28th February 2022

Market Background

The past year was an eventful one that saw global economies emerge from the Covid pandemic before facing a shock of a different kind with the first non-provoked invasion of a sovereign state in Europe since WWII. First of all, after numerous failed attempts following the emergence of increasingly transmissible Covid variants, the vast majority of the world ended the period with broadly reopened economies. It took the high efficacy of vaccines, the success of rollout programs started at the end of 2020, and some luck (both that vaccines stayed effective against new variants and that these variants did not prove more deadly), but as we approach Spring, lockdowns and restrictive measures appear behind us. China remains the exception, however, having pursued a zero-Covid strategy since the start of the pandemic which has led to lower immunity levels than elsewhere and raises questions about the country’s ability to reopen its economy. Even for the rest of the world, there is certainly no place for complacency as a lot of work remains to be done to vaccinate emerging countries and because the virus has shown an incredible ability to throw curveballs. Although the hope is that the current prevalent strategy of learning to live with the virus will prove successful, one cannot assume that we are completely out of the woods just yet.

As we moved towards a post-Covid environment, global economies continued to rebound strongly but started to show some loss of momentum from the second half of 2021. More importantly for market participants, economic data stopped surprising on the upside after the summer, a combination of a gradual return towards normality and of forecasters needing to revise their expectations down. At least as critical as growth, the main focus for the period was on inflation with data in the US and the UK at their highest in at least three decades. While initially relatively contained, inflation broadened quickly to a large amount of goods and services, although still had to take hold in wages by the end of the period. Wage inflation and a durable uplift in inflation expectations would move inflation from a transitory phenomenon driven by the Covid shock to a more permanent one. In that context, central banks are firmly in the spotlight, having to manage the difficult balancing act of preventing inflation from taking hold without squashing the economic recovery. Before the invasion of Ukraine by Russia in February 2022, market expectations were that interest rates would need to be raised relatively aggressively over the next few months to contain inflationary pressures.

At the end of the reported period, President Putin of Russia decided to launch an invasion of Ukraine, taking most observers by surprise. At the time of writing, it seems impossible to predict whether the conflict will be quick or prolonged. Putin certainly hadn’t planned on the level of tenacity and resistance that the Ukrainian people are showing in the early days of this attack. As surprising, has been the swiftness with which Europeans and Americans have agreed a united front against Russia and the magnitude of the measures they have taken so far. While sanctions against key political individuals and oligarchs are common, the US, EU and UK appear determined to respond to Russia’s aggression with an economic war, taking unprecedented measures to sanction the Russian central bank and payment systems, in effect, cutting the country off financially. So far, however, those sanctions haven’t applied to the European oil and gas markets, critical for the region which import around 35% of its gas from Russia. For now, supplies haven’t been interrupted since they represent a major source of capital for Russia but, with Putin increasingly backed into a corner, it remains possible that he would decide to turn those taps off. From a global economic standpoint, this conflict will add to inflationary pressures, mainly through the energy market but also through other commodities and food, at a time when they were already coming through strongly as discussed above. Depending on the severity and the length of the war, global growth, particularly in Europe, could also be impacted, pushing world economy into stagflation (high inflation and low-to-no growth) and, possibly, recession. While in the grand scheme of things, few global companies have meaningful operations in Russia or Ukraine, higher inflation and geopolitical uncertainty could put investment decisions on hold, while consumer demand should be affected by higher bills, in effect putting a brake on the recovery. Given their well-telegraphed intent to raise rates, we wouldn’t expect central banks to change course though, unless the impact of the conflict on economic growth proves significant. The most likely outcome suggests that, whilst the pace of rates rises might moderate, investors, for the time being at least, will have to adjust to being weaned off the historic support of low monetary policy.

