For Professional Clients Only

Macro & Market Update

October was a bruising month for so-called risk assets (equities and bonds) which were hurt by a combination of reassessment of future interest rates, weaker corporate data as well as political and geopolitical events. Starting with the US, the Q3 GDP growth figure of 4.9% annualised (coincidentally the same rate of growth as reported by China for the same period) illustrated how strong its economy is, helped by continuously robust consumers. The growth was supported by good employment numbers, which surprised on the upside, explaining why consumption remains sturdy. Another support for consumer confidence came from solid wage inflation, as shown by the 25% pay increase agreed with the powerful automobile trade union, UAW. Early signs of more fragile times ahead are starting to appear (reduction in purchases via credit cards, rising bankruptcies…) but, for now, the US central bank is left in a bind, hoping that it has raised interest rates enough to eventually stop the economy from burning up, but fearing more medicine might be required. On the other side of the Atlantic, the Bank of England was left in a different predicament, knowing that it needs to do more to rein inflation in (headline inflation was steady at 6.7% last month, higher than expected) but fearing that higher interest rates might break a febrile economy. In October, consumer sentiment in the UK dropped the most month-on-month since 2020 with rising jobs uncertainty, high inflation and falling house prices taking their toll. As has been the case for months now, the Eurozone found itself somewhere between its two main Anglo-Saxon counterparts, displaying a weakening economy but with inflation noticeably moving in the right direction. This might suggest that the European Central Bank has done its job for the time being.

Added to the mix of growth and inflation data investors have been grappling with for months, the war between Israel and Hamas further fuelled market worries, with fears that the situation threatened to escalate into another global conflict if neighbouring countries decide to actively participate. Paling in comparison with the atrocities committed in the Middle East but of significance nonetheless for broader political implications, the US narrowly averted a government shutdown after Congress passed a temporary extension to its spending bill after failing to agree on how to allocate the government spending. The Conservatives, who have a majority in the lower chamber of Congress, also ousted their leader (second in the presidential line of succession) and took 3 weeks to agree on a replacement. Disagreements within the party and across the aisle do not bode well for future budget negotiations and will keep investors on edge.

In that context, risk assets were weak in October. Concerns that interest rates might need to be raised further in the US in light of the strong data sent US 10-year government bond yields (which move inversely to price) to a 16-year high. Meanwhile, several equity markets entered a “correction”, known as a drop of more than 10% from previous peaks, including US equities and the Nasdaq which is mainly composed of US technology companies and has led global markets higher this year. Whilst it has taken those two indices since July to drop more than 10%, UK medium-sized companies fell a similar amount in just 6 weeks, illustrating the pressure UK smaller companies are under. Investors clearly switched to a less forgiving mood with companies reporting weaker earnings than expected falling more than the historical average, which is a sign of uncertainty and willingness to protect capital first rather than wait for greater clarity. Finally, gold, a traditional haven performed well amid this uncertainty and concerns, rising back above $2,000 per ounce, within touching distance of its all-time high. It also continued to benefit from record buying from global central banks keen to protect against inflation and to diversify away from the US Dollar as a reserve currency.

Fund Performance

Wise Multi-Asset Growth

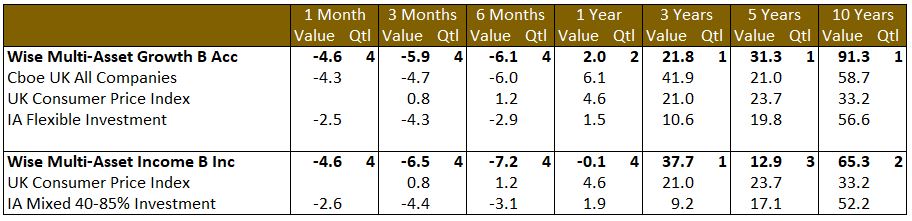

In October, the TB Wise Multi-Asset Growth Fund was down 4.6%, behind both the CBOE UK All Companies Index (-4.3%) and its peer group, the IA Flexible Investment Sector (-2.5%). This disappointing performance was mostly driven by a general widening of discounts with all the investment trusts we own finishing the month at a wider discount than they started. For the universe as a whole, the average discount is now at its widest since the Great Financial Crisis of 2007/09. A perfect storm of higher interest rates (which impact income generating strategies that represent a large part of the universe), macroeconomic uncertainty, competition from cash, continued outflows from UK equities (particularly within the small and medium-sized companies indices in which many investment trusts reside) and forced selling from large multi-asset funds (due to ill-conceived regulation forcing the disclosure of double-counted fees) has hit investment trusts badly. The index of UK-listed investment trusts fell ~5% last month and is trading back to its pre-Covid level in what have been rollercoaster 3.5 years. While our Fund is still ~17% ahead of its pre-Covid level, with 67% invested in investment trusts, we are facing an enormous headwind. The less liquid trusts, usually our favoured hunting ground because they present greater undervalued opportunities, were usually the worst impacted, in a possible sign of capitulation.

