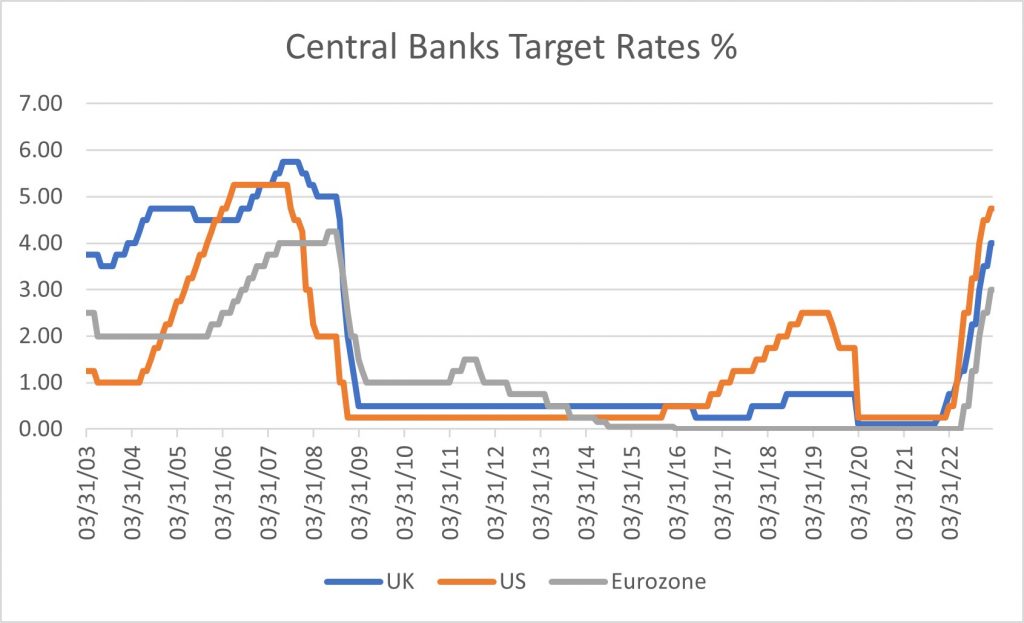

The year was dominated by rising inflation and market performance was driven by central banks and governments’ efforts to bring it back under control. Inflation was already starting to become an issue in the aftermath of the Covid crisis, due to cash-flushed consumers increasing spending post-lockdowns and supply shortages (mainly due to China persisting with its zero-Covid policy and locking down large manufacturing hubs as a result). However, the inflationary problem took a different dimension in February 2022 when Russia launched a unilateral invasion of Ukraine, sending the world in a full-blown energy crisis as well as impacting food prices. With Russia using its position as the world’s largest exporter of natural gas (as well as a significant exporter of oil and coal) to pressurize Ukraine’s allies by restricting exports, natural gas prices more than doubled into the summer, causing particular pain to European countries who used to import about 40% of their natural gas from Russia. The rampant price pressures on energy and food prices, as well as continued supply chain bottlenecks for consumer goods led inflation to rise to levels not seen in decades, rising to more than 10% per annum in the Eurozone and the UK by October, while reaching more than 9% in the US. Supply-led inflation caused by shocks like wars tends to be transitory but risks turning more persistent once it gets engrained into consumers’ psyche who, in turn, demand salary raises to cope with higher costs of living. History suggests that early and bold actions are the best way to ensure inflation pressures do not become structural, so global central banks have raised rates at an astonishing pace during the period. In the US, bank rates were increased from 0.25% at the start of the period to 4.75% by the end of it . In the UK, the move was from 0.5% to 4%. In the Eurozone, the central bank increased rates for the first time in 6 years, from 0% to 3%.

