The overriding issue impacting markets over the course of the year under review was the persistence of inflation and the substantial actions taking by central banks globally to combat it. Whilst high levels of inflation had been evident well before the start of the Fund’s February year, it was not until March that monetary policy was tightened (interest rates were raised) as it had become increasingly clear that the problem of higher inflation was a more embedded one than originally hoped. Initially central bankers had removed excessive financial liquidity from the system by unwinding their bond purchase programmes (quantitative easing) but had held back from increasing interest rates as they remained relatively relaxed that inflation caused by the rapid re-opening of the global economy and by supply chains that were struggling to keep pace would ultimately prove broadly transitory. As supply chains gradually sorted themselves out, particularly in China where manufacturing was disrupted by the restrictive government imposed zero-Covid policy, and labour market tightness eased as distortive government support schemes were withdrawn, it was hoped that high levels of inflation would naturally roll-off. The story of the last year has been one of central banks rapidly having to play catch up as they realised core inflation (where more volatile components such as food and energy are stripped out) was more ingrained than previously thought and consequently we have experienced one of the most rapid rate-tightening cycles in living memory. February also marks the anniversary of the Russian invasion of Ukraine. The long-term consequences of this will most likely be a renewed focus on energy self-sufficiency, renewable power generation and higher food inflation. In the short-term energy markets impacted by sanctions responded faster than expected as oil was redirected to China and India and a milder winter than feared in Europe, saw gas prices tumble as storage facilities were replenished. Whilst fears that Europe would have fallen into recession at this point have, therefore, proved premature, the direction of global economic growth forecasts over the course of the last year has been lower. That central bankers have been willing to continue to increase interest rates despite fears of a prolonged recession, as consumers grapple with lower real incomes and companies face weaker end demand, serves only to highlight the challenges of taming problematic inflation.

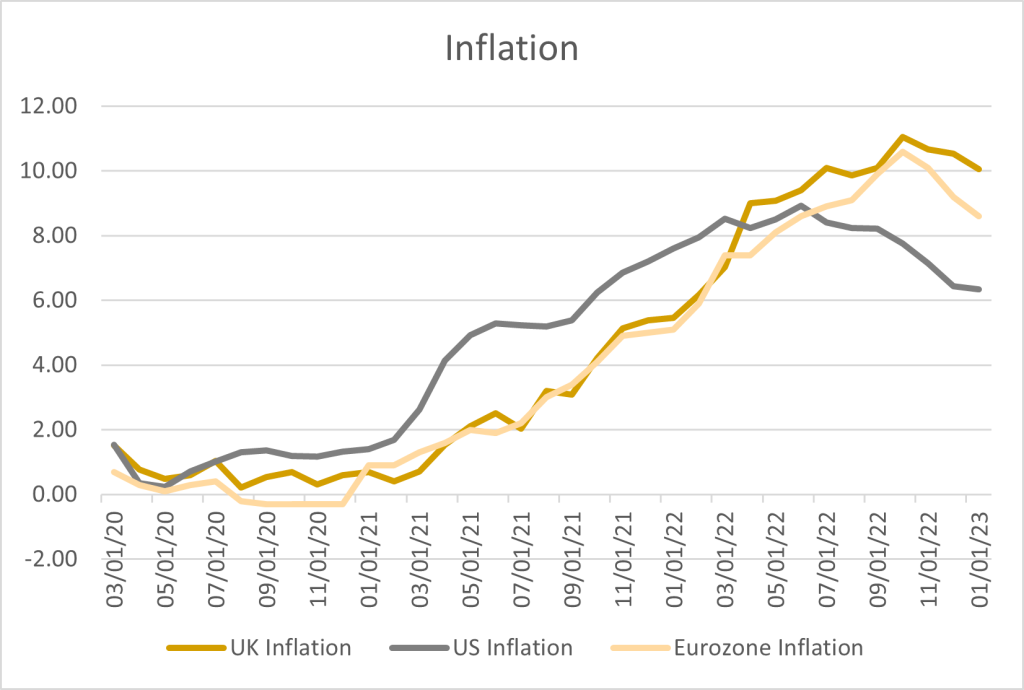

At the start of the Fund’s financial year inflation in the UK was already high, running at 6.2% year-on-year, however, the extent of the ongoing inflationary challenge was demonstrated by monthly inflation, which had already risen between January and February by 0.8%, its largest monthly increase since 2009. Inflation was similarly strong in the US and the Eurozone, however, any hopes that inflation might quickly be tamed were undermined by the Russian invasion of Ukraine just before the start of the period which fuelled the troublesome underlying situation, with the impact primarily being felt in commodity markets. Prior to the invasion, Russia was a significant exporter of gas, supplying around 40% of the gas used in the euro area as well as being the second largest global crude oil producer. Ukraine, Belarus and Russia are also large exporters of wheat and fertilisers, so the protracted nature of the conflict has led to higher food prices globally. The combination of inflation spreading out from manufacturing into services sectors of the economy

