Market Background

The 6-month period in review saw a high level of uncertainty about the future path of economic growth and inflation, leading to sharp shifts in interest rates expectations in a tug-of-war game with a regularly changing upper hand. The debate in global financial markets has not so much focussed on differing economic outlooks, but rather on different expectations of how central banks will react to economic data. Without a doubt, during the period, central bankers indeed moved to data-dependency modes, admitting that they failed to forecast how sticky inflationary pressures will be. With little clear direction on whether inflation is close to peaking and, if so, whether it will come back down sharply or stay elevated, and on how resilient the economy will be, financial markets were driven by the monthly cycle of economic data releases and central banks meetings. The market’s myopic focus on short-term data runs counter to our investment process focused as it is on taking a medium to long-term perspective.

Source: Factset August 2023

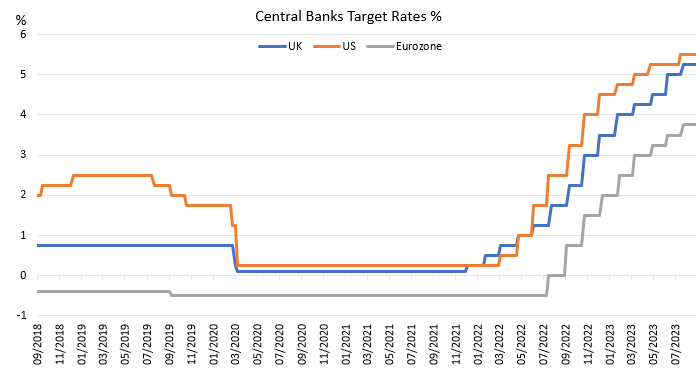

To put things in context, bank rates moved from 4.75% to 5.50% in the US (3 rate hikes), from 4% to 5.25% in the UK (4 rate hikes including one of 0.50% in June), and from 2.50% to 3.75% in the Eurozone (4 rate hikes including one of 0.50% in March). The hiking cycle since the beginning of 2022 has not only been relentless with rate increases most months, but also of an unprecedented magnitude since the 1970s. This is a new era for many investors as well as policy makers, having lived with near 0% interest rates since the Great Financial Crisis (GFC) of 2007-09 and having not had to face significant levels of inflation in the past 40 years. It explains why investors are struggling so much to adjust their expectations. Another factor is also, of course, how notoriously difficult it is to predict inflation levels since its sources are not always well understood or known (is inflation imported or are domestic factors at play?) and the tools to fight it are imprecise.

Across all developed regions, inflation proved stickier than anticipated, despite generally exhibiting signs of peaking. The main concern for central bankers is not so much headline inflation which is largely driven by external factors such as energy and food prices over which interest rates have little impact. Instead, it is the core inflation (inflation stripped out of those volatile energy and food prices) which they tend to focus on and it has proved much more resilient to rate hikes so far than ideal, particularly due to strong wage growth. In the UK, the most extreme case of sticky inflation over the period with core inflation continuing to rise, wage growth reached an annual record of 7.8% for the three-month to June, illustrating the difficult task for the Bank of England in the face of a strong jobs market where the balance of power remains tilted towards employees. Increasingly, the only reasonable path out of the inflation problem looks like a recession engineered by central banks, which is not an appealing prospect for investors, but would still be a better one than a scenario where inflation becomes so embedded that it becomes a structural issue like in the 1970s.

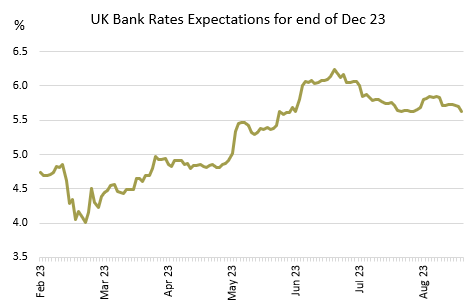

Looking at changes in interest rates expectations during the period is one of the best means to understand the tug-of-war at play and the volatility experienced by financial markets. In the US, in March, investors started with expectations of end-of-2023 bank rates of ~5.50% before dropping to 4% later that month after the collapse of several regional banks (more on that later) and spending the next 5 months grinding their way back up to 5.50%. That picture was very similar in the Eurozone, which fluctuated between 4% and 3% and back. The UK, however, in a different place due to its stickier inflation problem, saw expectations start at ~4.75%, drop to 4%, reach a high of 6.25% before settling down ~5.50%. These moves are extremely wild for what are some of the most liquid and followed instruments in financial markets. They are also the most critical ones since all assets are valued using those so-called risk-free rates.

