For Professional Clients Only

Macro & Market Update

In many respects, July saw a continuation of the macro-economic themes that have driven financial markets since the start of the year. Inflation and the cost-of-living crisis stayed firmly at the top of investors’ concerns and showed no signs of abating. On both sides of the Atlantic, inflation surprised yet again on the upside, at 9.1% in the US and 9.4% in the UK. Even in the Eurozone where inflation is usually tamer than in its Anglo-Saxon counterparts, the year-on-year change is flirting with 9% with energy costs in the region more affected by the war in Ukraine than anywhere else. Like in previous months, inflationary pressures led to central banks to slam hard on the brake pedal, with another 0.75% hike in the US, 0.25% in the UK and a surprise 0.50% increase in the EU (the first one in 11 years!).

What is changing, however, is the market perception of growth. The IMF (International Monetary Fund) downgraded its growth forecasts materially for 2022 in July, citing a “gloomy and more uncertain” global backdrop, with concerns about the ongoing war in Ukraine, the Chinese zero-Covid policy and signs of weakness from consumer spending. The deteriorating growth outlook weighed heavily on sentiment with surveys of consumers, businesses and investors all showing a material drop in expectations. Paradoxically, this negativity was the launch platform for a strong rebound in financial markets, led by the US (+9.2% in US Dollar terms) and, in particular, by the technology sector (the Nasdaq index of leading US technology names was up 12.4% in July).

After 6 gruelling months for markets, investors were in the summer mood to buy the bad news. Historically, some of the best returns are made on a contrarian basis, when the news is bad, sentiment is bleak and investors capitulate. The first two of those conditions are undeniably met at present. A lot of bad news is known and priced in already. Inflation risks are understood and poor GDP growth should force central banks to slow or halt the hiking cycle. From a sentiment standpoint, as mentioned, surveys are negative but we would note that earnings downgrades have been minimal so far, suggesting there could be room for further disappointment in the upcoming earnings reports. Finally, despite reporting feeling gloomy about returns from here, capital flows data don’t yet suggest we have seen a capitulation from investors. There have definitely been some heavy selling and reduction of risk but aggregate analysis of positioning indicates that many investors have stayed put so far and maintain high allocations to the riskiest assets. The strong rebound in asset prices, across equities, commodities and bonds, observed in July might very well mark the end of the difficult period experienced since the start of the year. Bad news and downbeat sentiment are usually strong indicators that we are getting close to the bottom. We remain prudent, however, and would like to see a proper capitulation with investors cashing out instead of only thinking of doing so, before calling the bottom with confidence. Meanwhile, our approach continues to prudently add to oversold positions and quality cheap assets, while maintaining diversification because volatility is here to stay.

nds

Fund Performance

Wise Multi-Asset Growth

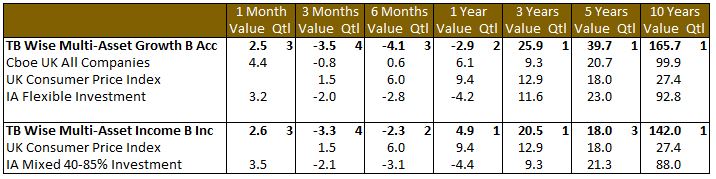

In July, the TB Wise Multi-Asset Growth fund was up 2.5%, behind both the CBOE UK All Companies Index (+4.4%) and the IA Flexible Investment sector (+3.2%). While our Fund didn’t benefit from the strong performance of large defensive UK equities which rebounded last month and helped the CBOE UK All Companies Index (those still seem too expensive to us), the improved risk appetite generally supported investment trusts’ discounts tightening. As an illustration, Caledonia Investments’ discount moved from 30% at the start of the month to 22% at the end. Our strongest contributor was Oakley Capital Investments, in the private equity sector. We have argued for a while that the discounts on display in the listed private equity sector offer a very substantial buffer for future potential Net Asset Values downgrades. Last month, Oakley not only proved that fact right, but also disproved any concerns over its portfolio’s ability to continue growing. Whilst reporting 11% NAV growth in the second quarter (+17% year-to-date), the company also reported three realisations at strong premiums to carrying value showing that its holdings are delivering operationally, are conservatively valued and in high demand.

