For Professional Clients Only

Macro & Market Update

The dominant event of the month was the collapse of two regional US banks and the hurried merger of Credit Suisse and UBS. The fastest tightening of monetary policy in decades has exposed fractures in the global banking system. Markets have been quick to question both the extent to which the issues that caused these banks to fail were due to specific mismanagement or were more systemic in nature and could lead to financial contagion. Since the Global Financial Crisis in 2008, there has been a significant overhaul of the global banking regulation with significant improvements in the amount of capital banks hold as well as their leverage and their liquidity. Banks are, however, inherently built on confidence with a significant proportion of their funding coming from corporate or retail deposits, which can to a certain extent be withdrawn immediately. Most banks diversify their sources of funding with their retail deposit largely guaranteed by the government in the case of the bank failing, whilst the banks themselves match the length of time they tie up their investments for with the time they expect to hold on to their deposits. Silicon Valley Bank, the first of the two US banks to fail, was in many ways unique. Its deposit base was not made up of thousands of government guaranteed retail deposits of less than $250k, rather its deposit base was highly concentrated into a small number of technology related companies, who themselves were experiencing funding strain and were able to withdraw their money overnight. The bank had then invested those into long-dated, but theoretically ‘low-risk’ government bonds. Were the bank able to hold these investments to maturity it was highly unlikely they would not have been repaid in full by the US government, however, in the meantime their value in the market had fallen to reflect the relative unattractiveness of the yield they had been issued at purchase as interest rates had risen. None of this would have mattered had the bank been able to hold these investments to maturity, however, large theoretical losses on the bank’s balance-sheet when applying tradeable market prices to these holdings caused the deposit base to panic that their cash was no longer safe and demand repayment. In order to do so the bank was forced to sell these assets and thereby crystallising a loss which turned a liquidity crisis into a capital crisis. This set of circumstances is relatively unique to the regional US banking sector, which has enjoyed a relatively lighter-touch regulatory framework over the last decade, so there is limited read-across to larger US and European banks. In some ways it was more concerning, therefore, that Credit Suisse, a bank that has suffered from a series of recent scandals but which had good liquidity, a more stable deposit base and plenty of capital and support from the Swiss central bank over the course of a weekend was forced into an emergency merger with its national rival.

These developments have led to a number of important changes in markets, in central bank support for the banking system and to expectations for the direction of future interest rates. Firstly, central bankers globally have been quick to state that investor deposits are safe, even if they do not fall under pre-existing guarantee schemes whilst the failed banks themselves have been bought by larger peers thus averting the need for any governmental intervention. The way the Credit Suisse merger was enacted, however, has caused some turmoil in a particular part of the bond market that emerged immediately post the financial crisis. A specific type of bank debt, called Additional Tier 1 bonds (or AT1), was issued that was designed to convert into equity in the event the bank looked as if it was no longer viable or its capital position fell below a pre-determined level. The convention has always been that bond investors sit in a senior position in the hierarchy to equity investors, so losses would only be felt by bondholders with equity investors having already been wiped out. This was not the case at Credit Suisse with equity holders retaining some value whilst bond holders of these AT1 bonds lost everything. This will no doubt have future implications for bank funding even though both the Bank of England and the European Central Bank were quick to state they disagreed with the Swiss regulatory approach. Finally, investors have scaled back their expectations of global interest rates in the aftermath of the banking sector turmoil.

Whilst central bankers are now having to weigh up broader concerns around financial stability, the challenge they face was brought into focus by the persistently high inflation data reported over the month as well as signs that global economies continue to perform better than expected. As a result, the Bank of England, Federal Reserve and European Central Bank pushed on with further rate rises at the same time as moderating their language regarding (?) future direction.

