For Professional Clients Only

Macro & Market Update

From a news and data standpoint, April felt like a pause for breath after a tumultuous few weeks the previous month that saw the collapse of two US regional banks, intervention from governments and central banks on both sides of the Atlantic to prevent a contagion to the rest of the banking system (including unlimited deposit government guarantees, liquidity measures provided to banks and the forced takeover of Credit Suisse by its arch-rival UBS), continued interest rate hikes to fight persistent inflation and increased recession risks. The main (non-)event in April was that the banking crisis appeared contained to a small number of regional US banks. Those remained in a precarious state, however, after reporting the extent of the deposit outflows they suffered during the first quarter, as customers preferred the safety of larger banks and diversified into money market funds. Testament to this prevailing fragility, on the first day of May, a third US regional bank, First Republic, collapsed and a sale of its assets was orchestrated by the US regulator.

On the economic data front, the picture was mixed with noisy economic activity indicators, continued strong employment data, and rebounds in consumer confidence and spending. Inflation was not mixed, however, and remained strong, particularly in the UK where it stayed stubbornly above 10% year-on-year, despite a sharp drop in energy over the past year. From next month onwards, the base effect (i.e. the influence of the starting point when making comparisons) should lead inflation to naturally come down, possibly dramatically, as the start of the data will include peak prices in energy and food. That said, core inflation (stripped of those two volatile components) is the one that matters for central banks since it is the only one they can hope to control through interest rates (by affecting demand) and, so far, it shows no sign of abating. There was no central bank meeting in the US, Eurozone or UK in April, while in Japan it felt like a holding meeting, helping to explain why global markets were relatively calm.

Finally, companies started reporting their earnings for the first quarter and, on the whole, beat expectations more than is usually the case, which helped support equity prices. This does not mean that earnings are strong (they are not and are mostly declining, as expected given pressures on profit margins) but rather that analysts’ expectations were overly negative. One would expect the adjustment process between expectations and reality to continue to take place over the next few months as economies navigate their way either into a recession or a narrowly avoided one.

Fund Performance

Wise Multi-Asset Growth

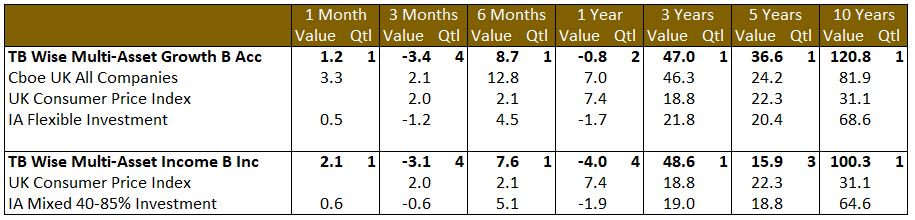

In April, the TB Wise Multi-Asset Growth Fund was up 1.2%, behind the CBOE UK All Companies Index (+3.3%) but ahead of its peer group, the IA Flexible Investment Index (+0.5%). The UK market outperformed the rest of the world, thanks to its large bank holdings (which rebounded on the relief that a contagion crisis appeared avoided) and its large defensive index constituents in pharmaceuticals and essential consumer products manufacturers, both of which performed well in the current uncertain climate.

For our Fund, our allocation to Chinese equities detracted, either directly (Fidelity China Special Situations) or indirectly (Templeton Emerging Markets, Mobius Investment, KLS Corinium EM). China reported stronger than expected GDP growth in April (+4.5% year-on-year), boosted by strong retail sales following the lifting of its Covid restrictions late last year. The stronger growth reduces the chance of a meaningful economic stimulus, however, which, paradoxically, has caused some disappointment from investors. On the positive front, our listed private equity names saw some discount narrowing, helping to recover some of the losses suffered in March when investors worried about any companies with some levels of debt. The results from our private equity holdings continue to confound the prevailing sentiment that private valuations are due a correction. During the month, Oakley Capital Investments updated its Net Asset Value (NAV) to the end of March showing a +1.25% return for the quarter, including some losses on its foreign exchange exposure (over which they have little control). While not a fantastic return, this follows NAV returns of +24% in 2022, +35% in 2021 and +18% in 2020. Moreover, in a context where the discount on the trust -and on most other listed private equity trusts- can only reflect expectations of a sharp drop in NAVs, those results are more than encouraging. In a similar vein, Caledonia Investments which is 30% invested directly in private companies and 31% in private equity funds reported strong annual returns to the end of March from those two categories of, respectively, +8.4% and +12.4%. The discount on the trust narrowed following those results but remains wide relative to its history.