In other developments of significance during the period, more uncertainty was injected in the system in the spring when two (initially and a couple more later) US regional banks collapsed, bringing back memories of the GFC. Those collapses did not prove systemic, however, and were caused by factors specific to those institutions, namely high concentration of their client types, large average deposit sizes and poor risk management. While idiosyncratic in their nature, those collapses were still an illustration of the impact tightening financial conditions (i.e. higher interest rates) have -and will have- on the economy: interest rates cannot rise by so much so quickly without any breakage. While it is near impossible to predict where the next cracks will appear, one can be confident that there will be more.

Source: Factset August 2023

Finally, China also found itself in a difficult position, having been on its own trajectory since the beginning of the Covid pandemic in 2020. After re-opening its economy in Q4 2022, its recovery proved much more tepid than expected, hurt by low consumption, rising youth unemployment, and persisting issues in the property development sector which represents ~25% of its economy. As such, at the end of the period, it reported its worst declines in both exports and imports for the past three years and was fighting deflation, in sharp contrast with the situation in developed markets.

Given the uncertainty described above and the ever-changing conditions and expectations, one could have expected equities to perform worse than they did. However, other than the UK and China, performance elsewhere was robust. The most notable performer were US equities which benefitted from a strong show, yet again, from -mainly- large growth companies, boosted by great enthusiasm about Artificial Intelligence (AI). Over the period, global growth companies outperformed global value ones by more than 10%, with investors seemingly keen to jump on the positive AI story, irrespective of already high valuations in the technology sector and the high risks that abound. Bonds were neutral overall despite some volatility due to interest rates expectations changes. When it comes to commodities, the ones closely linked to Chinese demand (industrial metals) suffered over the period, but gold played its safety role and oil rebounded strongly on the back of strong global demand and a cut in production from the Organisation of the Petroleum Exporting Countries (OPEC).

Performance

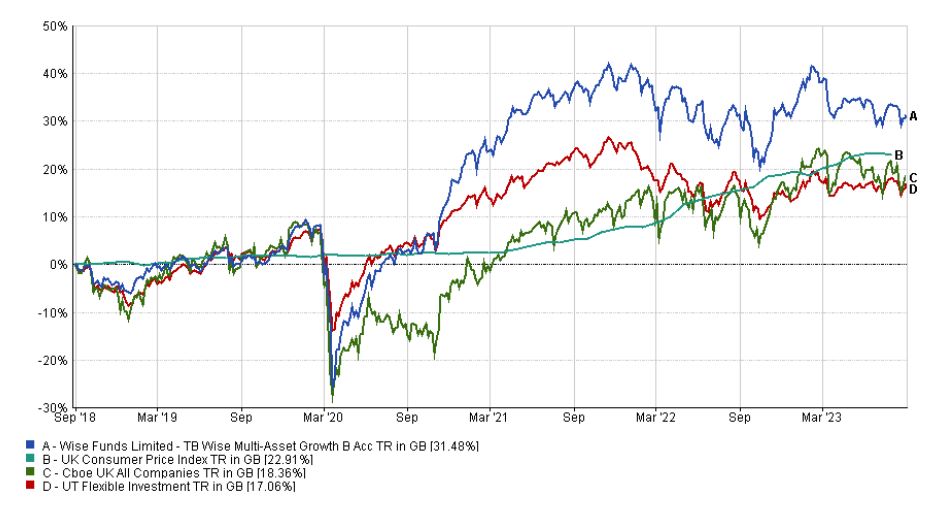

After a strong last quarter in 2022 and good start of 2023, the 6-month review period began at a relative high and performance to the end of August was poor at -4.7%, behind both the CBOE UK All Companies Index (-3.6%), UK Consumer Price Index (2.4%) and the IA Flexible Investment sector (-0.4%). This put our Fund in the bottom quartile (bottom 25%) of funds in our peer group. However, over one year, the Fund remains ahead of its peers and it is top quartile over 3-5-10 years and since inception in 2004. Unfortunately, short periods of underperformance are relatively common, a result of our focus on medium to long-term returns which implies looking through short-term volatility. As an illustration, going back to the inception of this Fund in April 2004, our Fund outperformed the UK equity market “only” 54% of months based on 6-month total returns (i.e. based on monthly 6-month rolling returns) or 1-year total returns. Our hit rate increases to 69%, however, looking at 3-year total returns (i.e. the Fund outperformed the UK market over 3 years on 69% of months) and 5-year total returns. Finally, on a 10-year returns basis, our Fund outperformed the UK market in 81% of months. The point of this analysis is to demonstrate that duration of holding periods matters and that, the longer one holds our Fund, the greater the chances of outperforming our benchmark

