For Professional Clients Only

Macro & Market Update

There was a marked improvement in investor sentiment over the month as economic data provided evidence that the global economy was finally showing signs of cooling, inflation came in lower than expected and hopes grew this would result in more interest rate cuts in 2024 than previously forecast. Having remained stubbornly strong for some time, US payroll numbers released at the start of the month provided welcome confirmation for investors that the anticipated slowdown in the labour market, necessary to curb core inflation was finally showing up in the data. The previous month had seen a worryingly strong forecast for jobs created in the month, however, this was revised down and the figure for October of 150,000 new jobs was both weak and below expectations. In recent months economic data has been stronger than expected and led investors to reassess the length of time monetary policy (interest rates) would have to remain at restrictively high levels for. However, a series of better (ie lower) than expected monthly inflation releases, coupled with the US jobs data led to a sharp reassessment of the outlook for interest rates next year. Eurozone inflation fell more than expected to 2.9 per cent in October, the slowest annual growth in consumer prices since July 2021, driven by falling energy prices and lower food price increases. US inflation fell more than expected to 3.2 per cent whilst the UK saw inflation fall to 4.6 per cent in October thanks to a retreat in energy prices, allowing prime minister Rishi Sunak to declare he has met his pledge to halve inflation by year end. This was lower than the 4.8 per cent predicted by economists and was well below the 6.7 per cent pace recorded for September. The core rate of inflation, which excludes energy and food, rose by 5.7 per cent in the 12 months to October, down from 6.1 per cent in September. The rate of services inflation, which is a guide to domestic price pressures and is closely watched by the Bank of England, retreated from 6.9 per cent to 6.6 per cent.

Markets quickly reset their expectations for interest rates next year. At the start of the month investors were expecting US interest rates to fall by 0.75% by December 2024, from their current peak of 5.5%. By the month end, a further fall of 0.5% of interest rates had been baked in (a total expected drop of 1.25%). At the same time the Eurozone and UK are now each factoring in 0.25% of cuts more than was expected at the start of the month. It is notable that investors now expect interest rates in the UK to end 2024 at 4.5% compared to the 6% expected as recently as July. Almost all of the fears that interest rates would remain higher for longer that rocked markets over the summer have now been extinguished. Investor sentiment both over the persistence of inflation and the likelihood high interest rates could result in a severe recession has moved from one extreme to the other in recent months and we have tried to maintain a more balanced view within the fund over this time. Whilst investors were quick to shift from their previous glass half-empty position to a much more positive one over the course of the month, central bankers acted as a counterweight reminding us the war against inflation is not yet won and the last phase of getting inflation down to their 2% targets could prove to be the most difficult. Despite these cautionary announcements, global equities recorded their best monthly performance since Covid vaccines were announced in November 2020, up 9%, while global bond indices had their best month for 15 years. The greater fall in interest rate expectations in the US than elsewhere led to a marked fall in the dollar over the month, which partially offset the strong performance of dollar-denominated assets over the month.

