For Professional Clients Only

Macro & Market Update

Domestically, stronger than expected UK inflation dominated the market backdrop for the month of May while international concerns were focussed more on the debt ceiling negotiations in the US and slower than expected growth in China. Whilst base interest rates in the UK, US, and Eurozone all rose by 0.25% during the month, there was a notable reassessment of the outlook for future interest rate rises from the Bank of England. Although UK inflation dropped to 8.7% in April, the fall was much smaller than the Bank’s forecasts, which expected inflation to have dropped from 10.1% to 8.4% as 2022 energy price rises fell out of the annual comparison. More worryingly, core inflation which excludes more volatile elements rose from 6.2% the month before to 6.8% (versus expectations of a drop to 6.0%). This represented its highest level since 1992, driven by persistently high food prices and wage inflation. The impact of stickier prices than expected caused a sharp repricing of government debt in bond markets, which have moved from anticipating no further rates rises after the last Bank of England meeting to now expecting three further interest rate rises (by December 2023) and peaking at 5.5%. By contrast, inflation in the US and Germany came in marginally below expectations relieving any pressure to change the expectation that peak rates have been reached in the US and of two further rate rises in the Eurozone, which would match its highest ever level in 2001.

Elsewhere, economic data was more patchy. Both the Bank of England and the International Monetary Fund (IMF) have been forced to admit their forecasts for a shallow but protracted UK recession were well wide of the mark. Having reiterated its expectation that the UK economy would contract by 0.6% just six weeks earlier, the IMF now forecasts growth of 0.4% this year, 1% next year and 2% the year after. During a month in which the governor of the Bank of England conceded that they had abandoned their own forecasting model for inflation due to its historic inaccuracy, the Bank also delivered a big upgrade to their outlook for UK GDP growth, abandoning their well-publicised prediction that we would now be in the middle of the longest UK recession in a hundred years. Both highlight the risks of relying on economic forecasts alone when determining portfolio asset allocation. However, Germany was the first major economy to tip into recession as it delivered a second negative quarter of economic growth. In part this was due to weaker growth from its important trade partner, China, where manufacturing growth contracted faster than expected and import volumes fell at the fastest rate for a year. In the US, the main focus was on the political negotiations around the debt ceiling, the statutory limit on the total amount of debt the US government is allowed to borrow. Without a bi-partisan amendment being agreed to increase the limit, the US government faced the prospect of running out of money and either having to slash public spending or defaulting on its debt obligations by the beginning of June. Whilst a remote possibility, markets were nervous given how close negotiations came to the wire, with an increase in bond yields being the most direct consequence. Commodity markets were also weak as a result of signs of a weakening global manufacturing, particularly in China, as well as concerns around the tail-risks to global growth that would result from a debt-ceiling amendment not being agreed. Subsequent to the month end an agreement has in fact now been voted through both Congress and the Senate kicking the political can down the road for another two years. Equity markets were generally weak over the month with the notable exception of the US, where indices rose strongly but driven by very concentrated performance from a handful of AI (Artificial Intelligence)-related technology exposed companies. Japanese equity markets continued their strong year-to-date performance as investors continue to recognise the low valuations and prospects for corporate reform.