coupled with the addition of elevated commodity prices saw developed world inflation reach levels not seen since the 1980s. With central bankers targeting inflation rates of 2% and inflation peaking at 9% in the US and above 10% in the UK and Eurozone, the need to act has led to a very rapid series of interest rate rises globally. In the US, bank rates were increased from 0.25% at the start of the period to 4.75% by the end of it. In the UK, the move was from 0.5% to 4%. In the Eurozone, the central bank increased rates for the first time in 6 years, from 0% to 3%. By September, despite deteriorating confidence surveys and weaker manufacturing data, tight labour markets and rising wages meant central bankers were forced to accelerate the pace of interest rate rises even if this increased the chance of a hard landing (a sharp economic slowdown) for the global economy.

Data uses UK CPI, US CPI and Eurozone (Harmonized) CPI

The need to prioritise reducing inflation even at the expense of jobs and economic growth was summarised by Jerome Powell, Chair of the Federal Reserve, who stated “We have got to get inflation behind us. I wish there were a painless way to do that. There isn’t.” Whereas in the rest of the developed world, government spending (fiscal policy) and monetary policy (interest rates) set by central banks both seemed to acknowledge the need to cool the economy and thereby supress inflation, in the UK the brief cameo appearance of Liz Truss and Kwasi Kwarteng as Prime Minister and Chancellor, saw the government and the Bank of England pulling in opposite directions. In September the government’s mini-budget succeeded in unnerving markets that fiscal discipline had been abandoned and its growth plan was certain only to cause the Bank of England to raise rates more aggressively than previously forecast. Whilst the £60bn cost of the energy price cap was broadly anticipated, the fact the reversal of the planned national insurance and corporate tax rises, a reduction in stamp duty and a reduction in the top rate of tax from 45% to 40% were not accompanied by any suggestion of how these were to be funded caused markets to worry that the budget deficit was out of control. Government bond yields witnessed extreme increases over the week and the Bank of England had to keep yields on longer-dated bonds supressed to circumvent panic-selling from pension funds. In addition, the pound slumped to its lowest level ever against the dollar and banks were forced to pull mortgage offers to home-owners given the rapid rise in their borrowing costs. Frayed investor nerves were only placated by a rapid change at the helm and a reversal of all previously announced spending cuts. However, by the end of this Parliament tax as a share of total UK GDP is set to rise to 36%, its highest in more than 70 years, which highlights the constraints facing the Chancellor. Increasing taxes further looks unpalatable as does reducing government spending at a time when public sector pay increases are running significantly below the private sector and inflation is extremely high.

There was some respite for markets in the fourth quarter of the year as headline inflation peaked, economic growth came in stronger than expected and China reversed its zero-Covid policy, which had caused economic growth to fall significantly short of its previous 5.5% guidance. October saw inflation data coming in lower than economists expected for the first time in many months and provided investors with the ammunition needed to fuel the belief that interest rates hikes were close to peaking. The Federal Reserve softened the language that accompanied its latest rate rise, stating that it would now “take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and the economic and financial developments.” The governor of the Bank of England further encouraged investors by stressing that “bank rate will have to go up less than currently priced in financial markets”. This provided welcome relief to markets, which had been under pressure all year as did the dramatic relaxation of self-isolation requirements and quarantine restrictions in China in spite of the increased number of Covid cases sweeping across its main cities.

