For Professional Clients Only

Macro & Market Update

As worry over Covid receded, investors began the month focussed on the persistence of global inflation, however, as the month progressed the escalating situation in Ukraine dominated, culminating in the unexpected decision by Putin to embark on a full-scale invasion of Ukraine. Beyond the tragic loss of life that is currently unfolding, we will use this monthly commentary to outline the immediate consequences the war is having on global markets and outline our current assessment of its possible medium-term impact.

Inflation continues to be a consistent issue that central bankers are now having to consider despite the negative impact the situation in Ukraine might have on global growth. The start of the month saw a strong US labour market report and another upside surprise to inflation, with both headline and core inflation rates hitting 40-year highs. Headline inflation in the US rose to 7.5% year-on-year leading certain members of the Federal Reserve to call for a 0.5% rise in interest rates at its next meeting rather than the anticipated 0.25%. This led to a dramatic repricing of the expected pace of US interest rate rises, with yields moving higher along the Treasury curve and the 10-year bond yield breaking through the 2% barrier. Similarly, the UK saw headline inflation rise 5.5% year-on-year, a near three-decade high. There has also been a notable broadening out of inflation across the basket of items measured. Rather than being focussed on a narrow group of items, 70% of the basket is now seeing year-on-year inflation of more than 3%. At the latest Monetary Policy Committee meeting, four members voted for 0.5% increase in the bank rate fearing that overly accommodative policy could lead to an upward spiral in inflation if it feeds through into higher wage demands. The Bank of England now expects CPI inflation to peak at 7.25%, up 2% compared to its November projection highlighting both the difficulty in forecasting inflation as well as the potential squeeze facing consumers as wage growth fails to keep up with the rising price of goods. These inflation forecasts will only have moved higher as a consequence of the invasion of Ukraine, which has pushed crude oil prices up to levels last seen in 2012. Against this inflationary backdrop, sectors such as commodities and initially financials performed well whilst defensive asset classes, such as fixed income, have struggled given the lack of inflation protection. Similarly, growth sectors such as technology have been under continuous pressure given the lofty valuation multiples the sector has enjoyed in recent years. Post the invasion of Ukraine there is now a two-way pull as inflationary pressures are likely to persist or even accelerate whilst global growth forecasts look set to come back. Central bankers, however, have indicated they are likely to continue to raise interest rates to combat inflation and markets have begun to contemplate the unpalatable prospect of stagflation (low economic growth coupled with high inflation).

The immediate consequence of the invasion of Ukraine was to see a fall in risk assets globally, with equity markets weak across the board and financial stocks reversing their previous strength. The UK market, however, was an outlier given the high weighting within the index to commodity markets, which performed strongly over the month. Eastern European indices were notably poor given the speed and breadth of sanctions imposed on Russian companies and fears over its regional economic impact. As described above, there was broad strength across the basket of commodities (industrial, agricultural and energy) as concerns over supply restrictions from Russia and Ukraine outweighed any concerns over a slowdown in demand. The traditional safe-havens of gold and government debt and the US dollar also performed well.

