For Professional Clients Only

Macro & Market Update

The ongoing debate over how high global interest rates will have to rise in order to tame inflation, how long they will need to stay at elevated levels for and whether a cooling of the economy can be neatly achieved without inadvertently tipping into recession continued to dominate investor sentiment over the month. The US Federal Reserve has been the most aggressive in tightening monetary policy, both in terms of the level of interest rate rises and the speed at which those increases have been applied. Inflation data there, has led the way in returning towards the targeted level and investors continue to believe that 5.5% now marks the peak in this interest rate cycle. Investors had been hoping that interest rates could start to fall in 2024 as economic growth slowed and inflation continues to come under control. Economic data over the month, however, provided mixed support to this argument. On the one hand, there are signs to show that strength in the US jobs market is cooling with substantial revisions lower to previously reported jobs growth being announced and the unemployment rate rising to an 18-month high of 3.8%, higher than the forecast 3.5%. On the other hand, rising energy costs pushed US inflation above forecast in August with consumer prices rising 3.7% year on year, up from 3.2% in July, and ahead of consensus forecasts of 3.6%. Core inflation, which strips out volatile energy and housing, continued its fall to 4.3% year on year but was stronger compared to July than expected. The Federal Reserve kept interest rates steady at their latest meeting but surprised markets by increasing their projection of how long interest rates would need to stay at higher levels for. Their new interest rate forecast is for rates to be a full 0.5% higher in 2025 that they expected in June, driven by their assessment that economic growth this year and next will be stronger than anticipated 3 months ago. The decision whether to raise rates in the Eurozone was finely balanced and, despite faltering economic growth, the European Central Bank elected to raise interest rates 0.25% to an all-time high of 4.0%. Given recent weak economic data, slow bank lending and a softer labour market, investors had on balance been expecting no change and as a result have now reflected this moving interest rate expectations marginally higher over the next 18 months as a result. The accompanying statement suggested that this would be the last rate rise this cycle.

The UK was an outlier, therefore, as September saw a sharp move down in the expected level of interest rates. At the start of the month investors were anticipating interest rates were set to rise a further 0.5% to a peak of 5.75% by the year end. They would then stay at that level for the next 12 months before starting to fall in 2025. Whilst wage growth announced over the month grew at the fastest pace on record at 7.8%, other data provided welcome relief to the Bank of England that inflation was more under control and the economy was responding to their efforts to cool it down. Firstly, UK economic growth in July contracted more than expected in July, partly impacted by strikes and wet weather. Secondly, unemployment moved higher than anticipated but most importantly inflation data was surprisingly weak. Having anticipated a rise in headline inflation to 7.0% from 6.8% in August, the announced fall to 6.7% was taken well by investors. Furthermore, core inflation (ex food and energy) fell to 6.2% from 6.9% compared to a forecast of no change. This allowed the Bank of England to hold rates flat at 5.25% and saw a significant shift in expectations that rates are now set to peak at that level, 0.5% lower than previously expected.

Whilst the change in UK interest rate expectations was positive for domestic equity markets, the view that US and Eurozone interest rates were likely to remain higher for longer acted as a headwind to both equity and bond markets elsewhere. There were few assets globally that provided positive returns. Energy and commodities stood out as the oil price moved higher following recently announced supply restrictions and iron ore (one of the main raw materials used to make steel) was boosted by comprehensive stimulus announcements in China to boost its ailing property sector. The dollar was notably strong against sterling and the Yen, reflecting the relative changes in the outlook for interest rates.

