“It is with great pleasure that we celebrate the 20th anniversary of the Wise Multi-Asset Growth Fund. 20 years is a long time in fund management and simply having survived for so long is an achievement in itself. Morningstar, the fund research company, estimated last year that less than 30% of equity and fixed income funds still exist after such a length of time. Corporate changes, staff turnover and, of course, poor performance often are the death of a fund so, sitting here to write about our anniversary feels like a true privilege. It is also an occasion for reflection about the events and challenges we encountered over those years, as well as about the elements that might explain our survival. Above all though, this is an opportunity to thank investors who have been loyal to us throughout this period, took the time to understand our strategy and stuck with us through, mostly, good years but also some difficult ones. It sounds cliché to say it but it is true: we would not be here without your support and we do not take managing your money for granted, so thank you for giving us the opportunity to invest on your behalf.“

Notable events of the period

I will not go through a history lesson here but, the past two decades, like any such period of time, have seen their share of turbulence and events that impacted financial markets. Two of those were of truly global significance. The Great Financial Crisis of 2007-2009, a shock so deep that it dictated the direction of interest rates for the next decade, sowed the seeds for remarkable returns from so-called risk assets (equities and bonds). The period of ultra-low interest rates that ensued was only brought to an end by another shock that will scar us all for a long time: the Covid-19 pandemic. Never in living memory had an event of such magnitude had a simultaneous impact on the whole world. Paling in comparison but significant nonetheless and with political and economic ramifications to this day, the Brexit referendum of 2016 created a high degree of uncertainty about the future direction of travel for the economy, divided the British population and political parties, sometimes to the point of implosion, and gave an excuse for foreign investors to look elsewhere. Outside of the UK, other political and geopolitical shocks were not in short supply either: a Trump presidency would surely have been unthinkable 20 years ago, as would have been the general rise in populism across developed and emerging countries alike. What would have been recognisable though, sadly, were more wars driven by religious, historical and/or egotistical reasons. It would, however, have been impossible to predict exactly the wars with ISIS, against Russia in Ukraine or in Gaza, but the seeds of those conflicts go back decades.

Meanwhile, on a more positive note, the technological advances since 2004 have been incredible: from the completion of the Human Genome Project which mapped the entire human DNA, to the invention of smart phones and tablets, to the inescapable rise of electric cars or the possibility, once again, of space exploration, our lives have changed dramatically in 20 years, often for the best (note that the invention of social media was not mentioned in that list!). The increase in the number of drugs tackling major and rare diseases alike coming to market recently, the speed at which a Covid vaccine was developed, and progress made in renewable energy are only some examples of how technological evolutions of recent years can give us hope of tackling global issues.

The rise of passive investing

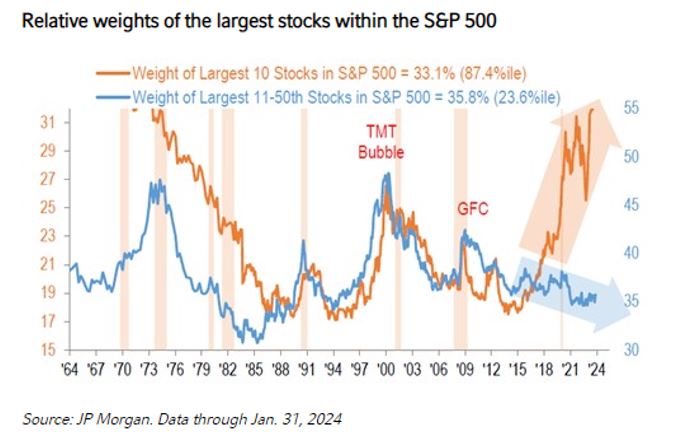

This somewhat random list of important events of the last 20 years (many more were omitted) is merely to make the point that a lot can happen in such a timeframe and that financial markets, the economic mirror reflecting all these global events, are never a dull place. They also saw their own share of structural change since the start of the millennium, possibly the most important of which has been the rise in passive investing. Passive investing consists of buying index trackers or Exchange Traded Funds (ETFs) which replicate an index like the FTSE 100 in the UK or the S&P 500 in the US. Its main advantage is cost: since there are no active decisions to be made by a fund manager as to which stock to invest in and which to avoid, fees can be kept to a minimum. Another advantage active investors do not like to talk about is that ETFs often beat active funds. In highly liquid markets like US equities, beating the index is incredibly difficult. Why thus pay extra fees for lower returns? This “no-brainer” led to total passive investments overtaking active ones last year, creating a seismic change for an industry where lots of cats were getting fat without catching any mice. Buying the whole market cheaply thus makes sense…until it does not and that point comes when the so-called “whole market” itself becomes distorted either by being overly concentrated or excessively valued. Using US equities as an example, as illustrated below, the index is now highly concentrated in a few giant companies, mainly in the technology sector, with the top 10 accounting for a third of the total. Investing in an S&P 500 index thus creates a massive concentration risk many investors may not be fully aware of. While technology names perform well, that risk can be ignored, but they will not perform at the current rate forever.

