop of the early optimism at the start of the year around the outlook for inflation and growth being challenged. Entering the year, market hopes had grown that 2023 might turn out to produce a ‘goldilocks’ year for economic growth. In this environment growth and inflation are neither too hot nor too cold, allowing central bankers to ease monetary tightening (interest rate rises) without the economy having already fallen into recession in order to do so. By the end of January, however, this narrative had already started to break down as growth in the US economy, in particular, was proving stronger than expected despite the rapid succession of interest rate rises already announced by the Federal Reserve. Whilst there is always a lag between an interest rate rise and the point at which the impact of that monetary tightening is felt in the economy, the last six-month period provided central bankers with limited firm evidence either that domestically generated inflation in the economy was falling at a sufficient pace or that the engines of economic growth were cooling down fast enough. As a result, markets have had to reassess both the point at which they expect interest rates to peak as well as the length of time interest rates are likely to remain at elevated levels.

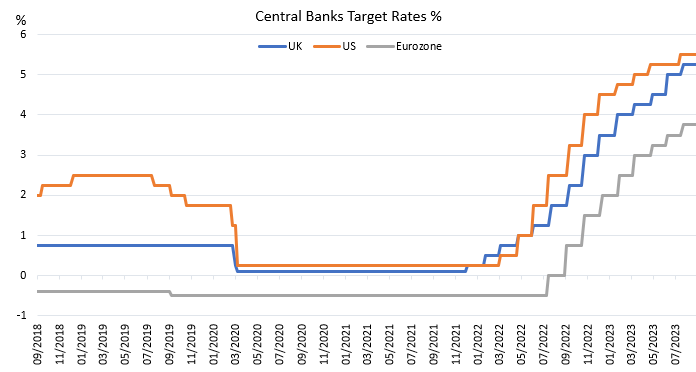

Not all economies have been running at the same speed, however, with inflation proving stickier in the UK whereas the US has been more successful in seeing its efforts to tame inflation rewarded over the period. Despite the volatility of monthly sets of economic data and the danger of placing too much emphasis on a single month’s information, markets have been keenly watching any news and reacting skittishly to anything that supports or dents hopes that inflation might be being brought back under control. The US Federal reserve has been the most aggressive central bank to increase interest rates this cycle and entered the period with interest rates already at 4.75%. At the start of the period the economic data gave mixed messages as to whether measures to curb inflation were biting. Whilst headline inflation had peaked in June 2022 at 9.1% and had fallen to 6.0% by February this year, core inflation (which strips out more volatile energy and food inflation) remained persistently high at 5.5%, well above the 2% level that US federal Reserve target when setting interest rates.

Source: Factset August 2023

Whilst Q1 economic growth came in weaker than expected, with clear signs of weakness in business confidence and the manufacturing sector, an unexpected increase in core inflation in March extinguished any hopes that the pace of monetary tightening could be eased. Buoyant consumer spending, helped by drawing down excess savings built up over Covid, and jobs growth increasing at nearly double the rate expected in June failed to provide the evidence needed that the domestic drivers of inflation were abating. Towards the end of the period, however, there was broader support to the counter-argument that tightening rates further might risk tipping the economy into recession and that a pause was warranted in order to let the lagged impact of previous policy action work its way through the system.

In August, US business activity surveys indicated that there had been a sharp recent decline in activity and that the global economy was teetering on the edge of stagnation. Whereas previous weakness had been concentrated in manufacturing, it became clear that weakness had started to spread to services sector of the economy too. Over the six-month period the Federal Reserve has increased interest rates a further 0.75% to 5.5%, the level where markets now expect interest rates to peak and remain through to the end of 2023. Notwithstanding the ebbs and flows in the market’s views around the strength of the economy during the period, this was broadly the same level expected at the start of the period. This masks significant volatility over the period, however, as during March investors digested the collapse of two regional US banks and the hurried merger of Credit Suisse with UBS in Europe, as the fastest tightening of monetary policy in decades exposed fractures in the global banking system.