Sentiment and flows against the sector are approaching extremes. It is impossible to call the bottom for markets and many scenarios could see not only discounts, but also net asset values fall further from here given the difficult transition period global economies are currently going through. That said, our investment experience is telling us that now is the time to stand firm and to resist the temptation to join the capitulating crowd. Investment trusts offer tremendous opportunities at this stage and we are keen to take advantage of those. Given the risks involved, however, we continue to tread carefully, focusing primarily on funds we know well and presenting the biggest upside potentials. In this environment, margins of safety will ultimately be rewarded, and our valuation discipline continually forces us to rotate the portfolio towards the best risk/reward options.

Wise Multi-Asset Income

In October, the TB Wise Multi-Asset Income Fund fell 4.6%, behind the IA Mixed Investment 40-85% Sector, which fell 2.6%. Specific news flow from our holdings was limited but supportive over the month, with the portfolio weakness reflective of the broader market risk aversion and increased discount widening among our investment trust holdings. In periods of risk aversion our financials holdings tend to perform poorly and Paragon, Legal & General and Polar Capital Global Financials were all weak, with the performance of the latter compounded by discount widening. Whilst banks reporting in the period announced weaker than expected margins as customers moved deposits to higher interest-bearing deposit accounts, expectations over future loan losses remain benign, balance sheets are robust and valuations are highly attractive. Our UK equity funds were weak reflecting market weakness and discounts themselves widening. There is some circularity here as our investment trust holdings form part of the small and mid-sized company indices, which fell 6.3% compared to 3.7% for the index of larger companies. This significant selling pressure of the index has caused many investment trusts to see their discounts widen as a result, compounding the negative performance at the asset level. For the investment trust universe as a whole, the average discount is now at its widest since the Great Financial Crisis of 2007/09. Equity market weakness was not contained to the UK with our international and sector specialist holdings also weak. There were no hiding places over the month with our commodity funds and private equity holdings also very weak.

Disconnects between underlying asset level performance and share prices abound. GCP Infrastructure, for example, fell more than 10% over the month and ended the month at a 45% discount to its net asset value. Having abandoned a possible merger with another investment trust, the strategy now is to realise cash from its portfolio of loans, pay down its expensive debt and ultimately buy back shares. During the month the trust announced it had refinanced an existing loan to a biomass customer that confirmed the valuation of the loan in the net asset value had been conservatively valued and, in the process, freed up £50m of cash to pay down debt. Likewise, a lettings update from abrdn Property Income, which saw the vacancy rate at its properties fall from 8% to 4.4%, provided support in the face of a similarly wide discount of 45%.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

We took some profits in BlackRock Frontiers (Emerging Markets), Pantheon International (Private Equity) and Fulcrum Diversified Core Absolute Return (Defensive), as well as reduced our position in Baker Steel Resources (Mining) and exited Herald (Technology). We reinvested that cash in Caledonia (Private Equity), Ecofin Global Utilities and Infrastructure (Infrastructure), Odyssean (UK small and medium companies) and International Biotechnology (Biotechnology). Our cash was left broadly unchanged.

Wise Multi-Asset Income

Over the month we exited our holding in CC Japan Income & Growth and reduced Starwood European Real Estate Finance following strong relative performance in order to take advantage of attractive valuation opportunities elsewhere. Correspondingly, we increased our holdings in Fidelity Special Values, International Biotechnology, Helical, International Public Partnerships and Urban Logistics. Reflecting recent market moves and rotation within the portfolio, the prospective yield on the portfolio for the current financial year has now moved above 6%.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the WS Wise Funds, including risk warnings, are published in the WS Wise Funds Prospectus, the WS Wise Supplementary Information Document (SID) and the WS Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds. The WS Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years could be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. Waystone Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.