For Professional Clients Only

Macro & Market Update

Financial markets continued to be challenging in May with the sharp weakness that has shaken prices since the start of the year persisting until the final week of the month. We described in April how growth sectors and, particularly technology companies, have borne the brunt of those falls year-to-date. While this continued in May, retail companies were also sold aggressively as profit warnings from US bellwethers such as Walmart and Target highlighted how inflation and supply chain issues are starting to bite into earnings. Some companies are finding it increasingly difficult to pass on cost inflation to their consumers who are feeling the cost-of-living squeeze despite a strong employment market. This is happening at a time when, due to ongoing supply chains disruptions, companies feel obliged to increase their inventories to satisfy potential demand. The combination of higher levels of stocks and lower demand due to increased costs does not make a happy recipe and this weighed on investor sentiment.

Market participants like to focus on milestones and, even if those can be arbitrary, they are worth mentioning because of their impact on the collective psyche. In May, the S&P500, the index of large companies commonly used to track US equities, entered a bear market. This is the expression used to describe a fall of 20% or more from the previous peak (the opposite of which being a bull market, describing a bounce of at least 20% from the previous trough). Last month, the index registered a 20% fall since its all-time-high at the start of the year, recalling bad memories from previous bear markets, such as the Covid crash of 2020, the Great Financial Crisis of 2007-09, the Tech bubble burst of 2000-02, etc… None of those experiences were pleasant ones but it is worth highlighting that each one of those bear markets had their own drivers and peculiarities. While we are not attempting to predict the future, the current environment certainly is unusual. The world is seeing high inflation taking hold caused by the conjunction of supply shocks (Covid, invasion of Ukraine), a strong economic rebound and years of extremely accommodative financial conditions. While fighting inflation is now the first priority for central banks whose actions, in turn, risk triggering a recession, we are entering a very atypical scenario which could see negative real GDP growth (growth stripped out of inflation) but positive nominal GDP growth (growth including inflation). Such an environment, while tricky to navigate, should allow some companies to grow their earnings and thus present attractive investment opportunities. This is a very different situation from, say, the 2007-09 Great Financial Crisis when huge levels of debt had to be unwound, unemployment was rising and consumers did not have spare cash to spend. What we do know is that bear markets are always uncomfortable and tend to be volatile with numerous false rebounds, thus necessitating caution and diversification, but we are optimistic that current markets present attractive opportunities for active managers like ourselves.

Data-wise, the US central bank hiked rates by 0.50% as expected but ruled out a 0.75% increase in upcoming meetings, which was taken favourably by the market. Conversely, the Bank of England only hiked by 0.25% but proved gloomier in its economic forecasts. In Europe, interest rates hikes are being planned for the summer. Across all three regions, these are necessary to tame inflation which stayed high in May, although showing early signs of peaking in the US, while growth data was mixed. In this context, global equities were volatile as described earlier but the rebound later in the month left them, on the whole, in mildly positive territory. Commodities markets remained well supported and bond markets recovered some of their recent losses.

nds

Fund Performance

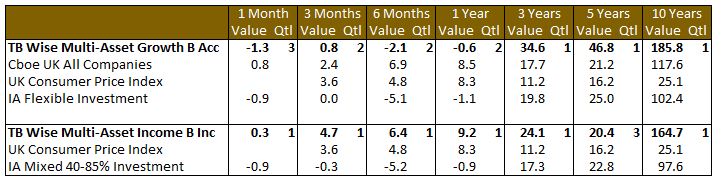

Wise Multi-Asset Growth

In May, the TB Wise Multi-Asset Growth fund was down 1.3%, behind the CBOE UK All Companies Index (+0.8%) and the IA Flexible Investment sector (-0.9%). Given the current macroeconomic uncertainty and the high degree of volatility, a number of our investment trusts saw their discounts widening. This typically happens when investors are keen to take their money out without much buying interest from other parties. Those movements can be frustrating, particularly when the underlying portfolios are performing well, but they tend to be short-lived and can present buying opportunities. Two of our largest negative contributors were in that category, Oakley Capital Investments and Mobius Investment Trust. The former saw its discount widen by close to 10% in the month despite strong results reported in April and robustness in its portfolio. The Mobius Investment Trust’s discount widened by ca 4% in the month as investors worry about emerging markets and the trust’s exposure to technology. We think those fears are unsubstantiated given the idiosyncratic themes driving the companies in the portfolio.

On the positive side, our value managers generally performed well, across regions. At the individual fund level, Caledonia Investments was a strong contributor following the release of its annual results. The strong performance of its portfolio was already broadly known (+27.9% NAV total return for the year), but the announcement of a special dividend equivalent to close to 5% was particularly welcome. It would appear that this helped put the trust on investors’ radar and helped narrow the trust’s discount in May.

Wise Multi-Asset Income

In May, the TB Wise Multi-Asset Income Fund rose 0.3%, ahead of the IA 40-85% Investment Sector which fell 0.9%. Our equity funds performed well over the month given the value-bias within their process. Murray International, Schroder Global Equity, CC Japan Income and Growth, Temple Bar and Man GLG Income all performed strongly. By contrast, weakness at Aberdeen Asian Income and Middlefield Canadian was predominantly driven by discounts widening which we would expect to reverse over time. A similar issue affected our private equity holdings, BMO Private Equity and Princess Private Equity, as investor concerns towards growth stocks have risen. Whilst these trusts are exposed towards more highly rated technology sectors, we believe valuations have not been inflated to the same extent as the broader quoted technology index and the 20-30% discounts to net asset values provide a further cushion. Within our growth-exposed names, we were encouraged to see Mergers & Acquisitions activity emerge in the biotech sector following its recent weakness with International Biotech receiving a bid for migraine drugmaker, Biohaven, at a 79% premium to its last closing price from Pfizer. Our holdings with direct exposure to the oil price and indirect exposure via the power price performed strongly in spite of negative news around windfall taxes. Blackrock Energy and Resources performed notably well as did John Laing Environmental, which announced a 15% increase in its net asset value in the first quarter of the year. Our property holdings also delivered positive trading updates in the month, as investor demand for industrial property and retail parks lifted the net asset values at Standard Life Investment Property and Ediston Property. In addition, Empiric Student Property provided an encouraging update showing the recovery from Covid is gathering pace. With 2/3rds of the booking cycle for the upcoming academic year now passed, revenue occupancy of its rooms is running 6% ahead of the last pre-Covid academic year. On the negative side, Randall and Quilter fell 38% as investors blocked the takeover of the company at a price 85% higher than the closing price at the end of the month. The company reiterated both the need to raise capital as well as extremely strong trading in its programme management business.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, we initiated a new position in the Fidelity Special Values trust. We have known the manager for years and have patiently been waiting for an opportunity to take a position. The discount on the trust is usually tightly managed but, despite strong absolute and relative performance, the trust was heavily sold last month sending the discount as wide as during the Covid crisis. The manager is a pragmatic value manager who has demonstrated an ability to perform in different environments so we took the chance to initiate a position at an attractive price. We funded the position by taking some profit in JO Hambro UK Equity Income, Schroder Global Recovery and Ecofin Global Utilities and Infrastructure.

Wise Multi-Asset Income

During the month we added to our holding in Empiric Student property on weakness and took profits on several of our infrastructure holdings, which have performed strongly year to date as well as Impact Healthcare REIT where the market has been attracted to its defensive, long-term inflation linked revenue stream.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.