By the fourth quarter of 2022, thanks to the easing of global supply chain bottlenecks, lower energy prices than earlier in the year (natural gas prices dropped more than 80% from their summer peak to February 2023) and the year-on-year comparison making it harder and harder for inflation to keep rising at breakneck speed, signs were pointing to the peak in inflation being in the rear-view mirror. That said, while reducing the pace of hiking, central banks remained keen not to take their foot off the brake pedal too early, in fear their efforts and the pain already inflicted to global economies would be for nothing. Supporting them in that view, macroeconomic data, while volatile, proved surprisingly resilient, making a resurgence in inflation -or at least a sticky inflation scenario- likely. Moreover, strong economies are better equipped to cope with higher interest rates, making it easier for central banks to pursue their inflation-control mandates.

The above context is essential to understand financial markets performance last year. Past the initial shock of the Ukraine invasion and the sharp rise in inflation, investors’ sentiment oscillated all year between different scenarios about central banks actions and their consequences.

Scenario 1 – Hard landing:

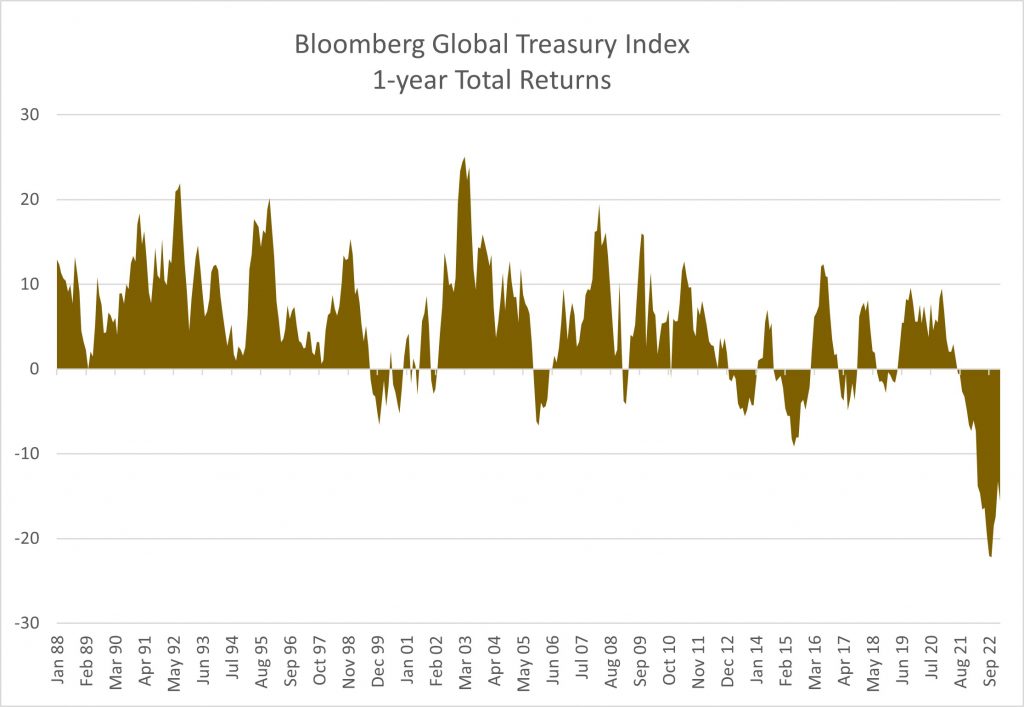

This is the view that central banks have to continue increasing rates to bring prices down and have no reason to hold back given the strength of the economy. Historically, sharp interest rates hikes led to recessions (the price to pay to keep inflation under control), hence causing a “hard landing”. This scenario was prevalent until October, before inflation peaked and as interest rates hikes had no end in sight. Higher interest rates and fears of a recession which would impact companies’ earnings was not a good combination for markets and left very few places to hide, with the traditional inverse correlation between bonds and equities (i.e. bonds go up when equities go down and vice versa) breaking down. During that period, bond markets saw their worst performance in decades -if not ever- with the surprising characteristic that safer bonds such as government bonds suffered more than riskier corporate bonds. This is due to their duration, i.e. their sensitivity to changes in interest rates, being higher. As an illustration, the Bloomberg Global Treasury index (an index of broad global investment grade (i.e. the safest) government bonds) fell more than 20% in US Dollar terms between the end of February and October. Coincidentally, this was also the performance of US equities in US Dollar terms over the same period, one of the worst performing equity markets despite usually being a safe harbour during stormy times. The combination of high starting valuations after years of outperformance and large allocation to high growth companies which tend to be more sensitive to interest rates rises dragged performance lower. Commodities (energy more than industrial metals which suffered from recession fears) were the only bright spot in that period, helped by, as well as being the main cause of inflation.

