For Professional Clients Only

Macro & Market Update

While tariffs continued to be a driver for global financial markets in June, the main event was the escalation followed by swift détente in the conflict between Israel and Iran. In just a few weeks, the conflict in the Middle East has evolved from proxy attacks between the two archenemies, to direct attacks, culminating with the involvement of the US who bombed the main Iranian nuclear sites. This was promptly followed by a ceasefire that, at the time of writing, appears to be holding. It is obviously still early days but, so far, President Trump seems able to claim quite a coup, having managed to achieve a ceasefire in the region through military actions his electoral base was mainly against (he was elected on the promise of a retrenchment of the US from endless foreign conflicts), but without the need to send troops on the ground and with no American casualties. From a market perspective, the main fear were oil prices in case a prolonged conflict led to disruptions in the Strait of Hormuz through which roughly 20% of global oil and liquefied gas passes. So far, after an initial spike, oil prices are back to their pre-strikes level.

Equities also reacted positively to these developments, driven by a relief about the absence of escalation which could have negatively impacted global growth, and the anticipation that a ceasefire in the region could last. Financial markets were also supported by a clear sense of de-escalation of tensions between the US and the rest of the world in June. The Group of Seven (G7) meeting in Canada did not see any new war of words between Trump and other global leaders. Instead, it is becoming obvious that counterparts of the US are now going out of their ways to stop antagonizing Trump, which is in contrast with their attitudes earlier in his second mandate. This was blatantly apparent during that meeting and the subsequent NATO (the North Atlantic Treaty Organization, a collective defence system of 30 European countries, the US and Canada) summit at the end of the month, which was kept purposedly short to avoid opportunities of tension (and to keep Trump’s attention!) and before which a great deal of work had been done to ensure an agreement satisfying to Trump was in place. The result was the commitment by NATO members to increase defence spending to 5% of GDP in order to secure protection from the US. Greater cooperation also came in other forms last month, such as a trade deal, albeit very limited, between the US and China and the signature of the trade deal between the US and the UK. In addition, concessions were given to US companies to a global minimum tax regime, and Trump hinted at the extension of the looming July 8th/9th deadlines on the implementation of global tariffs. Signs are thus that the rest of the world is adapting to Trump 2.0’s style, with Trump responding by being more conciliatory, but it is impossible to predict how long this new equilibrium will last for, so some caution remains warranted.

In other developments, the US central banks kept interest rates on hold, downgrading its outlook for growth and unemployment, while increasing its forecast for inflation due to the uncertainty caused by Trump’s tariffs. Similarly, the Bank of England left rates unchanged as inflation remains concerningly high at 3.4%, but weakness in the job market and GDP figures released during the month showing a contraction left the door open for a rate cut in August. A year into the Labour government, there is a sense that an increasing number of Labour MPs “smell blood” and are willing to push the government into corners after it showed signs of wavering on issues such as winter fuel allowance, benefits cuts, inheritance tax or taxation of non-doms. This is likely to lead to increasing expectations that the Autumn budget will see some tax increases to finance such concessions. In Europe, the central bank cut its benchmark rates but indicated that, having halved the rate from 4% to 2% in the last year, its easing cycle was nearly concluded. Finally, China continues to show some weakness with weaker manufacturing and deflationary pressures.

It was thus a strong month for so-called risk assets (equities, bonds and commodities) with technology companies benefitting from abated tensions and a reversal to the old playbook, while smaller companies were supported by an improving risk sentiment and ongoing corporate activities. While the One Big Beautiful Bill Act is still making its way through the legislative process in the US, bond investors are slightly more sanguine about the threat of larger deficits, but it is interesting to note that gold remains well supported close to its all-time high as a sign that not all concerns have evaporated.

