28th February 2022

Market background

The writing of this report has been overshadowed by the invasion of Ukraine which once again clouds the investment backdrop and brings further uncertainty and suffering at a point when all had hoped the misery of Covid was finally receding. We will discuss the impact of Ukraine later in the performance review and outlook but will start on the more optimistic subject of Covid as this was the primary factor impacting investment markets during the period under review.

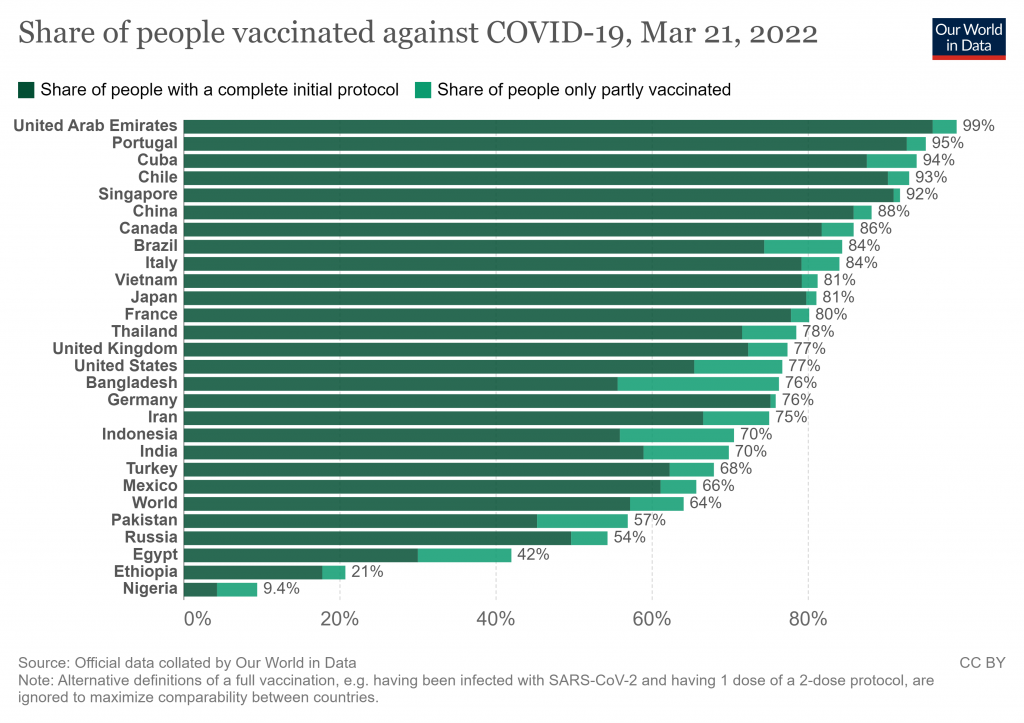

In retrospect the achievements in managing Covid over the course of the year have been remarkable. Following the announcement of successful vaccines in November 2020, their rollout over the course of 2021 has provided a step-change in our ability to live with the virus. Whilst new variants have emerged over the course of the year and have tested markets periodically, there appears to be much more cause for optimism as we exit 2021 that Covid will no longer dominate both the way we live our lives and the investment narrative for markets. The global economy as a result continued its recovery from its steep recession in 2020 and expanded at above trend rates of growth in 2022, providing a supportive backdrop both to corporate profits and equity markets. However, it is important to note that progress has not been uniformly felt across the world with stark differences in vaccination rates by geography and socio-economic groups. In addition, differing approaches to the restrictions governments have been willing to impose have led to diverging rates of economic growth between developed and emerging markets. Whilst expected growth rates for developed world economies have remained broadly flat over the period, emerging markets led by China have seen higher forecasts for economic growth pared back considerably. As a result the differential in growth between emerging and developed markets has narrowed to the lowest level since 2000 and helps explain the underperformance of equity markets in these regions over the period.

Currently 64% of the world population has received at least one dose of a Covid vaccine and 11 billion doses have been administered globally. Whilst 17 million doses are being administered each day only 14% of low-income countries have received at least one dose and it will not be until later this year before significant progress is made in emerging economies. It remains important that this progress continues, not only for the health of the populations of those countries but also to keep global economic growth strong and to ease the supply chain dislocations that have accompanied the rapid reopening of global trade. Over the period we saw the emergence of the Delta and Omicron variants of the virus which both saw significant spikes in the numbers of people contracting Covid as well as testing the effectiveness of vaccines against these unknown mutations. Markets were understandably nervous with significant bouts of volatility as cases rose, however, it was notable through these periods that government restrictions were less severe, often targeted at those who were unvaccinated and that booster shots were able to be administered quickly and continued to be highly effective in reducing the severity of the virus and keeping hospitalisation rates low. So far it has been encouraging that whilst they have proven to be more contagious and able to reinfect patients who have already had Covid before, these new variants have been less severe and have led to significantly fewer hospitalisations than feared. As a result, fewer lockdown restrictions have proved necessary and the economic impact of each successive wave has reduced. It has become apparent, however, that vaccine effectiveness wanes over time and that regular top ups for the most vulnerable will remain necessary. This puts further pressure on the global supply of vaccines and defers the point at which the whole global population is protected and increases the debate over vaccine nationalism. This disparity in vaccination rate by country has been marked during the period even among more developed countries and partly explains the divergence in performance within global equity markets. Japanese equity markets were down 7% in local currency, for example, and have failed to recover from the slow initial vaccine roll-out that resulted from its lengthy clinical testing and approval process. However, there has been a rapid improvement since, with 80% of the population now double-jabbed which puts it above both the UK and the US. Within developing economies China stands out as having a high vaccination rate, however, questions remain over the effectiveness of their chosen vaccine against Covid mutations and with hospitals under greater pressure and a political zero-Covid policy, recent Omicron outbreaks have led to draconian lockdowns similar to those experienced closer to home in 2020. This threatens to disrupt global supply chains and both reinforces the need to fully vaccinate everyone as well as reminds us that Covid will continue to impact us directly and indirectly for some time. As more effective vaccines roll-out, however, we would expect this to lead to an easing of this policy and an improvement of the relative growth rates in the region and to underpin equity markets in these areas.

