For Professional Clients Only

Macro & Market Update

Without too much surprise given how strongly they had performed into the end of 2023, so-called risk assets (equities, bonds, property…) took a pause for breath to start 2024. We expressed caution last month that the sharp repricing of interest rates expectations for the months ahead, based on the view that interest rates had peaked and would be cut aggressively as soon as in March in the US, was probably over-optimistic. Investors spent January revisiting their views as data and central banks officials dampened the case for immediate financial support via interest rates cuts. On the data front, the main disappointment was a re-acceleration in inflation across the US, the UK and the Eurozone. Those rises were marginal and not entirely unexpected since inflation can be notoriously volatile, but they weakened the argument that central bankers had finished the job and could soon claim victory in their fight against inflation. The other side of the economic coin, growth, meanwhile continued to show resilience, as illustrated by another set of consensus-beating employment data in the US. A silver lining, however, is that wage growth on both sides of the Atlantic is weakening, albeit slowly. As one of the stickiest components of inflation and one of the hardest to control without a rise in unemployment, this is good news that the downward trend in inflationary pressures may still be intact, despite month-on-month volatility.

Another factor leading to the cooldown of the previous months exuberance in financial markets were central banks officials reiterating throughout the month that they remain data dependent and that it was too early to consider rate cuts. Sadly, be it by the nature of their notoriously difficult jobs or by design, central bankers too often put a message out only to spend the next few weeks before the next interest rate decision meeting tweaking that message in the face of “misinterpretations” from market participants. This is what US officials did in January, culminating in the press conference from Jay Powell, the chair of the US Central Bank, on the last day of the month where he officially changed his tune and indicated that “greater confidence” that inflation will come down was necessary before considering rate cuts and that their base case was that those are not on the table for Spring. As we have lamented in the past, financial markets thus continue to move from one datapoint or one central bank meeting to the next for guidance and this is unlikely to change until interest rates cuts become a reality.

This backdrop led to asset returns generally in the red for January. Bond yields (which move inversely to price and had fallen dramatically at the end of 2023 to reflect expectations that rates would be cut quickly and aggressively) moved higher, i.e. bond prices fell. This also led to weaker equity markets, which react negatively to tight financial conditions. In Western markets, US equities were the exception and printed a new all-time high helped, once again by some large technology-related companies. US equities performance weakened at the end of the month after the central bank meeting, however, and they recorded their worst day in 4 months. It is also notable that the group of 7 companies that have led US equities to records for months (Alphabet (Google), Amazon, Apple, Meta (Facebook), Nvidia, Tesla and Microsoft, so called the “Magnificent Seven”) may be starting to show disparities in performance, suggesting that a more active investment management style might finally be required. Chinese equities continued to be weak as economic data remain poor in the country and, despite some hype from the government, measures announced to boost financial markets disappointed.

Fund Performance

Wise Multi-Asset Growth

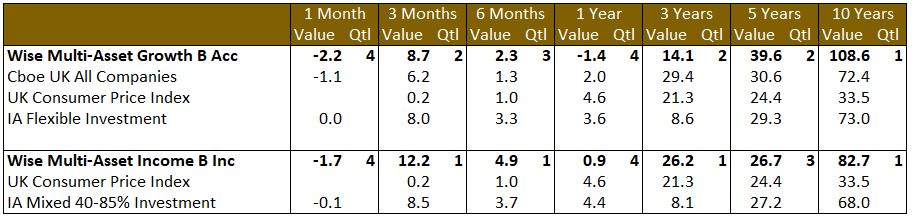

In January, the WS Wise Multi-Asset Growth fell 2.2%, behind both the CBOE UK All Companies Index (-1.1%) and its peer group, the IA Flexible Investment Sector (flat). The weakness in Chinese equities hurt emerging markets in general and our position in China Special Situations in particular. It is worth reminding here that we have not added to our position over the past year and believe that its current weight of 1.6% is appropriate given the ongoing uncertainty in the country. That said, on the ground, innovation is accelerating, and consumers have record savings, so we can see strong future returns were consumer sentiment to improve and the political risk to abate, especially given the cheap valuations currently. This is why we continue to hold onto that exposure. Meanwhile, unfortunately, poor Chinese demand also affected the mining sector and thus BlackRock World Mining. The repricing of interest rates higher affected our infrastructure names, mostly Ecofin Global Utilities and Infrastructure, despite its defensiveness and embedded inflation protection. Finally, gold miners also had a difficult month, hurting the Jupiter Gold & Silver Fund.