Adding to the mix during this turbulent period, political chaos in the UK rippled through to financial markets when Liz Truss, Boris Johnson’s successor of only a few weeks, unleashed mayhem with an ill-judged announcement of unfunded tax cuts which spooked bond investors (the 2-year UK government bonds had one of their worst weekly performances on record), froze the housing market and forced an intervention from the Bank of England to calm markets. This unforced error was ultimately resolved by a change of Chancellor promptly followed by a change of Prime Minister, but this erosion of confidence was the most unwelcome in an already more than turbulent year.

Scenario 2 – Soft landing:

from October until the beginning of February, the soft landing scenario started to prevail. This is the view by which central banks will manage to rein inflation in without engineering a recession, merely slowing the economy down. At some point, some market participants even considered a landing might be avoided altogether, i.e. the economy would barely need to slow down while inflation was brought back under control. Historically, such a situation is very rare but, after a bruising few months, with signs that inflation might have peaked from October onwards and with resilient macro-economic data (the US recorded its lowest unemployment rate since 1969 for example), investors started looking on the bright side once again. That period saw strong rebounds in equity markets, led mainly by the underperforming assets of the previous months, as well as a sharp repricing of future interest rates expectations with a peak forecast for the middle of 2023. An end to higher interest rates helped bond markets recover some of their losses too. The positive sentiment was further fuelled by the sudden U-turn from President Xi in China who, having freshly secured an unprecedented third mandate, put an end to the strict anti-Covid lockdown measures in place for 3 years, which had a stark negative impact on Chinese (and thus global) economic activity.

Scenario 3/Back to scenario 1 – The return of a hard landing:

in the last month of the period, robust inflation data raised the prospect of inflation remaining sticky for a few months, forcing central banks to hike interest rates for longer than previously expected. The hard landing scenario was back but, this time, bond markets were the only ones to price it in, reversing most of their recent gains and implying rate hikes until the end of 2023 where rate cuts were previously reflected. The divergence between bond and equity markets at the end of the period is unusual in the current context, raising fears that equities will need to come back down to earth and tread more carefully, once again. At the very least, what the latest swift change in scenario expectations by bond investors shows is how volatile and data dependent financial markets remain and how likely it seems that scenarios will keep switching and evolving for the foreseeable future.

The above scenarios are, of course, overly simplified, both in their description of investors’ thinking and their timeline. As ever, markets do not travel in straight lines and sentiment does not change at set dates. That said though, we think the above gives a summary of the main market performance for the past year, helping, hopefully, to understand it better.