Fund Performance

Wise Multi-Asset Growth

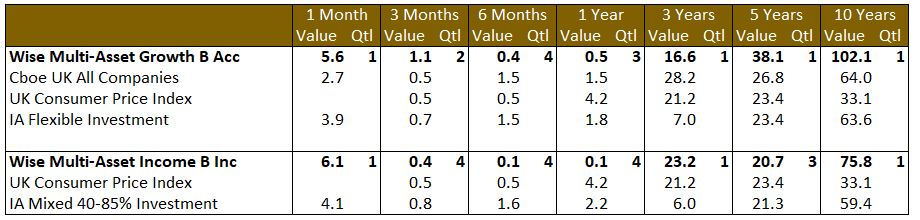

In November, the TB Wise Multi-Asset Growth Fund was up 5.6%, ahead of both the CBOE UK All Companies Index (+2.7%) and its peer group, the IA Flexible Investment Sector (+3.9%). We estimate that close to a third of our monthly performance was due to a tightening of discounts in our investment trusts holdings. This is not too surprising given that we mentioned last month that discounts for the investment trusts sector as a whole had moved to levels not seen since the Great Financial Crisis of 2007-09, and that sentiment and flows were looking extreme. Two of our most striking examples during the month were Caledonia Investments and Aberforth Smaller Companies Trust. The former is a trust invested in a mix of global equities, direct private equity holdings and funds of private equity. Despite its large size close to £3bn of assets, an excellent long-term track record and large recent realisations of assets at premium to carrying value (i.e. selling assets at a higher price than the one used in the trust’s valuations), this is a fund that is misunderstood by many. With its discount near an all-time record at almost 40% at the end of October, some investors noticed how abnormal it was though (us included and we added to our position then). As a result, its discount narrowed to 30% over the month. Aberforth Smaller Companies, a UK small companies value equity fund suffers from a quadruple discount: unloved UK equities, unloved small companies, unloved value style, and unloved trust as a result. With a portfolio comprised of very well capitalised companies, trading at valuations only seen that cheap twice in the past 30 years and with earnings already priced in for a bad recession, we think the cumulation of those discounts is unjustified. The trust was helped by the rebound in risk appetite in November and its discount tightened from 15% to 8%. Other strong contributors (AVI Global Trust, TR Property, Mobius Investment Trust) followed similar themes. Another contributor of note was the Jupiter Gold & Silver Fund which started to benefit from the strong rebound in the gold price (+12% peak-to-trough during the month). This highlights that gold is more than just a defensive play and it is currently supported by record buying from global central banks, a weaker US Dollar and the fall in interest rates. There was no noteworthy detractor.

Wise Multi-Asset Income

In November, the TB Wise Multi-Asset Income Fund rose 6.1%, ahead of the IA Mixed Investment 40-85% Sector, which rose 4.1%. The strongest performance came from those sectors which had performed worst for the fund over the summer when interest rate fears were at the most elevated. There was also a significant boost to performance from discounts narrowing on our investment trust holdings. We have been highlighting in recent commentaries the extreme levels these had reached and it is encouraging to see these return to more normal levels for some of the sectors held within the portfolio. Our property holdings performed strongly, particularly TR Property, Urban Logistics, Empiric Student Property and abrdn Property Income, all of which provided encouraging updates in the month. In most cases, net asset values are showing signs of stabilization, rental demand remains strong and, despite recent share price moves, there continues to be an extreme disconnect between the price of property shares and the values of physical property as observed on the ground. Aberforth Smaller Companies, a fund exposed to lowly valued UK smaller companies, has been very out of favour but was helped by the sharp rebound in risk appetite. The trust has suffered from a quadruple discount: UK equities are relatively cheap as are small companies, the value style has unperformed its growth counterpart, and the trust itself sat at an abnormally wide discount to its net asset value. With a portfolio comprised of very well capitalised companies, trading at valuations only seen that cheap twice in the past 30 years and with earnings already priced in for a bad recession, we think the cumulation of those discounts is unjustified and it was encouraging to see its discount tighten from 15% to 8%. Our infrastructure names also performed well, with discounts narrowing closer to net asset values, which themselves fell only modestly to reflect both higher interest rates and offsetting higher inflation expectations. HICL Infrastructure sold another asset, accommodation at the University of Sheffield, at a small premium to its full year valuation, providing useful further evidence that its valuation process is conservative and its closing 14% discount remains attractive, despite the 14% rise in the share price over the month.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

With economic conditions continuing to be extremely difficult to read and financial markets swinging regularly from one extreme to the other, the only sensible approach to us is to keep assembling a portfolio of quality funds offering strong upside potential -often in an idiosyncratic manner with low correlation to broader macroeconomic developments- and valuations that will provide a buffer against negative volatility. It is an environment where nimbleness and disciplined rotation of positions is required, thereby continuously repositioning the portfolio for the best trade-off between risk and reward. As such, we took some profits in some of our strongest performers (Caledonia Investments, AVI Global Trust, ICG Enterprise). We also reduced our positions in defensive assets (Pacific G10 Macro Rates, Fulcrum Diversified Core Absolute Return) which have helped so far in a difficult year but no longer offer the same upside potential as deeply discounted riskier opportunities elsewhere. We found those in healthcare and UK smaller companies and thus recycled the profits above into International Biotechnology Trust, Worldwide Healthcare Trust and Amati UK Listed Smaller Companies Fund.

Wise Multi-Asset Income

Portfolio changes were limited over the month after a more active month in October, when we had added on weakness to our UK equity, property, infrastructure and biotechnology holdings. We trimmed our holding in Blackrock Frontiers following strong performance year to date.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the WS Wise Funds, including risk warnings, are published in the WS Wise Funds Prospectus, the WS Wise Supplementary Information Document (SID) and the WS Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds. The WS Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years could be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. Waystone Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.