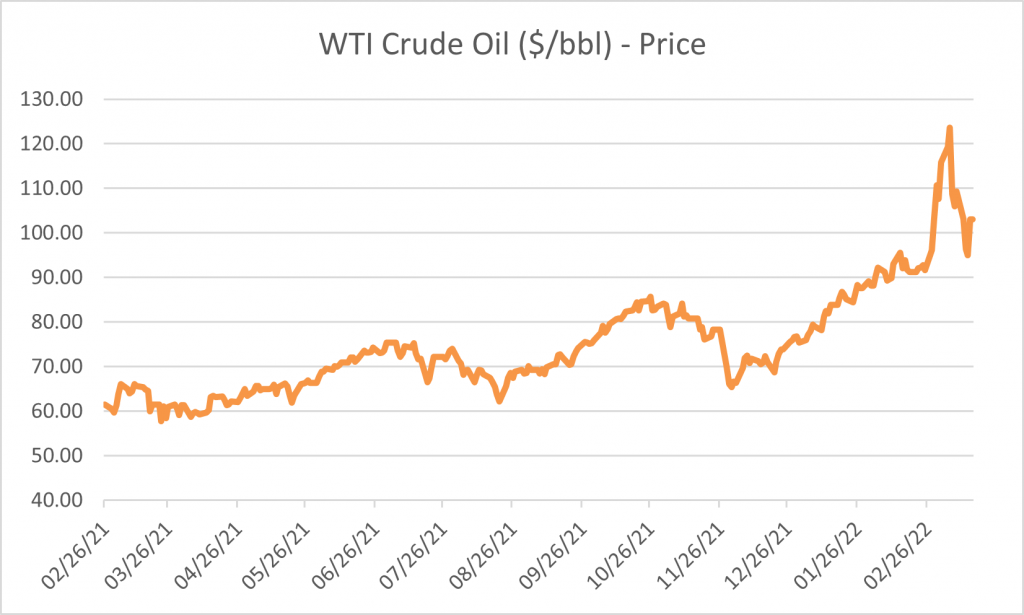

In the fluid context above, the standout performer were commodities, particularly energy with oil jumping from ~$60 a barrel to $95 over the year (and reaching $130 a barrel in the first week of March 2022). Even before the In the fluid context above, the standout performer were commodities, particularly energy with oil jumping from ~$60 a barrel to $95 over the year (and reaching $130 a barrel in the first week of March 2022). Even before the Ukraine invasion, it is worth remembering that oil supply was constrained by years of underinvestment as pushes have been made to transition away from fossil fuel. While this transition is necessary and welcome, there aren’t yet any established enough alternatives of the scale required to replace oil immediately, making fossil fuel a necessary evil for years to come. The conflict in Ukraine and the fear of disruptions from Russian supplies have brought this phenomenon even more in focus. Other commodities, such as metals and grains, also performed strongly, there again, driven by the rebound-led rise in demand, supply chains constraints post-Covid and, late in the period, the Russia/Ukraine conflict.

Elsewhere, bonds struggled, as broadly expected, given the rise in inflation and the prospect of rate rises from central banks. It was also notable that, in the risk-off environment of the later stage of the period, those inflation dynamics prevented bonds from playing their usual role as a way to protect portfolios on the downside.

