Performance Statement

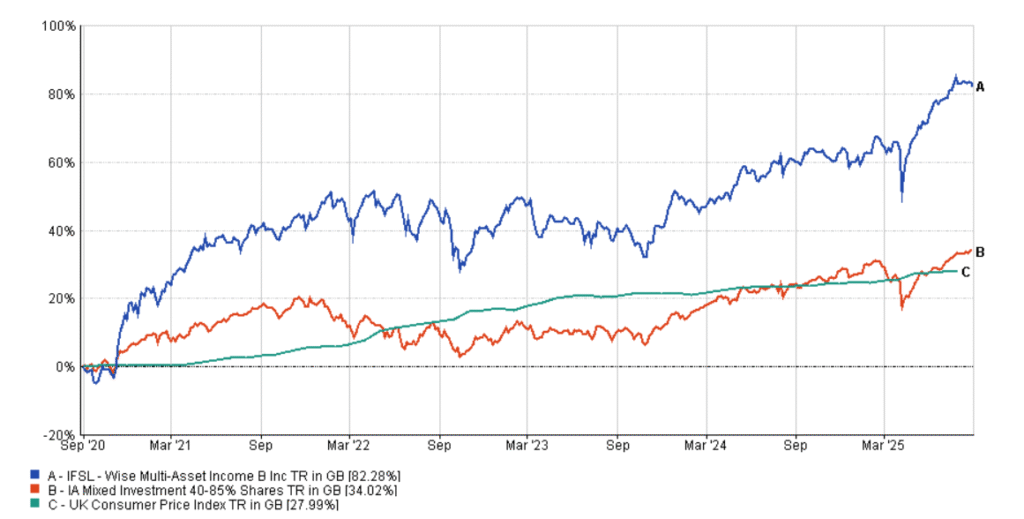

Over the 6-month period, the IFSL Wise Multi-Asset Income Fund rose 11.0% (B Income shares – total return). Over this period, we outperformed our target benchmark, the Consumer Price Index (CPI), which measures inflation and remains above the Bank of England target, up 2.2%. We also outperformed the comparator benchmark, the IA Mixed 40-85% Investment sector, which rose 3.8%. Over the 5-year time horizon we consider sensible to look at our performance and as per our objective, the Fund is up 82.3%, ahead of both CPI which rose 28.0% and the sector, which rose 34.0%.

There was a strong increase in the distribution per unit, which rose 17% from 3.3p to 3.9p (compared to last year’s interim period). This was helped in part by one of our highest yielding holdings paying its dividend the week after the start of the period rather than before. It remains the objective of the fund to increase the distribution per unit over 5 year rolling periods and we continue to anticipate strong double-digit growth over the forthcoming year as we outlined in the latest annual report. The forecast yield on the fund for this financial year (to end February 2026) remains attractive at 5.2%, reflecting the strong expected growth in income from our underlying holdings.

Market Review

The past six months have been something of a roller-coaster for global markets. Instead of the familiar rhythm of business cycles, investors have faced a barrage of sudden, often unpredictable policy changes now that the Trump administration is firmly in office. Each announcement sparked sharp swings in sentiment, only for the immediate impact to fade once measures were softened, postponed, or partially reversed. This recurring pattern—policy shock followed by relief—had the net effect of pushing global asset prices higher, but it has also obscured a more worrying backdrop of eroding institutional trust, mounting fiscal strain, and rising political interference in economic decision-making.

Trade policy offered the clearest example of this dynamic. Initial expectations had been that new tariffs would be carefully targeted at specific unfair practices, particularly in relation to China. Instead, the US opted for sweeping and unexpectedly draconian measures. The April “Liberation Day” package, which imposed a 10% tax on nearly all imports outside of Canada and Mexico along with surcharges on countries running trade surpluses with the US, was emblematic of this new approach. The market reaction was immediate and severe: stocks tumbled in one of their sharpest two-day declines in decades, volatility surged to crisis-era levels, and gold prices jumped to fresh records. Yet just as quickly, exemptions and delays were announced, easing the pressure and allowing markets to rebound with surprising strength.