The buoyant mood of the final quarter of 2022 continued into January, however, February data undermined the prevailing hopes that 2023 might be a year in which the global economy delivered a ‘goldilocks’ year of growth. In this environment growth and inflation are neither too hot nor too cold, allowing central bankers to pause monetary policy without previous tightening having delivered too strong a blow to economic growth. Subsequent economic data has shown this to have been a glass half-full view of the outlook as inflation, particularly core inflation, which strips out the more volatile energy and food prices, is proving stickier than hoped whilst closely watched jobs data in the US has shown the economy is running hotter than the Federal Reserve would have liked. At the same time, there have been a couple of warning signs that the significantly tighter financial conditions experienced this year are putting pressure on parts of the financial system. In the immediate aftermath of the UK mini-budget, pension funds using Liability Driven Investments (a leveraged investment strategy to hedge against pension deficits widening as bond yields move) were forced to sell government bonds at a loss in order to meet collateral requirements. and immediately after the year end two US regional banks, SVB and Signature Bank, went into administration as deposits were withdrawn and liquidity mismanagement forced low-risk government bonds to be sold before maturity, thereby crystallising capital losses.

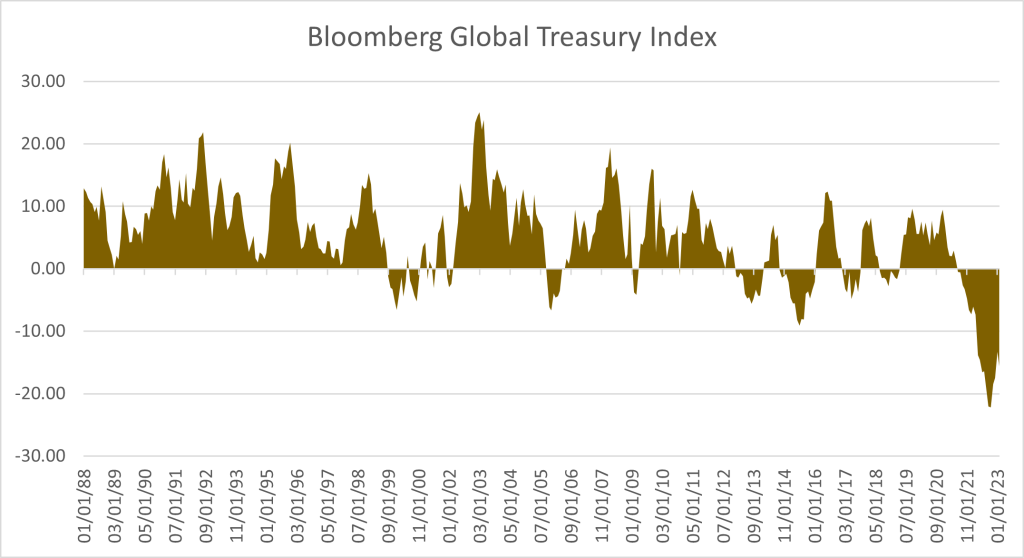

Against this backdrop there have been few hiding places for investors. Typically, a deteriorating economic backdrop and weak equity market performance would mean positive returns for investors in bonds. However, given the extremely low yields on offer at the start of the year, global bond markets have proven to be anything but the safe haven investors might have hope for. Historically, government bonds offered low fixed returns to investors but offered limited return in excess of inflation. This was commonly referred to as ‘risk free return’, however, as a result of a decade of sub-trend growth post the Global Financial Crisis and central banks buying bonds in the market to keep yields low, the bond market entered the start of 2022 with yields at anomalously low levels. Despite recessionary concerns, the yield on government bonds have increased over the period as investors try to keep pace with rapidly rising interest rates. As an example, the keenly watched yield on a 10-year US government bond rose over the period from 1.8% to 3.9%. In addition, the spread (extra yield) that investors demand over the yield on government bonds to invest in corporate credit, both for less risky investment grade credit and riskier high yield credit, has also widened during the period. The Bloomberg Global Aggregate Index, a multi- currency benchmark that includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers, fell 14% in total returns over the period in dollar terms, justifying concerns that bonds in recent years offered ‘return free risk’ rather than the traditional risk free return. Indeed, somewhat perversely the Bloomberg Global Treasury Index, which tracks ‘lower-risk’ government debt of investment grade countries fell even more (-16% in total returns) than the riskier Investment Grade credit market over the year, reflecting their even lower initial yields at the start of the year. Not only does this mark the worst year of performance for bond markets since these indices started over thirty years ago by some magnitude, it is also unprecedented for bond markets to deliver a year of negative returns at the same time equity markets also fell.