For more fund performance, please see the latest factsheet. Figures quoted refer to the past and that past performance is not a reliable indicator of future results

TB Wise Multi-Asset Growth – August factsheet (wise-funds.co.uk)

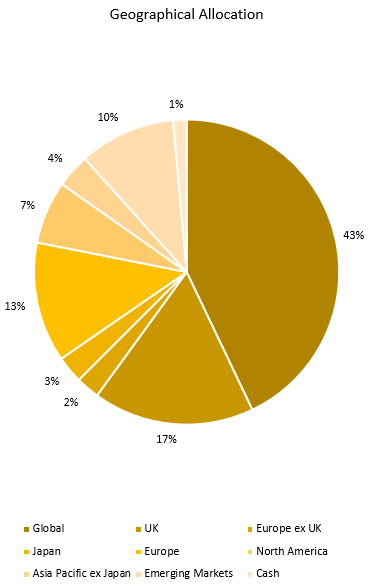

That said, even with our objectives focused on the medium-term (which we define as 5 years), it is disappointing to report some underperformance over the period, particularly since we have correctly erred on the side of caution in anticipation of rising volatility since February. Before discussing individual contributors and detractors, a large driver of our negative performance this period was discount widening of the investment trusts we hold in the Fund. We talked in detail over the years about how performance in investment trusts tends to be amplified because excitement/fear about the underlying assets they invest in translates into tighter/wider discounts, thus compounding the rise/fall of those assets. During the period, fears of higher interest rates for longer in the UK led to increased recessionary concerns which hurt domestically oriented UK equities. While our Fund’s direct UK exposure is only ~16%, all of our investment trusts (66% of the portfolio) are listed there. Moreover, the trusts and assets we tend to favour are not in the largest companies, because we find many more pricing opportunities away from mainstream names. Over the period, the UK medium-sized companies index underperformed its large companies counterpart by 1.4%, due of its greater exposure to domestic companies. Many of our investment trusts form part of that index and, as is often the case in panic-driven weaknesses, were sold indiscriminately as part of that basket of names, thus driving discounts wider. Looking at the entire universe of investment trusts in the UK, discounts widened by ~2.6% between the end of February and the end of August 2023. This headline figure hides some greater moves which, although of limited impact to our Fund, are still worth highlighting, such as Property investment trusts discounts widening by ~8% and Infrastructure ones widening by ~13%. The more interest rates sensitive the strategy, the more impacted they were, but the impact was widespread, creating a headwind for our approach.

Our focus on investment trusts and small/medium sized companies has historically been a strong contributor to our good long-term performance but there are periods of time (usually short) when it proves detrimental. The long-term benefits of our approach traditionally outweigh the short-term volatility though, so we continue to believe our strategy will deliver on its objectives.

On a holdings specific basis, without much surprise given the backdrop described above, our worst performers were found in UK smaller companies (Odyssean, Aberforth Smaller Companies) and interest rates sensitive infrastructure names (Ecofin Global Utilities and Infrastructure –whose discount widened more than 10%, Premier Miton Global Infrastructure Income). Financials and Commodities, two sectors largely held by our more value-oriented managers thanks to strong balance sheets, good cashflow generation and attractive valuations, were also detractors to our performance, either directly (Polar Capital Global Financials Trust, Baker Steel Resources Trust) or indirectly (Lightman European, Fidelity Special Values).