Fund Performance

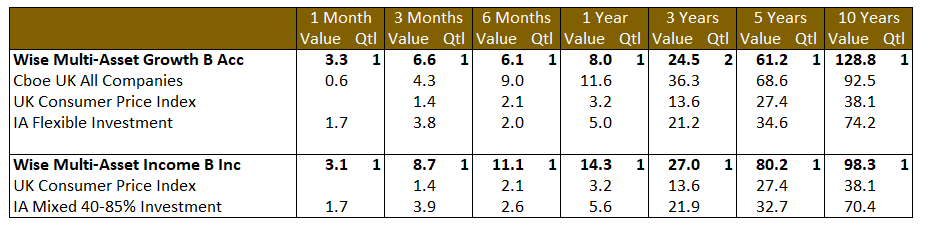

Wise Multi-Asset Growth

In June, the IFSL Wise Multi-Asset Growth Fund was up 3.3%, ahead of both the CBOE UK All Companies Index (+0.6%) and its peer group, the IA Flexible Investment sector (+1.7%). At the halfway point of the year, the Fund is up 6.1% against 9% for the CBOE UK All Companies Index and 2% for the IA Flexible Investment sector. Improving sentiment in the UK market and in investment companies in particular, thanks to extreme valuations and a flurry of corporate activity (mergers, returning cash to shareholders, share buybacks, reduction in fees…), helped discounts in our holdings narrow in June. Some of the biggest movers were in private equity (ICG Enterprise, Pantheon), emerging markets (Templeton Emerging Markets) and our renewables holdings. Our UK small companies managers also performed well, helped by increasing mergers and acquisitions in the sector, particularly Odyssean and Aberforth Smaller Companies. The abatement in global tension supported BlackRock World Mining in the commodities space, while sentiment in the biotechnology space might finally be recovering, helped by positive comments from RFK Jr, Secretary of the U.S. Department of Health and Human Services, among others, indicating they understand the importance of the sector and how much damage uncertainty and red tape might cause.

Wise Multi-Asset Income

In June, the IFSL Wise Multi-Asset Income Fund rose 3.1%, ahead of the IA Mixed Investment 40-85% Sector, which rose 1.7%. At the half-year point, the fund has risen 11.1% which compares favourably to the IA Mixed Investment 40-85% Sector which has risen 2.6%. In recent years, the property sector has seen extremely high discounts to net asset values that have already adjusted to reflect the higher interest rate environment result in increased levels of corporate activity. During the month, the fund was on the receiving end of its third potential bid this year as Empiric Student Property received a tentative approach from quoted competitor, Unite Group. Similar characteristics are seen in the renewables sector, where higher interest rates, lower power prices and disappointing production have resulted in falling asset values. However, these have also been accompanied by extremely wide discounts that are likely to result either in predatory interest or the sale of assets to prove up the net asset values. During the month a bid for a quoted competitor lifted the values of the basket of renewables holdings we have been adding to the portfolio since their March lows, with Renewables Infrastructure Group, Bluefield Solar and Greencoat UK Wind all performing strongly over the month. With investor risk appetite continuing to recover, there was strong performance across our equity fund holdings, with our UK mid and smaller companies funds lifted by persistent levels of corporate takeovers. In addition, our commodity funds and private equity positions performed well.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, we used intramonth volatility to top positions up on weakness. These included Odyssean in the UK (before its strong rebound mentioned earlier), Pershing Square in the US, and our basket of infrastructure trusts. These purchases were financed by taking some profits in Caledonia, Ecofin Global Utilities and Infrastructure, Fidelity Special Values and Lightman European.

We used those profits to top RIT Capital Partners up, as well as increasing our cash position, waiting for better opportunities to redeploy.

Wise Multi-Asset Income

We took profits in a number of strongly performing positions over the month, notably Pantheon Infrastructure, Empiric Student Property, Fidelity Special Values, ICG Enterprise and Blackrock World Mining. We increased our holding in Workspace following a reassuring set of results and strategy update from the new Chief Executive. We topped up our holdings in our renewables holdings and increased the holding the Premier Miton Strategic Monthly Income Bond Fund, a relatively low risk corporate bond fund. Given the strong rebound in markets in recent months, we have slightly increased the fund’s cash position..

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds. The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.