Fund Performance

Wise Multi-Asset Growth

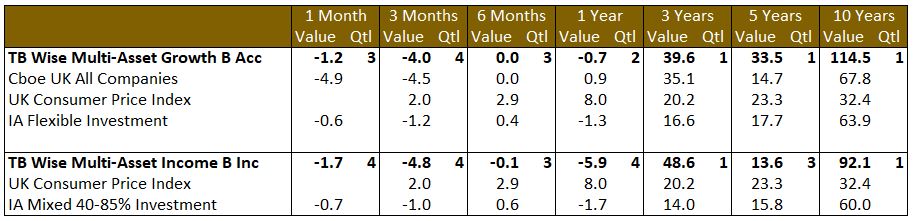

In May, the TB Wise Multi-Asset Growth Fund was down 1.2%, ahead of the CBOE UK All Companies Index (-4.9%) but behind its peer group, the IA Flexible Investment Index (-0.6%). Unsurprisingly given the movements in rates described above, our more interest rates sensitive sectors such as property (TR Property) and infrastructure (Ecofin Global Utilities and Infrastructure, Premier Miton Global Infrastructure Income) detracted from performance. Concerns about the economic outlook and weakness in China also affected some of our emerging markets managers (Fidelity China Special Situations, Mobius Investment Trust), as well as our commodities-exposed funds (BlackRock World Mining, Lightman European). Caledonia Investments also saw a widening of its discount on no apparent news.

On the positive front, our listed private equity trusts performed well, particularly Pantheon International, our largest holding, to which we have gradually been adding to over the past few months due to an irrationally wide discount in contrast with the strong performance of its underlying portfolio. It is too early to say whether the market is coming round to our view or not, but the discount on the trust has now tightened from 50% to 40% since April. A similar story drove performance at ICG Enterprise Trust, a new position in the month, trading at a similar discount to Pantheon International and helping us reinforce our conviction in the cheap listed private equity sector.

Wise Multi-Asset Income

In May, the TB Wise Multi-Asset Income Fund fell 1.7%, behind the IA Mixed Investment 40-85% Sector, which fell 0.7%. Our value equity managers and commodity holdings delivered negative returns as concerns over global growth returned, with our UK-focussed funds being hardest hit in reaction to the changed outlook for interest rates. Similarly, our UK financials holdings fell despite limited signs higher interest rates are impacting their operating performance. Vanquis Banking Group provided a positive trading update for its first quarter highlighting strong lending growth as it benefits from a competitively lower funding than peers and trends in credit card arrears unchanged from those reported over the last 12 months. Despite this, the shares fell 4% over the month. Given their sensitivity to interest rates, it was perhaps unsurprising our property holdings were also weak. Urban Logistics, TR Property and abrdn Property Income all fell more than 4%, however, it is encouraging to see that most companies continue to report positive lettings updates and net asset values to March that are stabilising. The speed at which valuers have marked down property values and positive occupational demand have led to increased corporate activity in the sector with a further two companies receiving bid approaches at material premiums during the month. Our infrastructure names were also weak given their interest rate sensitivity although we continue to believe this should be mitigated by revenues being linked to inflation. Elsewhere, CC Japan Income & Growth performed strongly, up 4%, as did ICG Enterprise, a listed private equity trust where we initiated a holding earlier in the month, as its extreme discount narrowed.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of activity, the febrile economic environment discussed earlier made us keep our cautious stance. Elevated cash levels appear like a sensible option in the current context, and we find it striking that other investors, by comparison have reacted to such uncertainty by throwing themselves back into the expensive large technology companies that continue to pull markets higher. The valuations on those leave little room for error and we think margin of safety (like abnormally wide discounts for example) are critical at the current juncture.

That said, we deployed some of our cash last month, reducing it from 6.7% to 4.8%, in very attractive and cheap opportunities such as the ICG Enterprise Trust mentioned earlier and the TR Property Trust where market prices and fundamentals appear disconnected. We also topped up our position in the defensive Fulcrum Diversified Core Absolute Return which has the potential to deliver positive returns in a difficult market environment. Finally, we rotated some of our exposure out of the Fidelity Asian Values (strong net asset value and tight discount) into relative underperformers in emerging markets (KLS Corinium Emerging Markets, Mobius Investment Trust, Templeton Emerging Markets).

Wise Multi-Asset Income

During the month, we reinvested the bid proceeds of Numis and a reduction in our holding in Chesnara into Paragon, Fidelity Special Values and Polar Global Financials. We added to TR Property and Urban Logistics on weakness. We switched between the Blackrock resources funds, in favour of Energy, given the relative discounts and we added to Fulcrum Income, a defensive holding that has the potential to deliver income in a difficult market environment.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.