With risk-free rates rising and global economic growth forecasts falling, equity markets faced the twin pressures of valuation compression and earnings forecasts being cut. The UK stood out as one of the only markets globally to post positive returns over the period, helped by its concentrated exposure to financials and commodities, both of which have enjoyed low starting valuations and a favourable tailwind from higher interest rates and commodity prices. US equity indices performed particularly badly, especially the technology focussed Nasdaq Index, and only the strength of the dollar over the course of the year helped offset capital losses for domestic investors. A year ago we highlighted there was still a noticeable divergence in valuation between the cheapest 20% of global equities and the most expensive 20%. Whereas the former sat at a valuation level below its long run average since 1990, the most expensive 20% had only ever been more expensive in the technology boom in 2000. In this environment cheap valuations rather than revenue growth looked set to be the key determinant in delivering positive returns to investors and a skewed allocation to ‘value’ equities was warranted. As interest rates rose and the era of cheap finance came to an end, speculative, loss-making technology companies, which had performed particularly well during Covid, were at the sharp end of the new reality of financial markets. The bellwether Ark Innovation ETF, focussed on early stage, disruptive technology companies, as an example, fell 44% over the period, compounding its fall of 46% a year earlier. Asian markets also fell as the combination of a stronger dollar and weaker growth from China both acted as a headwind.

Despite the disruptive impact of the Ukraine invasion, commodities were broadly weaker over the period as industrial metals, such as copper and iron ore, were impacted by slower Chinese growth and energy markets unwound their initial conflict driven spike. Finally, property stocks came increasingly under pressure as the initial tailwind of continued recovery in rents from Covid were offset by the negative impact on valuations from higher reference corporate bond yields, particularly in the aftermath of the September mini-budget.

Performance

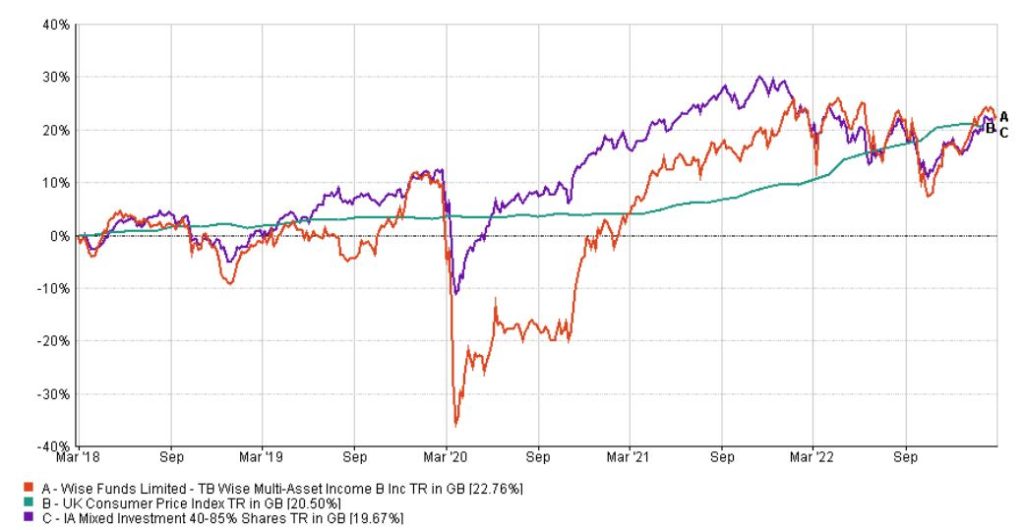

Given the market backdrop described above, the Fund made more limited progress following the strong rebound in performance in its last full financial year. Over the 12-month period, TB Wise Multi-Asset Income rose 3.5% (B Income shares). Over this time period, we underperformed the Consumer Price Index, which measures inflation and as explained above rose very strongly, up 9.2%. However, we outperformed the comparator benchmark, the IA Mixed 40:85% Investment sector, which fell 1.0%. Over 5 years as per our objective, the Fund has risen 22.8% compared to its target benchmark, the Consumer Price Index, which rose 20.5%, and the comparator benchmark, the IA Mixed 40:85% Investment sector, which rose 19.7%. Whilst it is disappointing not to have kept pace with inflation over the period, we are encouraged to have delivered positive returns against such a challenging backdrop for both defensive and risk assets. Compared to our peer group, the fund was in the top 10% of funds over the year. The distribution per share rose from 5.63p to 5.82p over this period. Whilst this also lagged inflation, we currently anticipate an increase in the rate of distribution growth over the course of the next 12 months.

