For Professional Clients Only

Macro & Market Update

With August bringing its usual summer lull, markets were driven by low volumes and by a reduced news flow. Unsurprisingly, the main themes remained the same as for the past few months with the ongoing tug-of-war between the “peak interest rates” team in one corner and the “there is more tightening to come” team in the other, raging on. Over the month, the latter team took the upper hand with future interest rates expectations in developed countries slightly higher at the end of August than in July. This was driven by stronger than expected inflation data in the US (albeit marginally), which prompted the Chair of the US Central Bank to remind investors that “inflation remains too high”. Equally, in the UK, wage growth beat expectations to reach a record annual growth rate of 7.8% for the three months to June, and a similar picture of strong wage inflation emerged in the Eurozone. Wage inflation is the factor that worries central bankers because the longer it goes on, the more embedded it becomes, driving employees to continuously expect annual salary increases. While this continues, despite experiencing higher cost inflation themselves, consumers are feeling more upbeat, as illustrated by strong retail sales figures in the US and an improvement in consumer sentiment in the UK. This creates an opportune environment for central banks to increase rates further to ensure inflation does genuinely come down.

The “peak interest rates” team did not fully capitulate, however, and had moments in the sun when jobs data in the US gave signs of weakening and economic activity across developed countries fell for the first time this year. The argument goes that, if the economy –and the jobs market in particular, is slowing down, not only will inflation come down on its own (a weaker jobs market means less negotiating power for prospective employees), but central bankers will also be reluctant to aggravate the situation further by increasing interest rates. As such, bond yields (which move inversely to prices) oscillated, rising strongly in the first half of the month, putting downward pressure on equities, before coming back down again. Rising rates in the face of a sluggish economic environment is not an appealing scenario for investors, explaining why most assets were down last month. With so much uncertainty and policy makers being data-dependent, the tug-of-war game will go on for some time and the upper hand is likely to change again before a winner is declared. It remains a time to be prudent.

Separately, China, which has been on its own trajectory since the start of the Covid pandemic in 2020, continued to display signs of weakness, leading its equity market to underperform the rest of the world. While already fighting deflation, it reported its worst declines in both exports and imports for the past three years, as its recovery remains tepid, hurt by rising youth unemployment, low consumption and persisting issues in the property development sector which represents ~25% of its economy. The government announced a few marginal stimulus measures during the month but, so far, those have failed to convince investors.

Fund Performance

Wise Multi-Asset Growth

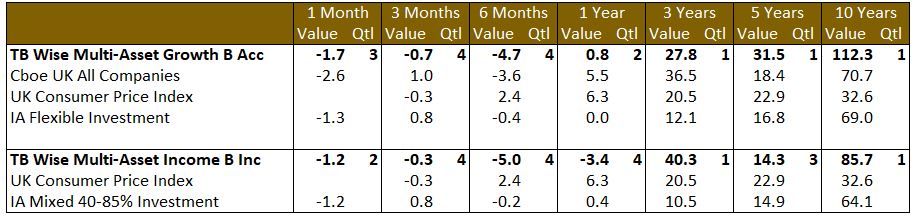

In August, the TB Wise Multi-Asset Growth Fund was down 1.7%, ahead of the CBOE UK All Companies Index (-2.6%) but behind its peer group, the IA Flexible Investment Sector (-1.3%). The worst detractors were our China related plays, namely Fidelity China Special Situations, but also our broader emerging markets names. Similarly, given the importance of China in the commodities market, the weak economic data reported over the month impacted our two mining trusts, Blackrock World Mining and Baker Steel Resources. The weakness in UK smaller companies persisted, impacting Odyssean, Amati UK Smaller Companies and Aberforth Smaller Companies. Finally, ICG Enterprise, a private equity trust we added in the portfolio earlier this year gave back its gains from July, with its discount moving back to a wide 43%.

