For Professional Clients Only

Macro & Market Update

After the flurry of activity on the tariffs front in July ahead of the August 1st negotiation deadline imposed by Donald Trump, things were quieter this month but there were still important developments in trade announcements. China benefitted from yet another deadline extension by 90 days, making November 10th the next milestone for the two countries to come to a trade agreement. India was not so lucky with the relationship between Trump and President Modi apparently strained, leading to the imposition of additional tariffs on Indian exports to the US, taking the total to a prohibitive 50%. In another unconventional twist to his approach to global trade, Trump struck a deal with semiconductor manufacturers Nvidia and AMD to grant them export licences to China in exchange for 15% of their revenues. It is likely that this unprecedented deal by the US government will be the blueprint for further deals where companies have to bow to the President’s threats and requests to conduct their business. In a similar vein, at the end of the month, the US government took a 10% stake in struggling chip manufacturer Intel. While this would not raise eyebrows on this side of the Atlantic, this is unprecedented in the US, home of free market capitalism and it might start concerning investors that the lines between private companies and the government are increasingly getting blurred.

Aside from the above, the main focus in August was on central banks, particularly in the US and the UK, where the tug-of-war between inflationary pressures and weakening growth are making central bankers’ decisions on interest rates harder. Firstly, in the US, while inflation figures remained unchanged at the consumer products level, there was increasing evidence that companies are feeling costs pressure from tariffs. Procter & Gamble, the multinational consumer goods company, announced it will have to increase its prices for household products by 5% this year. Similarly, Walmart, the supermarket behemoth and the world’s largest company by revenue, announced its profits were being squeezed by increased import costs. As such, it is becoming increasingly likely that inflation will be on the rise in the coming months as companies will see no other choice than pass on increased costs to consumers. For now though, the immediate concern is on the strength of the jobs market as previously released strong employment figures were revised sharply lower. Revisions occur every month, but investors have the bad habit of focussing mainly on the preliminary data, only paying attention to revisions when they are abnormal like this month (it was the biggest revision since records began aside from the Covid period). The revision also captured Trump’s attention who fired the head of the Bureau of Labour Statistics department as a result, on the accusation of falsifying the numbers to paint a bleak picture of the economy. This was a convenient excuse for Trump to place a loyalist in one of the key government statistics departments. Even more worryingly, this is also a tactic he is trying to emulate at the US central bank (the Fed) which he wants to cut interest rates aggressively, by firing one of the seven governors in charge of such decisions. This will be tested in court since the Fed’s independence was enshrined in law in 1951 in order to avoid political interferences like this one. If Trump succeeds in politicising such a pillar of global investors’ confidence and the Fed’s independence starts being questioned, one should expect some turmoil in financial markets, particularly in the bond and currency markets initially. For the time being, the Fed left its interest rates unchanged in August, despite constant pressure from Trump for cuts, but its chairman opened the door to a rate cut in September due to the deterioration in the labour market. With inflation on the rise though and what could be a stagflationary period (higher inflation and higher unemployment) ahead, it will be a tricky balancing act for the central bank.

Similarly, in the UK, inflation rose to the highest since January 2024 to 3.8%, creating an issue for the Bank of England (BoE). Meanwhile, employment data showed a weakening trend, echoing the situation in the US. Earlier in the month, the BoE cut rates by 0.25% to 4% for the fifth time in a year. In an unprecedented vote, the committee needed two rounds to reach a majority decision showing, like in the US, the tricky balancing act central bankers are faced with. Unlike the Fed, it is likely that the BoE will be more concerned with inflation rather than growth at this stage, which would lead it to pause its rate cuts in the coming months.

In other potentially significant market news, in France, after months trying to find a consensus on a plan to tackle the unsustainably high deficit, the Prime Minister called a vote of confidence for 8th September which, at the time of writing, looks like it will fail, deepening the crisis in the country.

In the short term, investors generally looked through the developments above, despite their significance, pushing equities to new highs. The combination of strong reported earnings and the expectation of a rate cut in the US generally supported sentiment and kept volatility low. That said, defensive assets like gold were also strong, highlighting a certain degree of unease.