Performance

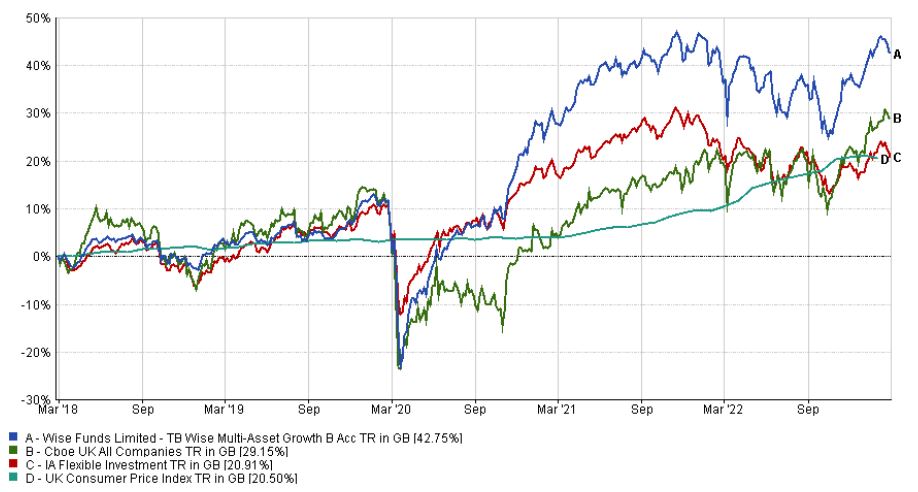

Looking at our performance for the year ending in February 2023, the TB Wise Multi-Asset Growth fund wasup 4.2%, behind the CBOE UK All Companies (+8.2%) and the UK Consumer Price Index (+9.2%). It beat its peer group, the IA Flexible Investment (-0.2%), however, to finish in the top quartile of its sector. While it is disappointing to report an underperformance relative to our target and comparator benchmarks for the last year, over the 5-year horizon defined in our objectives, the Fund delivered 42.8%, comfortably ahead of the CBOE UK All Companies (+29.2%), the UK Consumer Price Index (+20.5%) and the IA Flexible Investment (+20.9%). Over that period, the Fund is in the top 5% of funds in its sector. The Fund is also one of only 3 funds in the entire IA Flexible Investment sector to have delivered top quartile performance in each of the past 3 years. As mentioned above, while we think our performance should be judged in the medium to long term, having performed at the top of our peer group in widely different years which saw the Covid pandemic, an exuberant rebound, the worst inflation in decades and the worst year ever for the combined bond/equity returns is particularly pleasing.

For more fund performance, please see the latest factsheet

TB-Wise-Multi-Asset-Growth_0223.pdf (wise-funds.co.uk)