On the positive front, our Defensive names held their own and helped protect capital (Jupiter Gold & Silver, Pacific G10 Macro Rates, Fulcrum Diversified Core Absolute Return), highlighting the appeal of tactical trading strategies in these volatile times. Despite weakness in China dragging the whole region down, Fidelity Asian Values performed well, a testament of how uncorrelated to broader market developments stock-picking strategies can be. Finally, our private equity names also helped, continuing to report Net Asset Values (NAV) that defy the gloomy valuations that have plagued the sector for months. As an added bonus, some very positive developments were announced at Pantheon International, our largest holding in that space and one of the largest in the Fund overall. We have talked for some time about how anomalously wide the discounts in the listed private equity sector have been, and this has been the key reason for increasing our positions. While in a “normal” environment, investors would spot those valuations anomalies, buy the shares, and help bring the discount back to at least an average level, if the anomaly persists, one would like to see support from the board of the trust. This support would typically take the form of share buybacks where the company buys its own shares back. This is not only a strong signal to the market that the people closest to the trust believe it is trading too cheaply but is also value accretive because a reduction in the number of outstanding shares increases the ownership stake for remaining shareholders. A share buyback might not always be appropriate, however, for example if a trust is small already (it further reduces the size of the trust), if it hasn’t sufficient liquidity to buy the shares, or if the managers can find better investment opportunities elsewhere. None of those is an issue for Pantheon International which has a market capitalization of ~£1.5bn, has net cash available and, with a discount of 46% offers an upside potential hard to find elsewhere in the private market. As such, the board had already bought ~£20m shares back in the past year but, in its annual results at the beginning of August, its chairman made as supportive an announcement as possible by committing up to £200m to buybacks this financial year and, as importantly, dedicating a proportion of the Company’s net cash flow to share buybacks thereafter. This means that buybacks are now an explicit part of the investment strategy, as opposed to an after-thought, sending a strong message that, as long as the discount remains as wide as it currently is, the company will be supporting its share price by buying and cancelling shares. This helped send the price of the trust to its highest level in a year and has turned Pantheon into an example of what strong corporate governance should look like. This was an announcement we can only hope to see replicated by other boards across the sector.

Allocation Changes

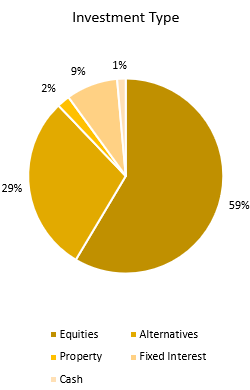

This interim period was characterised by cautiousness in our asset allocation and a reluctance to chase ever higher valuations in the face of an uncertain macro-economic environment, likely to end up in an engineered recession. As such, cash was our first line of defence early in the period, as a means to take a pause for breath after very strong market performance in Q4 2022 and beginning of 2023. Extreme gyrations in the market’s assessment of future interest rates and increasing divergence between equities and bonds markets, led us to gradually increase cash to reach a high close to 7% in April.

The mini-banking crisis of March illustrated the benefits of an approach we have favoured for years: when something does not seem right, it is always best to err on the side of caution and one should not be afraid of managing cash actively. This does not mean that we predicted the crisis itself but, like in the summer 2022 ahead of the UK “mini-budget” chaos, when strong dispersion and a degree of complacence appear in financial markets, little protection is provided against the unexpected and stretched valuations correct much quicker than average or cheap ones. Raising cash is also a means to take a step back for a short period of time, reassess conditions and stay on the front foot with dry powder ready to be deployed when opportunities inevitably present themselves. As it became apparent that the banking crisis was not going to be systemic, we gradually deployed some of our cash into our Defensive assets (Pacific G10 Macro Rates, Fulcrum Diversified Core Absolute Return), maintaining our wariness about investors’ future interest rates expectations, but giving ourselves the ability to generate performance in both up and down markets thanks to those very targeted and risk-controlled trading strategies.

We also increased our exposure to gold (Jupiter Gold & Silver) as a hedge against a stickier inflation scenario and/or a recession. We also increased our allocation to two sectors which present attractive characteristics through their underlying assets and defensiveness thanks to their cheap valuations: listed private equity and healthcare. The former, which we mentioned in the previous section, is an area that has suffered from sharp discounts widening since the post-Covid recovery in 2021. The sector moved from trading at par (i.e. price the same as the NAV) in Q3 2021 to an average 40% discount by March 2023. Many investors felt concerned about valuations in the private sector, casting doubts about methodologies and waiting for the lag between private and public valuations to be filled after public markets repriced lower. While the lag argument certainly had our sympathy and was in our expectations too, each NAV report from the listed private equity managers consistently showed that growth in their underlying holdings remained generally robust and that, for many of them, Covid was a blip they had more than fully recovered from. Following our names closely, these comments applied to all of them, so we were thus keen to take advantage of stretched under-valuations in the sector. Being heavily weighted towards Pantheon International, Oakley Capital and Caledonia Investments (2/3 in private equity) already, we added a new position in the ICG Enterprise Trust, a manager focusing on resilient growth stories in private markets which we already owned in the past, at ~45% discount.