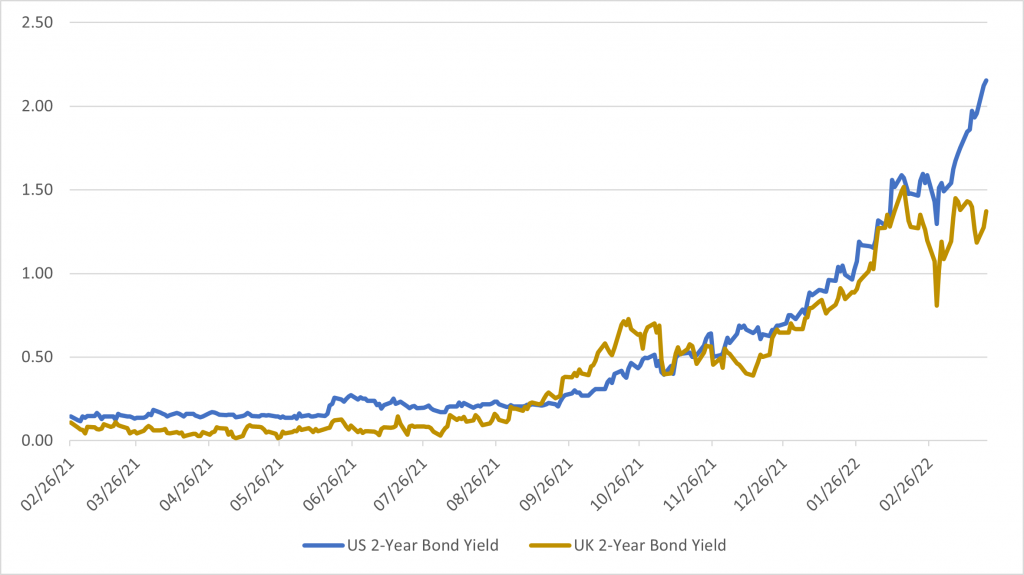

Whilst the improving Covid backdrop has supported the economic recovery, it has not come without it challenges. The rapid reopening of the global economy and the combination of a sudden increase in demand and supply chains that have struggled to keep pace had already translated into rising inflation at the start of the period. At that point investors and central bankers remained sanguine that this was likely to prove broadly transitory believing supply chains were likely to gradually sort themselves out and mathematically high inflation numbers would fall as comparator numbers eased. Tightness in the labour market was also expected to ease as furlough was withdrawn and employment data was no longer distorted by government support schemes. Over the course of the year, however, there has been a dramatic shift in market expectations both over the level and the duration of inflation that is likely to result from the Covid crisis. The extent to which these expectations for inflation have shifted over the course of the year is best demonstrated by forecasts announced by Bank of England at its quarterly Monetary Policy Committee meetings when the level of interest rates is determined. Whereas in March 2021 the Bank of England expected inflation to remain close to its 2% target through 2022 and 2023, at its February 2022 Committee Meeting the Bank of England expected CPI inflation to peak at around 7.25% in April 2022 and to fall back to a little above 2% in 2024. Economics is described as an inexact science but it is worth highlighting how wrong even the Bank of England have been over the course of the last year. The belief that inflation would remain benign and that monetary policy could consequently remain very loose has characterised financial markets ever since the financial crisis. The period since September has, therefore, proved a shock to many investors and had important implications both for asset class performance and for which sectors to hold within equity markets. It is worth noting that whilst inflation forecasts move ever higher, the belief still remains that inflation will return to target levels within the not-too-distant future. If 2021 has taught us anything it is that such predictions should be treated with a high degree of scepticism and that portfolios should not be constructed in a way that they perform only in such a benign environment. Such inflationary pressures have been felt not only in the UK but also in the US and even the EU. In the US, the Federal Reserve gradually acknowledged that the labour market was sufficiently strong and economic growth robust enough initially to taper its monthly bond purchase programme (quantitative easing) and eventually to accept that higher inflation than anticipated warranted a complete reversal of this policy (quantitative tightening) and higher interest rates. The path to monetary policy normalisation has accelerated dramatically over the period. Up until November central bankers were trying to navigate a path for monetary policy that maintained the recovery in economic growth, that supported the labour market whilst keeping an eye on inflation. Thereafter the commentary from central bankers has prioritised keeping inflation under control as the fear developed that high inflation could feed through into higher wage demands and that as a consequence inflation would become more persistent rather than transitory. This is taking place against a backdrop of much lower numbers of workers returning to the workforce post Covid, a problem exacerbated in the UK by Brexit, and at a point when labour costs as a percentage of GDP are at the lowest levels for many decades. A decade of austerity post the Global Financial Crisis had already led to greater political populism and it seems likely employees will use the current inflationary backdrop to push for higher wages. The extent to which this change in inflation expectations has led to a reassessment of the outlook for monetary policy is best shown by changes in the yield on 2-year government bonds in the US and UK over the period. At the end of August 2021 the yield on US bonds of this duration was 0.2% whereas at the time of writing (23/03/2022) the yield on the same bond is now 2.15%. This reflects where markets expect interest rates to go over the course of the next 2 years. Having raised rates for the first time in March 2022 by 0.25%, notwithstanding the geopolitical events in Ukraine, markets are now expecting a further 6 rate hikes in the US over the remainder of the year. In the UK rates have been raised to 0.75% and markets appear to pricing in another 1.25% of interest rates rises over the next 2 years.