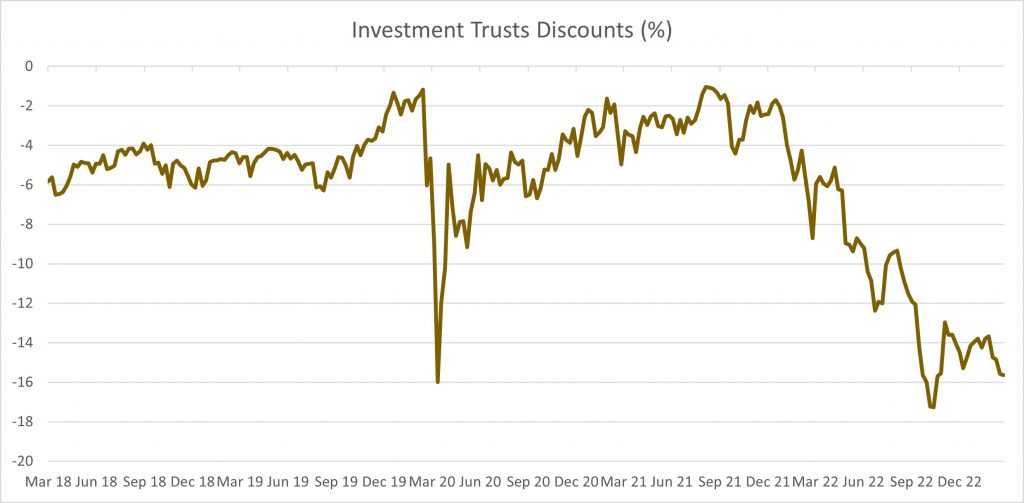

Before going into the details of our largest contributors and detractors to performance for the year, it is worth mentioning the impact our investment trusts holdings have had on our performance. As our investors know, our main focus in this Fund is in the investment trusts sector. We believe they offer a plethora of hidden gems, are the only way -other than direct investments- to offer a genuine multi-asset portfolio, are the perfect structure for less liquid assets and are also superior to open-ended funds from a shareholder governance standpoint. We believe that a lot of the value we have added over the years is thanks to having 60-80% allocated to investment trusts in this Fund (67% as of the end of the period). There are two distinct drivers to investment trusts’ performance: the Net Asset Value (NAV) and the price. The NAV reflects the performance of the underlying assets, while the price reflects what investors are prepared to pay for those assets. The difference between the price and the NAV is the discount (if the price is below the NAV) or the premium (if the price is above the NAV). During periods of volatility when risk aversion rises, like the period we experienced until October, investors tend to sell their holdings in a hurry to raise cash. It is thus common to see discounts on investment trusts widen when markets are down, amplifying the losses already suffered by the NAV. For the patient investor, however, those periods of volatility give the opportunity to invest at hefty discounts, which should amplify positive returns when the rebound comes and more optimistic investors push discounts to tighten again. This is part of the approach we have always followed and we continue to believe it is a long-term winning strategy. It implies, however, that we may suffer in the short term during volatile periods. This has indeed been the case in the reporting period and the best way to quantify the negative impact of discounts widening is to look at the weighted average discount on our Fund. At the start of the period, the Fund’s discount was 6.1%, which widened to 10.2% at the end of September (following the UK “mini-budget”). By the end of the period, our portfolio discount was 7.8%. Those moves in our portfolio discount explain in large part our performance pattern last year with a difficult period until October followed by a rebound.

The chart shows the average of discounts/premiums for all investment trusts listed in the UK, weighted by market capitalization

Our Private Equity trusts illustrate how risk aversion translates into discounts well: Pantheon International managed to grow its NAV by about 10% during the reporting period but its discount widened from 23% in March to 52% in October. A move of such magnitude for a liquid investment trust like Pantheon (£1.4bn market capitalisation) can only be a reflection of investors’ fears, not only about the economy in general, but also that private equity valuations would need to come down substantially. As the NAV growth of 10% suggests, the portfolio continues to perform well, even in the face of turbulences in public markets, and the manager continues to be able to exit positions at higher prices than marked in the NAV, so the current discount seems overly pessimistic and presents an opportunity in our view.

Other main detractors were linked to recession fears, liquidity drying out and changes to the rates market (bonds). Firstly, in the mining sector, Baker Steel Resources Trust and Jupiter Gold & Silver Fund underperformed, with the latter impacted by higher interest rates making precious metals less attractive relative to cash. Both of those holdings rebounded in the second half of the year though when the soft landing scenario started prevailing. Secondly, some of our emerging markets funds also struggled in the period (Somerset EM Discovery), there again, mainly in the first half of the year driven by weak conditions in locked-down China and general negative sentiment which took investors’ flows out of the region. Outflows and higher interest rates were also a reason for the poor performance of Amati UK Smaller Companies, hurt doubly by its smaller companies exposure -which underperformed larger names sharply in the UK as investors fled that part of the market- and its growth bias.

Our main contributors were varied, ranging from value managers (Lightman European, Fidelity Special Values, GLG Undervalued Assets), to good results-driven discount tightening investment trusts (Oakley Capital Investments, Caledonia Investments), and to well positioned strategies in the face of rising inflation (Ecofin Global Utilities and Infrastructure which combines defensive exposure with a large proportion of inflation-linked revenues).

Allocation Changes

While markets were adjusting to the invasion of Ukraine, rampant inflation and the new global interest rates regime in the first few months of the period, our portfolio activity was modest. A war is highly unpredictable in itself and markets reaction to wars is even more so. Meanwhile, it takes time for investors to grapple with sharp shifts in economic data and monetary policies. There is thus little first-mover advantage. We were a lot more active in the Fund from the end of Spring, however, once prices started adjusting to the new reality.

