Wise Multi-Asset Income

Fund Ratings

Investment Objective

The Fund aims (after deduction of charges) to provide:

- an annual income in excess of 3%: and

- Income and capital growth (after income distributions) at least in line with the Consumer Price Index ("CPI"), over Rolling Periods of 5 years.

Fund Attributes

- A flexible, diversified portfolio that can invest in all asset classes.

- Targets an attractive and growing level of income.

- The portfolio invests both direct and through open and closed-ended funds.

- Adopts a value biased investment approach.

- Pays monthly

Investor Profile

- Seek an attractive level of income and the prospect of long term capital growth.

- Accept the risks associated with the volatile nature of an adventurous multi-asset investment.

- Plan to hold their investment for the long term, 5 years or more.

Key Details

| Target Benchmark | UK CPI |

|---|---|

| Comparator Benchmark (Sector) | IA 40-85% Investment Sector |

| Launch date | 3rd October 2005 |

| Fund value | 78.2 million |

| Holdings | 35 |

| Historic yield | 3.50% |

| Div ex dates | First day of every month |

| Div pay dates | Last day of following month |

| Valuation time | 12pm |

- Past performance is not a guide to the future and outperforming target benchmarks is not guaranteed.

- The historic yield reflects distributions over the past 12 months as a percentage of the price of the B share class as at 31st January 2026. Investors my be subject to tax on their distributions.

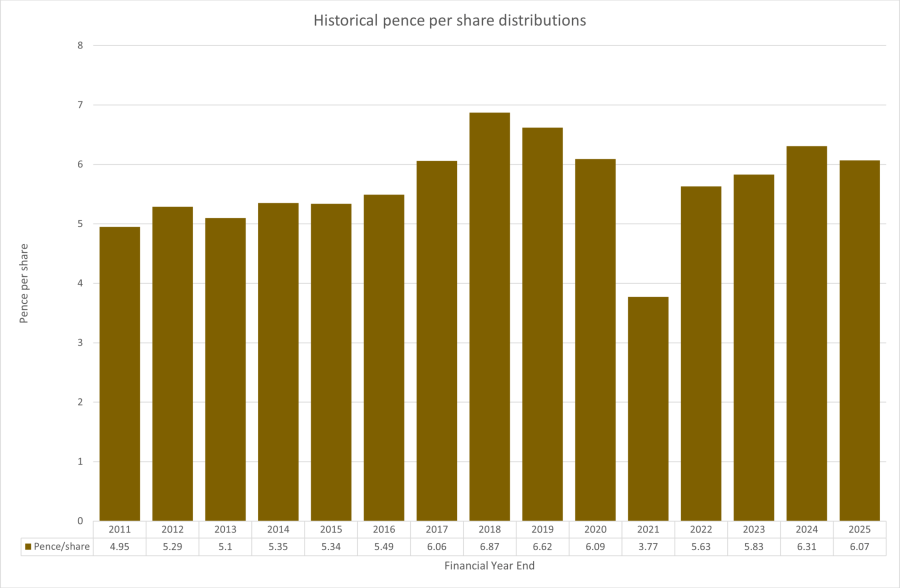

Dividend Information

Pence/share figures relate to the fund’s financial year ending in February of the relevant year.