UK & US 2-year Government Bond Yields

With decent economic growth but rising inflation and tightening monetary policy equity markets have continued to broadly perform well. US, European and UK equity indices all compounded their strong recovery of the prior 12 months, with the UK notably benefiting from its heavy overweight exposure to commodity sectors in the second half of the period. However, the broader strength of the overall asset class has masked weaker performance in specific markets and sectors. Chinese equity markets have performed badly as economic growth has disappointed. Power shortages hit industrial output, the housing market weakened as authorities targeted speculation and elevated leverage in this market following the collapse of the developer Evergrande and more restrictive Covid policies have held back economic recovery. Increased regulatory scrutiny of companies in the internet, technology and education markets further dampened investor appetite. This relative weakness in economic growth spilled over into neighbouring countries and Asia Pacific indices were weak as well. Unsurprisingly, the weakest region over the year was in Eastern European emerging markets following the invasion of Ukraine and the imposition of sanctions on companies in Russia and Belarus. Within equity markets there was a notable rotation away from growth sectors, particularly technology companies, towards traditional value sectors, such as financials and commodities. These sectors have benefited from cheap absolute valuations as well as from an improved cyclical outlook for earnings. Over the second half of the period, the leading index of US technology shares fell 7% as high valuations came under pressure from rising bonds yields. Since the Global Financial Crisis investors in have become increasingly dependent on the liquidity provided by low interest rates and quantitative easing, particularly in those sectors where low discount rates applied to expectations for high profits in the future have inflated valuations today. Whilst the pain has been felt particularly hard amongst those loss-making concept technology companies, many of which have more than halved over the period, there has been a broader derating of companies that have seen multiples steadily increase in recent years. As we entered the year end there was a noticeable divergence in valuations between the cheapest 20% of global equities and the most expensive 20%. Whereas the former currently sits at a valuation level below its long run average since 1990, the most expensive 20% of global equities has only ever been more expensive in the technology boom in 2000. Given the income requirement of the fund and the value bias to our investment approach we have been heavily skewed in our equity allocation towards value sectors over the period and remain so. Against a backdrop of rapidly increasing inflation expectations, rising government bond yields and heightened concerns over economic outlook towards the end of the period, fixed income markets have been a disappointing defensive asset class for investors with global treasury and credit indices delivering negative returns for the year. In order to deliver positive returns, credit selection has been key as well as investing into areas of the fixed income market where there is some inflation protection available to investors, such as asset backed security markets (e.g. commercial and residential mortgages), and corporate loans, both of which see coupons move up in line with interest rates.

Commodities have been the strongest performing asset class over the year. Strong capital discipline has limited supply of commodities at a point when government stimulus through infrastructure spending programmes has boosted demand already recovering from Covid. Industrial metal prices, such as copper and nickel, rose over the period whilst iron ore recovered to finish the year strongly following a sharp spike in the price earlier in the year. Oil & gas prices were also strong as supply discipline from OPEC led to tight markets. In all cases, an underlying positive pricing picture was turbo-charged by the Russian invasion of Ukraine given concerns over supply disruption following sanctions. Russia is a significant exporter of gas, supplying around 40% of gas used in the euro area as well as being the second largest global crude oil producer. Ukraine, Belarus and Russia are big exporters of wheat and fertilisers so a protracted conflict and sanctions will only feed through to higher food prices and general inflation. Consumer confidence that had already weakened as inflation rose has fallen further as the spectre of stagflation (economic stagnation & inflation) emerges.

Finally, property stocks also performed strongly over the course of the year. Industrial property continued to see strong rental growth as demand for logistics warehouse space outstripped supply. Office and certain retail assets benefited from the reopening of the economy post-Covid restrictions being eased, rent collection improved significantly over the period and increased as a result, paving the way for dividends to return closer to pre-Covid levels. Whilst net asset values in most cases stabilised and returned to growth, the biggest driver of performance was a narrowing of the extremely wide discounts these companies had moved to during the period of uncertainty in the prior year.