Breakdown of portfolio by revenue as of

31st August 2023

Healthcare and biotechnology is an area we have added to since the start of 2022, attracted by the structural tailwinds of supportive demographics (ageing population in increasing need for care) and a boom in innovation leading to a plethora of new drugs coming to the market (illustrated beautifully by the speed at which Covid vaccines were developed in 2020). The sector suffered a hangover after strong performance in Covid times, to a point where valuations are now as attractive as they have ever been. Moreover, a spate of older drugs reaching the end of their patent protection at large pharmaceutical companies should lead to an explosion in acquisitions of smaller biotechnology companies as the only way for larger players to inject growth in their businesses. All those characteristics make the sector very appealing at present. As such, we increased our allocation to Worldwide Healthcare, as well as added a new position in RTW Biotech Opportunities. This trust is unique in the space by bridging the gap between private and public markets, investing in companies from their earliest private stages (even founding some of them) and nurturing them all the way to fully fledged listed companies. This full lifecycle approach is extremely compelling and brings a complementary angle to our other biotechnology holdings. The sector and this particular approach can be volatile but, with the sector historically cheap and the trust itself trading at 30% discount to NAV, the margin of safety is attractive.

Other than those large changes, as always, we were active in rotating the portfolio between winners and losers, this strategy being an integral part of our value discipline. As such, we took some profits in some of our more successful equity strategies principally in Asia (Fidelity Asian Values), Japan (AVI Japan Opportunities) and Europe (European Smaller Companies, Henderson EuroTrust). Those were recycled into underperforming areas such as Property (TR Property), Infrastructure (Ecofin Global Utilities & Infrastructure, Premier Miton Global Infrastructure Income) and Emerging Markets (KLS Corinium EM, Fidelity China Special Situations). Uncertain environments like the one we are currently in necessitate nimbleness. Active management allows to lock profits in as and when they occur and constantly recycle those into better valued opportunities.

Outlook

As we enter September when central banks will decide whether they have raised rates enough or whether more pain should be inflicted in order to rein inflation in, the economic environment remains febrile. It seems likely that, for the time being, data dependency will remain the order of the day, meaning that financial markets will continue to evolve at the whim of monthly data releases. For us, this means staying alert, maintaining a degree of cautiousness and focusing on opportunities that provide the greatest upside potential per unit of risk. After months of having stayed on the sidelines, we start to note other investors capitulating and throwing themselves back into the expensive large technology companies that, on the whole, continue to pull markets higher. We believe that those offer very little room for error and we prefer to avoid them altogether or find cheaper alternative ways to get exposure to those themes, like in the private markets for example.

Despite short-term disappointments, we remain confident in our strategy that has broadly remained unchanged for the past nearly 20 years and has produced strong results. As difficult as the current environment is, we believe in the quality of our managers, know that investment trusts will reward our patience by turning a double negative (negative NAVs and negative prices) into a double positive, and are excited by some of the opportunities that have been surfacing recently.

Finally, as a silver lining in what was, otherwise, a challenging period, we are pleased to announce that the TB Wise Multi-Asset Growth Fund was named Fund Manager of the Year 2023 by Investment Week in the Flexible Investment category. This award honours fund managers who have demonstrated consistently strong performance for the previous 3 years, using a combination of quantitative and qualitative metrics. It is a proud achievement for our team to have won this coveted award, particularly given the 3 years considered covered some of the most challenging and rapidly shifting market conditions since the Great Financial Crisis. The TB Wise Multi-Asset Growth Fund was the only fund in the IA Flexible Investment sector to deliver top quartile performance in each of 2020, 2021 and 2022 demonstrating our genuine multi-asset and flexible strategy. We will continue to use the same investment approach as we have since we launched the Fund in 2004, and will strive to live up to this award for the many years to come.

I would like to thank, personally and on behalf of the Wise Funds team, all our investors for their ongoing support, particularly in the current challenging times for financial markets. The Fund started the interim period with £89m under management and finished with £84m, mostly due to poor performance and some outflows.

Please feel free to contact us if you would like a meeting or have any questions.

Vincent Ropers

Fund Manager

Wise Funds Limited

September 2023

TO LEARN MORE ABOUT THIS FUND , PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.