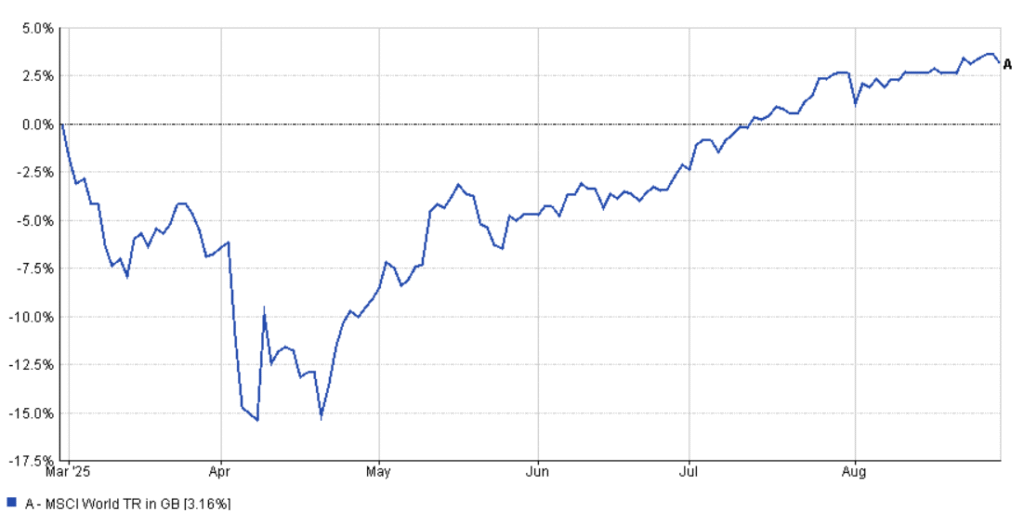

Global Equity Market Performance

This sequence became familiar. Aggressive pronouncements were followed by market turbulence, then by a climbdown that allowed confidence to return. Traders even coined an acronym—“TACO,” shorthand for “Trump Always Chickens Out”—to describe the cycle. Over time, investors became adept at discounting the first shock, waiting instead to see whether rhetoric would be matched by real implementation. Still, the cumulative effect of this stop-start approach was significant: companies struggled to plan around shifting costs, supply chains were repeatedly unsettled, and the predictability of US economic policy was undermined.

A central misconception during this period was the treatment of trade deficits (where the amount a country imports is greater than it exports) as evidence of cheating. While deficits were cited as justification for tariffs, in most cases they simply reflected consumer preferences or efficiency advantages abroad. Viewing them as proof of unfairness oversimplified a complex reality. Gradually it became evident that tariffs were being wielded less as principled instruments of economic correction and more as tools for extracting concessions or raising revenue.

International responses generally leaned toward accommodation rather than confrontation. The European Union, Japan, and Vietnam, among others, pledged to increase imports of US goods or channel investment into American industries to avert harsher penalties. NATO partners promised higher defence spending to maintain Washington’s goodwill. Large corporations adopted their own strategies of appeasement, with CEOs visiting the White House to showcase loyalty and secure carve-outs. Yet these pledges often lacked detail or enforceability, leaving underlying uncertainty unresolved. Relations with India deteriorated, culminating in steep tariffs on its exports, while China managed to negotiate extensions that kept the risk of escalation alive without delivering resolution.

Another striking feature of this period was the blurring of lines between government and business. Semiconductor firms agreed to revenue-sharing arrangements with Washington in exchange for export licences, while the government acquired a direct equity stake in Intel. Such moves marked a departure from longstanding free-market norms. If extended more broadly, they could force investors to incorporate political favouritism into corporate analysis, challenging assumptions about transparency and fair competition.

At the same time, governments across advanced economies were loosening fiscal constraints. In the US, expansive tax-and-spending bills added new spending commitments even after the loss of the nation’s top-tier credit rating. Germany approved unprecedented plans to spend up to a trillion euros on defence and infrastructure, breaking with its tradition of fiscal conservatism. The UK, meanwhile, saw its limited budget flexibility eroded as growth forecasts weakened, while policy reversals on expected cuts to welfare spending deepened fiscal uncertainty. The consequence across markets was clear: borrowing costs began to rise, with yields on long-dated bonds climbing sharply as investors demanded greater compensation for mounting debt risks. While fiscal stimulus supported near-term growth, concerns about long-term sustainability increased.