Performance

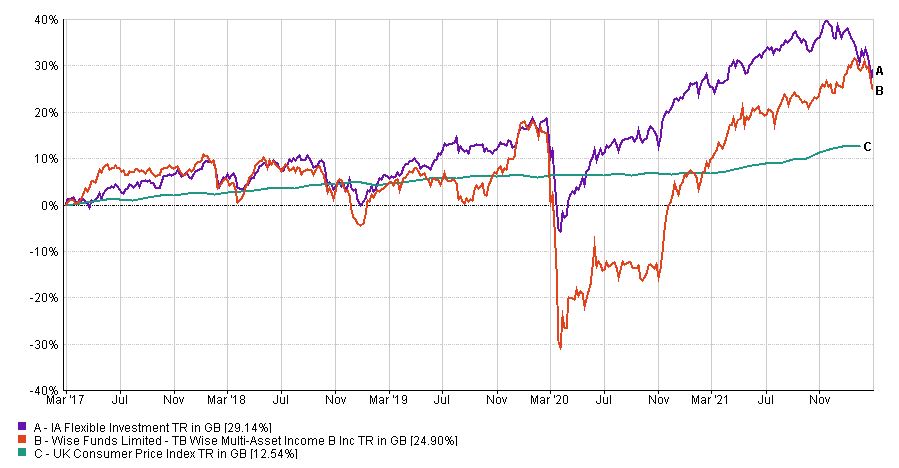

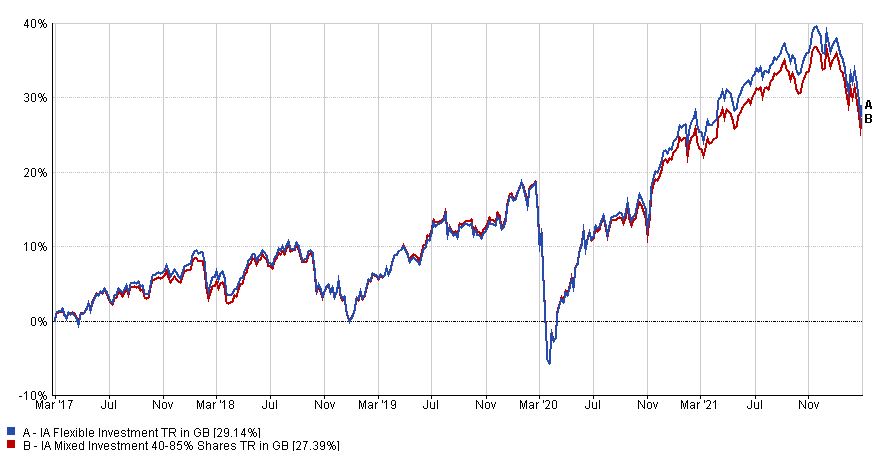

Over the 12-month period the fund rose 15.2% compared to its target benchmark, the Consumer Price Index, which rose 5.3%, and the comparator benchmark, the IA Flexible sector, which rose 3.6%. Over 5 years the fund has risen 24.9% compared to its target benchmark, the Consumer Price Index , which rose 12.5%, and the comparator benchmark, the IA Flexible sector, which rose 29.1%.