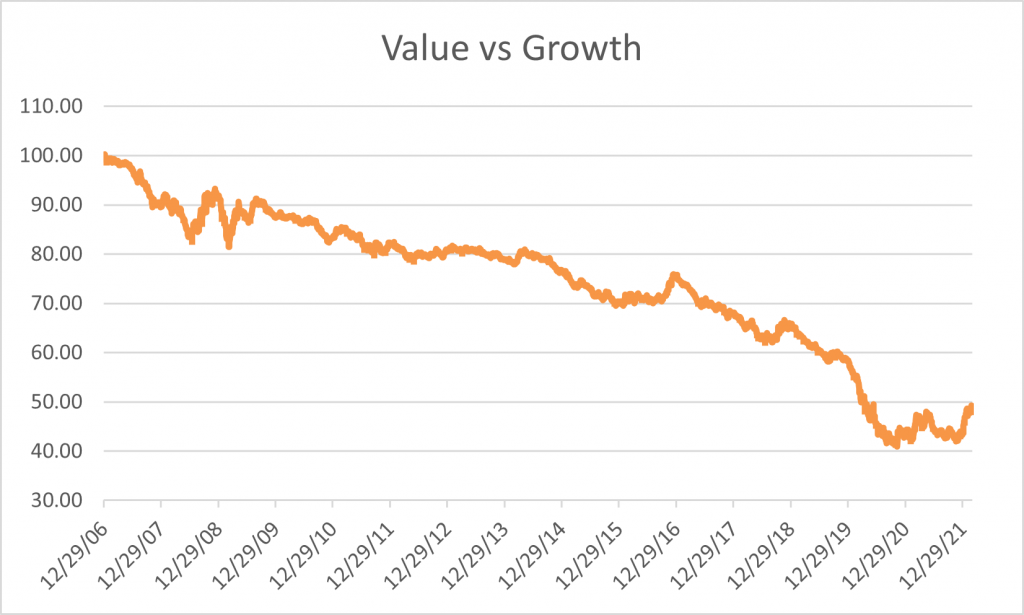

MSCI AC World IMI Value – Price Relative to MSCI AC World IMI Growth

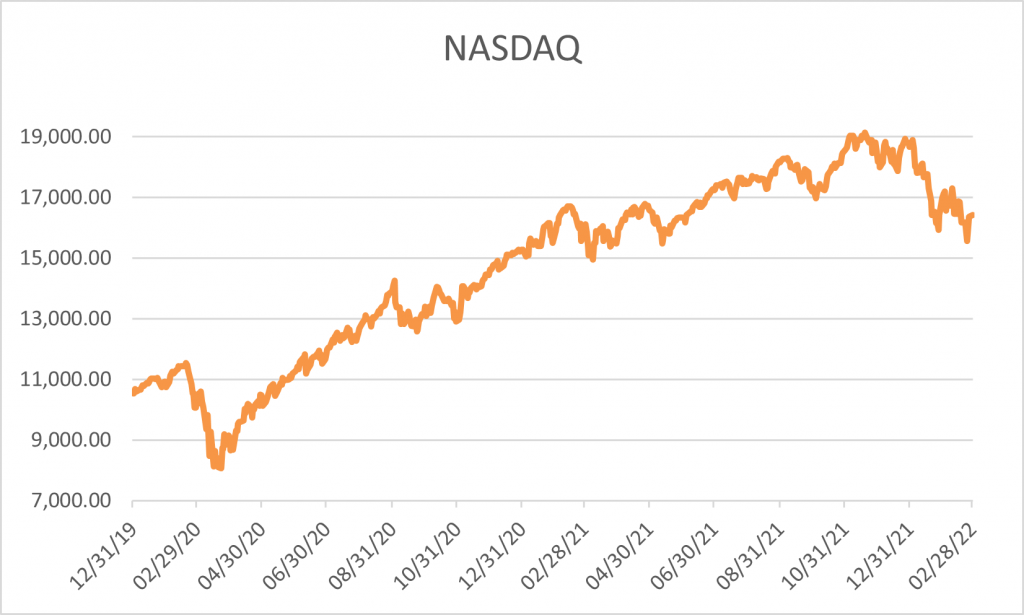

Finally, interesting dynamics were at play in equity markets too, particularly in the Value vs Growth thematic battle we have been discussing for years. As the economic recovery showed signs of peaking in the second half of 2021, investors returned to technology as a way of sheltering portfolios from the vagaries of the recovery. However, Value stocks staged a strong rebound late in 2021 when it became increasingly clear that inflationary pressures became more engrained and that central banks were resolved not to let them get out of hand. All else being equal, higher interest rates penalise Growth stocks by increasing the rate at which future cash flows are discounted. The further in time those cash flows are expected, the lower their present value when discounted with higher rates. By comparison, Value stocks, which are cheap relative to their current assets as opposed to their future growth prospects look increasingly attractive. In that context, a sharp rotation took place out of -mainly- technology sectors and into Value ones such as financials, energy, retail or consumer discretionary. The Nasdaq index (the bellwether benchmark of US technology stocks) thus dropped about 20% between November 2021 and February 2022. It is worth noting though that, despite this sharp drop, the index remains at more than double where it was trading in March 2020.