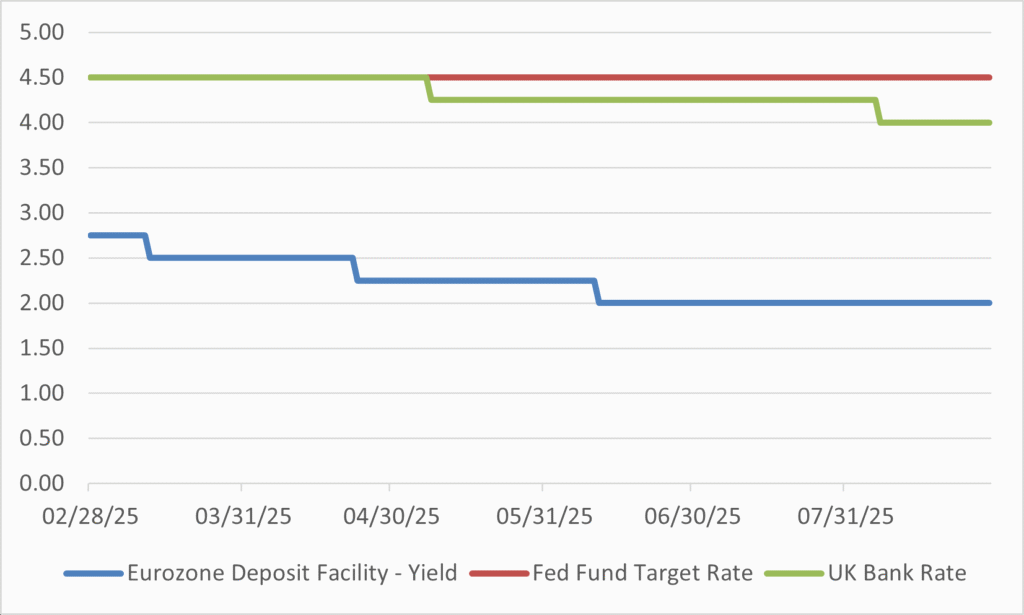

Central banks were left in an unenviable position. The combination of tariffs and widening fiscal deficits threatened to fuel inflation at a time when growth was already showing signs of fatigue. In the US, the Federal Reserve held rates steady but faced extraordinary political pressure, with the President openly demanding cuts and hinting at replacing Jerome Powell, the Chairman of the Federal Reserve. The dismissal of the Bureau of Labor Statistics chief following unwelcome negative revisions to US employment data only deepened concerns about institutional independence. In the UK, the Bank of England trimmed rates despite inflation remaining above target, reflecting worries about faltering growth. The European Central Bank nudged rates lower but signalled that its room for further rate cuts from here was limited. China’s authorities pursued a more aggressive easing path, lowering both interest rates and reserve requirements to cushion the slowdown.

Interest Rate Movements over the Period

Geopolitics added yet another layer of complexity. The breakdown of a minerals agreement with Ukraine, coupled with the suspension of US military aid, raised questions about the durability of previous long-standing security commitments. Germany’s announcement of a significant increase in government spending was in part a response to this new strategic reality, highlighting Europe’s need to assume greater responsibility for its own defence. In the Middle East, US strikes on Iranian nuclear facilities briefly pushed oil prices higher before a measured response restored stability. Tensions with India grew over its purchases of Russian oil, while disputes between the US and Europe over digital regulation strained transatlantic ties. The lesson was clear: geopolitical flashpoints are now an enduring feature of the economic backdrop, shaping both government spending priorities and market movements.

Despite these storms, financial markets displayed extraordinary resilience. Equity indices across major economies reached new records, driven in large part by strong earnings, particularly in the technology sector. Optimism about artificial intelligence propelled valuations to unprecedented heights, with companies like Nvidia and Microsoft surpassing $4 trillion in market capitalization. Somewhat counterintuitively, however, gold also set new records as investors sought a hedge against the very risks equities seemed to dismiss. The dollar weakened, diminishing its traditional safe-haven appeal, while the euro gained ground and sterling remained volatile. Commodities painted a mixed picture: copper edged higher, iron ore slipped, and oil prices retreated despite geopolitical turbulence.

This juxtaposition—soaring risk assets alongside surging safe-haven demand—captured the paradox of the period under review. On the surface, investors were eager to bet on innovation and growth. Beneath that optimism, they continued to hedge against the possibility that political volatility or policy missteps could derail the story. Markets may have learned to shrug off tariff headlines and political surprises, but structural vulnerabilities are quietly intensifying. Debt levels are climbing across major economies, inflationary pressures are arguably re-emerging, and the independence of central banks is being tested. Geopolitical risks, far from receding, remain unresolved.

