For Professional Clients Only

Macro & Market Update

Tariffs dominated the global economic narrative in July, as nations rushed to secure trade deals ahead of President Trump’s August 1st deadline. Markets initially feared widespread disruption but ultimately responded positively to the trade frameworks that emerged, which were generally seen as no worse than expected. A major development came from Japan, which agreed to lower tariffs to 15% and pledged a $550 billion investment in US strategic sectors. However, the ultimate terms of the deal were disputed, and no binding deal appears to have been finalised. Additional agreements were reached with Vietnam and Indonesia, setting tariffs at 20% and 19% respectively, in exchange for expanded market access and commitments to purchase US goods, including energy and aircraft.

Countries failing to strike deals—notably Canada and Brazil —were hit with steep tariffs ranging from 25% to 50%. Brazil faced the highest tariffs, reflecting broader political tensions. The EU narrowly avoided 30% tariffs by accepting a 15% tariff rate on most exports and agreeing to purchase large volumes of US energy. France and Germany voiced concern over the deal’s inflationary impact. Meanwhile, the US imposed a 50% tariff on copper and threatened a 200% tariff on imported pharmaceuticals. To keep negotiations with China alive, the US temporarily paused export restrictions. While customs revenues surged, inflation and geopolitical risk also increased, raising concerns over the long-term impact of Trump’s aggressive trade posture.

Domestically, Trump achieved a narrow vote to pass his flagship tax and spending bill. The legislation includes major tax cuts and increased border security funding, aligning with key campaign promises. The US economy remained resilient, with the jobs market remaining strong in June and unemployment falling to 4.1%, defying expectations amid trade uncertainty. However, inflation rose to 2.7% and core inflation hit 2.9%, prompting concerns from Federal Reserve officials. Tensions escalated when Trump suggested firing Fed Chair Jay Powell, causing brief market volatility. In the UK, Prime Minister Keir Starmer faced backlash after scaling back a major welfare reform to avoid internal Labour revolt, cutting £5 billion in planned savings. The political retreat triggered a fall in UK government bonds and a decline in the pound. UK inflation rose to 3.6%, its highest in 18 months, driven by energy, food, and travel costs.

Meanwhile, public borrowing jumped to £20.7 billion in June, amid weakening payroll employment and slowing wage growth. China’s economy grew 5.2% in Q2, outperforming expectations despite weak domestic consumption. Exports surged 5.8%, likely front-loaded to avoid US tariffs. Beijing introduced new childcare subsidies to counter demographic challenges. In Japan, the ruling LDP lost its upper house majority, politically weakening Prime Minister Ishiba. Inflation expectations rose, driving Japanese bond yields to multi-year highs as speculation over fiscal stimulus intensified. The Eurozone’s inflation remained at the ECB’s 2% target, prompting a pause in further rate cuts..