NASDAQ Composite (TR)

When it comes to Value, while cyclical sectors such as financials, retail or consumer discretionary gave some of their gains back in the uncertainty of the war, energy and commodities still helped the style. Those stylistic themes help to understand why UK equities managed to perform on par with US equities over the year. The US market is heavily skewed towards Growth sectors (about a third of the index is in technology vs less than 3% in the UK). Meanwhile, the UK is skewed towards Value with about 40% of in the index in financials, energy and materials (vs about 15% in the US). Over the recent months, what has caused the stark underperformance of the UK market relative to the US (more than 40% of relative underperformance over the past 10 years), turned into an advantage. Elsewhere, without much surprise, emerging markets struggled, hurt not only by the Ukrainian conflict towards the end of the period but also by China’s poor performance in 2021 as the government embarked on a regulatory crackdown in the technology and education sectors, and concerns about the exit from its zero-Covid policy. That said, those reforms now seem implemented and the government is showing a willingness to focus on stability and growth once again, with easing policies in contrast to tightening ones elsewhere, which may suggest that the outlook is due to improve in the country.

Performance

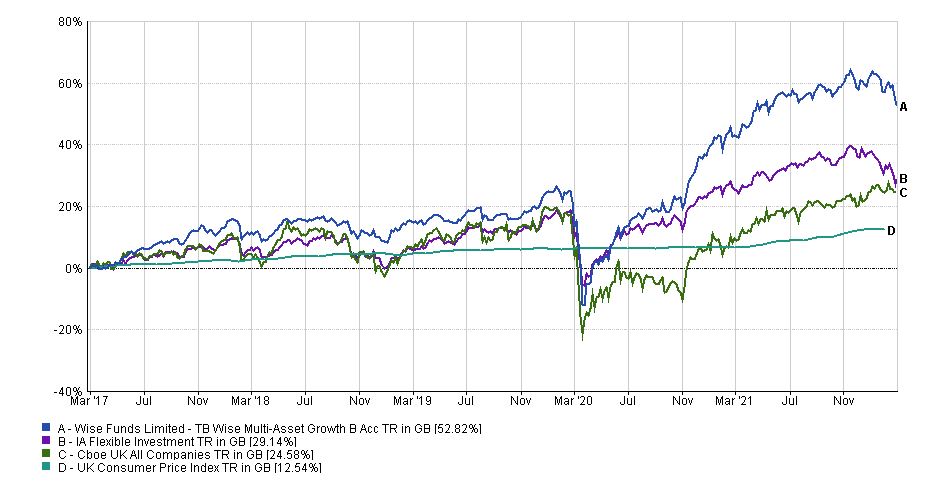

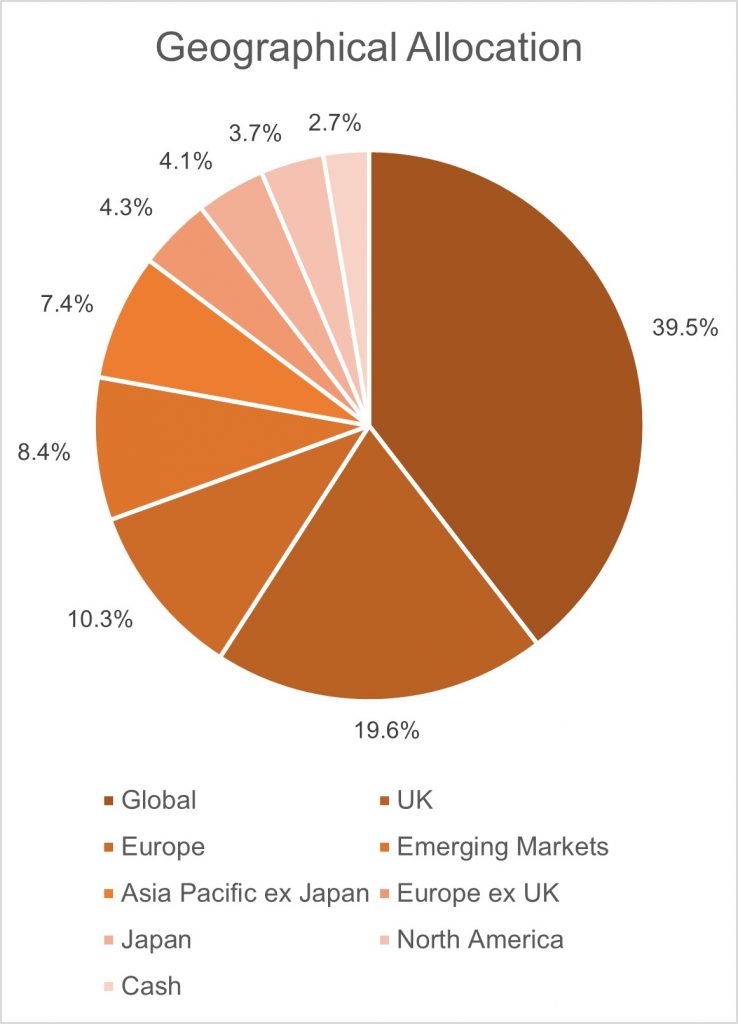

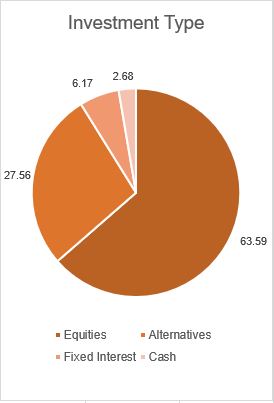

Looking at our performance for the year ending in February 2022, the TB Wise Multi-Asset Growth fund was up 7.5%, behind the CBOE UK All Companies (+16.7%) but ahead of the UK Consumer Price Index (+5.3%). It also beat its peer group, the IA Flexible Investment (+3.7%) to finish in the top quartile of its sector. Over the 5-year horizon defined in our objectives, the Fund delivered 52.8%, comfortably ahead of the CBOE UK All Companies (+24.6%), the UK Consumer Price Index (+12.5%) and the IA Flexible Investment (+29.1%). Over that period, the Fund is in the top 10% of funds in its sector.