The bank had then invested those deposits into long-dated, but theoretically ‘low-risk’ government bonds. Their value in the market had fallen to reflect the relative unattractiveness of the yield they had been issued at purchase as interest rates had risen. None of this would have mattered had the bank been able to hold these investments to maturity at which point it is highly likely they would have been repaid in full by the US government, however, large theoretical losses on the bank’s balance-sheet when applying tradeable market prices to these holdings caused the deposit base to panic that their cash was no longer safe and demand repayment.

In order to do so, the bank was forced to sell these assets and thereby crystallise a loss which turned a liquidity crisis into a capital crisis. This set of circumstances is relatively unique to the regional US banking sector, which has enjoyed a relatively lighter-touch regulatory framework over the last decade, so there is limited read-across to larger US and European banks where there has been a significant overhaul of the global banking regulation since 2008, with significant improvements in the amount of capital banks are required to hold as well as their leverage and their liquidity. In some ways it was more concerning, therefore, that Credit Suisse, a bank that has suffered from a series of recent scandals but which had good liquidity, a more stable deposit base and plenty of capital and support from the Swiss central bank over the course of a weekend was forced into an emergency merger with its national rival. Furthermore, the way the Credit Suisse merger was enacted caused some turmoil in a particular part of the bond market that emerged immediately post the financial crisis. A specific type of bank debt, called Additional Tier 1 bonds (or AT1), was designed to convert into equity in the event the bank looked as if it was no longer viable or its capital position fell below a pre-determined level. The convention has always been that bond investors sit in a senior position in the hierarchy to equity investors, so losses would only be felt by bondholders once equity investors have already been wiped out. This was not the case at Credit Suisse with equity holders retaining some value whilst bond holders of these AT1 bonds lost everything. Although both the Bank of England and the European Central Bank were quick to state they disagreed with the Swiss regulatory approach, this caused specific weakness in this part of the bond market over the period.

Despite this volatility at the start of the period, investors became more relaxed during the course of the subsequent five months that central banks would not need to deviate from their prior course of interest rate hikes and that rates were likely to peak at the same level where expectations started at the end of February. Where expectations in the US have changed, is around the length of time interest rates are likely to remain at elevated levels. Previously, investors expected interest rates to start coming down in 2024. Whilst the market still expects interest rates to fall in 2024, expectations are now for them to end 2024 c.0.5% higher than previously hoped.

Inflation has fallen at different rates in different countries, with the US leading the way, the Eurozone following behind and the UK standing out as suffering from more persistent inflation. The broad picture for interest rates in the Eurozone was similar to the US. Despite intra-period volatility, investor expectations of where they now see interest rates ending the year have changed little since February, albeit with rates having had to rise faster than in the US as the European Central Bank plays catch up against the Federal Reserve, which has already tightened more aggressively. Interest rates have risen 1.25% over the period and investors now expect the latest 0.25% rate rise in September to be the last.

Source: Factset August 2023

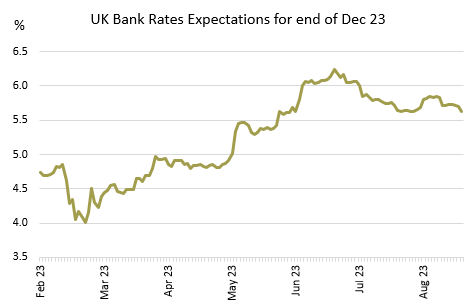

The UK, however, has seen a significant reassessment by investors as to how much further tightening was necessary to curb inflation over the last six months. Whereas at the start of the period investors hoped interest rates would only have to rise a further 0.75% from 4%, stronger inflation data in May and June, led to a significant reassessment from the Bank of England both of the economic outlook and consequently the direction of future interest rates. In May, core inflation (which excludes more volatile elements) rose from 6.2% to 6.8% (versus expectations of a fall to 6.0%). This represented its highest level since 1992 and lead to a sharp repricing of government debt in bond markets.

