Performance statement

The IFSL Wise Multi-Asset Growth Fund returned 9% for the 6 months to the end of August 2025, ahead of both the CBOE UK All Companies Index (+7.7%) and its peer group, the IA Flexible Investment Sector (+3.9%).

Over the 5-year time horizon we consider sensible to look at our performance and as per our objective, the Fund is up 61.6%, behind the CBOE UK All Companies Index (+82.1%) but well ahead of the IA Flexible Investment Sector (+36.2%). The Fund sits in the top 3% of funds in the peer group over that time horizon, which is a pleasing outcome given the broad challenges thrown at investors during the period (Covid, wars, political changes, dominance of large technology companies, sharp shifts in interest rates, trade wars, etc…) and the many headwinds faced by investment trusts (our main focus).

Market Review

The period in review has been shaped by a combination of economic fundamentals, political shocks and policy unpredictability. Donald Trump’s second mandate has again redefined the balance between economics and geopolitics, with tariffs, trade negotiations, and unconventional policymaking driving sentiment across asset classes. While creating some shocks along the way, over the past few months investors have become accustomed to Trump’s unconventional governing style, possibly leading to a degree of complacency regarding general market risk.

At the centre of this period stood the global tariff saga, widely telegraphed by Trump during his campaign and culminating in the so-called “Liberation Day” announcement on April 2nd. Tariffs are taxes on imports from another country, used as a means to favour domestic companies by making their foreign competitors more expensive. As such, they fit into Trump’s mandate of “making America great again”. Expectations were that those tariffs would be justified and targeted, however. Instead, the tariffs announced on April 2nd were broadly incoherent and global, muddying the message and creating uncertainty. Trump’s administration initially appeared to use trade deficits (when a country imports more goods and services than it exports) as a proxy for unfair trade practices. While there are many unfair practices the US can claim to have been the victim of, particularly from China, which would justify some retaliation, trade deficits themselves are not unreasonable if goods cannot be manufactured domestically or if consumers want products that are more cheaply manufactured abroad. Equating deficit and unfairness is thus a gross simplification at best. Over the weeks following the announcement, however, it became clear that, rather than being driven by ideological or economic rationales, tariffs are used by Trump as a profit maximisation exercise (via the increase in taxes collected by the US government), using the US clout to bully international partners into submission. The result was volatility spikes of an extraordinary magnitude, followed by equally rapid recoveries as concessions, pauses, or new negotiation deadlines were announced. Markets learned that while Trump’s threats could not be ignored, overreacting risked missing the equally sudden reversals. The international response to US policy, on the whole, was one of accommodation and submission, as opposed to confrontation. As such, trade deals were struck with the UK, the EU, Japan and South Korea amongst others ahead of deadlines set by Trump, thus preventing what could have been nasty trade wars. Similarly, there was a clear desire by non-US countries to avoid conflict by making pledges such as to raise defence spending in NATO (the North Atlantic Treaty Organisation). Such strategies of appeasement were also used by companies whose CEOs are now a regular feature of White House meetings where praise and gifts are given to the President. Yet beneath the surface, dissent lingers with many aspects of deals remaining fuzzy and being contested after official announcements. At the time of writing, India appears to be on the of the biggest losers in tariff negotiations with the US, with a punitive 50% tariff on its exports being imposed following a breakdown of the relationship between Trump and Modi. China is a special case and has benefitted from a further extension to previous deadlines until November 10th for an agreement to be reached. The fluidity of these announcements, the superficiality of signed agreements, and the unpredictability of President Trump all ensure that tariffs will continue to hang over markets for the foreseeable future. Trump 2.0 also includes a gradual blurring of lines between the state and private sector in the US with revenue-sharing deals with semiconductor giants being struck, and the government taking an equity stake in Intel, both signalling a departure from America’s free-market orthodoxy. These interventions risk unsettling investors accustomed to a clearer boundary between private enterprise and government. Should such measures proliferate, markets may begin pricing in a more interventionist US model, with unpredictable consequences for valuations.