For a breakdown of the dividends, please click here

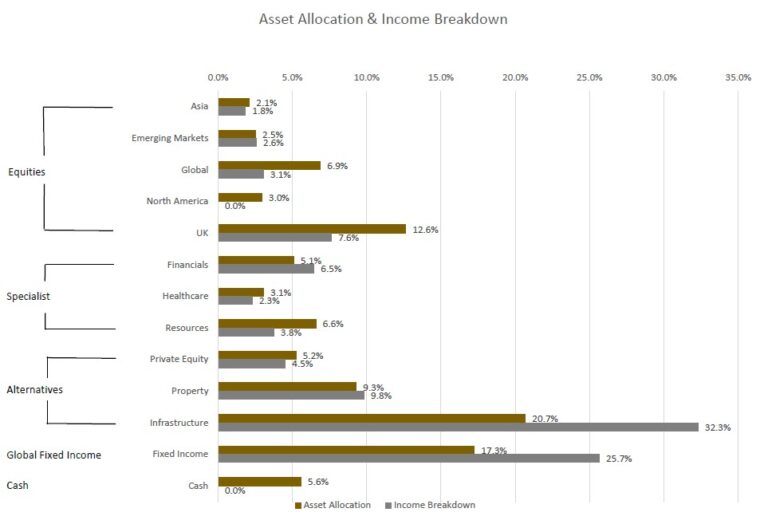

Investment Portfolio - December 2025

Source – Wise Funds Limited as at 31st January 2026.

The asset allocation is derived from the full portfolio holdings and the income data shows where the the current yield is being accrued from by asset class.

- Past performance is not a guide to the future

- Data as at 31st January 2026

Share Class Information

| | B Acc (Clean) | B Inc (Clean) | W Acc (Institutional) | W Inc (Institutional) |

|---|---|---|---|---|

| Sedol Codes | B0LJ1M4 | B0LJ016 | BD386V4 | BD386W5 |

| ISIN Codes | GB00B0LJ1M47 | GB00B0LJ0160 | GB00BD386V42 | GB00BD386W58 |

| Minimum Lump Sum | £1,000 | £1,000 | £50 million | £50 million |

| Initial Charge | 0% | 0% | 0% | 0% |

| IFA Legacy Trail Commission | Nil | Nil | Nil | Nil |

| Investment Management Fee | 0.75% | 0.75% | 0.50% | 0.50% |

| Operational Costs | 0.16% | 0.16% | 0.16% | 0.16% |

| Look-through Costs | 0.15% | 0.15% | 0.15% | 0.15% |

| Ongoing Charges Figure 12 | 1.06% | 1.06% | 0.81% | 0.81% |

All performance is still quoted net of fees.

- The Ongoing Charges Figure is based on the expenses incurred by the fund for the period ended 30th August 2025 as per the UCITS rules.

- Includes Investment Management Fee, Operational costs and look-through costs.

The figures may vary year to year

Fund Commentary - January 2026

January was an eventful month with geopolitics dominating investor attention. The month started with the unexpected yet successful capture and removal of President Maduro in Venezuela. Whilst there have been long-standing concerns over the authoritarian nature and electoral legitimacy of the regime, the decision to justify the operation as a law-enforcement exercise rather than a military action, bypassing Congressional approval, left many questioning the legal basis of the intervention and denouncing it as a covert means of gaining control of the country’s large oil reserves.

Whilst many historical allies were prepared to remain relatively silent with regards Venezuela, Trump’s subsequent pronouncement that he was intent on taking over Greenland, possibly via military intervention, caused huge consternation among Nato (the defensive alliance made up of countries from Europe and North America) partners and risked turning upside down the political order that has existed since the end of World War II. Over the course of 2025 investors learnt that President Trump’s bark can be worse than his bite and that following a period of grandstanding and subsequent diplomatic flattery, that the worst-case scenario rarely materialises. The relatively muted market response to the potential ‘rupture in the World order’ described by Canadian Prime Minister, Mark Carney, suggests investors now increasingly expect a more sensible outcome to be concluded once Trump has been able to claim some sort of victory. In the end, despite threats of 10% tariffs on those countries who deployed military personal to Greenland, Trump eventually agreed that military action would not happen and that he was happy to have concluded an agreement with the head of Nato with regards to Greenland’s ownership. The other significant geopolitical development over the month was the mass demonstrations in Iran and subsequent brutal reprisals by government forces. Since the military confrontation between Iran and Israel last year, conditions have deteriorated dramatically in the country with inflation rising rapidly, particularly food inflation and the currency under severe pressure. As yet, there has been no direct intervention by the US government, although manoeuvrings of military assets in the region and the strong rise in the oil price over the month suggest investors remain concerned as to how the situation might develop.