On the negative side, Fidelity China Special Situations and Lightman European detracted marginally.

Wise Multi-Asset Income

In July, the TB Wise Multi-Asset Income Fund rose 2.6%, behind the IA 40-85% Mixed Investment Sector which rose 3.5%. Our property holdings were the strongest contributors to returns in the month. Ediston Property Investment Trust announced an increase in its net asset value (NAV) of 2.4% over the quarter, its fifth consecutive quarter of NAV growth, whilst also announcing the disposal of its last non-core property at a 67% premium to its March valuation. Palace Capital announced an updated strategy that will look to sell the property assets and to realise the 30% undervaluation of the shares compared to its latest NAV. We have actively engaged with the board of the company to drive through these changes. Our direct holdings in the financial sector also performed well on the back of positive trading updates that were at odds with their depressed valuations. Paragon reported continued momentum in lending volumes, improved margins and an exemplary credit performance whilst Legal & General announced performance in line with expectations, with cash and capital generation slightly ahead of target. Our equity funds performed well in line with the strength of global equity markets with notably strong performance from Aberforth Smaller Companies, Schroder UK Mid Cap, Middlefield Canadian and Man GLG Income. Blackrock World Mining and Blackrock Energy & Resources rebounded from significant weakness in the prior month whilst also benefitting from a narrowing of their discounts to NAV. This was a feature of a number of the trusts held in the portfolio and is to be expected given the improved investor optimism and the historically wide discounts at which most of the fund traded.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

As mentioned above, we think it is too early to confidently call the market bottom but we remain keen to take advantage of the attractive opportunities recent volatility has thrown at us. As such, we had a relatively active month adding to recent underperformers such as Fidelity China Special Situations, Mobius Investment Trust, Blackrock Frontiers, Pantheon International and Herald Investment Trust. The additions to Asia and emerging markets were partly financed by exiting Aberdeen Asia Focus and trimming Fidelity Asian Values. In the UK, we switched some of our exposure from Polar UK Value Opportunities into Fidelity Special Values, two funds with some overlap but the latter trading at 7% discount. In order to maintain diversification and as the market focus shifts from inflation to growth, we also added to Jupiter Gold & Silver which could benefit from central banks’ inability to increase rates much further, while miners’ valuations remain attractive.

Finally, we added a new position in VPC Specialty Lending Investments, a £225m trust lending capital predominantly to non-bank lenders. This strategy is part of a much large $7bn firm specialised in such lending and its appeal is that all the loans it provides are senior and fully asset-backed, with VPC having a full claim on cash-flow generating assets in case of defaults (of which they have only had 3 since 2007 and in each case have recovered all of their capital). The loans are structured in such a way that VPC are in the driving seat, dictating terms and lending money in stages only when objectives are delivered, limiting the risk and the duration of the debt. We were impressed by the level of due diligence and ongoing monitoring performed on the collaterals used against the loans. Each loan has a floating rate, offering a particular appeal in an inflationary environment. The trust trades on a wide 27% discount and currently offers a covered yield of more than 10%. While not without risk, we think the upside more than outweighs the downside risk with this trust.

Wise Multi-Asset Income

During the month changes to the portfolio were relatively limited. We remain cautious over the outlook given the limited extent to which the deteriorating macro backdrop has been captured in earnings expectations and lack of evidence that investor sentiment shows signs of capitulation. Valuation dispersion within the market remains wide so we continue to actively favour those equities where valuations look attractive in a historical context. Within our property allocation we exited New River Reit whilst increasing our holding in Empiric, a provider of student accommodation where current trading looks strong and suggests a return to pre-Covid levels of profitability. We switched part of our holding in Standard Chartered into Polar Capital Global Financials, which traded at a similar discount to the lows of 2020. Finally, we made a small switch between Blackrock World Mining and Blackrock Energy & Resources, which is less exposed to Chinese economic growth, benefits from exposure to tight energy markets and energy transition as well as trades on significantly wider discount to net asset value.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.