For more fund performance, please see the latest factsheet

TB Wise Multi-Asset Income February 2022 Factsheet

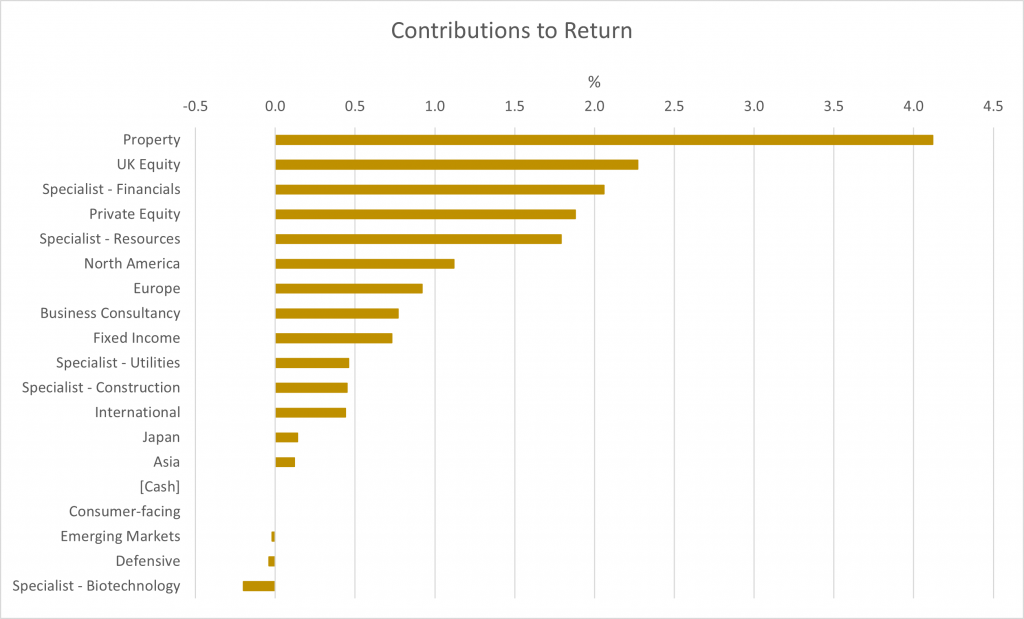

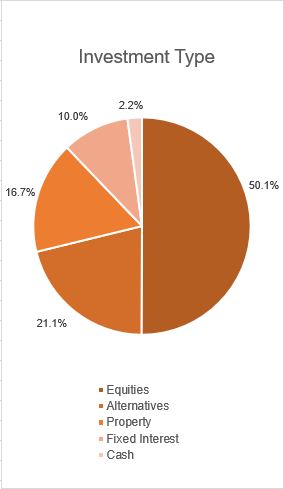

The strong performance of the fund over the period reflected its heavy allocation towards asset classes that have benefited from the continued recovery of the global economy over the course of the year as well as the value bias of our investment process. This has helped not only in exposing the portfolio to companies and funds which have delivered positive returns but, as importantly, avoiding those sectors and asset classes that have produced negative returns. The fund is multi-asset with a wide remit allowing us to invest across the broadest range of assets, in whatever proportions we believe is appropriate and this flexibility has served us particularly well during a period when traditionally defensive assets classes, such as fixed income, have detracted from benchmark performance. Whilst we are pleased to have recovered the relative underperformance the fund suffered during the initial months of the Covid pandemic in early 2020, we are mindful that the volatility of the fund during this period was higher than we would have liked and have taken steps to diversify the portfolio both geographically and by asset class. We believe these actions should bring great resilience to the portfolio at a time when valuations for most assets have recovered strongly and geopolitical developments and inflationary pressures are leading to a more uncertain investment backdrop. Furthermore, we believe these actions should have a significant impact on improving the resilience of the fund’s dividend as a result of greater diversification and a stronger allocation to investment trusts rather than direct equities. The former not only demonstrated a much greater willingness and ability to maintain dividends during the crisis but also offered an opportunity to retain equity exposure whilst trading at wider discounts to net asset value than normal. In our previous annual report we spoke of our disappointment over the drop in the fund’s dividend and outlined the efforts we had made in trying to restore the dividend without sacrificing the significant capital upside we saw in markets at the time. It is very welcome to be able to report strong progress on both fronts over the period.

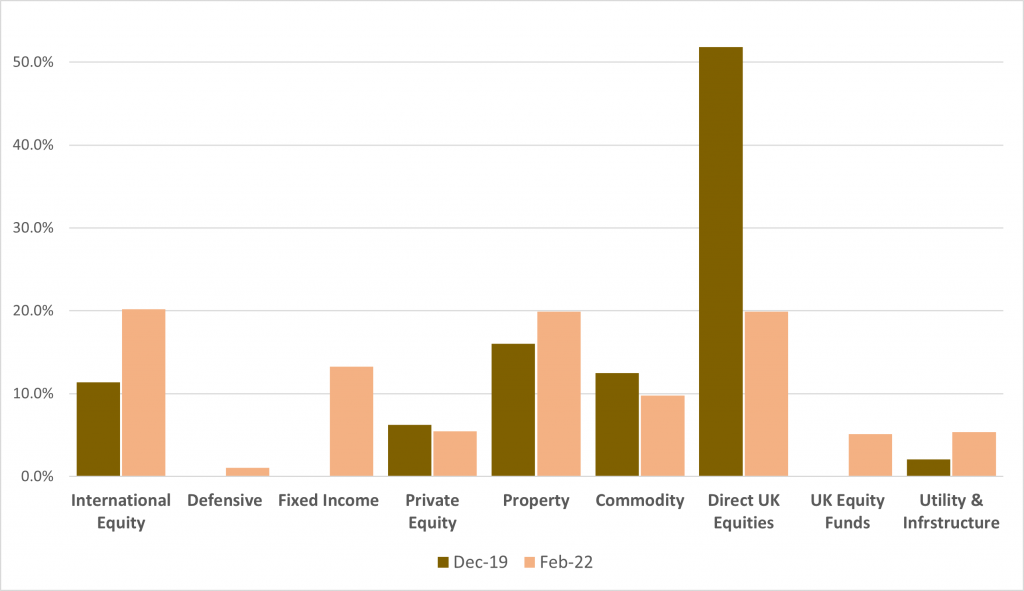

Income Diversification Changes

This chart demonstrates the greater diversification of the fund’s income today both by asset class and geographical allocation. It illustrate the extent to which the fund is now more exposed to investments trusts within the equity allocation for income compared to the position at the end of 2019.

Throughout 2020 and into 2021 we have increasingly switched our direct equity allocation into funds managed by third parties. Predominantly we achieved this by investing into investment trusts at discounts to net asset value. These equity funds have proven to be some of our strongest contributors to performance, particularly for those funds which have a strong value-driven investment process. Temple Bar, Man GLG Income, Polar Capital Global Financials, European Assets Trust, Middlefield Canadian Income and Murray International all performed strongly over the period and we have used the strong performance to reduce or exit those holdings where we felt valuations had become extended or to diversify the portfolio internationally whilst maintaining our valuation discipline. Our direct equity holdings have continued to perform positively and the dividend outlook has improved. Sthree, the global STEM-focussed recruitment company, saw a very strong rebound in demand for its services and we exited the holding as the valuation better reflected its outlook for earnings. The vast majority of our direct equity holdings sit within the financials sector and are direct beneficiaries of both the improving economic backdrop as well as higher government bond yields. Whilst valuations remain very low, many of the companies in this sector have improved their balance-sheet strength over the Covid crisis and demonstrated much greater earnings’ resilience than in the GFC when they were firmly in the eye of the storm. Dividends have also been restored following a period of regulatory pressure to suspend them during the uncertainty of the previous year. Whilst high levels of inflation are causing a drop in consumer confidence and concern over a cost-of-living squeeze, employment remains strong and wage growth looks set to grow providing some protection. The sector looks to be well-positioned to weather this particular headwind and valuations remain attractive. We saw strong performance from Legal & General, Aviva, Paragon, Polar Capital Holdings, Natwest and Standard Chartered. In many cases dividends and earnings are now higher than in 2019. Performance was not uniform, however, with Morses Club disappointing in the final month of the year citing a pick-up in complaints driven by claims management companies. This was at odds with previous commentary from the senior management team and we therefore exited our holding in its entirety.