Passive investing is equivalent to a momentum strategy, that is buying securities that have already performed well in the hope they will continue to perform. It is a perfectly valid strategy and one that, over time, delivers strong results. Momentum can turn abruptly, however, especially when driven by only a handful of names, so this is the risk to be prepared for. On the other hand, active management is about choosing which companies to own and which ones to avoid and, as such, the role of an active manager should be as much about finding the next winners as it is about side-stepping tomorrow’s losers. If done properly, this justifies an additional fee but, unfortunately, few do, hence the current dominance of passive investing.

The evolution of Investment Trusts

As our readers will know, from inception in April 2004, our Fund has been heavily invested in investment trusts. They have been a great source of returns for our investors (more on that later), but the current universe of trusts available is radically different from what it was 20 years ago. At that time, roughly 80% of trusts were invested in equities. Since then, an increasing number of new strategies have made full use of the investment trust structure to offer retail investors access to less liquid asset classes, such as property, infrastructure or private equity. By allowing fund managers to have a genuinely long-term focus (without having to worry about flows in or out of their funds) and with the option of smoothing income, it has rightly been an attractive option for retail investors. The structure is thus perfectly positioned to provide capital to areas in critical need of funding, such as renewable energy or early-stage growth companies. The sector is now £272bn in size and represents roughly a fifth of all listed companies in the UK.

Recently, however, the sector has gone through a perfect storm caused by continued outflows from UK equities (where the trusts are listed), a dislike of smaller companies (which many trusts are themselves), a reduction of the traditional pool of investors due to consolidation amongst wealth managers and, most frustratingly, unhelpful regulatory changes affecting costs disclosure and forcing long-established investors to sell. I will spare you another rant on the latter point but, if of interest, we have written in detail about these issues, most recently in our annual commentaries published in March 2024. We are confident that this storm, like many in the past, will pass and that the sector will continue to evolve like it has done since the first trust was launched in 1868.

“I am honoured to have been asked to comment on the occasion of the twentieth anniversary since the IFSL Wise Multi-Asset Growth Fund (known back then as TB Wise Investment) was launched in April 2004.

The Fund was our first venture into the world of unit trusts. We had been running ‘broker funds’ for our clients since our company was founded in 1992. Broker funds allowed us to construct portfolios from a range of global sectors (UK Small Companies, Japan, Index-Linked Gilts, cash etc) offered by insurance companies. These funds were successful but we had always wanted the far greater freedom of choice offered to us by unit trusts and as soon as we had the required £5m we launched this, our first fund. The Wise Multi-Asset Income Fund followed close on its heels in 2005.

There has been no shortage of traumatic events in the outside world during the twenty-year life of the Fund – the Great Financial Crisis, Brexit and Covid to name a few. By contrast, the history of the company has been one of quiet, peaceful evolution. We often used to say that being investment managers felt like being lookouts on a ship, seeking to avoid the storms as they came along, and for that we needed the ship to be as stable as possible to allow us to give our full attention to the view ahead.

In 2013, I had passed my sixtieth birthday, and though I was as enthusiastic as ever and in no hurry to retire (which I eventually did in 2021) it was clear that a decision needed to be made about the long-term future of the company. After considering various options, we felt that the best solution would be to become employee-owned. We accordingly set up a trust which has gradually become full owner of the company, holding shares on behalf of the employees, who qualify as beneficiaries. This solution has fulfilled all our expectations and gives the Wise Funds staff security and an even greater sense of involvement.

Looking at the company from the outside today, I see a stable and secure entity, with a proud history of caring for its clients and staff, and all with a genuine commitment to the local community through charitable and other activities. I remain a client of Wise Funds, with a substantial proportion of my personal investment portfolio looked after by the company I founded over thirty years ago.“

How did we survive?

As I mentioned in introduction, it is a privilege to be one of the roughly third of funds still standing two decades after their launch, but how did we get there? Other than chance which will always be a factor one should not ignore, a few others can provide some pointers.

From day one, the most important factor for us has been to get the right people and the right structure in place. As fund of funds managers, we know that the best fund managers do not thrive in an unsuitable corporate structure and, that hiring the wrong people can disrupt the best of organisations. Getting both of these right starts and finishes with getting the correct alignment of interests between individuals and organisations. At Wise Funds, being employee owned is how we try to get that balance right. While not a panacea and certainly not the only structure that works, employee ownership gives employees a bigger sense of accountability and responsibility, working for the bigger picture as opposed to purely their own individual silos. It is a structure that only attracts people with a long-term vision and the desire to be part of building a successful company. As a result, staff turnover at our firm is low with the only fund manager departure due to the retirement of our founder, Tony, in 2022. Philip and I have managed the Fund since 2018 and 2017 respectively.