Fund Performance

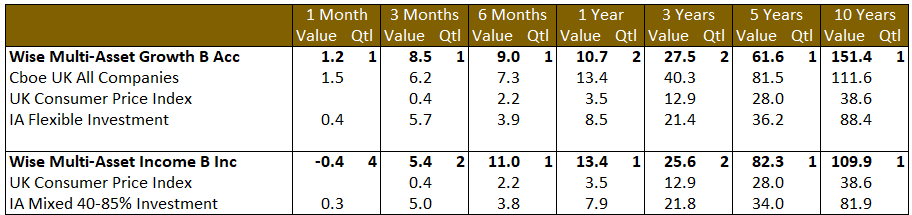

Wise Multi-Asset Growth

In August, the IFSL Wise Multi-Asset Growth Fund was up 1.2%, behind the CBOE UK All Companies Index (+1.5%) but ahead of its peer group, the IA Flexible Investment sector (+0.4%). Our biggest contributor was the Jupiter Gold & Silver Fund, up more than 15% thanks to the solid performance of precious metals and even more so of the gold mining companies which are strongly cash generative and increasingly returning cash to shareholders. Our healthcare trusts continued their strong rebound from last month, thanks to more constructive comments on the sector from the White House and mergers and acquisitions. Our main detractors were in the UK smaller companies space as they struggled despite the general good performance elsewhere.

Wise Multi-Asset Income

In August, the IFSL Wise Multi-Asset Income Fund fell 0.4%, slightly behind the IA Mixed Investment 40-85% Sector, which rose 0.3%. During the month, our renewables holdings underperformed as falling medium-term power price forecasts and rising UK government bond yields drove weaker Net Asset Values (NAVs) and wider discounts. The Renewables Infrastructure Group’s June NAV fell 4% over the quarter, mainly from reduced demand growth assumptions and wind generation 10% below budget, leaving cover tighter for its reaffirmed dividend. Future sentiment hinges on asset disposals and recycling into its 1GW pipeline of development assets. Bluefield Solar’s NAV also fell, despite strong solar output, on weaker price forecasts for power. Core names like HICL Infrastructure proved steadier, with disposals validating NAVs and future dividend payments confirmed. Our property holdings also came under pressure reflecting a more downbeat assessment from investors towards domestic UK-focussed assets given subdued economic growth, inflationary pressures and a government that looks set to increase taxes to cover wider fiscal deficits. Empiric Student Property fell despite the agreed takeover from Unite whilst Helical was weak on no specific news. Workspace was flat over the month despite providing an encouraging update on lettings and the news that Saba, an activist shareholder, has built a 5% stake in the company. Paragon Banking Group also fell as expectations grew the upcoming budget might include a specific banking tax to help plug the gap in government finances. By contrast, our international equity holdings, such as Schroder Global Equity Income, Aberdeen Asian Income and Schroder Emerging Market Value performed positively helped by the relatively calm trade developments over the month, notably between the US and China. This also positively impacted both of our commodity focussed investment trusts. Finally, International Biotechnology Trust continued to recover from its April lows as a result of increased levels of mergers and acquisitions and a more conciliatory tone towards the sector emanating from the White House.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, we trimmed positions in Jupiter Gold & Silver, Fidelity China Special Situations and Oakley Capital Investments after strong returns. We redeployed some of the cash we raised in recent weeks on weakness in the renewables and infrastructure sector. We also topped up TR Property which has been broadly flat for the past 3 months. Finally, we completed our switch out of Caledonia into RIT Capital. The former has been a longstanding holding in our portfolio and is one of our strongest historical contributors, but we believe that RIT Capital, with new management, a deeper portfolio of private companies, many in exciting technology and AI sectors, and an attractive discount has got more potential to rerate from here. Our cash levels remained elevated relative to history as we continue to expect some volatility over the coming weeks.

Wise Multi-Asset Income

Over the month, we deployed some of the cash that has recently been built up by increasing our holdings in areas that have seen recent weakness. Notably, we increased our exposure to infrastructure, particularly renewables, where discounts have widened against NAV that have been rebased lower. Dividend yields of over 9% and discounts to NAV of over 25% look to be pricing in considerable negativity around future power prices and appear attractive relative to the return available from longer dated government bond yields. At the same time, we topped up our holdings in HICL Infrastructure and International Public Partnerships. We also added to CT Private Equity, Odyssean Investment Trust and Workspace.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds. The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.