Wise Multi-Asset Income

In April, the TB Wise Multi-Asset Income Fund rose 2.1%, ahead of the IA Mixed Investment 40-85% Sector, which rose 0.6%. Despite a backdrop of increasing bond yields, our property holdings were the strongest contributors to performance over the month. A number of quoted peers have announced their net asset values for March, which in most cases have stabilised or increased from the year end. A continued positive backdrop for lettings, good rental growth and better market evidence for transactions have given valuers greater confidence that the yields used to price portfolios do not need to increase further. Furthermore, Blackstone announced an offer for Industrials Reit at a 42% premium to its previous closing share price and at a premium to its September net asset value. This served not only to highlight the attractive supply-demand dynamics within the industrial subsector but also the additional scalable value inherent in the operational capabilities of many quoted property companies to manage shorter, more flexible leases that is not captured in their net asset values. Whilst we did not hold Industrials Reit itself, our closet comparator, Urban Logistics, rose 10% over the month in sympathy. Our generalist property holding, abrdn property income, has nearly 60% of the portfolio exposed to the industrials subsector but only saw its share price rise 2% over the month. Despite being modestly geared, the shares ended the month at a 48% discount to their September 2022 net asset value, highlighting the value that we believe exists in the more diversified rather than specialist property names. Ediston, TR Property and Impact Healthcare Reit all rebounded strongly in the month with the latter reporting an increased net asset value over the first quarter of the year.

Corporate activity, as mentioned above, was a notable feature of the month with nine UK listed companies receiving bid approaches over the period. Our holding in Numis, which has been operating in cyclically weak investment banking and trading markets for the last eighteen months, received a bid approach from Deutsche Bank at a 70% premium. Elsewhere, we saw good returns for our equity funds, particularly our UK exposed names, supported by positive underlying equity markets and some discount narrowing. GCP Infrastructure and CT Private Equity also saw a sharp narrowing in their discounts from the extreme levels highlighted in last month’s commentary. Despite a more challenging backdrop of rising rates, our fixed income holdings contributed positively to performance helped by the discount narrowing at GCP Infrastructure as well as a positive update from Twenty Four Income. The company announced a much increased final dividend for the year as a result of rising interest rates and active investment opportunities that emerged over the course of the year and marks the highest year-end dividend since inception.

Our commodity related holdings, Blackrock World Mining and Blackrock Energy & Resources, as well as Aberdeen Asian Income were modestly weaker over the month. Chinese GDP growth surprised positively over the period, which served to reduce investor expectations of future monetary and fiscal stimulus in the region.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of activity, we kept our levels of cash elevated during the month. Despite the absence of contagion in the banking system for now, markets remain febrile and discordances between equities and bonds persist. While inflation stays sticky and central banks’ resolve to tackle it is intact, one should expect sentiment and prices to be volatile. The sharp rise in interest rates in the developed world since last year are only just starting to be felt in the economy and some cracks are appearing (like the collapse of some poorly managed banks). With that backdrop, some parts of equity markets exhibit some degree of complacency, having rebounded strongly since last October and trading at valuations that are no longer cheap. We prefer to err on the side of caution.

Caution does not equate inactivity, however, and we continue to be on the lookout for opportunities. As such, we increased our allocation to Caledonia Investments mentioned earlier, before its results were digested by the market. We also increased our position in the Fulcrum Diversified Core Absolute Return Fund as a defensive play. Finally, we took some profits in some of our European equities names (Henderson EuroTrust, European Smaller Companies) after a strong bout of performance, and recycled those in two relative underperformers of late, Odyssean and KLS Corinium Emerging Markets Fund.

Wise Multi-Asset Income

Over the month we continued to run the fund with an elevated cash position, which ended the period at 5.8%. We exited the remainder of our holding in Henry Boot and reinvested the majority of the proceeds into Aberforth Smaller Companies and International Biotech on relatively wide discounts to net asset value and undemanding valuations. We added to two more defensive holdings, HICL Infrastructure and Fulcrum Income, where dividend yields are supportive.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.