When a company like ours is purely focused on one simple activity (our sole business is to manage our two funds), the company’s interests, employees’ and our clients’ are in perfect harmony. Success for all parties can only come from one driver: strong performance.

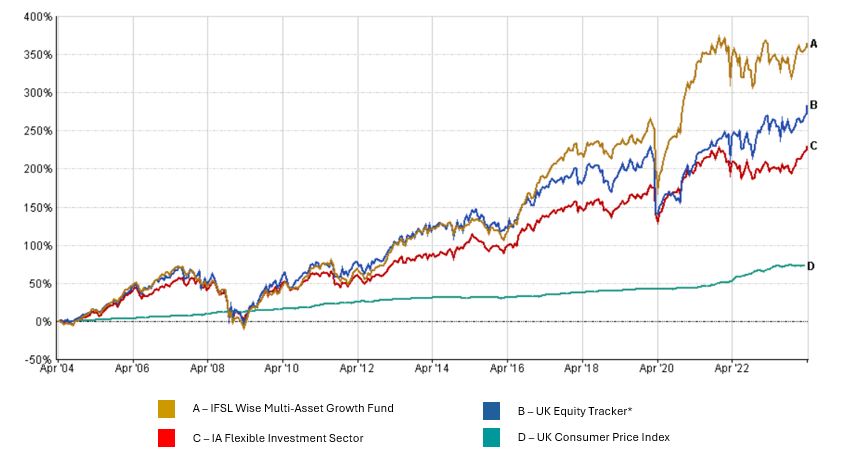

On that point, over the past 20 years, our Fund grew by 366% after fees, or 8% per annum. It outperformed UK equities by 67%, inflation by 292% and its peers in the IA Flexible sector by 135%. £1,000 invested in the Wise Multi-Asset Growth Fund at launch would now be worth £4,658 vs £3,850 for a passive investor in UK equities and £3,306 for an investment in the average fund in the IA Flexible sector. Survival in fund management tends to be highly correlated with performance and, the longer the time horizon, the greater the survivorship bias. We think our strong performance for two decades comes from two main factors:

*UK Equity tracker performance has been used as Cboe UK All Companies (Target Benchmark) only launched in 2011. More information provided below.

For more fund performance, please see the latest factsheet

Wise Multi-Asset Growth March 2024 factsheet

1

Our focus on investment trusts allows us to create genuine multi-asset portfolios, diversifying away from the traditional equities and bonds. Private equity, in particular, but also infrastructure and property have contributed greatly to our returns over time. Within equities, investing in less liquid companies, with managers who often take an activist approach (having the privilege to use their permanent source of capital to force management changes over, sometimes, a long time period) has also generated extra returns. Such strategies are only conceivable through investment trusts. Our engagement with the boards of those trusts is also a positive contributor to performance, although less directly palatable, but it at least gives us a strong governance oversight. Finally, being able to use discounts to our advantage helps boost returns over time. To that end, our small size allows us to hunt for opportunities in a universe of trusts ignored by larger players.

2

Our consistency of investment approach, with a focus on value, is the other critical driver of performance. Every investment style goes through cycles and value investing has faced struggles in recent years as investors have focused more on growth than on value for money. That said, over long periods of time, value remains a winning strategy and we think it is sensible to look for margins of safety (by not overpaying) to limit the downside and, hopefully, maximise the upside. But maybe even more than the investment style itself, a consistency of approach is important in fund management. Active management is a constantly humbling experience with markets’ ebbs and flows testing one’s conviction on a regular basis. Investing without a consistent and disciplined approach is akin to letting oneself drift on a barge in a stormy sea…and it rarely ends well.

In addition to producing good returns, these factors have helped us deliver a performance profile different from the rest of the market. Going back to the rise of passive investment we described earlier, our portfolio can not easily be replicated by a tracker. This is key because one cannot beat the market by doing the same as the market. It is also critical because there is no point in delivering market-like returns for above-market fees. This would not be a sensible business model. Our active, hard-to-replicate, multi-asset, value strategy can actually be very complementary to a passive, readily-available, equity, momentum, tracker strategy, for investors willing to cover all basis and diversify their holdings.

While we cannot guarantee our performance in the future will match the performance from the past, we can assure our investors that our focus and style will not deviate from what they have been since 2004. The portfolio will evolve, for sure, as the market will continue to change, but our principles will remain the same.

I will conclude by, once again, thanking you, our clients, old and new, for your support over the past two decades, through good times and more challenging ones. We always welcome feedback and interaction, so please feel free to engage with us how and when you so desire. The same way as we see our investments in other funds as a relationship with those managers, we hope you can feel you can build a relationship with us too.

TO LEARN MORE ABOUT THIS FUND , PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.

*UK Equity tracker is the L&G UK Index Trust. We have used this index as it has a track record that precedes the IFSL Wise Multi-Asset Growth Fund and has tracked all companies with the UK equity market.