For Professional Clients Only

Macro & Market Update

The US Federal Reserve voted to keep interest rates unchanged whilst the accompanying commentary and a subsequent interview with its chair, Jerome Powell, were designed to reign in market hopes of imminent cuts to come. With markets having entered the year expecting interest rate cuts of c.1.5% over the course of the year, starting as early as March, the central bank’s view that it is not yet appropriate to reduce rates until inflation has obviously been tamed was seen as disappointing for bondholders. Powell explicitly stated that a March rate cut was not the Fed’s base case whilst also tempering expectations for the quantum of rate cuts to come. Subsequent strong jobs data coupled by news that inflation had fallen less than hoped and survey data showing the services component of the economy was performing more strongly than expected all served to dampen investor optimism further. Eurozone inflation slowed to 2.8 per cent in January, but the decline in underlying price measures was also less than economists expected after stripping out more volatile energy and food costs. Closer to home, the Bank of England kept interest rates steady, similarly stating that more evidence was necessary that inflation will fall all the way to its 2% target before rates could be cut. With service price inflation still high and the negative contribution of falling energy prices set to fade in coming months, the BoE could not yet declare that “the job is done”. There were some grounds for optimism, however, as weak GDP data suggested higher interest rates are having the desired effect and have cooled economic growth. Headline inflation itself remained steady at 4%, which, although higher than target, undershot forecasts unlike in the US and Eurozone. Whereas Western Economies have been battling with elevated levels of inflation, China has recently fallen into deflation. China’s consumer prices fell at the fastest rate in 15 years in January, missing analysts’ forecasts and underlining the challenges for policymakers trying to revive investor confidence in the world’s second-largest economy. The country’s consumer price index fell 0.8% year on year in January, the fourth straight month of declines. The fall, which was steeper than the expected drop of 0.5%, comes as China’s economy contends with an extended property market decline as well as weak manufacturing and export demand.

As was the case in January, bond markets were weak as investors further pushed back the timing of expected interest rate cuts. This month, however, there was a notable divergence in the performance of bonds and equities. While the prospect of higher interest rates in recent months has been accompanied by weaker equity markets, this was not uniformly the case last month. US equity markets extended their recent strong performance driven higher by technology names, such as Nvidia (Artificial Intelligence semiconductors), Meta (Facebook) and Amazon, as did Japan whose equity market is finally regaining the all-time high it last reached in 1984. Emerging markets benefitted from a rebound in China where expectations have grown that the authorities will increase stimulus to support the economy and financial markets. By contrast, UK equity markets lagged, particularly more interest-rate, economically sensitive small and mid-sized companies. Finally, commodity markets were mixed with stronger oil markets offset by weak performance from mining companies who face uncertain Chinese demand and higher costs.

Fund Performance

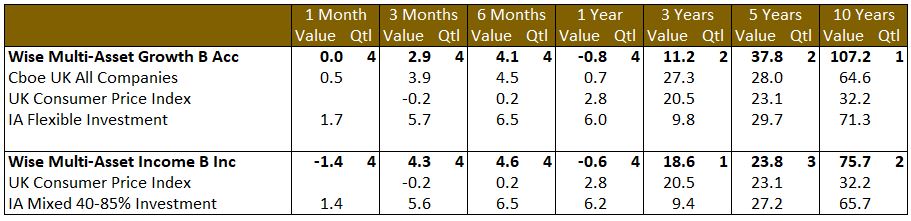

Wise Multi-Asset Growth

In February, the WS Wise Multi-Asset Growth fund was flat, behind both the CBOE UK All Companies Index (+0.5%) and its peer group, the IA Flexible Investment Sector (+1.7%). Despite good performance elsewhere, conditions remained challenging in UK listed securities and investment trusts, in particular. This impacted our Fund’s overall performance with discounts on our investment trusts widening or remaining wide. The sector is currently facing headwinds from continued outflows in UK equities, higher interest rates making some income-oriented strategies less appealing, competition from strong performers, such as US equities, and a regulatory regime forcing a double-counting of fees, which, although being actively reviewed by the government and regulators, is yet to be corrected and thus remains unhelpful. It is encouraging, however, to see a sharp step up in activity from boards to address some of investors’ most pressing concerns in investment trusts, such as sub-optimal trust sizes or abnormally wide discounts. As a result, corporate activity is increasing via mergers, acquisitions or share buybacks which will, ultimately, strengthen the sector and leave it in a position to continue to offer a unique and desirable structure for retail investors looking to access less liquid asset classes and strategies.