For investors, several lessons stand out. Tariffs may be transitory, but the erosion of policy credibility leaves lasting scars. Increased government spending can boost growth in the short term, but it comes at the cost of higher borrowing costs and long-term debt burdens. State intervention in corporate strategy introduces a new, less predictable dimension to valuations. And institutional independence, once taken for granted, is increasingly fragile.

Performance Review

Over the six months to the end of August, the fund’s strongest contributions came from the infrastructure and property allocations. At the end of February, we highlighted both sectors as unusually attractive, with wide discounts to net asset value offering high starting yields whilst corporate activity and activist pressure provided likely catalysts for a re-rating. That assessment has proved broadly accurate, and subsequent events validated our conviction.

In core infrastructure, the fundamental resilience of cash flows has been increasingly recognised by the market whilst highly attractive opening valuations have allowed the sector to overcome persistent concerns about higher bond yields. Companies across the sector took concrete steps to demonstrate the strength of their underlying portfolios. Both HICL Infrastructure (+13%) and International Public Partnerships (+12%) committed to further asset disposals and buybacks in the spring, which reinforced confidence in their valuations. Pantheon Infrastructure (+15%) delivered solid results with strong operational progress and by highlighting the conservatism of its valuation process with an exit at a premium to book value. Later in the period, International Public Partnerships underscored the appeal of the sector’s government-backed returns by committing to the Sizewell C nuclear project, while also returning capital to shareholders through its buyback programme. As a result, our core infrastructure holdings provided consistent positive contributions throughout the period.

In Renewables, we took the opportunity at the end of March to add exposure after sharp declines in valuations had left the sector trading on extreme discounts. Initially this move was rewarded, as corporate activity among peers during the second quarter helped to validate asset values and lift sentiment. However, as the summer progressed, lower power price forecasts and weaker-than-expected wind generation weighed on net asset values (NAVs) and share prices once again. For example, The Renewables Infrastructure Group (+8%) and Bluefield Solar (+6%) both reported reductions in NAVs, due to reduced medium term power price forecasts. Nonetheless, these companies reaffirmed their dividends, and several were able to dispose of assets at levels in line with or above stated NAVs, which helps to demonstrate the disconnect between market pricing and the value of the portfolios. Despite near-term volatility, the combination of high dividend yields and historically wide discounts suggests that the medium-term opportunity in renewables remains attractive.

The property sector also played a central role in driving performance, with the themes of undervaluation and corporate activity proving decisive. At the start of the period, we had highlighted that property companies were trading on highly attractive implied yields and unusually wide discounts, and over the subsequent months this was repeatedly confirmed through bids and activist pressure. In March, Care REIT (+37%) was subject to a takeover offer at a sizeable premium, Urban Logistics (+40%) advanced as activist investors forced a boardroom challenge, and Helical (+17%) rose on the back of positive planning approval for a key development and the disposal of a recent development for a significant profit. Further corporate activity followed in April and May, culminating in a formal offer for Urban Logistics from LondonMetric, while in June Empiric Student Property (+15%) received an approach from Unite, marking the third bid across our holdings in the period. Later in the summer, sentiment towards UK domestic property softened as investors grew more cautious about the economic outlook, fiscal risks and the potential for higher taxation, which led to weaker performance from Helical, Empiric and Workspace. However, the impact of this was more than offset by the strong returns already delivered through corporate activity earlier in the period, ensuring that property was one of the strongest contributors to fund performance overall.

Over the six months to August, global equity markets moved higher despite softer global growth forecasts, underpinned by robust earnings, falling interest rate expectations and supportive government spending commitments in the US and Europe. Regional performance diverged: US equities delivered solid local currency returns but were far less attractive in sterling terms as the dollar weakened, while UK, Japanese and Chinese markets were particularly strong. Europe lost momentum after its very strong performance in the first two months of the year. Against this backdrop, the period was defined by an exceptionally sharp fall in global equity markets in April following “Liberation Day,” when the announcement of new US tariffs triggered the steepest two-day market fall since the pandemic and equity market volatility reached a level rarely seen outside of crisis episodes, such as 2008 and 2020. Remarkably, volatility then normalised at record speed, underscoring both the intensity and transience of the shock.