For more fund performance, please see the latest factsheet

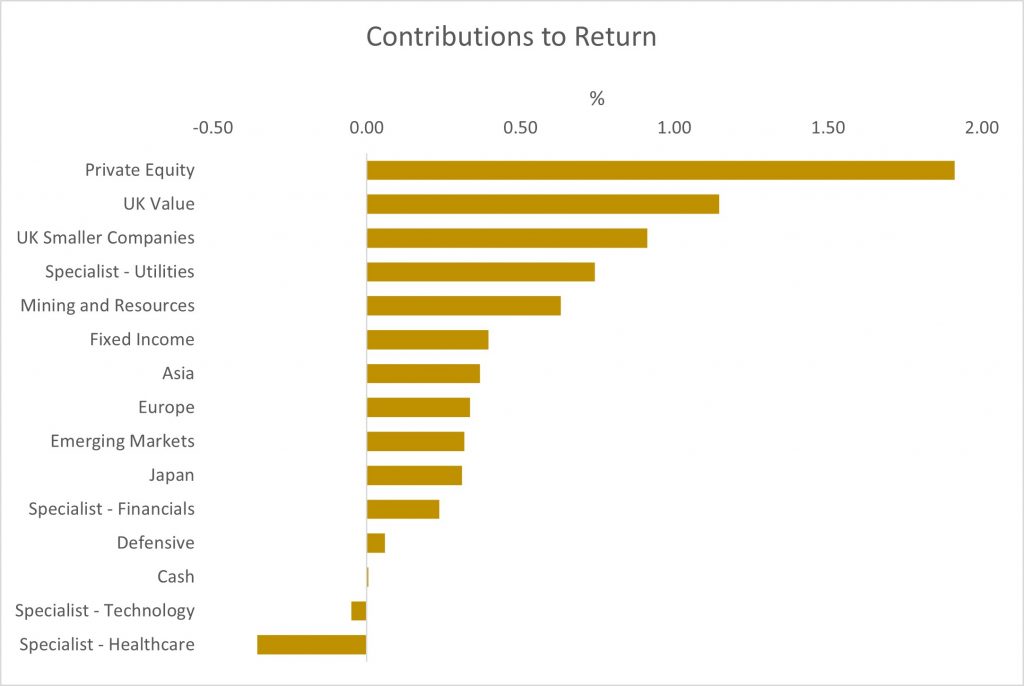

In what proved a tricky year to navigate, with oscillations between optimism and fear which translated in big In what proved a tricky year to navigate, with oscillations between optimism and fear which translated in big gyrations in top/bottom performers throughout the year, our list of top contributors to performance is relatively diverse and, to a large extent, driven mainly by idiosyncratic factors such as the quality of management and realisation of latent value, than broad market movements.

A first category of contributors came from our private equity investments, namely Caledonia Investments, Oakley Capital Investments and Pantheon International. We have been attracted to the private equity model for years, particularly the ability it gives managers to access opportunities only available in private markets, to take an active rA first category of contributors came from our private equity investments, namely Caledonia Investments, Oakley Capital Investments and Pantheon International. We have been attracted to the private equity model for years, particularly the ability it gives managers to access opportunities only available in private markets, to take an active role in growing those companies and to be able to do so for the long-term, away from the pressure of frequent public market reporting. We have focused our investments on quality trusts looking particularly appealing from a discount standpoint and, since the Covid crisis, have been attracted by the lagged reporting from private equity, meaning that the strong rebound observable in public markets took a while to be reported in the private equity trusts’ NAV, offering attractive entry points. All three of our managers reported strong earnings growth over the period, took advantage of an attractive realisation market and remained disciplined with their new investments. That said, despite returns of between 25% and 36% over the period, discounts on those trusts ended at levels similar to where they started the year. We thus think that they continue to offer value.

Our investors with an activist streak were also strong contributors to performance. We tend to like managers who are able to deliver Our investors with an activist streak were also strong contributors to performance. We tend to like managers who are able to deliver performance irrespective of their underlying markets. Those managers will often focus on smaller companies where they can take large enough positions to influence management. This was the case of both Mobius Investment Trust in emerging markets and Odyssean Investment Trust in UK equities. Those two trusts delivered strong NAV returns but also saw a tightening of their discounts highlighting how good performance can be amplified in investment trusts when acknowledged by the market. The lack of correlation between those idiosyncratic managers and their respective markets is well illustrated by the performance of Mobius Investment Trust which delivered a performance of 26% while the broader emerging markets index was down 8% in US Dollar terms.

Finally, our allocation to BlackRock World Mining Trust also proved beneficial, particularly in the second half of the period when inflation concerns became increasingly anchored and investors realised that mining equities offer a natural hedge against rising commodity prices while being strongly cash generative and attractively valued. There again, the trust not only benefitted from strong NAV growth but also from a tightening of its discount.