The tariff story also blurred into US domestic economic debates. The “One Big Beautiful Bill Act,” promising tax cuts but threatening trillions in new debt, underscored investors’ unease with US fiscal discipline, a theme also prevalent on this side of the Atlantic. For the reporting period, the US economy continued to prove resilient in the face of uncertainty, however. Employment and consumption held up through much of the period, and corporate earnings, particularly in the technology sector, delivered record-breaking milestones. Nvidia’s market capitalisation surged beyond a record $4 trillion, swiftly joined by Microsoft, fuelling optimism about the Artificial Intelligence (AI) revolution. Such strength provided a cushion against political noise, though the durability of margins in the face of rising input costs remains an open question. Companies from Procter & Gamble, the multinational consumer goods company, to Walmart, the supermarket behemoth and world’s largest company by revenue, have begun flagging the need to pass tariff-related cost pressures on to consumers, an early sign that inflationary dynamics may soon bite harder. Indeed, the inflation narrative started shifting at the end of the period. Until then, consumer inflation data appeared benign, but the fear of future inflationary pressures caused by tariffs forced the central bank (the “Fed”) to hold rates steady despite constant pressure from Trump to aggressively cut them. As supply chain costs filter through and corporate warnings grow louder however, the risk of stagflation—weakening growth combined with renewed inflation—begins to loom larger. Labour market data in the US painted a less robust picture than initially thought, triggering not only market concerns but also political interference: Trump’s decision to fire the head of the Bureau of Labor Statistics, and attempts to politicise the Fed, alarmed investors who rely on institutional independence as a bedrock of confidence. At the end of the period, the Fed indicated that, on balance, it is likely to be more concerned by the weaker jobs market than a resurging inflation, which should lead to rate cuts in the coming months, generally a positive factor for so-called risk assets. Should the Fed’s autonomy weaken further, however, the consequences for US credibility in global markets could be severe.

The UK mirrored many of these dynamics, grappling with the same uneasy balance between slowing growth and stubbornly high inflation. The Bank of England, having cut rates from 4.5% to 4% over the period, now finds itself divided over how much further it can ease without stoking price pressures. Political headwinds are equally strong, with the Labour government under increasing pressure from its own MPs to soften austerity-like measures, setting the stage for potential tax increases in the autumn budget. In Europe, fiscal debates also reached boiling point, most notably in France where a looming confidence vote threatens to deepen instability. This was in contrast to Germany where a new Chancellor managed to break the country’s reluctance to use debt as a financing tool and pushed for up to 1 trillion Euro extra spending in defence and infrastructure over the next few years.

Amid this swirl of risks, markets have shown a paradoxical resilience. Equities across major regions pushed to record highs, propelled by a combination of corporate earnings strength, relief over avoided crises, and expectations of eventual monetary easing. At the same time, gold too traded at historic peaks, a hedge against the very risks equity investors seemed willing to overlook. This unusual cohabitation of exuberance and caution suggests markets are torn between optimism about growth and innovation, and fear of political and fiscal instability. There could be signs that vulnerabilities are growing under the surface (debt burdens, creeping inflation, fragile institutional independence, and unresolved geopolitical tensions), which would point to an environment where complacency could prove costly. The coming months will test which narrative prevails.

Fund Performance Review

The Fund delivered a return of 9% over the 6-month period thanks to our diversified exposure outside of US equities, the outperformance of the value versus growth style, a refound interest in interest in investment trusts and strong manager selection.