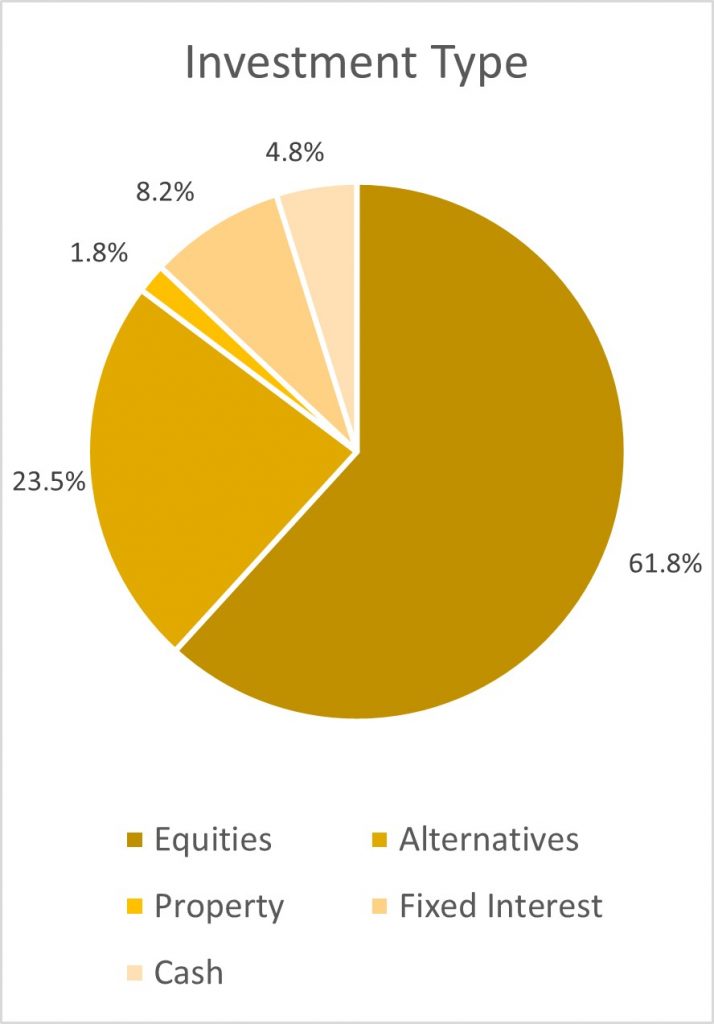

From a broad asset allocation standpoint, the two main changes were to increase our allocation to fixed income strategies over the summer and autumn, and, towards the end of the period, our allocation to cash. The latter clearly is a defensive move driven by what we perceive to be a divergence between equity and bond markets with regards to where we stand on the growth/inflation balance, which will likely be resolved by greater volatility and, possibly a retracement of recent strong performance. Our cash level thus fluctuated from 2.7% at the start of the period to 4.4% in August, down to 2.1% in January and up to 4.8% at the end of the period. This active management of cash is a way for us to try and stay on the front foot, taking profits after good returns and protecting on the downside while we wait for opportunities to return to the market

In contrast, our allocation to fixed income was primarily driven by attractive future return prospects. As mentioned above, bond markets had some of their worst half-year performance ever in 2022. In the US, 10-year bond yields (which move inversely to prices) moved from 1.5% to close to 4%. In the UK and Europe, those moves were as dramatic from, respectively, 1% and 0% to 4.5% and more than 2.5%. Those yields are some of the most attractive of the past decade and, to us, after years of avoiding bonds altogether, are starting to price in enough margin of safety to look attractive again. Meanwhile, in the credit market, panic selling drove yields to levels implying defaults rates, in some cases, higher than during the Great Financial Crisis of 2008-09. While defaults will undoubtedly rise in what is likely to be a recession in the coming months, it is difficult to argue that the landing will be as hard as 2008. The average company is currently cash rich and has extended its debt maturity, meaning that there is no broad-based repayment pressures expected until 2026 in Europe and 2029 in the US. Corporates have got time on their side, which, from a fixed income investor standpoint, makes the market very attractive with high yields that can be locked-in without significant fear of borrowers defaulting. Moreover, those attractive yields are found in the safer parts of the market with little incentive to take more risk for an only incremental pickup in yield. This backdrop gave us the confidence to add two new bond positions in the portfolio. The first one is the TwentyFour Strategic Income Fund, managed by the TwentyFour Asset Management team we know well through our other investment in the TwentyFour Income Fund. The fund gives us a broad exposure to the global government and corporate bond markets, managed by a team we rate highly and offering us a yield close to 9% without taking undue risk. We also added a new position in the VPC Specialty Lending Investments, a £228m trust lending capital predominantly to non-bank lenders. This strategy is part of a much larger $7bn firm specialised in such lending and its appeal is that all the loans it provides are senior (i.e. they are the first ones to be repaid in case of default) and fully asset-backed (i.e. the loans are secured by cash-generating assets), with VPC having a full claim on cash-flow generating assets in case of defaults (of which they have only had 3 since 2007 and in each case they have recovered all of their capital). The loans are structured in such a way that VPC are in the driving seat, dictating terms and lending money in stages, only when objectives are delivered, limiting the risk and the duration of the debt. We were impressed by the level of due diligence and ongoing monitoring performed on the collaterals used against the loans. Each loan has a floating rate (as opposed to a fixed rate that does not move higher when central banks hike rates), offering a particular appeal in an inflationary environment. The trust traded on a wide 25% discount at our entry point and currently offers a covered yield of 10%.