Our biggest detractors were found in two categories, emerging markets, both Templeton Emerging Markets Investment Trust and Fidelity China Special Situations had a difficult time given, initially, their large exposure to China and, in particular, to the technology sector which saw a regulatory crackdown by the Chinese government, followed by the negative sentiment in emerging markets post the invasion of Ukraine. Our biggest detractors were found in two categories, emerging markets and biotechnology. Starting with emerging markets, both Templeton Emerging Markets Investment Trust and Fidelity China Special Situations had a difficult time given, initially, their large exposure to China and, in particular, to the technology sector which saw a regulatory crackdown by the Chinese government, followed by the negative sentiment in emerging markets post the invasion of Ukraine. When it comes to China, we see the government’s tightening of regulations as part of a transition phase that will, eventually, present attractive investment opportunities. There are big question marks over how the economy will exit the government’s strict Covid restrictions, however, we take comfort from the fact that it is now the only country where monetary policy is easing as opposed to tightening. With regards to Russia/Ukraine, like for the rest of our holdings, the exposure of the Templeton Emerging Markets Trust to the region was small going into the crisis (~6%) and has now been written down. It thus doesn’t represent a direct risk anymore, although sentiment for emerging markets equities is likely to remain volatile until a resolution to the conflict is found.

International Biotechnology Trust was another large detractor to performance with the trust hit by the double-whammy of falling NAV and widening of its discount. The performance was hit particularly badly in the first quarter of 2021 and January 2022 during rotations out of Growth sectors we described in the Market Background section. While we understand the desire by investors to move away from Growth areas in a rising rate environment, the performance of the biotechnology sector is still somewhat puzzling to us. The sector was one of the big winners of the pandemic, having been catapulted to the forefront of the news cycle with companies such as Moderna proving instrumental in developing successful vaccines in record time and showcasing the benefits of new technology. If there was a need for a case study of the benefits that the sector can bring to society, this was it. However, the sector might have been victim of its own success, having attracted many generalist investors to the sector who were prompt to sell once they became more comfortable with cyclical parts of the market again. That said, it appears extreme that the sector saw its longest and largest drawdown in its history last year, underperforming the broad US equity market by more than 60%. Since 2015, the Biotechnology index is now flat, which is astonishing for such a dynamic sector, benefitting from the structural growth drivers of an ageing of population and the fast development of new technologies, coupled with appealing valuations. As an illustration of the latter point, there is currently 16% of the US Biotechnology index trading below the level of cash on their balance sheets. Since the companies in the sector tend to be relatively small and larger healthcare companies are craving growth, one would expect the sector to be ripe for acquisitions given current valuations.

Allocation Changes

As a team, we met with more than 170 managers, either held in our portfolios or new ones. As the recovery is becoming more uncertain and some of the “easy gains” have already been made, it is particularly important to reinforce our convictions in our managers and continue to look for opportunities for the next stage of the cycle.

Some of those opportunities continued to be apparent in private equity, where Oakley Capital Investments and Pantheon International persisted in trading at attractive valuations relative to their peers and at appealing discounts to their net asset valuations. Although we have now seen some of the lagged growth we were expecting come through, we remain confident in those managers being able to continue delivering strong returns, while investors are yet to recognise the quality and benefits of those trusts. We thus continue to expect discounts to narrow from here.

As the cycle progressed, we increased our allocation to more defensive plays by building up our position in the TwentyFour Income Fund, a bond trust that invests in asset-backed securities (financial securities backed by income-generating assets such as mortgages, credit card debt, auto loans…) and lagged the recovery, as well as by adding a new position in GCP Infrastructure Investments, which invests in the debt of infrastructure projects. Both of those positions offer direct inflation hedges, unlike fixed income assets where the coupon is fixed and at risk of being devalued in a rising rates environment. With similar direct linkage to inflation, we also added to the Ecofin Global Utilities and Infrastructure Trust throughout the year when discount opportunities arose. By investing in listed equities in the utilities and infrastructure sectors, a large proportion of the revenues within the fund is directly indexed to inflation.

Finally, we also added two undervalued growth trusts in the Fund. The first one is the Worldwide Healthcare Trust which offers a mixture of biotechnology and pharmaceutical exposure. As we described above, we like the sector and this trust is quite complementary to our existing position in the International Biotechnology Trust (to which we added too). The second one was a new position in the BlackRock Frontiers Investment Trust, which offers a diversified and relatively uncorrelated way to access growth outside of the largest emerging markets. The trust trades close to its lowest ever discount and is currently around 30% below its 2018 peak.

