For Professional Clients Only

Macro & Market Update

June was a grim month with all asset classes delivering negative returns as markets grew increasingly concerned that actions by central banks to tame inflation could tip the global economy into recession. Inflation data continued to rise at uncomfortably high levels during the month, increasing pressure on central banks to push on with interest rate rises. In the US, consumer prices rose at an annual rate of 8.6% whilst at the same time the economy added 390,000 jobs, more than economists had expected. On the back of the first half-point rate rise in 22 years, the Fed duly raised interest rates a further 0.75%, the largest single move since 1994. There are signs, however, that the cost-of-living crisis coupled with increased borrowing rates is now being felt by the consumer with data showing a marked drop in consumer confidence and May retail sales declining for the first time in five months. In the UK inflation edged up to 9.1%, although somewhat encouragingly for the first time in many months this was in line with expectations and longer-dated inflation expectations have now started to fall. As expected, the Bank of England increased interest rates by a further 0.25% despite the economy shrinking 0.3% in April. The headline unemployment rate also edged up to 3.8%, the first rise since late 2020, with some evidence that the labour market is becoming less tight and welcome news that thus far average earnings growth remains moderate. This should remove pressure on the Bank of England to increase the pace of interest rate rises. The ECB also surprised markets by signalling that it was likely to raise rates by half a percentage point in September, in addition to a planned quarter-point rise in July, aligning eurozone monetary policymakers with the US Federal Reserve and Bank of England. Whilst bond yields in the US, UK and Europe rose over the course of the month to reflect interest rate rises, it was noticeable that these peaked intra-month and have continued to fall into July, suggesting markets believe that inflation expectations have themselves peaked and that the global economy risks falling into recession, which will necessitate a reversal of the current policy in a couple of years’ time. In contrast Japan continues to adopt a policy of negative interest rates and China is embarking on a loosening rate cycle as it grapples with weaker economic growth than planned. During the month, China cut its required quarantine period for international travellers by half, to one week, in the first significant nationwide relaxation of restrictions since Covid-19 outbreaks in Shanghai and Beijing. The State Council also reduced a post-quarantine “home health monitoring” period to three days, from seven days previously.

Global equity markets were almost universally weak over the month, with US markets leading the way. US equities fell 8% in dollar terms, extending their fall over the first 6 months of the year to 20%, their largest first half drop in 50 years. US technology indices fared even worse and have fallen nearly 30% so far this year. These falls have only partially been mitigated by the strength of the US dollar, which has gained over 10% against sterling. Whilst UK, European and broader Emerging Market equities all fell, China was a notable exception as investors welcomed the news of relaxed zero Covid measures. Bond markets again provided limited protection for investors over the course of the month and continued their dreadful performance so far in 2022. Global bond markets have now fallen 14% this year (in US Dollars), although markets now appear to have priced in a considerable amount of bad news around inflation and yields look more attractive than they have done for some time. Commodity markets, having previously performed well, succumbed to the negative outlook for global economic growth as concerns over the outlook for demand trumped the hitherto positive supply backdrop arising from the Ukraine conflict that had supported commodity prices in the first few months of the year. Copper fell 14% over the month and the oil price edged 6% lower.

