For Professional Clients Only

Wise Funds

Macro & Market Update

The war in Ukraine continued to be the main event of the month, driving sentiment and reassessment by market participants of their macro-economic views. While the conflict persisted throughout the month, talks between Ukraine and Russia hinted at times that a diplomatic and face-saving solution might be possible. This hope is what drove sharp rebounds across equity markets from the middle of the month. The Vix index is an easy representation of this shift in sentiment. The index uses prices in options markets to derive expectations for future volatility. Because volatility is usually synonymous with risk and fear, it is often known as the “fear gauge” and is widely followed by investors. When Russia invaded Ukraine, the index moved sharply to a level only seen in the top 5% of cases over the past 30 years. By the end of March, that level was back down to its long-term average. It is too early to say whether this benign picture painted by market participants is justified or not (at the time of writing, combat continues despite the encouraging talks mentioned above), but it explains why so-called risk assets performed well. In this very fluid environment, however, further volatility has to be expected.

Commodities markets also continued their march higher. One certainty from the war is that inflationary pressures will remain, driven by already tight supply chains, and even more strained now on the back of sanctions and a global scramble to diversify one’s sources of raw materials. Those pressures translated into inflation numbers at or above 6% in the EU and the UK, and close to 8% in the US, forcing central banks to react. As such, the US central bank raised rates, stating that the strength of the economy justifies a hike and hinting at more to come. The market is expecting those hikes to continue. Similarly, the Bank of England raised rates for the third time in three meetings, up to 0.75%. In parallel though, the Chancellor was forced to address some of the cost of living squeeze in his Spring Statement. The EU central bank is in a less obvious position because, although inflation is biting in the region too, it is the most likely to suffer a profound hit to growth if the conflict persists and sanctions on Russian energy imports escalate. As such, the European Central Bank stayed put for the time being, but bond markets expect it will eventually be forced to hike rates as well. Inflation and higher rates are a dreadful combination for bonds and those recorded one of their worst quarters on record in Q1 as a result.

Fund Performance

Wise Multi-Asset Growth

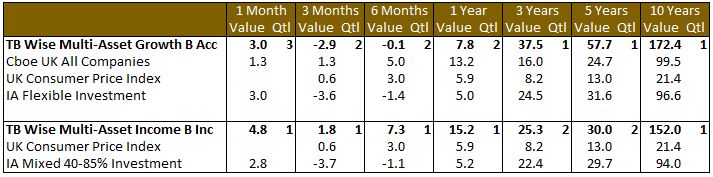

In March, the TB Wise Multi-Asset Growth fund was up 3%, ahead of the CBOE UK All Companies Index (+1.3%) and in line with the IA Flexible Investment sector (+3%). For the quarter, the fund is down 2.9%. Our top contributors for the month include a mixture of defensive assets (Ecofin Global Utilities & Infrastructure Trust, Jupiter Gold & Silver, BlackRock World Mining Trust) and recovering oversold positions (Oakley Capital Investments, AVI Global Trust). This combination illustrates how febrile sentiment still is and how important it is not to overreact to price movements in the current environment. For example, Oakley Capital Investments, a private equity trust that last provided an update on its underlying portfolio’s valuations in January and has no direct exposure to Russia while providing good inflation protection oscillated between a discount of 19% pre-Russian invasion and 31% in the middle of March. By month-end, it had recovered to 21% discount. Those moves are purely sentiment as opposed to fundamentals-driven.

We think our worst detractor, TwentyFour Income Fund, was similarly impacted when it suffered from a widening of its discount. Being mainly exposed to mortgages, which have a track record of resilience in times of stress (mortgage repayments are usually the last payments consumers are prepared to miss), and to floating rates, thus protected from inflation and higher rates, we think the trust was unjustifiably sold in sympathy with the rest of the bond market. Another noticeable detractor was the Fidelity China Special Situations Trust which suffered from a weak and volatile Chinese market. China is still, officially, adopting a zero-Covid policy which had to be abandoned in Hong Kong due to the sharp rise in cases, but led to another set of lockdowns in Shenzhen and Shanghai, impacting global supply chains and consumption. That policy is increasingly at odds with the rest of the world and it is hard to see how the government will manage to extricate the country from it. The poor market reaction to those lockdowns forced the government to verbally intervene and to commit to introducing policies that are favourable to the market. What those policies are remains to be seen. Due to the uncertainty in the country and despite being a large detractor last month, our position has been kept small.

Wise Multi-Asset Income

In March, the TB Wise Multi-Asset Income Fund rose 4.8%. Our equity funds performed strongly as their asset values rebounded in line with global equity markets and certain investment trust discounts returned to a more normal level compared to stressed levels at the end of the previous month. Middlefield Canadian Income was our strongest equity fund performer as its underlying net asset value benefitted from its exposure to energy markets and financials. Murray International, Schroder Global Equity, Abrdn Asian Income and CC Japan Income & Growth also enjoyed strong performance. A number of funds with exposure to commodity prices held within the portfolio also performed strongly. Blackrock World Mining rose strongly, boosted by higher commodity prices on the back of Russian sanctions. JLEN Environmental, Ecofin Global Utilities and Infrastructure and GCP infrastructure all rose reflecting an expectation that power prices would be supported by higher gas prices. Our property and certain financials holdings rose from over-sold levels at the end of the previous month. Both Palace Capital and Impact Healthcare REIT provided positive trading updates and two takeovers of commercial property REITs in the month further supported the sector. Provident Financial, Chesnara and BMO Private Equity also updated the market in the period announcing positive full year results. Against the negative backdrop for bonds, it is unsurprising that our fixed income allocation was the only sector that delivered negative returns over the month. Primarily this was due to the Twenty Four Income Fund moving to a 5% discount rather than a significant fall in its net asset value (NAV). The fund’s exposure to asset backed securities, such as mortgages, provides protection against the negative impact of inflation as coupons are linked to movements in interest rates and supported NAV performance over the month.

Past performance is not a guide to future performance

** As of the 8th April 2022, the TB Wise Multi-Asset Income Fund moved into the IA Mixed 40-85% Investment Sector. To learn more about this change, please click here

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, after waiting patiently in February for sentiment to settle down, we prudently put some money back to work in the first half of the month, in various stages. Firstly, we topped up some more defensive names at attractive valuations (TwentyFour Income Fund, GCP Infrastructure Investments, Worldwide Healthcare Trust) and, progressively, moved closer to the epicentre of the panic by adding to riskier positions (Polar Capital Global Financials Trust, Aberforth Smaller Companies Trust, European Smaller Companies Trust, Templeton Emerging Markets Trust). All of those purchases were small in size and financed from cash although, thanks to inflows, our cash levels remained relatively unchanged through the month. As sentiment improved later in the month, we have kept our trading activity on hold, keeping the portfolio balanced and on the look-out for the next opportunities.

Wise Multi-Asset Income

We initiated a holding in Blackrock Energy and Resources over the month funded through a reduction in our holding in Blackrock World Mining and Temple Bar. This marginally increases the fund’s exposure to Energy whilst reducing some of its more consumer cyclical value exposure. We switched our holding in Natwest Group into Paragon during a period of relative price weakness. As markets fell, we took advantage of downside moves to add to our holdings in International Biotechnology Trust, Polar Capital Global Financials and Standard Life Investments Property Income. These purchases were funded by a reduction in Henry Boot and Urban Logistics, both of which have performed well.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.