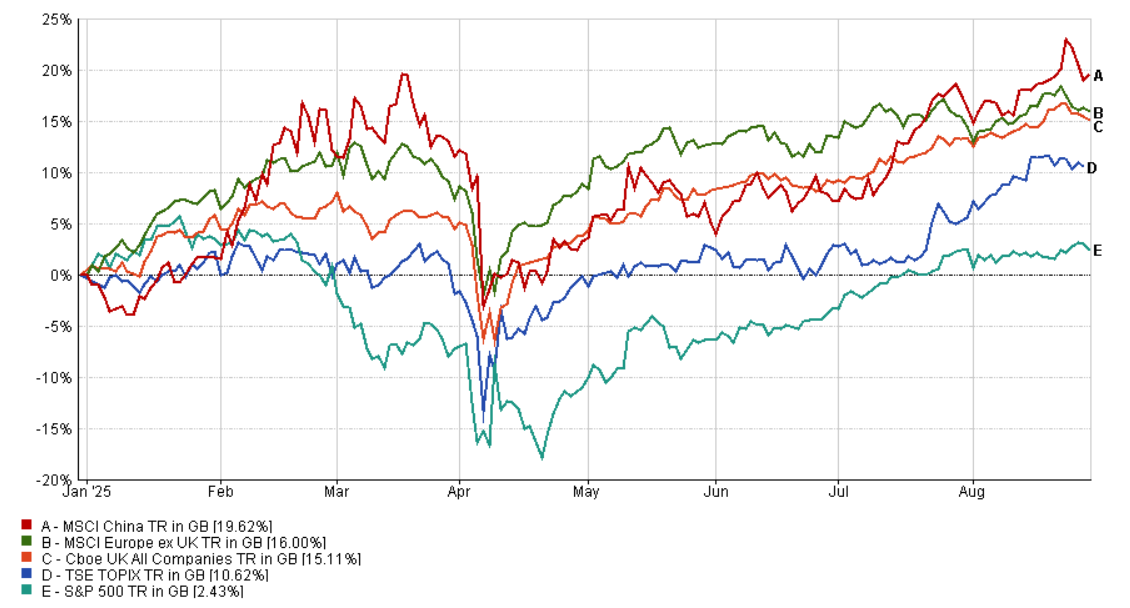

Addressing these factors in order, it is worth pointing out that, for now at least, the US outperformance relative to the rest of the world in equities is having a pause. The uncertainty caused by the reappointment of Trump in the White House and his often-chaotic leadership style have led investors to question the durability of American exceptionalism (the strong outperformance of the US economy and equity market over the past few years). While reported earnings from US companies continue to outpace the rest of the developed world’s, we may increasingly be reaching the point where they struggle to exceed expectations and justify the high valuations attributed to them. Moreover, the biggest casualty of Trump’s tariffs so far has been the US dollar, down 9% against a trade-weighted basket of currencies since the start of the period. This is starting to push investors to consider alternatives to US assets by fear that the capital value of their investments gets wiped out by currency depreciation. In this new paradigm, for the pound sterling investor, each of UK equities, European equities, Chinese equities and Japanese equities has outperformed US equities since the end of 2024. These moves still very much occur under-the-radar but are likely to gather momentum when more widely acknowledged. As a result, our allocations to all of those regions benefitted our performance, both in absolute terms and relative to our peers who largely remain overweighted US equities.

Total return of key equity markets year-to-date (in GBP)