nds

Fund Performance

Wise Multi-Asset Income

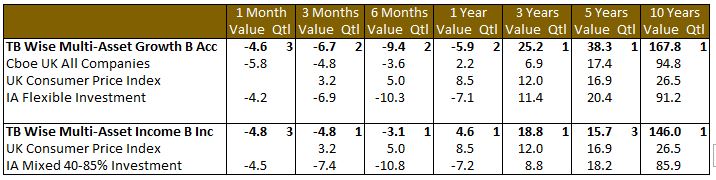

In June, the TB Wise Multi-Asset Income Fund fell 4.8%, behind the IA Mixed 40-85% Investment Sector which fell 4.5%. Year to date the fund has fallen 3.1% compared to 10.8% for the Sector. As markets faced up to the prospect of weaker global economic growth, it is unsurprising our equity funds and direct financial holdings were the weakest performers over the month. In certain cases, this performance was exacerbated by investment trust discounts widening. CC Japan Income & Growth, Middlefield Canadian Income, Aberforth Smaller Companies, Temple Bar, Polar Capital Global Financials, Provident Financial, Murray International, Legal & General and Man GLG Income all fell more than 6% in the month. Whereas year-to-date the weakest performance has been centred on the most expensive areas within global equity markets, it was noticeable in May that low valuations reflected in the holdings above, provided limited protection against a widespread equity market sell-off in June. The largest detractor to performance in the month came from our two commodity focussed funds, Blackrock World Mining and Blackrock Energy & Resources. Weaker net asset value performance was compounded by a sharp widening in the discounts of both trusts. On the more positive side, International Biotechnology Trust made strong positive gains. John Laing Environmental also gained over the month, affirming its defensive characteristics whilst Palace Capital responded well to its full year results and a strategic update.

Wise Multi-Asset Growth

In June, the TB wise Multi-Asset Growth fund was down 4.6%, ahead of the CBOE UK All Companies Index (-5.8%) but slightly behind the IA Flexible Investment sector (-4.2%). For the first half of the year, our fund is down 9.4%, behind the CBOE UK All Companies Index (-3.6%) but ahead of its peer group (-10.3%). Unlike in recent months when our equity value managers contributed positively to performance thanks to high margins of safety from low valuations and allocation to energy and mining, the weakness in those two sectors penalised them in June. As such, not only were the Blackrock World Mining Trust and the Jupiter Gold & Silver Fund two of our largest detractors, our value exposures also hurt across regions. Our largest individual detractor was Pantheon International Trust in the private equity sector. With no new news, its discount widened from 32% to 45%. Due to lagged valuations, the private equity sector is rightly expected to see downgrades in Net Asset Values over the coming months. That said, we take some comfort in the fact that our managers are investing in a diversified set of quality companies, with time on their hands and via trusts with strong balance sheets, meaning that financing issues won’t force them to realise losses. We thus think that the current discount of 45% in Pantheon offers a sufficient margin of safety. Being listed in the UK mid-cap index, the trust also currently suffers from forced and passive sellers in that part of the market. We think this wholesale liquidation should eventually create opportunities for the patient investor.

On the positive front, it is pleasing to see that one of big contrarian bets this year is showing early signs of paying off. We have gradually increased our position in the Biotechnology sector to 4.6% since the start of the year and both of our holdings in that space (International Biotechnology Trust and Worldwide Healthcare Trust) delivered positive returns in what was a very challenging month. Hopefully, this is the start of our investment thesis coming to fruition. Another strong performer which also delivered positive returns was the Fidelity China Special Situations Trust helped by the regain in optimism towards China.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Income

Trading activity has been relatively limited against an uncertain economic backdrop that warrants caution. We supported a capital raise in Randall & Quilter and initiated a holding in TR Property, a fund which provides exposure to European Property markets at attractive levels that we have invested in previously. We exited our holding in Princess Private Equity, where the discount looks anomalously narrow in a wider sector context and trimmed our holdings in Middlefield Canadian Income and Murray International, which have been strong performers for the fund so far this year.

Wise Multi-Asset Growth

We initiated two new positions in June. The first one was in TR Property Trust which we have owned in the past. We think the portfolio is looking particularly attractive currently having reversed about half of the gains made post-Covid and we like the very sensibly managed portfolio of diversified European property exposure. We also initiated a new position in the Vontobel TwentyFour Strategic Income Fund, which allows us to start building a position in the global fixed income markets (government and corporate bonds) at levels we think are starting to look the most attractive in years. Finally, without much surprise given earlier comments, we topped up our position in the Pantheon International Trust.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.