For the portfolio, diversification away from the US and a bias to value managers meant we were well placed to withstand these swings and capitalise on the recovery. UK equity funds, particularly those focused on smaller and mid-sized companies, such as Aberforth Smaller Companies (+14%) and Fidelity Special Values (+17%) delivered strong performance, materially outpacing the broader UK equity index. Our emerging market allocations, notably Schroder Emerging Market Value (+18%) and Aberdeen Asian Income (+14%), also produced strong outperformance against benchmarks. Whilst there were no detractors to performance among our equity allocation, Schroder Global Equity Income (+4%) lagged despite the tailwind of a value style and an underweight exposure to the US. Similarly, International Biotechnology Trust (+2%) made limited headway with the overall positive performance masking a significant intra-period fall and subsequent recovery in performance. Overall, strong manager selection, exposure to undervalued areas of the market and our decision to maintain a diversified portfolio outside of US equities combined to deliver returns ahead of broader global markets in sterling terms.

Elsewhere, our commodity holdings, Blackrock World Mining (+21%) and Blackrock Energy and Resources (+8%) both performed well despite the overhang of global and commodity specific tariffs, helped by a gradual thawing of relations between the US and China over the period, the strong performance of Gold and continued mergers & acquisitions in the sector. Our private equity holdings, CT Private Equity (+4%) and ICG Enterprise (+8%) also delivered positive returns reflecting the strength in quoted equity markets and a consequent narrowing of extremely wide discounts to NAV as confidence grew that the outlook for future disposals of their underlying assets should also improve.

Finally, our fixed income holdings also delivered positive returns. Despite bond markets having to balance hopes of easier central bank policy with lingering concerns about inflation and government spending, our bond managers managed to navigate their way positively through the period. Attractive starting yields coupled with a more benign view of the prospects for corporate credit saw TwentyFour Income (+8%), GCP Infrastructure (+4%), TwentyFour Strategic Income (+3%) and Premier Miton Strategic Monthly Bond Income (+5%) all contribute positively over the period.

Portfolio Activity

Against a backdrop of elevated political and economic risks yet with global assets (both equities and bonds) moving ever higher, we were active in recycling the portfolio towards areas where we felt likely future returns and commensurate risk remain attractive. A significant new addition to the portfolio over the period has been the inclusion of a handful of funds exposed to renewable energy (both wind and solar). The sector has seen net asset values come under pressure for over two years now on the back of higher bond yields, falling power prices and weaker generation than forecast. Against these more conservatively struck asset values, the trusts themselves have seen discounts also widen considerably. This is a phenomenon we have observed both in the property and core infrastructure sectors and in each case has resulted in boards coming under increased pressure to prove up asset values via disposals whilst the companies themselves have been on the end of predatory interest from activist shareholders and in many cases subject to corporate takeovers. Whilst reduced production and power price forecast might put the high dividend yields (c.10%) under some pressure in the short term, current share prices imply very attractive medium-term returns for investors prepared to take a long-term view. As a result, we added The Renewables Infrastructure Group, Bluefield Solar and Greencoat UK Wind to the portfolio at the end of March.