One such transaction in our Fund last month was the acquisition of Arix Bioscience by RTW Biotech Opportunities (added to our portfolio last spring). The Arix’s portfolio comprised of 45% in cash with the rest invested in biotechnology companies complementary to the RTW portfolio. It suffered from idiosyncratic issues leading its shares to trade at a wide discount and its shareholders to look for a way to realise some of the embedded value in the trust. The acquisition by RTW, approved by shareholders in February, allows RTW to access quality assets as well as cash it can readily deploy into a very attractively valued sector. It also gave the trust immediate scale (from ~£280m market capitalisation on the announcement of the deal to £412m at the end of February) which is critical in order to attract new investors and help reduce the discount of ~30%. Given some complexities in the proposed deal, we had waited for completion before adding to our position but did so on a dip mid-month after confirmation of the vote. This deal is a good illustration of the opportunities thrown up by the current difficult market conditions within the investment trust sector. We are confident that these sorts of opportunities will reward patient investors.

Wise Multi-Asset Income

In February, the WS Wise Multi-Asset Income Fund fell 1.4%, behind the IA Mixed Investment 40-85% Sector, which rose 1.4%. February marks the financial year end for the fund at which point the historic yield on the fund sits at 5.4%.

Within our equity allocation, our lack of exposure to non-income producing, highly rated technology companies impacted relative performance. Whilst abrdn Asian Income, International Biotechnology Trust, Blackrock Frontiers and Polar Capital Financials performed strongly, our value equity funds (Middlefield Canadian and Schroder Global Equity Income) lagged as did our UK-focussed funds, notably Aberforth Smaller Companies and Fidelity Special Values. There is, however, some cause for optimism as part of the underperformance in each case came from investment trust discount widening whilst the attractiveness of cheap UK equity markets is being reflected in increased numbers of corporate takeovers. As an example, Aberforth’s largest holding, Wincanton, was subject to a competing bid over the month and rose a further 44%, having risen 39% the previous month on the initial approach. Property and Infrastructure are two sectors whose performance is most sensitive to shifting investor expectations around interest rates. Whilst higher rates have a negative impact on valuations, we believe the high discounts already factored in by markets to current asset values provide investors with a significant protective cushion and share prices have become disconnected from the prices at which these assets can be realised in the open market. Over the month, these two sectors again negatively contributed to performance, however, there were notable attempts by the companies themselves to demonstrate the value that fails to be recognised by the market. Within the property sector, arbdn Property Income was subject to a second takeover proposal, this time from another holding within the portfolio, Urban Logistics. We have engaged with the board asking them to consider any merger proposal against the alternative of a managed wind-down of the company. Clearly others see the attractions of the underlying property portfolio and we believe an orderly sale of the underlying holdings (predominantly within the popular industrials sector) could lead to cash proceeds closer to net asset value being realised. Within the core infrastructure sector, HICL Infrastructure announced the disposal of one of its largest holdings, a US toll-road, at a 30% premium to its latest carrying value. This compares to the shares which traded at 24% discount. Having realised proceeds of over £500m at a premium to book value over the last 12 months to prove up the portfolio value, the company has now paid back in full its debt facility and will embark on a £50m buy back of shares.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

Other than the addition to RTW above, we also added to Ecofin Global Utilities and Infrastructure which saw its discount widen again to 20%, unjustified in our view for a portfolio of listed equities in defensive sectors such as utilities, infrastructure and transportation. Those purchases were financed by taking small profits in a number of names such as BlackRock Frontiers, Mobius Investment Trust, GLG Undervalued Assets, Pantheon International, TwentyFour Income, European Smaller Companies, Oakley Capital and AVI Global Trust. We also took some profits, at the end of February, in International Biotechnology Trust which, like RTW Biotech Opportunities, has started to benefit from the recovery in the biotechnology sector we have positioned for over the last few months. That recovery is only nascent though and the trust’s discount remains too wide, so this trim is not a reflection of a change in conviction but rather of our risk management discipline.

Wise Multi-Asset Income

Over the month, we exited our holding in Blackrock Frontiers, which has performed strongly. We trimmed certain property holdings (TR Property and Urban Logistics) which have performed relatively strongly and which we had added to at lower levels last year. Conversely, we added to HICL where the yield on the portfolio of defensive, critical infrastructure assets looks highly attractive.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the WS Wise Funds, including risk warnings, are published in the WS Wise Funds Prospectus, the WS Wise Supplementary Information Document (SID) and the WS Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds. The WS Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years could be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. Waystone Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.