The services sector of the economy has continued to perform stronger than expected and wage growth has continued to surprise positively, both of which forced the Bank of England to admit their forecast of a shallow but protracted recession was well wide of the mark. At the worst moment in the period, investors forecast rates would have to rise above 6% by December this year, higher than was expected in the aftermath of the “mini-budget” in September 2022. Whilst these fears have receded somewhat, investors now expect one further interest rate rise this year to 5.5% and for interest rates to end next year 0.75% higher than they thought they would six months ago

Whilst the broad outlook for economic growth has been more positive than feared, there has been one notable pocket of weakness during the period. China’s economy has failed to rebound as strongly as hoped following the relaxation of Covid restrictions, with trade exports and weakness in the property sector mainly to blame. Lending rates were cut for the first time in a year as authorities attempted to reignite economic growth although so far stimulus measures have not been sufficiently large to convince investors that growth will rebound quickly.

Given the backdrop above of heightened volatility and the expectation that interest rates are likely to stay restrictively high for longer, it is perhaps surprising that equity market performance was as strong as it has been in the first half of the year. With the exception of the UK and China, global equity markets have delivered positive performance over the period. The US market was notably strong, driven by a concentrated number of large technology companies fuelled by enthusiasm around Artificial Intelligence (AI). The dispersion in performance between global growth companies and value companies was marked and a wide gulf has re-opened in valuations between these two segments of global equity markets. Global bond markets were neutral over the period, with high income yields offsetting moderate capital losses. UK bond markets, however, were negative reflecting the expectation that interest rates would need to move materially higher to curb inflation. The performance of commodity markets diverged, with those commodities most exposed to demand from China, such as copper and iron ore, seeing prices fall whereas energy prices (oil & gas) rose, reflecting stronger than expected economic growth and a cut in supply from the Organisation of the Petroleum Exporting Countries (OPEC).

Performance

Given the market backdrop outlined above, our focus on income generation and the value bias of our process, the fund’s performance was weak over the period. Over the six months of this report, to 31st August 2023, TB Wise Multi-Asset Income made a total return of -5.0% (B Income Shares). Over this time, we underperformed the Consumer Price Index (CPI), which measures inflation and as explained above rose strongly by 2.35%. We underperformed our comparator benchmark, the IA Mixed Investment 40-85% Sector, which fell 0.2%. Over 5 years as per our objective, on a total return basis, the fund has risen 14.3% compared to a rise of 22.9% for CPI, although this remains broadly in line with the comparator benchmark, which has risen 14.9% over the same time period. The distribution per share for the six-month period rose strongly over the period at 3.57p compared to 3.24p for the same period last year. This represents strong growth in the distribution year on year of over 10% and we expect the full year distribution to grow strongly in excess of CPI.

For more fund performance, please see the latest factsheet. Figures quoted refer to the past and that past performance is not a reliable indicator of future results

TB Wise Multi-Asset Income – August factsheet (wise-funds.co.uk)