On the positive side, our healthcare names kept on delivering good returns, as did AVI Global, helped by a tightening of its discount.

Wise Multi-Asset Income

In January, the WS Wise Multi-Asset Income Fund fell 1.7%, behind the IA Mixed Investment 40-85% Sector, which fell 0.1%. The sectors which have performed strongly in the prior two months for the fund were the ones that detracted most from performance. In particular, our core infrastructure and property names gave back some of their recent strong performance, reflecting the expectation that UK rates would stay higher for longer. Discounts at both HICL and International Public Partnerships moved to highly attractive levels despite the latter commencing its recently announced share buy back programme. Having sold assets above book value and repaid its debt facility, the board has decided to buy back shares in an attempt to narrow the discount and in the belief the share price materially undervalues the company. Whilst property share prices have fallen over the month, announcements from our holdings continue to demonstrate that the real estate market is showing resilience from an occupational perspective combined with strong rental growth. Impact Healthcare REIT announced a 13% increase in contracted rent as well as improving tenant profitability to cover those rents, driven by better occupancy in their care homes. This increases the sustainability of its growing 8% dividend yield. Urban Logistics continues to see demand for space outstrip supply within the industrials sector whilst Helical announced positive asset management progress with several significant lettings above expected levels in the London office market. As long as deep discounts to net asset values and high implied yields on the underlying property assets persist within the sector, we expect to see boards within the sector put under increasing pressure either to realise assets, reduced leverage, buy back shares or consolidate. It was unsurprising, therefore, to see Abrdn Property Income subject to a merger proposal from Custodian REIT, which we support. This was done at an attractive implied premium to the prevailing share price, increases the dividend whilst improving the dividend cover, and improves liquidity for shareholders. Reflecting the broader weakness in smaller companies and China-exposed holdings, Blackrock World Mining, Blackrock Energy and Resources, Aberforth Smaller Companies, Abrdn Asian Income, Man GLG Income and Murray International fell over the month. Despite a negative bond market backdrop, our fixed income holdings performed well, helped in part by the floating rate nature of their holdings which provide protection against higher rates as well as strong demand for asset backed securities (such as mortgages) from investors. Despite the broader ‘risk-off’ environment, our financials holdings were also resilient. Paragon announced a positive first quarter trading with margins running ahead of expectations and a buy-to-let lending pipeline comfortably ahead of the 2023 year end level.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

Like at the end of last year, we continued to take some profits in our strongest performers at the start of the month, raising cash and rotating into laggards. We thus reduced AVI Global, AVI Japan Opportunity, Oakley Capital Investments, Pantheon International, TR Property, TwentyFour Income Fund and JO Hambro UK Equity Income. We rotated some of those proceeds into BlackRock World Mining and Polar Capital Global Financials. We also finished exiting our position in Baker Steel Resources Trust, a mostly private early-stage mining trust which performed phenomenally well in the 5 years to 2021 but has struggled since as capital for mining developments has dried out. The trust has become too small for us, so we had been trimming our position for the past few months.

Wise Multi-Asset Income

Given the strong finish to 2023, we reduced risk within the portfolio early in the month, taking profits in certain holdings which had performed most strongly and increasing the fund’s cash position. As such, we reduced our holdings in Paragon, TR Property, TwentyFour Income and Legal & General. As interest rate expectations reset, however, we took advantage of wider discounts to increase both core infrastructure holdings, HICL and International Public Partnerships, at attractive levels.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the WS Wise Funds, including risk warnings, are published in the WS Wise Funds Prospectus, the WS Wise Supplementary Information Document (SID) and the WS Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds. The WS Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years could be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. Waystone Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.