In the same private equity sector, however, Pantheon International was our largest contributor. We have talked about how anomalously wide the discounts in the listed private equity sector have been for months, and this has been the key reason for increasing our positions. While in a “normal” environment, investors would spot those valuations anomalies, buy the shares, and help bring the discount back to at least an average level, which for Pantheon would be ~30% vs ~46% at the start of August, if the anomaly persists, one would like to see support from the board of the trust. This support would typically take the form of share buybacks where the company buys its own shares back. This is not only a strong signal to the market that the people closest to the trust believe it is trading too cheaply but is also value accretive because a reduction in the number of outstanding shares increases the ownership stake for remaining shareholders. A share buyback might not always be appropriate, however, for example if a trust is small already (it further reduces the size of the trust), if it hasn’t sufficient liquidity to buy the shares, or if the managers can find better investment opportunities elsewhere. None of those is an issue for Pantheon International which has a market capitalization of ~£1.5bn, has net cash available and, with a discount of 46% offers an upside potential hard to find elsewhere in the private market. As such, the board had already bought ~£20m shares back in the past year but, in its annual results at the beginning of August, its chairman made as supportive an announcement as possible by committing up to £200m to buybacks this financial year and, as importantly, dedicating a proportion of the Company’s net cash flow to share buybacks thereafter. This means that buybacks are now an explicit part of the investment strategy, as opposed to an after-thought, sending a strong message that, as long as the discount remains as wide as it currently is, the company will be supporting its share price by buying and cancelling shares. This helped send the price of the trust to its highest level in a year and has turned Pantheon into an example of what strong corporate governance should look like.

Wise Multi-Asset Income

In July, the TB Wise Multi-Asset Income Fund fell 1.2%, in line with its peer group, the IA Mixed Investment 40-85% Sector, which also fell 1.2%. Continued uncertainty about the direction of global monetary policy and the prospect either that rates might have to increase further or at the very least be maintained at restrictive levels for longer periods proved a difficult backdrop for all asset classes. Global equity markets were weak, particularly Asian markets reflecting the weakness in China and disappointment that insufficient stimulus was being provided to support the economy. Specific concerns in the property market led to commodity indices falling with the notable exception of oil. Oil demand hit record levels with stronger economic growth in developed markets than expected whilst production from OPEC (a cartel of countries which dominate global oil supplies) reduced with Saudi Arabia significantly cutting its production.

Reflecting the above, the largest contributors to the fund’s negative performance over the month were our two commodity funds, Blackrock World Mining and Blackrock Energy and Resources. Similarly, our equity funds with most exposure to Asian markets, Abrdn Asian Income and Murray International, were weak driven by heightened concerns over the outlook for the Chinese economy. On the back of the strong wage growth data and persistently strong core inflation, real bond yields rose. Real yields are the return investors expect after stripping out the negative impact of expected inflation and in the first two weeks of the month this expected return rose and prices consequently fell. This proved a difficult backdrop for both our property and infrastructure names which suffer when bond yields rise. Over the longer term, this negative headwind should be offset if the cause of higher yields (namely inflation) is captured either in higher inflation-linked regulatory revenues in the case of infrastructure or via higher property rents. However, when yields rise over and above the change in inflation expectations, this means investors have increased the underlying return they demand from those assets. In particular, this hit Abrdn Property Income, Ecofin Global Utilities & Infrastructure and Pantheon Infrastructure, all of which fell at the start of the month yet failed to rally as bond yields subsequently returned to the levels they started the month as weaker economic data was reported. Despite this challenging backdrop, our strongest performer over the month was Ediston Property, which announced it was in advanced discussions to sell the company’s property portfolio to Realty Income Corporation and saw its share price narrow the large discount to net asset value at which the company traded.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

Portfolio activity was limited during the month. Given the strong discrepancy in performance between ICG Enterprise and Pantheon International (~15% while their net asset values performed similarly), we took some profit in the latter and switched into the former. Pantheon remains our second largest holding in the portfolio, highlighting our conviction in the name, but this switch allows us to build up our position in ICG on attractive terms.

Wise Multi-Asset Income

During the month, we exited two of our direct financial equity holdings, Vanquis Banking Group and Chesnara, and added to Polar Capital Global Financials. We initiated a holding in International Public Partnerships, increasing our exposure to the core infrastructure sector. We also topped up Ecofin Global Utilities & Infrastructure, International Biotechnology and TR Property on weakness.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.