For more fund performance, please see the latest factsheet

TB-Wise-Multi-Asset-Income_0223.pdf (wise-funds.co.uk)

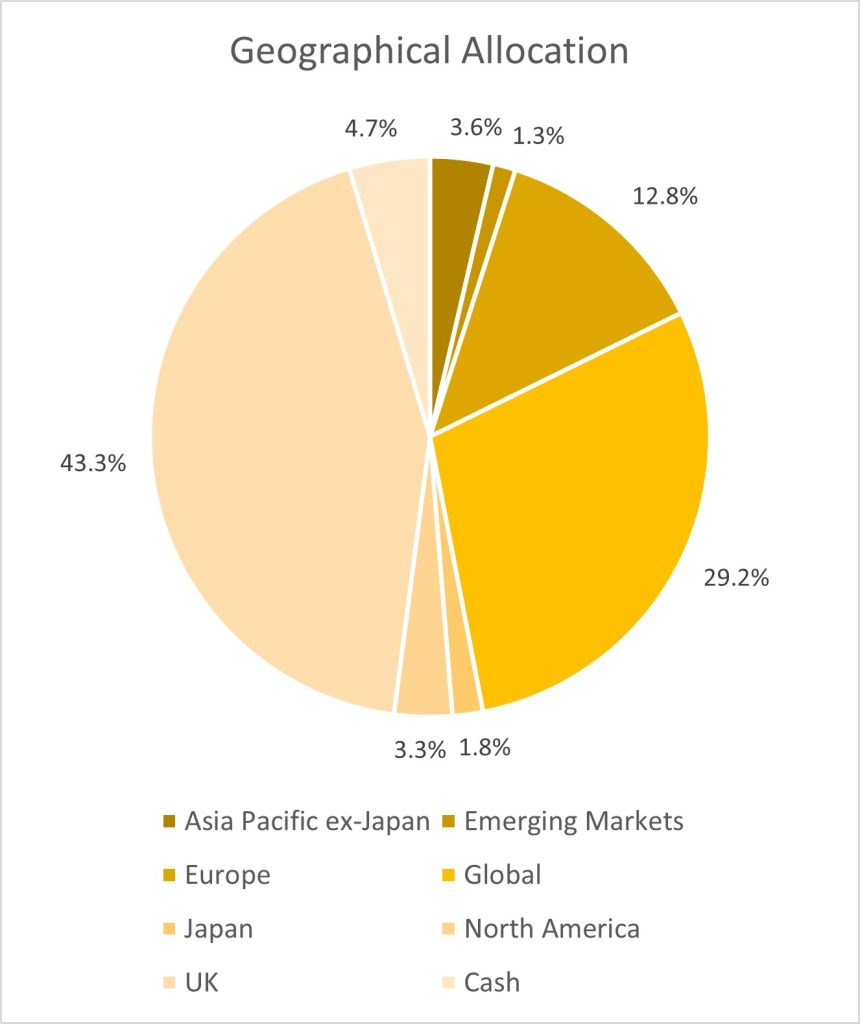

A common factor uniting our equity fund holdings is a style-bias towards value rather than growth. Geographically this has pushed our equity allocation towards equity markets outside the US, where high index exposure to the expensive technology sector made valuations unappealing. We have maintained a high exposure to UK equities, both via third party funds and directly, and were encouraged to see strong performance at a time when active managers faced the headwind of small and mid-sized companies delivering negative returns. Fidelity Special Values (+13%), Man GLG Income (+12%) and Temple Bar (+6%) performed strongly whilst Aberforth Smaller Companies (+6%) saw its strong value approach more than offset the negative broader trend impacting its peers. A similar focus of valuation benefitted our international holdings, Schroder Global Equity Income(+14%), Murray International (+17%) and Middlefield Canadian Income (+10%), which in addition saw its discount to Net Asset Value narrow considerably. Elsewhere, CC Japan Income & Growth performed strongly (+7%) as did Blackrock Frontiers (+7%) with its focus on smaller, frontier markets which have historically delivered good returns uncorrelated to developed world equity markets. Despite the drag of weaker growth from China, Abrdn Asian Income delivered positive returns helped by its focus on quality dividend paying stocks. Finally, specialist equity fund International Biotechnology Trust (+13%) performed well as valuations appear to have troughed having reached historically low levels and M&A (Mergers and Acquisitions) returned to the sector, with larger pharmaceutical companies seeking to replenish their drug pipelines in the face of impending patent cliffs.