Fund Performance

Wise Multi-Asset Income

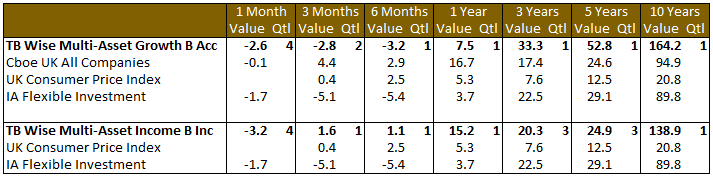

In February, the TB Wise Multi-Asset Income fund fell 3.2%, behind the IA Flexible Investment sector which fell 1.7%. February marks the end of the fund’s financial year over which time the fund has risen 15.2%. This compares to a rise of 5.3% for CPI and 3.6% for the IA Flexible sector. Given the increased economic uncertainty, our direct financials holding were the worst contributors during the month. This was exacerbated by an unexpected profit warning from Morse’s Club citing elevated complaints from Claims Management Companies. In response we have exited our holding in its entirety. Equity and Private Equity funds, such as BMO Private Equity, Schroder Global Equity, Schroder UK Mid Cap and Aberforth Smaller Companies were weak in a risk-off environment that saw discounts to underlying net asset values widen. We saw similar discount widening at property companies, Palace Capital, Ediston Property and Standard Life Investment Property Income. All three companies have recently significantly strengthened their balance-sheets via asset disposals and announced increased net asset values. We continue to believe they are well positioned for the current environment as a result. Our commodity exposed holdings positively contributed to performance, most directly via Blackrock World mining but also indirectly via JLEN Environmental and GCP Infrastructure, which benefit from rising power prices.

Wise Multi-Asset Growth

In February, the TB Wise Multi-Asset Growth fund was down 2.6%, behind the CBOE UK All Companies Index (-0.1%) and the IA Flexible Investment sector (-1.7%). For our full financial year ending in February, the fund is up 7.5% vs 16.7% for the CBOE UK All Companies and 3.6% for the IA Flexible Investment sector. Our direct exposure to Russian assets is extremely limited although some of our international and emerging markets managers hold small positions in Russian banks or oil companies. Although our worst performers last month were found in emerging markets (Fidelity China Special Situations, Templeton Emerging Markets), their impact on the fund was limited due to their relative small size. Our biggest detractors to performance were our more value and smaller companies oriented names (AVI Global, European Smaller Companies, Aberforth Smaller Companies) as investors looked for defensiveness and liquidity. Related to the last point, our private equity holdings performed badly too, hurt by a widening of their discounts, rather than by their underlying holdings’ performance. On the positive side, our defensive holdings did their job and protected capital, while our mining exposure added to performance (Blackrock World Mining, Jupiter Gold & Silver, Baker Steel Resources).

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Income

In recent months we have geographically diversified and reduced the overall equity allocation within the portfolio as the outlook for global growth has moderated. We have sought out areas which we believe are both more defensive yet capable of protecting investors against inflationary pressures. In this vein, we further reduced our holding in Princess Private Equity and took some profits in Blackrock World Mining during the month. We have added to our holdings in Starwood European Real Estate and GCP Infrastructure as well as Impact Healthcare REIT and Empiric Student Property. We have also added to our holding in the Schroder Global Equity Fund. We believe our underlying funds holdings have minimal direct exposure to Russia and our value managers are well-exposed to sectors that should perform well in the current environment. In response to the situation in Ukraine, at the beginning of March, we have increased our exposure to energy marginally via the Blackrock Energy and Resources Income Trust whilst further de-risking our more cyclical value exposure by reducing UK equity fund, Temple Bar.

Wise Multi-Asset Growth

In terms of portfolio activity, so far, we have resisted overreacting to the conflict and the increased volatility in the market. While we undeniably have got a pro-cyclical bias through our exposure to value equity managers, we think that those positions are well underpin by attractive valuations in the medium term. Our portfolio is also well diversified by names, asset classes, strategies and styles. We have a number of inflationary plays in the fund, through mining and renewables strategies, and have maintained our allocation to defensive strategies via absolute returns or low duration fixed income funds. We also have a strong preference for idiosyncratic managers whose approach is niche and somewhat uncorrelated from broader market movements. Ultimately though, our best layer of protection will always be the quality of the managers we invest in and we have been impressed with the level of reactivity we have observed in their portfolios and the communication they have provided us with. All those factors give us some degree of comfort in the current uncertain environment, allowing us time to calmly assess the situation. Market angst at military conflicts is historically short-lived but only time will tell if this will be the case in this instance or not.

Prior to the Russian invasion, we initiated a position in the Worldwide Healthcare Trust, which increases our allocation to the healthcare and biotechnology sectors. Those appear to have been unjustifiably punished post the Covid rebound and look particularly attractive to us at present, both from an absolute and relative valuation standpoint, as well as thanks to structural growth drivers that show no signs of abating (ageing population, new technologies…).

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.