The market volatility meant that we were active in managing our positions at the more idiosyncratic level too. We continued to build our position in Healthcare and Biotechnology up, by increasing our allocation to Worldwide Healthcare Trust. We also added TR Property Investment Trust back to our portfolio. We think the trust is looking attractive currently having reversed about half of the gains made post-Covid and we like the very sensibly managed portfolio of diversified European property exposure. As alluded to earlier, we used the widening discount in Pantheon International to take our position up to the second largest holding in the portfolio. We also traded Fidelity China Special Situations by adding to our position through the summer and early autumn, but then took some profits after the trust rebounded close to 70% in 3 months following China’s re-opening.

On the other side of the ledger, we took some profits in some of our strongest performers to raise cash at times and finance the above purchases (Ecofin Global Utilities and Infrastructure, Caledonia Investments, Schroder Global Recovery, JO Hambro UK Equity Income). We also exited our position in GCP Infrastructure, preferring using cash as a defensive position rather than an attractive yet sometimes volatile bond infrastructure trust to protect our portfolio.

Finally, we did a few fund switches to focus the portfolio on the most attractive opportunities. Firstly, we exited our position in Abrdn Asia Focus and reduced Fidelity Asian Values to broaden our exposure towards global emerging and frontiers markets managers, as opposed to pure Asia. Within emerging markets, we exited our position in Somerset EM Discovery to allocate to investment trusts and the newly added KLS Corinium EM Fund which offers us access to a rare macro-driven investor in the space. We exited our position in the Polar UK Value Opportunities Fund to switch into the similarly managed Fidelity Special Values Trust. The latter is an investment trust trading at a relatively wide discount while the former is an open-ended fund without a discount, so we hope the switch presents an attractive arbitrage. We also exited the TwentyFour Absolute Return Credit Fund to finance our new position in the TwentyFour Strategic Income Fund mentioned above, preferring taking more risk in bond markets given their attractive characteristics than focus on downside protection.

The list of portfolio changes above is longer than is usual for our Fund. This is not due to any change in the management of the Fund but purely a reflection of the volatile environment markets experienced last year and the resulting sharp changes in prices. We have always been disciplined in rotating our portfolio between winners and losers, both as a way of protecting capital and of maximising upside potential. Last year was an extreme illustration of that process in action.

Outlook

In what has been one of the most challenging environments for investors in decades, the message from central banks is clear: they are determined to combat inflation aggressively, on both sides of the Atlantic, even if this will undoubtedly inflict pain to their economies in the short term. It thus seems premature for market participants to expect support from monetary policy. Moreover, with the conflict in Ukraine entering its second year and inflationary pressures broadening out and becoming more anchored, the outlook certainly remains uncertain.