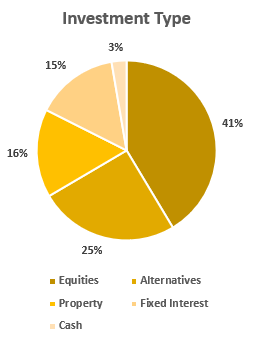

It is disappointing to report on a negative period of performance for the fund. Having rebounded strongly after the Covid pandemic, the headwind we have faced as interest rates normalise from abnormally low levels has proved particularly challenging, in spite of our initial caution around low yields and our disciplined focus on valuation. Before discussing individual contributors and detractors, a large driver of our negative performance this period was discount widening of the investment trusts we hold in the Fund. We have talked in detail over the years about how performance in investment trusts tends to be amplified because the excitement/fear about the underlying assets they invest in can also translate into tighter/wider discounts, thus compounding the rise/fall of those assets. Over time we expect these discount anomalies to normalise and to be a source of incremental returns for investors, however, over the course of the last six months many of the trusts in which we invest have seen those discounts widen. During the period, fears of higher interest rates for longer in the UK led to increased recessionary concerns which hurt domestically oriented UK equities. Whilst these concerns impacted our UK equity funds and domestic financial holdings directly, all of our investment trusts (74% of the portfolio) are listed there. Moreover, the trusts and assets we tend to favour are not in the largest companies, because we find many more pricing opportunities away from their larger peers. Over the period, the UK medium-sized companies index underperformed its large companies’ counterpart by 1.4%, due of its greater exposure to domestic companies.

Many of our investment trusts form part of that index and, as is often the case in periods of market weakness, were sold indiscriminately as part of that basket of names, leading to discounts being driven wider. Looking at the entire universe of investment trusts in the UK, discounts widened by ~2.6% between the end of February and the end of August 2023. This headline figure hides some greater moves, such as Property investment trusts discounts which widened by ~8% and Infrastructure trusts, which widened by ~13%. The more interest rates sensitive the strategy, the more impacted they were, but the impact was widespread, creating a headwind for our approach.

At a holding specific level, our exposure to financials whether via our direct equity holdings or through our holding in Polar Capital Global Financials caused the largest negative impact for the Fund. Fears that the benefit to revenues from higher rates could be offset by higher impairments as borrowers struggle to cope saw valuations fall across the sector. Despite the issues around the collapse of the US regional banks appearing to be contained to that area as discussed above, the sector was marked down more broadly and has not yet fully rebounded from its fall in March.

Polar Capital Global Financials, Legal & General, Paragon and Vanquis Banking Group all fell during the period. News flow out of these companies did not necessarily reflect the weakness in share prices. Paragon, as an example, a lender to professional UK buy-to-let landlords, announced a strong trading performance with robust new business flows and resilient portfolio credit performance despite volatility in financial markets and higher interest rates, yet saw its shares fall 10% over the six-month period. Encouragingly corporate buyers have been willing to look through short-term economic uncertainty and take advantage of the long-term value on offer in many areas. Over the period, Numis, a broker to mid and smaller sized UK companies, which has been operating in cyclically weak investment banking and trading markets for the last eighteen months, received a bid approach from Deutsche Bank at a 70% premium.

We saw general weakness in many of our equity fund holdings, particularly those with a focus on the UK or Asian markets or where the manager adopts a value rather than growth approach to their investment. Our UK funds Aberforth Smaller Companies, Fidelity Special Values, Man GLG Income and Temple Bar all fell over the period, with performance compounded by discount widening. International value-focussed managers, Schroder Global Equity Income and Middlefield Canadian, were similarly weak. Slowing Chinese growth proved a headwind for many of our funds with Asian exposure even if direct exposure to China is limited. Aberdeen Asian Income, Murray International fell over the period as did both our commodity funds, Blackrock World Mining & Blackrock Energy & Resources. The performance of the latter was particularly frustrating as its discount widened by 8%. There were pockets of positive performance with Blackrock Frontiers and CC Japan Income & Growth providing welcome diversification against the broader backdrop of equity weakness. Given our focus on income generation and valuation, we had limited exposure to the technology, growth theme that dominated equity market performance.