Fund Performance

Wise Multi-Asset Growth

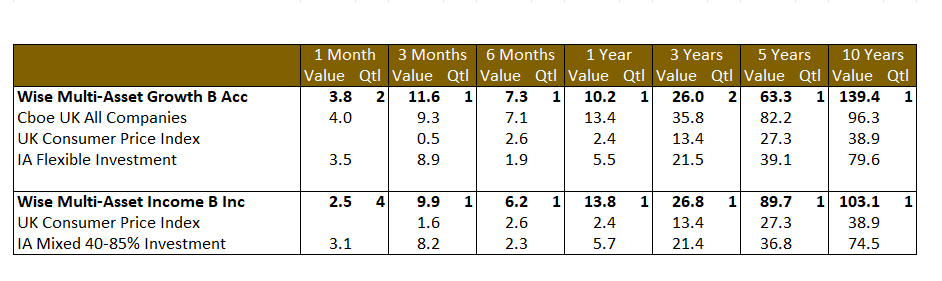

In July, the IFSL Wise Multi-Asset Growth Fund was up 3.8%, behind the CBOE UK All Companies Index (+4%) but ahead of its peer group, the IA Flexible Investment sector (+3.5%). Drivers of performance during the month were wide-ranging as our equities (developed and emerging) and commodities holdings were generally supported by the positive investor sentiment. Healthcare was our strongest performing sector, continuing the recovery we noted last month after a gruelling few months. Our two dedicated biotechnology names in particular (International Biotechnology Trust and RTW Biotech Opportunities) benefitted from more encouraging noise coming from the White House, with the launch of the MABA initiative (Make American Biotech Accelerate) stressing that the government is aware of the significance of the sector. Corporate activity, such as the acquisition of Verona Pharma in the RTW portfolio by Merck at a 23% premium to its closing share price, also remains a supportive theme for the sector. Our private equity names (Oakley Capital, Pantheon International, ICG Enterprise) also performed well, following the take-private deal in Apax Global Alpha, a competing listed private equity trust, at a 17% discount to Net Asset Value versus the 40% discount it was trading at before the deal was announced. While a specific case in the sector, it highlights the increasing realisation that discounts in many investment trusts are too wide, leading to corporate activity.

Wise Multi-Asset Income

In July, the IFSL Wise Multi-Asset Income Fund rose 2.4%, slightly behind the IA Mixed Investment 40-85% Sector, which rose 3.1%. Equity markets globally continued to move higher as market comfort grew that trade deals between large trade partners and the US looked set to be agreed at tariff levels no worse than forecast. US markets were notably strong for sterling investors as underlying strength was compounded by the dollar reversing some of the weakness it experienced in the first half of the year. By contrast, bond markets were weaker as yields on government bonds rose due to market unease over high fiscal deficits and concerns over the impact of higher tariffs on inflation. Commodity markets were mixed with copper negatively impacted by tariff moves whilst iron ore and oil were boosted by restocking by Chinese steel mills and receding fears of a tariff-induced shock to the global economy.

Over the month, the largest contribution to performance came from our infrastructure holdings, notably from those exposed to core infrastructure rather than power price exposed names. International Public Partnerships announced a further realisation from its schools’ portfolio to fund its £200m buyback plan. In addition, it announced it was committing £250m to the proposed Sizewell C nuclear reactor, at attractive returns with obvious risks, such as cost overruns, largely underwritten by the government. GCP Infrastructure announced a net asset value that was broadly flat over the latest quarter and that it had agreed settlement terms on a contractual claim that allowed for further debt paydown. The company is committed to disposing of further assets to prove up the net asset value, pay down debt and undertake further share buy backs. Greencoat UK Wind, however, saw its net asset value fall 5% over the quarter as power price forecasts were rebased lower and generation came in 14% below budget due to lack of wind. It is worth remembering, however that the shares traded down to a more than 30% discount at the end of March, far worse than the subsequent reduction in net asset value. At the same time, Greencoat announced the disposal of three windfarm assets in line with net asset value. The fund saw strong performance from its commodity holdings as well as across its equity holdings. Private Equity names, ICG Enterprise and CT Private Equity benefitted from the more positive market backdrop as well as from continued realisations and a takeover of a quoted peer at a material premium to the share price. Property was one area of weakness over the month despite encouraging trading updates from Helical, LondonMetric and Workspace.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, with the strong rebound in risk assets since April, valuations looking stretched in key parts of the market, volatility being low, and pockets of exuberance appearing, we continued to err on the side of caution. We thus raised some cash from our most profitable positions last month, particularly where discounts have moved sharply tighter, such as in Templeton Emerging Markets, BlackRock World Mining, Fidelity Special Values and Oakley Capital. Our views on their underlying assets remain positive but tight discounts leave us exposed to potential shocks, so this course of action seems sensible to protect the portfolio in the short term. Longer-term, we believe that valuations in our holdings, which are not part of the hyped assets described above, remain attractive.

Wise Multi-Asset Income

We took profits in a number of strongly performing positions over the month, notably Pantheon Infrastructure, Empiric Student Property, Fidelity Special Values, ICG Enterprise and Blackrock World Mining. We increased our holding in Workspace following a reassuring set of results and strategy update from the new Chief Executive. We topped up our holdings in our renewables holdings and increased the holding the Premier Miton Strategic Monthly Income Bond Fund, a relatively low risk corporate bond fund. Given the strong rebound in markets in recent months, we have slightly increased the fund’s cash position..

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds. The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.