Our direct equity holdings delivered mixed returns. These holdings are mainly focussed on the financials sector and, with the exception of Randall & Quilter and Numis, all reported strong earnings results and confident statements over the outlook. Higher interest rates should help profitability unless the current increases lead to a rapid deterioration in the economic outlook. Our two large bank holdings, Paragon (+24%) and Standard Chartered (+13%), saw increased net interest margins and upgrades to forecast earnings. Balance-sheets and liquidity positions also look very robust. Within Life Insurance, Chesnara (+10%) was strong as cash generation continues to support a high and growing dividend whilst Legal & General (-1%) derated around concerns over the fallout from the LDI sell-off. Provident Financial (-18%) saw a sharp derating in its shares as investors were put off by its unsecured, credit card lending business at a time when cost of living pressures are rising. Positive regulatory announcements during the year over capital and liquidity were overlooked by the market as were its strong market share gains despite recent tightening in lending criteria. Thus far there have been no sign of stress in the loan book reflecting tight labour markets. Randall & Quilter posted a very disappointing update around capital and a failed takeover for the group. We supported a subsequent rights issue, however, exited our position on the back of a disappointing price achieved for the disposal of a US subsidiary.

Private Equity experienced a very difficult year as markets were concerned about their use of leverage and high valuations. Within the listed Private Equity sector discounts to net asset values have widened considerably over the period as investors became increasingly sceptical about historic valuations when compared to moves in public equity markets. We believe it is very important not to conflate venture capital start-up investments with more traditional buy out private equity, which involves the purchase and private ownership of existing profitable established companies. The former has seen valuation increases not dissimilar to the technology boom in 2000 and backs business models that require more capital in order to move to profitability. The latter has seen more gradual valuation increases and the conservativeness of valuations has been tested as underlying businesses held are sold at significant premiums to the level they were held at beforehand. Despite seeing its discount widen by 10% over the course of the year, it was very encouraging to see CT Private Equity deliver a positive return (+11%). The fund is invested in the relatively lowly valued, less geared European small and mid-sized profitable private companies and delivered another positive year of net asset value growth. It was, therefore, particularly heartening to see the realisation of San Siro, an Italian funeral homes business, provide tangible reassurance that net asset values have been conservatively struck as it disposed of its holding at a 200% premium to the June valuation. Despite sitting on a 34% discount to net asset value at the year end, the group currently enjoys historically low levels of gearing and funding commitments, positioning them very well to invest at attractive levels in 2023.

Notwithstanding the weaker backdrop for global commodities, both our commodity funds, Blackrock Energy & Resources (+8%) and Blackrock World Mining (+2%) delivered positive performance as investors recognised the low valuations, strong balance-sheets and capital discipline on offer in the sector.

Elsewhere within our more defensive holdings, our specialist Utilities holdings performed well. Whilst rising rates acts as a headwind to net asset value performance, this has been tempered by higher initial yields than respective government bonds and more than offset by the inflation linkage their revenue streams enjoy. This was particularly true for those investments with exposure to power prices which saw significant increases post the invasion of Ukraine when gas prices spiked. Ecofin Global Utilities and Infrastructure (+16%) and John Laing Environmental Assets (+14%) performed particularly as a result whereas Pantheon Infrastructure (-12%) with no power price exposure moved more in line with bond markets.

Our bond allocation was a neutral contributor despite a torrid year of performance for the wider asset class. Rising interest rates caused bond yields to rise and prices thereby fall. We have been cautious with regards our bond allocation, nervous that low yields offered unattractive returns and limited protection were inflation to return. Having held no bonds for some time, we initiated a couple of holdings during the depths of the Covid crisis when high yields to maturity offered attractive returns for lower risk than equities. Where we have bond exposure it has been predominantly focussed on floating rate parts of the market, which allows an element of inflation protection as higher interest rates are automatically passed through borrowers. Both Twenty Four Income (-3%) and GCP Infrastructure (-3.5%) fell in value, the latter in spite of strong NAV (Net Asset Value) growth as the discount widened materially, whilst Starwood European Real Estate Finance (+3.5%) rose on news that it intended to wind up the company given the persistent discount to NAV the company has traded on. The contribution from our bond allocation was further helped by the timely increase in allocation to the asset class in October when we added materially to our holding in the Twenty Four Strategic Income Fund.