In terms of reductions, our discipline dictates that we take profits in our strongest performers, such as AVI Global Trust, European Smaller Companies Trust, Mobius Investment Trust and Caledonia Investments. We also took some profits in the Baker Steel Resources Trust, a mostly private resources companies trust, in April, after a strong period of performance and a tightening of its discount.

Outlook

The macroeconomic landscape has changed dramatically again this year, suffering from the second global shock in as many years. As war rages in Ukraine, the economic recovery is in doubt and the risk of stagflation (low growth and high inflation), or even recession, have increased. The length of the conflict and the level of escalation in terms of combat, sanctions and commodity supplies will determine how much economic damage will be inflicted globally. Given how uncertain the situation is in the short-term, one can try to think about the long-lasting consequences of the conflict instead, which may be more obvious. Inflationary pressures make the cost of living squeeze that was already underway even more palatable, with increased risks of insurgency from consumers around the world unable to afford food, heating or petrol. The swiftness with which Europeans and Americans have agreed a united front against Russia and the magnitude of the measures they have taken so far could also be a sign of a new type of war, using financial weapons as opposed to physical ones, which is likely to have important ramifications for the years ahead. China, for example, might think twice before invading Taiwan having now seen how much economic damage the West is prepare to inflict. Other consequences of Putin’s actions are likely to be a renewed sense of urgency to transition away from fossil fuels and to promote energy self-sufficiency. Likewise, and more broadly, the reshoring of supply chains which started after the Covid pandemic are likely to be accelerated as companies realise how vulnerable they can be by being too dependent on foreign countries or regions.

From a market standpoint, the risk of stagflation or recession is not an enticing prospect. That said, for the time being, with the war constrained to the edge of Europe, there is still hope that the impact on global growth will be contained, while inflationary pressures abate as Russian supplies are slowly replaced and the move into Spring reduces demand on energy. Every situation is different but it is also worth remembering that the impact of wars on markets is usually relatively short-lived. We thus think that our best course of action is to thoroughly assess our portfolio but not to succumb to panic. Our portfolio is well diversified by names, asset classes, strategies and styles. We have a number of inflationary plays in the fund, through mining and renewables strategies, and have maintained our allocation to defensive strategies via absolute returns or low duration fixed and floating income funds. We also have a strong preference for idiosyncratic managers whose approach is niche and somewhat uncorrelated to broader market movements. Ultimately though, our best layer of protection will always be the quality of the managers we invest in and we have been impressed with the level of reactivity we have observed in their portfolios and the communication they have provided us with. All those factors give us some degree of comfort in the current uncertain environment, allowing us time to calmly assess the situation and look out for opportunities.

General Update

The TB Wise Multi-Asset Growth Fund started the interim period with £65m of assets under management and finished with £83m, thanks to the performance described in this report, as well as strong positive inflows, for which we are grateful.

Since the end of the third lockdown in March, our team has adopted a hybrid work structure, combining working from home with a day or two a week in the office, allowing us to meet our colleagues in person. This approach is one that is well suited to our needs and our work requirements, and could be one that we keep using indefinitely. Being a small company however, we have the luxury of flexibility and are prepared to tweak our working habits, were this to be necessary.

At the end of June, Tony Yarrow, whom many of you know, retired, almost 30 years after founding Wise Investment from which Wise Funds started to emerge in 2004. His succession planning has been a few years in the making and, as a business, we think we are well prepared to manage this new phase. It has been an honour for all of us to work with Tony and to learn from him. Although he stopped his direct involvement in the management of our funds, he remains a significant investor and has joined the employee-ownership trust that owns Wise Funds Limited as an independent trustee. We thus look forward to continue working with him in his new capacity.

Finally, all is left is for me to thank, personally and on behalf of the Wise Funds team, all our investors for their ongoing support. Please feel free to contact us if you would like a meeting or have any questions.

Vincent Ropers

Fund Manager

Wise Funds Limited

March 2022

TO LEARN MORE ABOUT THIS FUND , PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.