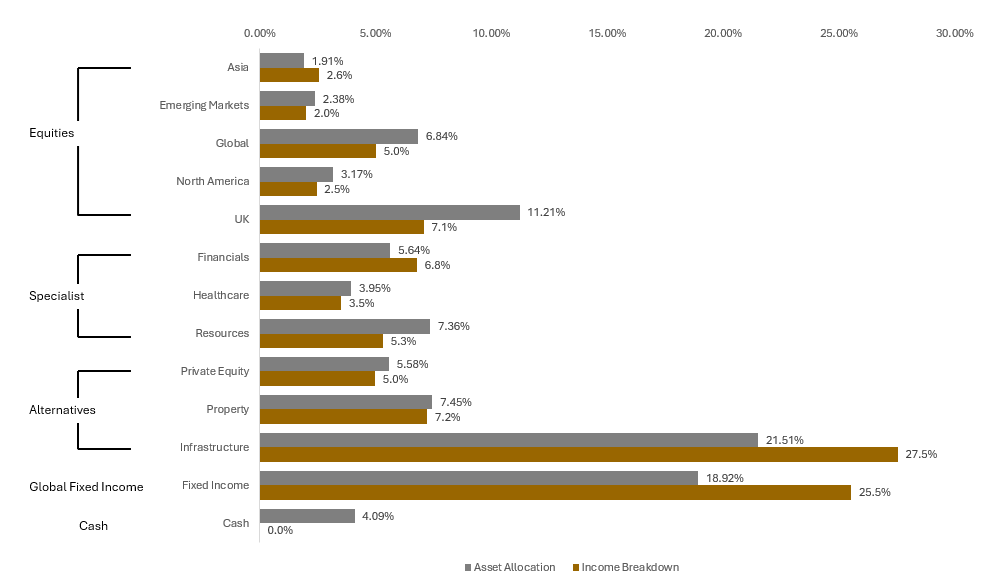

Asset Allocation & Income Breakdown

This chart shows the allocation of the holdings (asset allocation) and the income that is accrued by those assets.

Our property allocation has remained broadly steady over the period, however, we have been active in recycling out of those names subject to corporate takeovers (Urban Logistics, Care Reit and Empiric Student Property) and added both to Helical on weakness whilst initiating a new position in Workspace, a London focussed provider of flexible office space.

Our overall allocation to equities has reduced reflecting the strong performance we have seen from many of our managers in the period. Similar reductions were made in certain commodity, private equity and infrastructure funds that have performed well and where investment trust discounts have narrowed. As a result, Fidelity Special Values, Man Income, Paragon Banking Group, ICG Enterprise, Blackrock World Mining, Ecofin Global Utilities and Infrastructure and Pantheon Infrastructure were all reduced in the period.

At times of extreme market stress, however, it is important that we remain nimble and take advantage of opportunities as they arise. The sharp global decline in April provided one such opportunity and as a result we recycled out of lower risk holding, TwentyFour Strategic Income, into International Biotechnology Trust and the Odyssean Investment Trust, a UK focussed equity fund with a concentrated portfolio of mid-sized companies, where we felt the upside opportunity was compelling.

Overall, however, the direction of travel for the portfolio has been to reflect a greater degree of caution over the market outlook into the portfolio. As a result, we meaningfully increased our holding in the Premier Miton Strategic Monthly Bond fund. We also added to our holdings in HICL Infrastructure and International Public Partnerships, core infrastructure holdings where we believe attractive returns are less sensitive to future economic growth in the UK. Finally, our cash position ended the period at 4.1%, providing plenty of firepower in the event markets weaken in the coming months.

Outlook

Despite mounting pressures from US trade policy, relatively weak growth in China and persistent geopolitical uncertainty, investors continue to expect global economic growth to remain resilient for the remainder of this year and into 2026. Employment trends, although weakening, remain supportive for consumer demand, interest rates look set to come down further in the US and UK and government spending should underpin growth in the months ahead.

However, global equity markets sit meaningfully higher than they did at the start of the year when the extent of the disruption caused by the US tariff policy was not anticipated. Whilst the margin of safety for equity investors has, therefore, been eroded, there do remain areas where equity market valuations remain attractive. Conversely, the continued positive earnings momentum in US technology names and optimism around the deployment of AI have seen valuations for concentrated US equity indices once again look extended. The fund, however, maintains a regional preference for UK, European and Emerging Market based companies, particularly less favoured mid-sized and smaller companies, as well as towards managers with a strong valuation discipline in their investment process. We also continue to find attractive opportunities within specific sectors, such as financials and biotechnology.

When considering the outlook through the prism of our objective (to produce a high dividend yield that can grow in real terms over the medium term), we continue to find attractive opportunities to deliver on that objective across a broader set of asset classes than has been the case in recent years. The returns that our bond managers look set to deliver, without having to take on significant credit or duration risk (the risk of not being paid back and the risk to bondholders if interest rate expectations rise), remain attractive and a core component of the distribution of the fund. Wide investment trust discounts are accentuating what we believe are very attractive underlying returns from our core infrastructure and renewables holdings whilst our equity allocation is built on the foundation of low valuations that should help support growth in the fund’s distribution over time.

I would like to take this opportunity to thank our investors for their ongoing support. The whole Wise Funds team is at your disposal should you have any questions or would like to talk to us.

Philip Matthews

Fund Manager

Wise Funds Limited

September 2025

TO LEARN MORE ABOUT THIS FUND , PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.

This presentation is for Professional Clients only and not for re-distribution.

All data is sourced by Wise Funds and any third party data is detailed on the specific page.