The only area that significantly detracted from performance over the course of the year was our property holdings. Having performed positively in the first half on the back of further recovery from Covid, over the second half of the year they were hit hard. Property yields which drive net asset value calculations moved higher in sympathy with bond yields and as fears heightened over the impact slower economic growth might have on the outlook for rents. In aggregate our property holdings detracted 1.8% from the Fund’s overall performance over the year. The sharp falls in the sector around the September mini-budget meant many of the holdings appeared to have more than reflected any future pressure to net asset values. In many cases, the shares traded at near 50% discounts to the net asset values posted in earlier in March, whilst commentary from the companies themselves around tenant demand and rental growth remained encouraging. As a result, the implied yields on offer to holders of the investment trusts, after adjusting for the discounts, looked particularly attractive, especially as over time there ought to be an element of inflation linkage to rents in areas where supply-demand dynamics are favourable. Balance-sheets look increasingly robust as our holdings have reduced debt via asset disposals over the last two years. Nonetheless, abrdn Property Income (-16%), Ediston Property (-9%), Palace Capital (-6%), Urban Logistics (-19%) and TR Property (-18%) all negatively impacted performance. Empiric Student Property (+1%) managed to buck the trend of net asset value downgrades posting an 8% increase as recovery from Covid continues benefit occupancy and self-help measures. Its 24% discount to net asset value highlights the disconnect between public market valuations and those determined by the independent valuers, which now reflect movements in bond markets. It is notable that two of the fund’s property holdings, Palace Capital and Ediston Property, representing nearly 8% of the portfolio, have now announced strategic reviews either to sell down their assets and prove up the net asset values or to sell the entire company given the extent and persistency of their discounts.

Allocation Changes

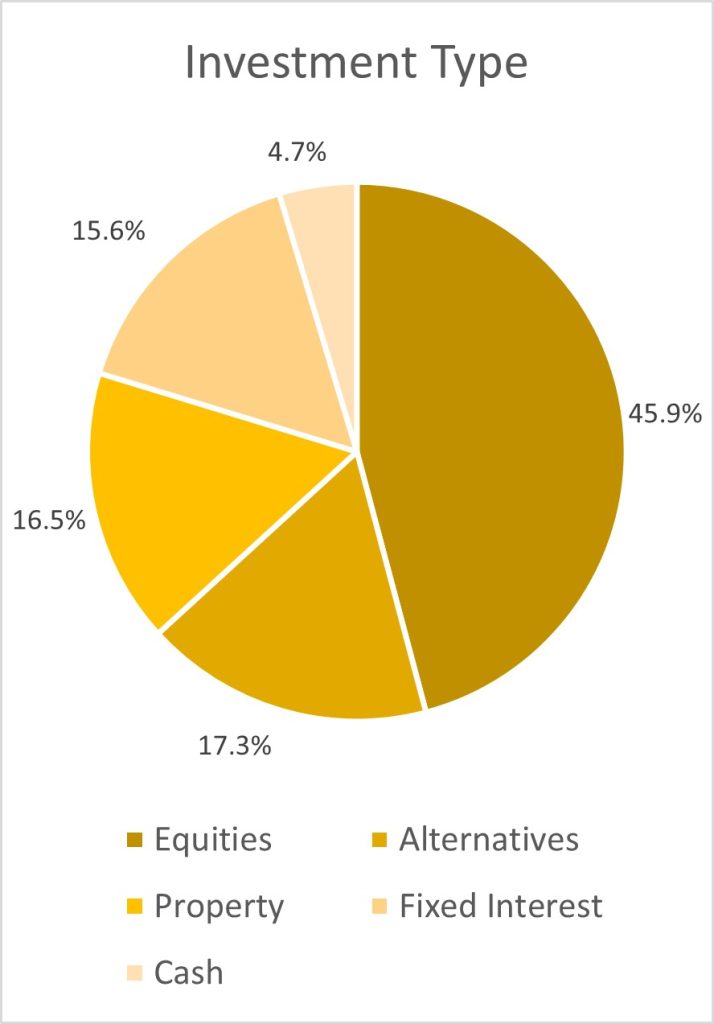

The biggest allocation change to the portfolio during the period was to increase the allocation to fixed income (bonds). As bonds fell and the economic outlook became cloudier, the yield on offer became increasingly attractive as did the defensiveness they offered at a time corporate earnings look set to come under pressure. We added the Twenty Four Strategic Income Fund, an unconstrained fund that seeks value across global bond markets, which is designed as a core fixed income allocation to be held throughout the economic cycle. As a result, our fixed income allocation rose from 10% at the start of the year 15.5% by the year end.