Fund Performance

Wise Multi-Asset Growth

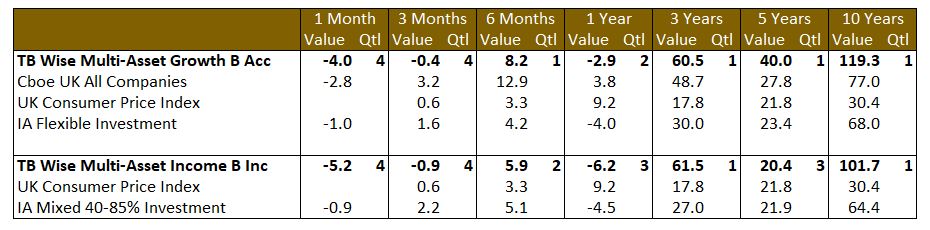

In March, the TB Wise Multi-Asset Growth Fund was down 4%, behind both the CBOE UK All Companies Index (-2.8%) and its peer group, the IA Flexible Investment Index (-1%). As alluded to earlier, our worst performers were found in the worst sectors for the market as a whole, namely financials (Polar Global Financials Trust) and areas requiring debt like private equity (Pantheon International and AVI Global Trust which invests in listed private equity managers) even if the leverage with those trusts is not a concern. Property (TR Property), for similar reasons, also suffered during the month. Finally, our value bias hurt the Fund in general because those managers have tended to like financials for fundamental reasons, as well as the energy sector which dropped on recession fears.

There were few places to hide but our position in precious metals (Jupiter Gold & Silver) benefitted from increased fears due to their safe haven characteristics, while some of our more trading-oriented managers like Pacific G10 Macro Rates managed to navigate the uncertainty well. Higher than normal levels of cash also helped limit the negative performance.

Wise Multi-Asset Income

In March, the TB Wise Multi-Asset Income Fund fell 5.2%, behind the IA Mixed Investment 40-85% Sector, which fell 0.9%. Unsurprisingly it was our direct financial holdings, Legal & General, Polar Capital Global Financials and Paragon, which were most heavily hit. Our UK Equity fund holdings as well as Middlefield Canadian Income, with a bias towards cheaper, more cyclically-exposed sectors also fell hard as concerns grew about the economic outlook. These fears spilled over into the property sector, with abrdn Property income, TR Property, Urban Logistics and Impact Healthcare REIT falling sharply. Despite reporting a strong set of annual results (Net Asset Value total return of 15% and 25% of the portfolio realised over the year at a 73% premium to book value), CT Private Equity was weak as its discount widened to levels last seen at the depths of the Covid crisis. Disappointingly, our fixed income holdings posted negative returns and failed to provide portfolio protection reflecting their exposure to banking sector debt and, in the case of GCP Infrastructure, a widening of the discount despite the announcement of a £15m share buyback.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of activity, we had started the month with elevated levels of cash, having raised 2.7% in February. As we explained last month, we had grown increasingly concerned about the market reassessment of future interest rates, the strong recent performance, and the increasing divergence between bond and equity markets. We will admit that a crisis in the banking sector was not on our radar, however, but it illustrates the importance of erring on the side of caution and the benefits of managing cash actively when something does not seem right. We did a similar move last summer when equity markets appeared overly complacent in light of uncertainty about interest rates and it protected us somewhat ahead of the “mini-budget” chaos in September, despite having not forecasting it. Strong divergences in markets do not create events or crises per se but, were those to happen, stretched markets correct much quicker, hence the need for caution.

During the month, we increased cash further to 5.4%, as well as added to defensive areas such as Jupiter Gold & Silver, Pacific G10 Macro Rates, Premier Miton Global Infrastructure Income and Worldwide Healthcare Trust. Those additions were financed from equity positions by trimming some of our relative outperformers (AVI Japan Opportunities, BlackRock Frontiers, Fidelity Asian Values) as well as some of our positions possibly at risk in the current environment (Polar Global Financials Trust, European Smaller Companies Trust, Amati UK Smaller Companies).

We will remain cautious and active in the management of our risk as this crisis evolves.

Wise Multi-Asset Income

During the month, we continued to reduce equity risk within the portfolio and increased the cash levels to 5.9% We reduced our holdings in Numis, Blackrock Frontiers, Henry Boot, CC Japan Income & Growth, Vanquis Banking Group (previously named Provident), Murray International and Empiric Student Property. Within our more defensive allocation, we reduced our holding in Twenty Four Strategic Income and introduced HICL Infrastructure at an attractive yield with strong inflation-linked revenues.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.