Fund Performance

Wise Multi-Asset Growth

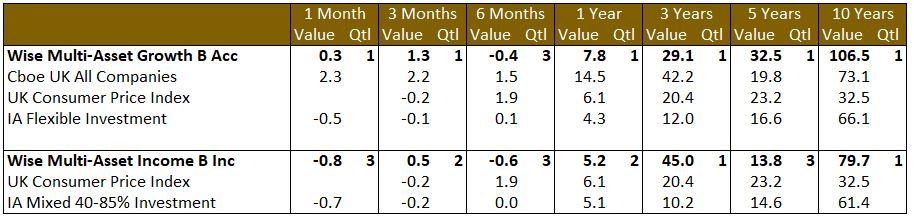

In September, the TB Wise Multi-Asset Growth Fund was up 0.3%, behind the CBOE UK All Companies Index (+2.3%) but ahead of its peer group, the IA Flexible Investment Sector (-0.5%). For the third quarter, our Fund was up 1.3%, behind the CBOE UK All Companies Index (+2.2%) but ahead of the IA Flexible Investment Sector (-0.1%). Our listed private equity trusts were, again, our largest contributors. We mentioned the large buyback programme announced by Pantheon International last month, and the trust continued to perform strongly since then (up ~14% since the August announcement). Meanwhile, ICG Enterprise, a position we added to the portfolio in the spring and have built up over the past few months was up 12% in September alone. Despite being of a decent size at £800m market capitalization, this trust is not the most liquid, so it is unclear whether its strong performance in the short term was driven by technical factors or by a broader reassessment of the listed private equity sector due to unjustified wide discounts and the expectation that more Board take similar action to the Pantheon’s buyback announcement. In the medium-term in any case, we believe the latter argument should prevail. In another example of how corporate action can boost share prices, AVI Global, our largest holding, also saw strong performance after its largest position received a bid for one of its holdings and a second position announced a realisation of its assets to address its unsustainably wide discount.

On the detractors side, volatility in interest rates created a difficult environment for our positions in precious metals (Jupiter Gold & Silver) and infrastructure (Ecofin Utilities and Infrastructure, Premier Miton Global Infrastructure Income).

Wise Multi-Asset Income

In September, the TB Wise Multi-Asset Income Fund fell 0.8%, marginally behind the IA Mixed Investment 40-85% Sector, which fell 0.7%. We have highlighted the issue of discount widening within our investment trust holdings in recent months and over the course of the month this almost entirely explains the Fund’s negative performance. Once again, the largest impact was felt within our infrastructure and property holdings, despite evidence suggesting investor pessimism towards these sectors has been stretched too far. Ediston Property announced it would sell its portfolio of retail warehouses at a 10% discount to net asset value compared to the near 30% discount they traded at in the summer. Similarly, HICL announced the disposal of a £241m portfolio of school, hospital and offshore electricity transmission assets at a premium to its latest net asset value. Despite this validation of their valuation methodology and reducing debt in the process, the discount widened 6% to 25% over the month. On the positive side, our UK equity exposed funds performed strongly as did our commodity holdings and ICG Enterprise, a private equity fund which has seen its discount narrow.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, we were keen to increase our bond exposure as we are nearing peak interest rates (positive for bonds) and yields are at multi-year high levels. As such, we added to TwentyFour Strategic Income Fund. Using a similar reasoning, we added to Ecofin Utilities and Infrastructure on weakness as the interest rates backdrop is likely to stop being a headwind for infrastructure plays in the near future and their defensive characteristics are appealing. Meanwhile, the trust traded on its widest discount since the Covid pandemic. We also looked for more idiosyncratic opportunities in the continuously disliked UK small companies market (Odyssean) and the biotechnology sector (RTW Biotech Opportunities). Finally, we also increased our cash to 2.7% from 1.4% at the start of the month as a means to navigate uncertainty and take advantage of upcoming opportunities.

Those positions were financed by taking profits from some of our strongest equity funds in recent months, namely Henderson EuroTrust (position exited fully), Fidelity Asian Values, BlackRock Frontiers and GLG Undervalued Assets.

Wise Multi-Asset Income

We sold our holding in Ediston Property on the confirmation of their asset disposal and reinvested the proceeds into TR Property, Urban Logistics and initiated a holding in London office specialist, Helical. We also topped Ecofin Global Utilities and Infrastructure, INPP and TwentyFour Strategic Income given the defensiveness of these holdings and as we reach the peak in the interest rate cycle. Within the UK, we sold out of Temple Bar and reinvested the proceeds into open-ended funds, Man GLG Income, Schroder Global Equity Income and Jupiter Income, which are all managed with a similar value approach.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the WS Wise Funds, including risk warnings, are published in the WS Wise Funds Prospectus, the WS Wise Supplementary Information Document (SID) and the WS Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds. The WS Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years could be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. Waystone Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.