As interest rates have risen in the UK, sectors that reference government bond yields when considering valuation have also come under pressure. With persistently strong wage growth data and core inflation remaining high, real bond yields rose. Real yields are the return investors expect after stripping out the negative impact of expected inflation. This proved a difficult backdrop for both our property and infrastructure names which suffer when bond yields rise. Over the longer term, this negative headwind should be offset if the cause of higher yields (namely inflation) is captured either in higher inflation-linked regulatory revenues in the case of infrastructure or via higher property rents. However, when yields rise over and above the change in inflation expectations, this means investors have increased the underlying return they demand from those assets. This explains the discount widening in the property and infrastructure sectors but leaves both sectors now offering very attractive yields with an element of inflation protection. Despite their defensive and predictable revenue streams, the government backed nature of much of their revenue and its protection against inflation, our infrastructure holdings were the worst performing holdings. HICL Infrastructure, Pantheon Infrastructure, Ecofin Global Utilities and Infrastructure and GCP Infrastructure all fell more than 10% over the period. Whilst the property sector shares many of the valuation attributes to infrastructure in that investors consider the yield premium they can derive from these assets compared to government and corporate bonds, they differ in that inflation linkage of revenues is less direct and comes over time in the form of rent reviews. Furthermore, revenues are more cyclical and less underpinned by government contracts. It was notable, therefore that whilst the broader sector was weak, the performance of our property holdings was very dispersed with some of our best and worst performing holdings over the period in this sector. Abrdn Property Income, Urban Logistics, Impact Healthcare REIT and TR Property underperformed despite being exposed to strong rental growth in the end markets to which they are most exposed, such as industrial property and care homes. Once very significant discounts to net asset value are factored in, the implied yields on the underlying assets now look highly attractive whilst there appears to be limited stress from overly stretched indebted balance-sheets. Whilst discounts to net asset value can imply private market valuations are out of date and it is only a matter of time until they catch up with where public markets have already got to, they also can reflect the fact public markets have become overly pessimistic and do not reflect the underlying value of those businesses. Two holdings within the portfolio accepted this to be the case and came under pressure to sell assets in the market in order to prove up their asset values. Both Palace Capital and Ediston Property, two of our larger property holdings, undertook such strategic reviews and progress in soliciting bids for assets close to net asset value saw their shares respond strongly over the period.

Similarly wide discounts existed in the Private Equity sector and another strong performer during the period was CT Private Equity. Whilst underlying asset performance has been resilient, performance has mainly been driven by discount narrowing. Investor focus has shifted from concerns over valuation and leverage to recognising the quality of the underlying companies and accepting discounts were overly pessimistic. This view was helped by the decision of a large competitor fund committing to a significant ongoing repurchase of shares rather than reinvestment into new holdings given the compelling investment logic of such a shift in asset allocation.

Finally, our fixed interest exposure (with the exception of GCP Infrastructure mentioned above) reasserted its more defensive attributes. Twenty Four Income delivered strong positive performance, although this was tempered by the fund moving from a small premium to a discount and some broader market weakness emanating from the Credit Suisse AT1 issue above. Starwood Real Estate Finance has made its first distribution of capital since its decision to cease new lending and return the proceeds to investors at asset value as their underlying loans are repaid and the Vanquis Banking Group bond matured at par as expected.

Allocation Changes

Given the attractive yields available in more defensive asset classes over the course of the last six months, coupled with an expectation either that we are getting closer to the point at which interest rates are peaking or that those defensive characteristics will become more attractive should growth weaken from here, we have initiated two new holdings in the core infrastructure sector, HICL and International Public Partnerships. For much of the last decade these trusts have traded at significant premiums to net asset value on account of the relative attractiveness of their yields when compared to government bonds. These have now moved to discounts of over 20% and the implied yields on these once again look very attractive. Similarly, we have added to our holding in Ecofin Global Utilities and Infrastructure, a fund which invests in equities of utility and infrastructure companies.

In a similar vein, we added exposure to fixed income as yields of government and corporate bonds and asset backed securities (eg mortgages) look increasingly attractive given the movement in base rates globally. We increased our holding in the Twenty Four Income Fund, a fund which invests in less liquid, higher yielding UK and European asset backed securities, as well as topping up our holding in the Twenty Four Strategic Income Fund, an unconstrained fund that seeks value from across the global bond markets.

Within our property holdings, we exited our holding in Palace Capital, taking advantage of strong share price performance in response to the updated strategy and a company share buyback, as we were disappointed by the management remuneration scheme accompanying the proposal to realise the asset value of the company. Given attractive discounts to asset value elsewhere, better liquidity and more favourable subsector exposure, we switched our holding into TR Property and Urban Logistics.

