For Professional Clients Only

Macro & Market Update

May was a strong month for global equities, continuing to illustrate investors’ relief at the pause in the global tariffs announced by President Trump in April. As is now expected by a president who likes to change the narrative at regular intervals, it was impossible to fully ignore the noise of often contradictory announcements coming from the White House, however. Growing impatient about the pace at which trade negotiations were taking place (due to the bottleneck of his making of more than 150 countries needing to agree deals with the US at once), Trump threatened tariffs to be “un-paused” in a matter of weeks rather than waiting until the beginning of July (90 days after the initial pause announcement). A specific threat of raising tariffs on EU products to 50% within a week was then made, before a friendly phone call between Trump and President of the European Commission, Ursula von der Leyen, a couple of days later unfroze the relationship again. At the end of the month, specific tariffs on steel imports were announced to double from 25% to 50%, making it particularly awkward for the UK who was the first country to agree a trade “deal” with the US with great fanfare, until it transpired that the deal was barely more than a set of promises from the US, without set dates or measurable benchmarks. As it stands, the UK is thus unsure when the agreement with the US to scrap tariffs on UK steel imports will start and whether it will be hit by the 50% tariff in June or not. The tension with China appeased mid-month when an agreement was reached between the two countries to lower tariffs for 90 days to, respectively, 30% from 145% on Chinese goods and 10% from 125% on US goods. At the end of the month, however, both countries were accusing the other of violating the terms of their agreement. Meanwhile, the US Court of International Trade ruled the sweeping tariffs illegal on the basis that Trump overstepped his presidential powers without approval from Congress. The case will now move to appeal.

While market participants are getting used to the US erratic approach to trade policy, leading to each headline having an increasingly marginal impact on prices, the uncertainty and fatigue it creates ought to affect corporate and political decisions around the world. More time is needed for this to be translated into the hard data such as GDP growth and inflation though, because, for now, every economic actor continues to play the system for as long as possible (e.g. by depleting high levels of inventories imported pre-tariffs, by delaying key investment decisions, by paying lip service to Trump in an attempt to play the clock, etc…). More traditional trade deals like the ones announced between the UK and India (the first of the post-Brexit era) and between the UK and the EU in May, while limited in scope and not without controversy, show that old fashioned political negotiations remain possible, however, and those shined a positive light on the UK on the global stage.

In other developments, bond market participants were more nervous than their equity counterparts about the “big, beautiful bill” Trump is hoping to get through Congress over the next few weeks. While a key commitment from his election campaign, the tax cuts in the bill threaten to add more than $3 trillions of debt over the next 10 years to levels that are already a source of concern as shown by the downgrade of the US credit rating by Moody’s, a rating agency. This is mainly backward-looking and the other two main rating agencies downgraded the US from the best possible rating years ago already, but this is yet another illustration of the malaise around the direction of travel for the US, even prompting the Secretary of the Treasury to publicly insist that the US will not default on its debt, an unimaginable scenario just a few months ago. The US central bank cited uncertainty from the government’s actions as the reason to leave its benchmark interest rate unchanged. The Bank of England announced a cut to 4.25% but also made it clear that the economic uncertainty means it is not on a pre-determined path.