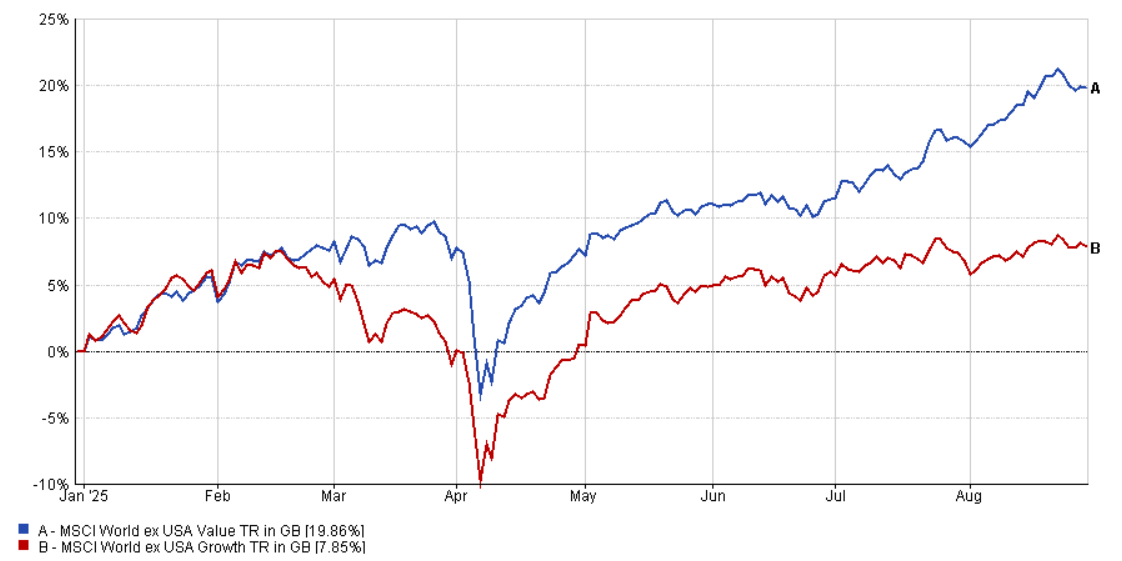

Another interesting driver of our performance during the period was the outperformance of value investing, outside of the US. Performance in the latter, while starting to broaden, remains heavily driven by large technology companies, which tend to be growth rather than value oriented. Value investors (of which we are one) tend to compare companies’ share prices today relative to their fundamentals, while growth investors focus on finding companies that can grow faster than their peers, thus demanding higher valuations than value stocks. Because growth stocks are dependent on how their earnings will grow in the future, macroeconomic uncertainty and higher interest rates tend to hurt their share prices (at a higher interest rate, the threshold is higher for earnings growth to justify a given rating). Comparatively, value stocks tend to outperform in such an environment because they are more dependent on present conditions (i.e. the value of their existing assets) than on the future (i.e. how their earnings will grow in the next few years). While benchmark interest rates have been cut or left unchanged by the main central banks over the period, fears about inflation and fiscal deficits have put some pressure on longer-term bonds, keeping interest rates elevated and thus benefitting value strategies. As a result, since the start of the year, value stocks in global equities ex-US have outperformed growth stocks by about 12%.