Against this favourable backdrop for quoted equities, our private equity funds, Princess Private Equity and BMO Private Equity also performed strongly. Strong earnings growth from the underlying portfolio holdings, some upward revaluation coupled with a bumper year for realisations of their co-investment holdings drove excellent net asset value growth over the period. We have slowly been switching our holding in Princess Private Equity into BMO Private Equity, where we believe there is a stronger outlook for future realisations, the underlying portfolio valuation metrics are more favourable and the relative discount at which the fund trades represents further upside opportunity.

Our best performing asset class was property, driven both by a general cyclical recovery from Covid and reversal of the extremely attractive valuations last year. In addition, we benefited from a stock-specific bid for U&I. U&I reflected the significant undervaluation that markets were placing on certain subsectors of the property sector, particularly towards companies with less predictable development-led earnings. Despite the uncertainty over when and by how much the company might restore its dividend, we had held on to our position on valuation grounds and it was encouraging, therefore, to see this valuation anomaly recognised by Land Securities who bid for the company at a 73% premium at the start of November. In all cases we have seen an improvement in rent collection as well as letting activity whilst more recently net asset values have been rising. This reflects greater comparative evidence available to valuers from transactions that have taken place in the secondary market when determining valuation levels. These had all but dried up last year forcing valuers to take a more conservative approach. We have exposure to industrial property, retail warehouses, regional offices, care homes as well as student property and believe there is still strong scope for rents to grow from here either due to further cyclical recovery or on account of direct inflation linkage in their lease structures. This positions these companies well to further increase dividends which already look attractive. We continue to hold Standard Life Investment Property Income, Ediston Property, Palace Capital, Urban Logistics and Impact Healthcare Reit. Recently we have added to Empiric Student Property, which we believe should benefit from a lagged post-Covid recovery as universities fully return to in-situ teaching next year and longer-term structural growth in their markets.

Our resources holdings also performed strongly. As discussed earlier, the backdrop for commodities was positive as supply-demand dynamics supported higher commodity prices. Concerns over geopolitical events and inflation meant the sector also acted as a hedge for investors against these twin risks. We used the period to switch our holding in Rio Tinto, predominantly exposed a single commodity, iron ore, into the Blackrock World Mining investment trust. The trust sat at an unusually wide discount to its net asset value at the time and gives greater exposure to a more diversified set of industrial metals, many of which are needed to deliver medium term net-zero carbon goals.

Within the more defensive allocation of the portfolio, we hold funds invested in areas of fixed income as well as holdings exposed to infrastructure, utility and renewables sectors. Given the moves in government bond yields over the period and the adverse inflation movement over the period, this element of the portfolio has faced a headwind over the year. Our overall allocation to this area has been low reflecting both our view that economic recovery and attractive valuations supported higher allocation to risk assets, such as value equity funds, but also our view that the extremely low yields on offer for defensive assets provided limited opportunity to deliver positive inflation-adjusted returns for investors. It was very encouraging to see, therefore, that whilst government and credit bond markets delivered negative returns over the year, the more defensive parts of the portfolio still made positive returns over the period. We have sought to invest into bond funds where we believe there is some sort of inflation protection available to investors. The Twenty-Four Income Fund, for example, invests into asset back security markets where coupons on their debt instruments move up in line with interest rates. Starwood European Real Estate Finance invests in loans to property companies, which again have a linkage to interest rates. Furthermore, we believed there was scope for capital upside notwithstanding the interest rate headwind given the improving cyclical outlook for their borrowers and the unusually wide discount to net asset value at which the trust traded. Similarly, we felt the backdrop of rising power prices provided a strong tailwind for the net asset value of GCP Infrastructure and a yield of 7% positioned the trust well to deliver a strong total return. As markets have performed strongly during the course of the year we have reduced the overall risk of the portfolio and added to our overall defensive allocation. We initiated holdings in infrastructure trusts, Pantheon Infrastructure and JLEN Environmental Assets as well increasing our holdings in Ecofin Global Utilities and Infrastructure and GCP Infrastructure. We have also increased our holdings in Starwood European Real Estate and Twenty Four Income as well as initiating a position in Fulcrum income which proved very resilient in the Covid crisis and further diversifies our sources of income.

