For Professional Clients Only

Macro & Market Update

March was a strong month for risk assets (equities, bonds and commodities), supported by central banks that, while keen to manage expectations, continue to send messages of financial easing to come. Market participants have gradually shifted their views, however, from seeing rate cuts as a necessary condition for returns to continue their march ahead, to seeing them as a nice to have. Indeed, investors’ focus now appears to be more on the growth side of the equation than on the inflation one and, with the former surprising on the upside, the thinking goes that even if interest rates do not come down as much as hoped for a few months ago, provided this is because growth is robust as opposed to inflation staying too high, all is well. Data over the month generally showed that growth remains strong on both sides of the Atlantic, which was acknowledged by both the chairman of the US central bank and the Bank of England. On the other hand, inflation remains hard to predict, with another set of sticky prints in the US but more encouraging ones in the UK and the Eurozone. The US is closer to the target of 2% inflation that central banks aim for, and it might thus be a good illustration of how much more difficult the last few steps are going to be before claiming victory. As a result, bond investors in the US continued to push future interest rate cuts out, now pricing in only three cuts by the end of the year versus four at the start of March and seven at the start of the year. Three is the number predicted by the US central bank so, for the first time in months, markets and policy makers are now aligned.

As mentioned, however, while such sharp moves in interest rates expectations would have led to weak equity markets last year, equity investors have their eyes firmly on growth and if higher for longer interest rates is the price to pay, so be it. Equities were thus positive in March, led by UK large companies for once, supported by the positive comments from the Bank of England but also by the strong performance of oil companies which represent the largest sector in the index. Oil had a good month as not only the growth outlook appears supportive but also thanks to an extension to the production cuts from the world’s largest producers (less production means greater competition from demand and thus higher prices). US equities also had a positive month, although it is worth noting that smaller companies started performing better, in the short-term at least, than their large technology-oriented competitors. More growth sensitivity and cheaper valuations should indeed have that effect, so investors might be getting more sensible again after the exuberance that led them to turn a blind eye on record valuations in some parts of the market. Even emerging markets had a better month, helped by better economic activity data from China and despite the absence of any new stimulus announced at the annual National People’s Congress.

If growth indeed is the new focus for investors, as opposed to inflation and interest rates, then close attention will need to be paid to how companies deliver on their earnings in the next few months. The risk is that, as is the nature of financial markets, expectations are already high in some sectors. When combined with high valuations, it creates room for disappointment. The new record high for gold prices, a traditional safe haven, might be an indication that risks have not fully vanished, and we thus continue to opt for sound investments with attractive upside but only if they benefit from valuations support.

Fund Performance

Wise Multi-Asset Growth

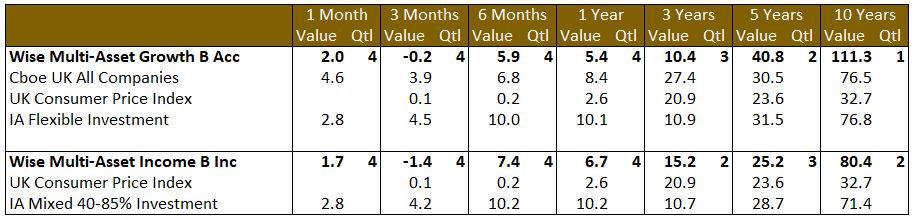

In March, the IFSL Wise Multi-Asset Growth Fund was up 2%, behind both the CBOE UK All Companies Index (+4.6%) and its peer group, the IA Flexible Investment Sector (+2.8%). As alluded to in the earlier section, with large oil companies pulling the index higher, we struggled to keep up. Our bias tends to be towards smaller companies, where we see the most risk/reward potential. That said, some of our UK managers (JO Hambro UK Equity Income, Man GLG Undervalued Assets), thanks to their value bias, are exposed to that theme. More generally, all of our UK funds contributed positively to performance, particularly Fidelity Special Values and Aberforth Smaller Companies, despite their discounts widening. Following the new record high in gold, the Jupiter Gold & Silver Fund was our strongest contributor to performance. This is hopefully the start of precious metals miners grabbing the attention of equity investors and catching up on the strong performance of the underlying metals they have lagged for months. Other strong performers were BlackRock World Mining Trust and the Ecofin Global Utilities and Infrastructure Trust.

On the negative side, the only detractor of note was International Biotechnology Trust which gave some of its gains since the end of October back, mostly through a widening of its discount as opposed to poor performance from the underlying portfolio.

Wise Multi-Asset Income

In March, the IFSL Wise Multi-Asset Income Fund rose 1.7%, behind the IA Mixed Investment 40-85% Sector, which rose 2.8%. Given the strength of global equity markets, it was unsurprising to see our equity fund holdings perform strongly. Aberforth Smaller Companies, Fidelity Special Values and Man GLG Income reflected the strength in UK markets as did our direct financial holdings, Paragon and Legal & General. International equity holdings, Middlefield Canadian Income, Polar Capital Global Financials and Schroder Global Equity Income were similarly strong performers whilst Murray International and abrdn Asian Income Fund lagged, in line with Asian Emerging Market equities. Our commodity holdings, Blackrock World Mining and Blackrock Energy & Resources, were the strongest performers over the month, as mining companies outperformed their underlying commodities, and rebounded following a period of prolonged weakness. Discount narrowing at the investment trust level compounded returns. Despite a c.0.4% fall in 2-year UK government bonds yields over the month, it was disappointing not to see our more interest rate sensitive property and infrastructure holdings perform better over the month. Newsflow from the companies themselves was positive supporting our view that current share price discounts do not reflect the quality of the underlying assets. Notably, HICL and International Public Partnerships detracted from performance despite positive updates. Whilst INPP saw its net asset value fall as discount rates were increased further, the latest results demonstrated the strong operational performance of the underlying assets. Having increased the dividend 5% last year, the board has been able to commit to further 3% growth for the year ahead as a result. The board has explicitly stated that the current near 20% discount to the latest Net Asset Value materially undervalues the company and that they will continue to actively recycle the portfolio, having already sold £200m of assets above book value, repaid all short-term borrowing and committed to a share buy-back. HICL’s update showed the continued resilience of their high-quality portfolio and announced cash generation in line with forecasts underpinning its current 6.5% dividend yield. They also confirmed the market for high quality core infrastructure assets remains in good health, again reinforcing the disconnect between public market and private market investor valuations.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, as our strategy and discipline dictate, we used the strong markets to take some profits in a number of positions: JO Hambro UK Equity Income, Aberforth UK Smaller Companies, AVI Global Trust, AVI Japan Opportunity and Polar Capital Global Financials. We also exited our position in BlackRock Frontiers, a trust investing in smaller emerging markets which has performed strongly over the past few years and had become a small position after a few rounds of profit taking.

Wise Multi-Asset Income

Property performance was impacted by the news at the end of the month that investors (ourselves included) had voted against the merger of abrdn Property Income with Custodian Reit in favour of a managed wind-down of the company over the next two years. Despite announcing the disposal of two assets at a 0.3% discount to the December 2023 valuation, the shares fell on the vote to a 35% discount. We believe there is substantial upside to the current share price to be delivered from an orderly disposal of the underlying properties. Elsewhere in the sector, Impact Healthcare Reit’s net asset value rose 5% over the year as it delivered rental growth of 4% and improving profitability of their care home tenants. Over the same time period, however, the shares have seen their discount widen by over 20%. Empiric Student Property’s full year results delivered excellent rental growth of over 10%, with rooms being filled faster than ever and strong momentum for the year ahead.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.