Global ex-US Value vs Growth year-to-date

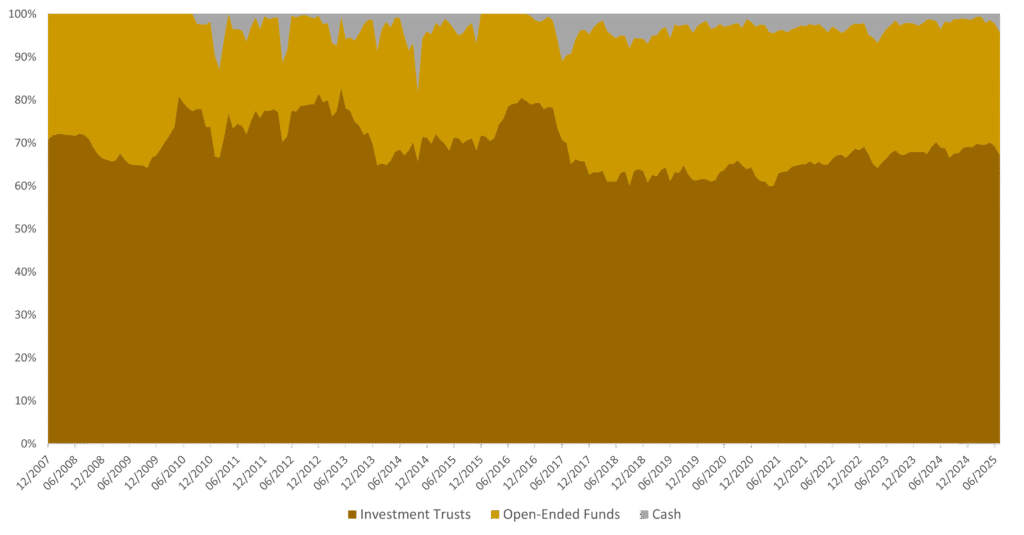

As our regular readers will know, the investment trust sector (close to 68% of our Fund at the end of the period) has suffered from headwinds for the past couple of years, including struggles in a rising rate environment for income strategies, a reduced investor base following consolidation in the wealth management sector, a dislike for UK assets where they are listed, and changes to cost disclosures. This had led to investment trusts discounts relative to their Net Asset Values (NAVs) to widen to historically high levels. This year, however, one can see early signs of a recovery, thanks to improved corporate governance leading to more investor-friendly changes (such share buybacks, tweaks to investment mandates, reduction in fees, redemption facilities…), corporate activism and mergers and acquisitions helping to sort out the wheat from the chaff. As a result, discounts have continued to tighten since their historic trough a couple of years ago. For our Fund, over the reporting period, discounts reached an average trough of 18% in April and closed at 15%, still above our long-term average of 12% but moving in the right direction nonetheless.

Historical allocation to investment trusts

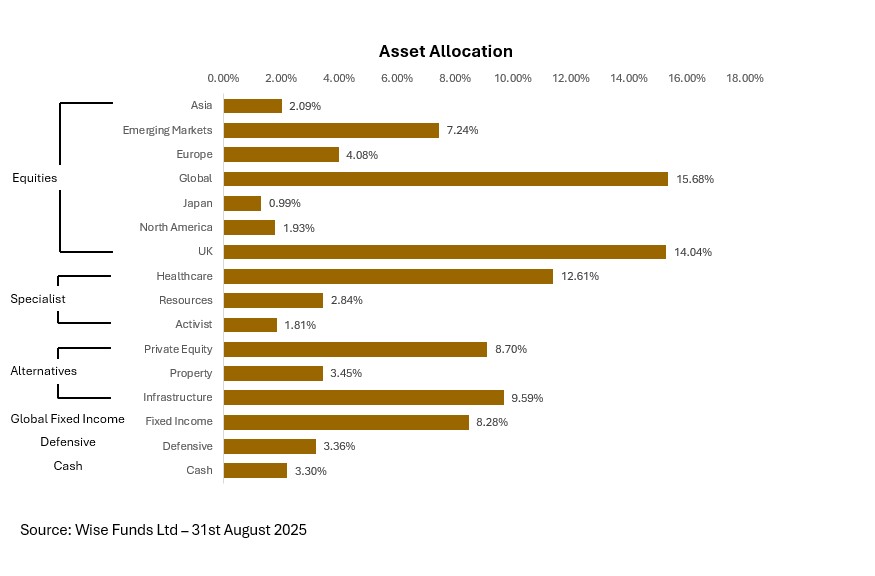

Finally, in an environment where stock picking is getting increasingly difficult given the noise in financial markets, our ongoing focus on finding the best managers for each of our holdings proved fruitful during the period with about half of our managers finishing in the top 25% of their respective sectors, helped both by their NAV performance and discount tightening, a sign that other investors are also acknowledging the quality of these funds. Notable performers were found across sectors, like in commodities with both Jupiter Gold & Silver (+46%) and BlackRock World Mining Trust (+21%). In regional equities, strong performers were found in the UK (Fidelity Special Values +17%, Aberforth Smaller Companies +14%), in China (Fidelity China Special Situations +23%) and broader emerging markets (Schroder EM Value +18%, Templeton Emerging Markets +17%). We also had strong returns from our specialist managers like Ecofin Global Utilities & Infrastructure (+16%) and Oakley Capital Investments (+18%). There were no significant detractors of note over the period, although it is worth noting that the performance of our healthcare holdings (12.6% of the Fund at the end of the period) was volatile due to pressure from the Trump administration and a lack of clarity on healthcare policies. We continue to believe that the sector is very attractive thanks to long-term growth drivers and cheap valuations, and remain encouraged by good trial results as well as merger and acquisition interest for the underlying companies in the three funds we own.