In addition to its objective around capital return, the fund has a specific objective to deliver an income higher than the CBOE UK All Companies Index and to increase that income in line with inflation or better over rolling 5-year periods. In our annual report last year we expressed our disappointment in the delivery on our income objective and the extent to which we were prioritising the restoration of the dividend. At that time we estimated that given the return to dividend payments across equity markets and the changes we had made to the portfolio, the distribution per unit for the fund should be at least 5.04p for the 2021/2022 year. It is encouraging, therefore, to able to report that the total of monthly distributions over the period has in fact been 5.69p, a reduction of 7% compared to the dividend announced for the year to February 2020. Last year the dividend had fallen by 43% so this represents a significant rebound towards prior levels of distribution and we are particularly happy that we managed to achieve this without sacrificing the very significant capital upside we saw at the time. Looking ahead we expect further growth in the dividend to 5.8 pence per share over the course of the next year. This represents a yield on the fund of 4.7%. It is important to note, however, the fund is unlikely to meet its objective to grow the distribution per unit in real terms over a 5-year rolling basis and, given our desire to diversify the portfolio away from historically higher-yielding direct UK equities, that investors should consider the latest distribution the one from which we will now look to grow in real terms. Whilst it is painful to acknowledge a re-basing of the dividend, we believe this is a sustainable level from which to build and still represents a competitive level of income.

Allocation changes

Given the strength in global equity markets and the implied belief in economic forecasts that the recovery from Covid would continue to remain strong, we used this period to recycle the portfolio out of some the more cyclical and highly rated growth holdings, which have performed exceptionally strongly since the announcement of successful vaccines. As valuations have moved higher there is less buffer for markets to deal with unexpected bumps on the road to recovery beyond pre-Covid levels. Inflation, rising interest rates, supply chain blockages and geopolitical tensions all have scope to disrupt the smooth recovery of the global economy and in many cases valuations already appear to discount earnings exceeding pre-Covid levels. As discussed earlier, however, valuation dispersion within equity markets remains extremely wide and we continue to believe that the biggest cause for concern remains the elevated level of valuations of growth stocks to which we have limited exposure rather than value equities, which still remain cheap in absolute terms. We have, however, somewhat derisked the portfolio over the period and continued on the strategic path we set in 2020 to diversify the portfolio away from its high direct equity allocation. This diversification has not only involved a switching of UK direct equities into UK equity funds but, more recently, we have further diversified the equity allocation internationally as well as further diversifying the portfolio by asset class. We believe these actions should all improve the resilience of the fund in the face of unexpected future events without changing our valuation driven approach.

Within our direct UK equity holdings, we have sold our holdings in Aviva, Morses Club, Polar Capital, Shoe Zone, Sthree and Taylor Wimpey. In certain cases these were residual positions where we had limited confidence in their ability to return to paying a dividend or were due to an unexpected change in the investment case. In most cases, these decisions were driven by strong recovery in the share prices and have been used a source of capital to add to existing equity funds where we believe there is broader valuation support. Overall our direct UK equity allocation has reduced from 30% to 17% and marks a significant change to the end of 2019 when direct UK equities represented 55% of the portfolio. Last year a significant beneficiary of our switch out of direct equities were UK equity funds. Over the course of the year we have reduced this allocation given exceptional performance and considerable narrowing of discounts to net asset values in this area. In particular, we have reduced our holding in Temple Bar, Schroder UK Mid Cap and Aberforth Smaller Companies. UK equity funds now represent 10% of the portfolio compared to 14% at the start of the period. International equity funds have seen an increase in allocation, particularly to funds where performance has lagged or which are underpinned by strong valuation support. The increase in the international equity allocation from 17% to 23% is somewhat distorted by the complete exit of our 3.8% holding in European Assets Trust on valuation grounds over the period. New holdings have been initiated in Blackrock Frontiers, CC Japan Income & Growth, International Biotech and Schroder Global Equity and we have increased our holding in Murray International. We believe this not only diversifies the portfolio internationally but also improves the overall dividend cover and valuation of the portfolio. We continue to hold some growth holdings within the portfolio but have reduced our exposure given their strong performance at a time when the valuation headwind from higher discount rates has strengthened. In addition to Schroder UK Mid Cap, European Assets Trust and Polar Capital mentioned above, our overall allocation to Private Equity has also reduced from 6% to 5% in spite of strong relative performance in the period. Within our private equity allocation, there has been a significant switch out of the more highly rated Princess Private Equity into BMO Private Equity.

Over the 12-month period our property allocation has increased from 13% to 17% notwithstanding the bid for U&I over the period. Strong relative performance has partially driven this increase in allocation as have new holdings Impact Healthcare REIT, Empiric Student Property and Urban Logistics in the period. We believe each holding further diversifies our exposure within the property sector to areas with strong rental growth prospects. We have further added to Ediston Property and Standard Life Investment Property, both of which have significantly strengthened their balance-sheets over the period, have seen net asset values growth and whose discounts appear not to reflect an improving outlook for dividend growth.

Finally, our defensive allocation has seen the biggest change over the period increasing from 9% to 17%. The biggest increase has been driven by the addition of two new infrastructure funds, Pantheon Infrastructure and JLEN Environmental, and an increase to our holding in Ecofin Global Utilities and Infrastructure. Pantheon is focussed on building out a portfolio of Private Equity Infrastructure investments, JLEN is an established fund investing in a diversified portfolio of renewable, infrastructure assets whilst Ecofin invests in regulated utilities, renewables and transport infrastructure globally. In aggregate, we believe these portfolio changes position the portfolio well for a global economy that continues to recover from Covid but where risks have increased, particularly towards the end of the period. We are mindful of our objective to provide investors with an above average yield that can grow in real terms whilst at the same time delivering capital growth at or above the Consumer Price Index over the medium term. We believe the changes we have made in the portfolio in recent months not only allow for these three objectives but also that the increased diversification should reduce the overall volatility of the fund.