Fund Performance

Wise Multi-Asset Growth

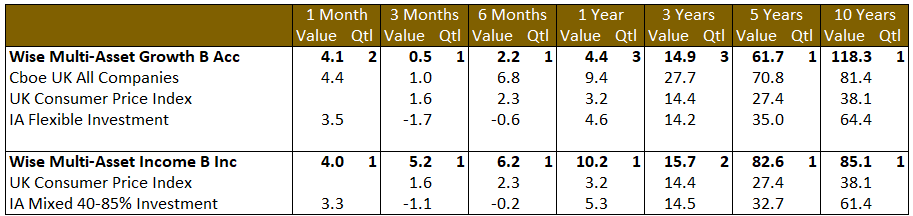

In May, the IFSL Wise Multi-Asset Growth Fund was up 4.1%, behind the CBOE UK All Companies Index (+4.4%) but ahead of its peer group, the IA Flexible Investment sector (+3.5%). As mentioned above, despite the macroeconomic uncertainty, equities generally performed strongly last month, helping our performance. Our UK managers, particularly those with a bias towards smaller companies such as Odyssean and Aberforth Smaller Companies performed strongly. Emerging markets managers benefitted from the détente between China and the US. This also helped commodities manager Blackrock World Mining. Meanwhile, our holdings in infrastructure were supported by better broad sentiment (bringing discounts tighter) and their defensive characteristics.

Our main detractors were in the biotechnology sector, hurt mainly by the attack from Trump during the month against the high price large pharmaceuticals charge US patients for their drugs. The companies our managers invest in tend to be at the niche, smaller end of the spectrum, very different from the large pharmaceutical companies targeted by Trump. They are thus driven by different factors, such as innovation, acquisitions and valuations, which should provide support to their share prices in the medium term. We were also hit by poor clinical trial results in one of our look-through companies.

Wise Multi-Asset Income

In May, the IFSL Wise Multi-Asset Income Fund rose 4.0% ahead of its peer group, the IA Mixed Investment 40-85% sector, which rose 3.3%. Global equity markets all saw a strong relief rally in May as the fog of uncertainty around trade tariffs appeared to clear somewhat. This was reflected across our global equity funds with notably strong performance coming from our UK focussed equity managers with a bias towards more domestic mid- and small-sized companies. We also saw strong performance from our direct equity holdings, Legal & General and Paragon. Middlefield Canadian Income was particularly strong as underlying strong performance at the net asset value (NAV) level was compounded by a narrowing of its discount. As a result of an activist shareholder attracted by the persistently wide discount, the board has offered investors the opportunity to exit their holding close to NAV or rollover into a new vehicle that should trade much closer to NAV. The thawing of relationships between the US and China also boosted our commodity holdings, Blackrock World Mining and Blackrock Energy & Resources. Property holding, Urban Logistics, received a formal offer from London Metric and performed strongly benefitting from solid full year results from London Metric themselves. The terms of the offer mean that the majority of our holding will be rolled into London Metric shares so it is encouraging to see them deliver continued strong operational performance. The only significant detractor to performance came from the International Biotechnology Trust as the Trump administration focusses on trying to reduce prescription drug pricing and personnel changes at the Food & Drug Administration, the pharmaceutical regulatory body, caused some concern around the economics of new drug development. Increased innovation, patent cliffs at large pharmaceutical companies and historically low valuations in the sector, however, provide a more supportive backdrop for the sector.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, we used intramonth volatility to top positions up on weakness. These included Odyssean in the UK (before its strong rebound mentioned earlier), Pershing Square in the US, and our basket of infrastructure trusts. These purchases were financed by taking some profits in Caledonia, Ecofin Global Utilities and Infrastructure, Fidelity Special Values and Lightman European.

Wise Multi-Asset Income

We initiated two new holdings in the month. Workspace is a property company focussed on flexible office space in central London. The company has suffered from a cyclical downturn as a number of tenants have vacated larger units in their estate. As a result, earnings have fallen, however, a covered yield of 7% appears to offer an attractive point into the company that should be well-placed to see its earnings recover over the next couple of years as these larger units are sub-divided and re-let at higher rents. We also added the Odyssean Investment Trust to the portfolio. The trust holds a concentrated portfolio of small companies where it believes there is an opportunity to unlock value through operational improvements and strategic focus. The trust has a skew towards high quality global, industrial companies which have experienced some cyclical weakness as well as a derating around tariffs. However, historically low valuations suggest now is an attractive entry point as many of the near-term headwinds appear to have already been discounted by investors. We funded these purchases by trimming holdings that have performed strongly, namely Ecofin Global Utilities & Infrastructure, Fidelity Special Values, Helical, Paragon and Urban Logistics.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds. The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.