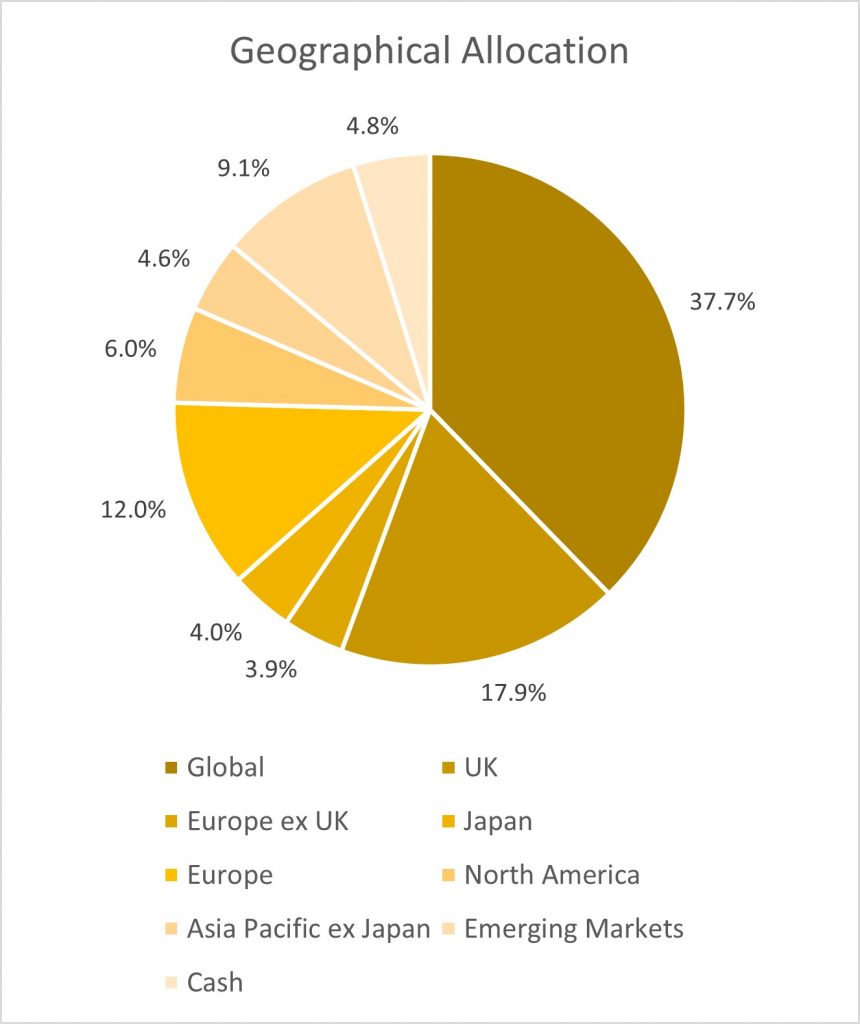

From a market perspective, the assets that were cheap entering 2022 remain cheap in absolute and relative terms, while the very expensive ones are getting closer to fair value. That said, some pockets of exuberance that are bursting now had been building up for years and fair value is not yet attractive enough to make them appealing. Opportunities are emerging though and we feel it is important to be able to take advantage of those, hence the attraction of holding some extra cash and to stay flexible. Recent months have shown us how febrile investor sentiment can be and how quickly markets can turn. This is a very data dependent environment in which, like has been the case since the Covid pandemic started 3 years ago, portfolios need to be actively managed and remain diversified by asset classes, geographies and styles. We are embracing the challenge and, similarly to what we have done since the inception of this fund 19 years ago, think we are well placed to rise to it.

I would like to thank, personally and on behalf of the Wise Funds team, all our investors for their ongoing support. The Fund started the interim period with £83m under management and finished with £89m, thanks to performance and inflows for which we are extremely grateful.

Please feel free to contact us if you would like a meeting or have any questions.

Vincent Ropers

Fund Manager

Wise Funds Limited

March 2023

TO LEARN MORE ABOUT THIS FUND , PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.