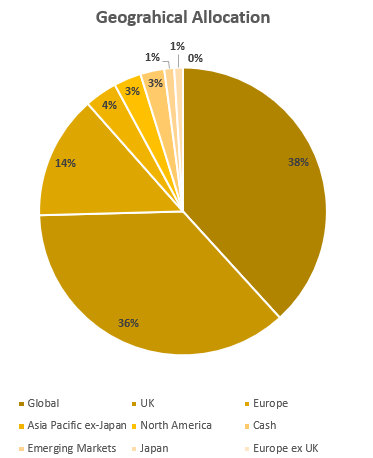

Breakdown of portfolio by asset types as of 31st August 2023

We have reduced risk within the portfolio by further selling down our direct equity holdings. Chesnara, Henry Boot, Numis and Vanquis Banking Group were all sold. Proceeds were partially reinvested into equity funds with attractive underlying valuations that traded at wide discounts, such as Fidelity Special Values, International Biotechnology and Polar Capital Global Financials. We also initiated a new holding within the private equity sector, ICG Enterprise Trust, a defensively run portfolio that traded on a historically wide discount. This position was partially funded from CT Private Equity which has seen very strong relative performance.

Breakdown of portfolio by revenue as of

31st August 2023

Outlook

The US, Eurozone and UK have undergone the steepest interest rate tightening cycle since the 1980s and the next six months will be critical to determine whether sufficient policy action has already been taken to tame persistently high levels of inflation. Investors increasingly believe that the headwind of ever-higher global interest rates is abating yet it remains to be seen whether historic policy action has already been effective in cooling the economy or whether rates will have to stay at elevated levels for longer. Inflation is a backward looking metric and there are some encouraging signs in manufacturing and services survey data as well as within the labour market that inflationary pressures are set to cool. The traditional lag between interest rates rising and inflation coming down has been disrupted this cycle by high levels of consumer savings built up over the Covid period which has allowed consumer demand to stay stronger than economists had expected. This buffer, however, is now nearly exhausted so a more normal relationship between higher rates and economic growth should re-establish itself. Given so much uncertainty, however, there is a risk of policy error and trying to engineer the perfect type of economic slowdown is extremely difficult given the timing lag between taking the medicine and seeing its effect. There is a risk, therefore, that raising interest rates now would be like taking a second painkiller too quickly, thinking the first one had done nothing to alleviate the pain of a hangover. The consensus is currently that economies are likely to slow but not too aggressively, commonly referred to as a ‘soft’ as opposed to a ‘hard’ landing.

Given the movement in bond yields over the period, yields for this asset class look increasingly attractive and provide some protection even if inflation proves persistent. Should the economy slow more than expected they should reassert their more defensive characteristics and act once again as a source of returns uncorrelated to equities, a relationship that has broken down since the start of 2022. The abnormally wide discounts across the investment trust sector provide investors with a further cushion of protection but there are notable opportunities in private equity, infrastructure and property. The latter two are more sensitive to movement in bond markets whereas private equity will take equity market movements as a reference. Equity markets once again exhibit extreme levels of valuation dispersion between the most expensive 20% of global companies and the cheapest. Not only do the lowest priced 20% look historically cheap when compared to the most expensive 20% on a relative basis, they also offer value in absolute terms compared to their long run average. This represents a solid foundation upon which to construct the equity allocation of the portfolio.

I would like to thank, personally and on behalf of the Wise Funds team, all our investors for their ongoing support, particularly in the current challenging times for financial markets. The Fund started the interim period with £85m under management and finished with £80m, mostly due to negative performance and some outflows.

Please feel free to contact us if you would like a meeting or have any questions.

Philip Matthews

Fund Manager

Wise Funds Limited

September 2023

TO LEARN MORE ABOUT THIS FUND , PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.