Portfolio activity

In a period that saw a number of shocks and increasing uncertainty, but also a general march higher in global equity and bond markets, we were active in recycling ideas in the portfolio and looking for new attractively valued positions. This led to four full exits (Polar Capital Global Financials Trust, Fidelity Asian Values, European Smaller Companies and Caledonia Investments), all positions that we had been trimming on the way up for a number of months and had become relatively small. Each of these positions are from managers we have invested with for years and we continue to hold in high regard. They are thus likely to find their way back into the Fund in the future if valuations become more attractive. In addition to those full exits, we also took profits in the strong contributors to performance we mentioned earlier such as BlackRock World Mining Trust, Jupiter Gold & Silver Fund, Fidelity Special Values, Oakley Capital Investments and AVI Japan Opportunity Trust.

Conversely, while some of the proceeds of these sales was kept in cash, particularly towards the end of the reporting period when we got increasingly wary of pockets of overexuberance in financial markets and some complacency from investors regarding valuation and political risks, the rest was reinvested in areas of greater upside potential. Some of those were in recently added positions we are still building up to full weight, such as Pershing Square Holdings, a high conviction value-oriented US equity manager, and RIT Capital Partners, a prudent and nimble manager of strategies in public and private assets, both trading at attractively wide discounts. We also added to our positions in TR Property Investment Trust which we think will continue to benefit from corporate activity (mergers and acquisitions, wind down of strategies…) and a re-rating of the property sector, and Odyssean Investment Trust as a means of getting expert exposure to UK smaller companies. Finally, we built a basket of 6 infrastructure and renewables trusts, a sector that suffered from higher interest rates in the post-Covid area and went from trading at unsustainably high premiums to wide discounts. We think those are equally unsustainable now that portfolios have been revalued lower by managers, are more credible following increased disposals validating NAVs, and are offering attractive yields well in excess of cash. The sector is also starting to gather interest from activist shareholders and private buyers, which we think is likely to create a catalyst for a revaluation. Assets and strategies in those trusts are very idiosyncratic, which can make them difficult to differentiate, so we believe that a basket approach is sensible way to gain exposure.

Investment Outlook

We started the reporting period by questioning whether the US exceptionalism trade was going to be put to the test in light of greater economic and geopolitical uncertainty under Trump 2.0. Liberation Day and a raft of executive decisions since then (many of them impulsive and hasty) have certainly alerted investors to the risks of having portfolios with allocations concentrated in the US. We are far from seeing the unravelling of this trade but, at the margin, we are seeing returns broadening out to non-technology, non-US smaller companies. The weakness in the US dollar is also a sign that global investors are looking for diversification. We believe that this presents a fantastic opportunity for our Fund which is underweight US equities and the giant technology companies, preferring diversifying undervalued assets. The performance of the recent months highlights that the assets we own are amongst the ones other investors are now scrambling to get access to, attracted by their quality and valuations. We are also encouraged by the fact that the vehicles we use to access those undervalued assets, investment trusts, are themselves undervalued, thus offering a double discount. With the investment trust sector now taking steps to address issues of oversupply of shares, irrelevance of some mandates and lack of shareholder consultation, we are optimistic that the seeds have been sown for a future improvement in the vitality of the sector. As ever, financial markets rarely move in straight lines and we are not ruling out the US which remains, after all, one of the greatest global growth engines despite political interference. We think, however, that the shocks created by the boundary-testing presidency of Trump are forcing investors to widen their opportunity set. A small reallocation out of expensive US equities into other assets would be sufficient to create a period of sustained strong performance. Meanwhile, like we have for more than 20 years, we will continue to use the full flexibility of our mandate to ensure the most appropriate positioning in our Fund.

I would like to take this opportunity to thank our investors for their ongoing support. The whole Wise Funds team is at your disposal should you have any questions or would like to talk to us.

Vincent Ropers

Fund Manager

Wise Funds Limited

March 2025

TO LEARN MORE ABOUT THIS FUND , PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.

This presentation is for Professional Clients only and not for re-distribution.

All data is sourced by Wise Funds and any third party data is detailed on the specific page.