This was mainly funded by a decrease in our equity allocation, both direct and indirect, which fell from 50% to 46%. The process continues of selling down our direct equity exposure and aligning the strategy with our Multi-Asset Growth Fund, which invests into equities via third party funds, predominantly investment trusts. As a result, Natwest, Standard Chartered, Randall and Quilter exited the portfolio while Chesnara and Henry Boot were reduced. We took advantage of strong performance and tight discounts to reduce Murray International, Middlefield Canadian Income, Man GLG Income, Temple Bar and exited our holding in Schroder UK Mid Cap. Conversely, we topped up our holding in Aberforth Smaller Companies in the second half of the year and Polar Capital Global Financials whilst initiating a position in Fidelity Special Situations, a fund we highly regard that offered an usually attractive discount.

as of 28th February 2023

During the period we initiated a holding in Blackrock Energy & Resources funded through a reduction in our holding in Blackrock World Mining. The former is less exposed to Chinese economic growth, benefits from tight energy markets and energy transition and was trading on a significantly wider discount to net asset value than the latter. Overall, our commodity allocation reduced over the course of the year.

Despite the weakness of property markets, we maintained our exposure to the sector over the course of the year. We initiated a position in TR Property, an investment trust that we have invested in previously, which provides exposure to European Property markets, whilst increasing our holdings in abrdn Property Income, Ediston Property and Empiric Student Property.

Within the Infrastructure sector we took profits in John Laing Environmental Assets, exiting the holding which had seen extremely strong growth in its net asset value over the year as power price and inflation assumptions increased significantly. Similarly, we reduced our exposure to Ecofin Global Utilities & Infrastructure, which has benefitted from similar tailwinds and seen its discount tighten.

Finally, we have increased our cash position from 2% to nearly 5% as we are more cautious about the immediate outlook for equity markets given the strength of recent performance.

Outlook

Whist bond market indicators, in particular, are now pointing to a developed world recession as the ultimate consequence of a year of rapid interest rate rises, thus far economic data itself has remained stronger than feared and core inflation stickier than hoped. Both looked set to limit central bankers room for manoeuvre and increase the likelihood that interest rates were likely to stay higher for longer than expected. However, recent stresses within the banking system suggest higher interest rates are starting to bite and a more cautious approach in now necessary. A world in which rates cannot rise further for fear of causing systemic stress in the banking system would mean central bankers having to abandon previous targets of returning inflation to 2%. Both outcomes are unpalatable and warrant a more cautious positioning within the portfolio. We have had some concerns that equity markets have been more sanguine than bond markets with strong performance year-to-date implying that the global economy can enjoy both sustained growth and falling inflation and no monetary policy mis-steps. As interest rates have risen and the yield available to investors from investing in low-risk short-dated government bonds has increased, so too the relative attractiveness of other riskier assets has diminished, particularly those areas where elevated valuations relied not only on interest rates staying low in perpetuity but also where business models were predicated on an unlimited supply of cheap financing remaining available to fund unprofitable growth. Many of these distortions in financial markets have pre-dated Covid, however, the response of central bankers to massively increase liquidity only served to stretch these further. The challenge in recent years, particularly for income investors, has been where to find attractive, defensive yield that offers an element of inflation protection. The year under review has witnessed a very significant ironing out of many of these anomalies, such that there is now a much broader playing field of investment opportunities available to income investors than there has been since the Global Financial Crisis in 2008. Reflecting this, the portfolio is now much more diversified than it has been for some time. Our focus remains on finding investment opportunities that represent good value with attractive yields, which at the portfolio level we believe can grow in line with inflation. The historic yield on the B Income shares is 4.6% and over the course of the year the distribution per share has risen by just over 3% to 5.82p. We currently anticipate slightly stronger growth in the distribution per unit over the upcoming year.

I would like to thank, personally and on behalf of the Wise Funds team, all our investors for their ongoing support. The Fund started the interim period with £86m under management and finished with £85m. The fund has seen an improvement in net flows over the course of the year for which we are extremely grateful.

Please feel free to contact us if you would like a meeting or have any questions.

Philip Matthews

Fund Manager

Wise Funds Limited

March 2023

TO LEARN MORE ABOUT THIS FUND , PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.