Domestically, US investors were most concerned over the month by the perceived threat to the independence of the Federal Reserve (the Fed, the US central bank). President Trump is keen for the central bank to lower interest rates and blames the current chair of the Fed, Jerome Powell, for not having reduced them faster. This undermining of his authority was further enflamed by the threat to bring criminal charges against him in relation to cost overruns renovating the Fed’s headquarters. This came at a time when the next Chair of the Federal Reserve was due to be appointed by the President and market speculation grew that a politically subservient appointee might be announced, fuelling concerns in the bond markets that inflation might run out of control were interest rates to be kept artificially low. Over the month, interest rates were kept on hold as economic growth grew strongly, unemployment looked to be stabilising and inflation remained elevated. Market fears around the independence of the Fed and more general geopolitical concerns were expressed most clearly in high precious metal prices as well as through a further fall in the dollar. Somewhat unexpectedly, therefore, toward the end of the period Trump announced Kevin Warsh as Jerome Powell’s replacement. Warsh is the most mainstream candidate, having served as a Fed governor in the past, with a reputation of preferring to keep interest rates high to combat inflation and having a dislike of quantitative easing, the Federal Reserve’s historic bond buying programme. His appointment saw a sharp reversal in gold and silver prices and a rebound in the dollar at the month end.

Elsewhere, interest rates in the UK were kept on hold. Whilst private sector wage growth has showed some signs of cooling, inflation remains stubbornly high and constrains the Bank of England’s ability to cut rates more aggressively. In Japan, Prime Minister Takaishi called a snap election and declared plans for a two-year suspension in VAT on food. This fiscal stimulus at a time of resurgent inflation triggered a sharp fall in longer dated government bonds, the impact of which rippled through other global markets where yields on longer dated government bonds rose.

In January, the IFSL Wise Multi-Asset Income Fund rose 3.8%, ahead of the IA Mixed Investment 40–85% sector, which gained 1.6%. Despite the geopolitical noise over the month, investment markets reflected many of the themes apparent throughout the course of last year. Markets chose to ignore the US president’s military and tariff threats and focussed on the relatively positive outlook for the global economy. Economic stimulus in Europe and the US, particularly as we head towards the US mid-term elections, coupled with the prospect of lower interest rates are providing a supportive backdrop to risk assets (equities, commodities, private equity). The US dollar continued to weaken as investors diversify away from the US, particularly US technology, with investors favouring cheaper international markets. Despite a sharp fall at the end of the month, commodities remain a favoured hedge against the threat of inflation from high government fiscal deficits and interest rates being kept too low. Our two commodity exposed funds were the strongest contributors to performance given the surge in the gold and copper prices. Our UK equity funds also performed strongly with our holdings focussed on mid- and small-cap companies enjoying a belated period of strong performance. The focus on value and international markets also saw strong returns from Pacific North of South EM Equity Income, Prusik Asian Income, Middlefield Canadian Income and Paragon Banking Group. Our property holdings were boosted by the announcement of a bid for Life Science Reit, the announcement that Picton Property Income was putting itself up for sale and news the activist, Saba, was agitating for change at Workspace. A more favourable outcome than feared regarding the treatment of inflation for subsidy calculations (outlined in our November factsheet) helped our renewables holdings.

We continued to take profits in our commodity positions, Blackrock World Mining and Blackrock Energy & Resources given the recent strong performance. We added to the Renewables Infrastructure Group and HICL Infrastructure, which have seen their share prices punished following their aborted proposed merger. We added to Odyssean Investment Trust, Brickwood Global Value and Prusik Asian Income where equity valuations remain attractive as well as topping our two strategic bond holdings. The fund’s cash level remains relatively high at 5% which we will look to deploy if there are bouts of market volatility ahead.