Outlook

Events in Ukraine now dominate the investment outlook. In the short-term sanctions and commodity price shocks have exacerbated underlying inflationary pressure and markets are having to consider the unpalatable scenario where higher levels of inflation no longer go hand in hand with higher levels of economic growth. Such stagflationary conditions (economic stagnation & inflation) would make progress difficult for most asset classes. It is impossible to know at the moment whether this turns out to be a relatively short-lived event or whether its impact will endure. A febrile atmosphere with the potential for wider escalation has already caused spikes in market volatility. Changes we have made to the portfolio in recent days either reflect our view that it is neither sensible to hope for the best when it comes to assessing recent geopolitical events nor it is wise to ignore the opportunities that indiscriminate selling has presented in certain areas. In some cases, share prices have retraced the majority of the recovery enjoyed post the vaccine news. Before the decision to invade Ukraine we had already taken steps to gradually de-risk the portfolio driven by a view that valuations for risk assets had skewed more in favour of risk rather than return. Economies are still on their recovery out of Covid, however, some of its longer-term costs remain. Debt to GDP in developed world economies are high, inflation could prove stickier than hoped for and the voices of populism and deglobalisation are likely only to increase as a result of reduced real wages and supply chain disruption. Equity market valuations remain very polarised and we believe a skew towards cheap, globally diversified companies still provides the bedrock of a portfolio that can deliver above average income that can grow in real terms. We are maintaining our exposure to commodities, which we believe will provide protection against inflation as well as a hedge against further geopolitical risk. Our property holdings all provide high and well covered dividend streams with scope for these to grow further as strong balance-sheets are deployed and rents enjoy a cyclical recovery. Whilst we have undoubtedly entered choppier waters, we believe the portfolio is well-diversified, its yield supported by improving corporate profits and rents and there is now better balance from defensive areas to face into the uncertainty we are currently presented with.

We recently announced an upcoming change to the objective and policy for the fund, details of which can be found by clicking on this TB Wise Multi-Asset Income Update. I would like to reassure you that these changes will not affect the way we continue to manage the fund. We currently aim to yield more than the Cboe UK All companies Index, however, last year the Cboe confirmed they were going to stop calculating a yield for this index. In order to remain compliant with regulation and to ensure MAI has appropriate targets, we were required to find an alternative target benchmark that also ensures we don’t change how we manage the fund. Since launch MAI has always sought to pay a good level of income, as well as grow that income and the capital in line with inflation. The new objective aims to capture these same principles.

In addition, we have also decided to make a change in the sector classification in which the fund sits. Since launch we have always been in the IA Flexible Investment Sector but after careful consideration, we feel the IA Mixed 40-85% Investment Sector better reflects the way the portfolio is managed. Over the past 5 years, the Flexible Sector has seen an increase in non-multi-asset funds, which are often more growth orientated and a decrease in multi-asset income funds. We would again stress that this move in sector classification will not change our management approach but will provide a better comparison of the fund against a more representative group of peers. Whilst in theory this does add a constraint to the asset classes we are able to hold, in practice we have always managed the fund comfortably within the sector limits. For comparison, over 1 year the IA Flexible sector has risen 3.7% compared to 4.0% for the IA Mixed 40-85% Investment Sector. Over 5 years, the IA Flexible sector has risen 29.1% compared to the IA Mixed 40-85% Investment sector, which has risen 27.4%.

General Update

Despite the strong capital return delivered over the period, the assets under management of the TB Wise Multi-Asset Income Fund fell from £87m at the start of the period and ended the period at £83m as the fund continued to suffer net outflows. We have been very encouraged, however, to see these outflows reverse in the first two months of the year and return once again into positive territory and remain grateful for your continued support.

Since the end of the third lockdown in March, our team has adopted a hybrid work structure, combining working from home with a day or two a week in the office, allowing us to meet our colleagues in person. This approach is one that is well suited to our needs and our work requirements, and could be one that we keep using indefinitely. Being a small company however, we have the luxury of flexibility and are prepared to tweak our working habits, were this to be necessary.

At the end of June, Tony Yarrow, whom many of you know, retired, almost 30 years after founding Wise Investment from which Wise Funds started to emerge in 2004. His succession planning has been a few years in the making and, as a business, we think we are well prepared to manage this new phase. It has been an honour for all of us to work with Tony and to learn from him. Although he stopped his direct involvement in the management of our funds, he remains a significant investor and has joined the employee-ownership trust that owns Wise Funds Limited as an independent trustee. We thus look forward to continue working with him in his new capacity.

Finally, all is left is for me to thank, personally and on behalf of the Wise Funds team, all our investors for their ongoing support. Please feel free to contact us if you would like a meeting or have any questions.

Philip Matthews

Fund Manager

Wise Funds Limited

March 2022

TO LEARN MORE ABOUT THIS FUND , PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.