Performance statement

The IFSL Wise Multi-Asset Growth Fund returned 11.5% for the year to the end of February 2025, behind the CBOE UK All Companies Index (+18%) but ahead of its peer group, the IA Flexible Investment Sector (+9.7%).

Over the 5-year time horizon we consider sensible to look at our performance and as per our objective, the Fund is up 55%, in line with the CBOE UK All Companies Index (+55.1%) and ahead of the IA Flexible Investment Sector (+36.1%). The Fund sits in the top 14% of funds in the peer group over that time horizon, which is a pleasing outcome given the broad challenges thrown at investors during the period (Covid, wars, political changes, dominance of large technology companies, sharp shifts in interest rates, etc…) and the many headwinds faced by investment trusts (our main focus).

Market Review

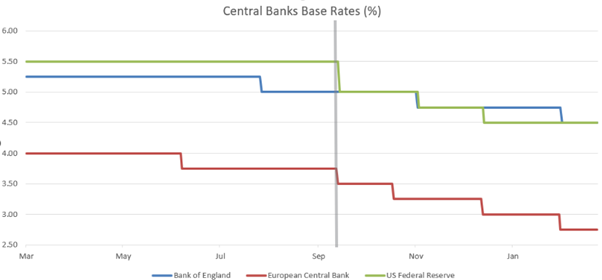

So-called risk assets (equities, bonds and commodities) reported solid headline numbers over the period although a difficult to read macro-economic environment was rendered even trickier by political developments during the year. Broadly speaking, the year was split in two halves of relatively equal lengths. The first half from March until September was dominated by improvement on the inflation front driven initially by lower energy prices before broadening out, combined with resilient growth indicators, particularly in the US. After the highest increase in interest rates since the Great Financial Crisis of 2007/09, the combination of inflation seemingly under control and supportive growth allowed central banks on both sides of the Atlantic to ease financial conditions. The European Central Bank (ECB) was the first one to cut rates in June, followed by the Bank of England (BOE) in August and by the Federal Reserve in the US (Fed) in September. Coming roughly a year after the last rate hike for this cycle in each of those regions and thus having been long awaited, the well-telegraphed loosening of the cost of money boosted investor sentiment in the first part of the year.

The second half of the year saw further interest rate cuts (another 4 by the ECB and 2 by both the BOE and the Fed) but at a disappointing pace for investors, so had more of a marginal impact on financial asset prices. From September onwards, sticky and increasing inflation forced central banks to slow down the pace of easing, while both economic and financial developments became dominated by the US presidential election and its aftermath. Ahead of the election in November, increasing expectations of a Trump victory raised inflation concerns given his pro-tariff and anti-immigration policies. Worries of a repeat of the 2019 election with close and contested results also kept investors on their toes. The clear Trump victory on November 6th provided relief and boosted equities into the new year, helped by the prospect of tax cuts and a pro-growth agenda. The period ended with investors coming to the realisation that Trump’s second mandate, boosted by a clear victory and surprisingly winning both Houses of Congress, was going to be much more assertive, autocratic and fast-moving than his first one. From his first few days in office, the “zone was flooded” by Trump-related news, pushing his America First agenda and leaving US allies such as Canada, Mexico or the EU scrambling to adapt to a world where the US is not only less supportive but, at times, outrightly antagonistic. Trade tariffs, retreat from global organisations such as the Paris Climate Agreement, the World Health Organisation or the North Atlantic Treaty Organisation (NATO), and a transactional approach to peace negotiations in Gaza and Ukraine make it difficult for counterparties of the US, central banks and investors to navigate and adjust. We thus ended the year with a high degree of uncertainty, a sharp drop in consumer confidence and what could turn out to be a change in market leadership.

US equities relative to the Rest of the World

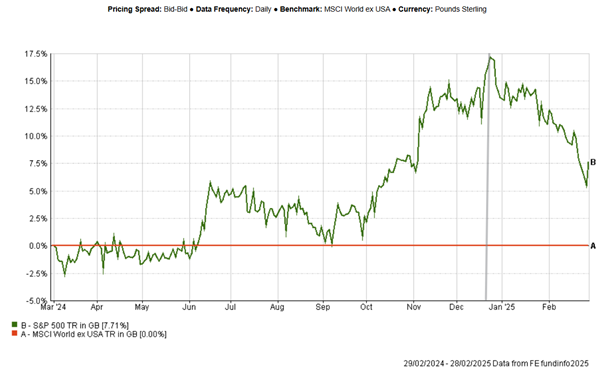

Looking at performance over the year, it is interesting to see UK equities outperforming the US, including the technology sector. Equally, after a strong end of the period, European and emerging markets equities compare well with their American competitors. Longer term, however, US equities remain the clear leader, but it is noticeable that they are showing some signs of fatigue with disappointing earnings and investors increasingly wary of overpaying for future promises while greater opportunities for more immediate value are available elsewhere. It is well known that US valuations are extended relative to their own history and, particularly, relative to the rest of the world. Concentration into a small number of very large technology companies also creates increasing risks for shareholders. While valuations themselves are never enough of a catalyst for timing a change in allocation, it is encouraging to see flows increasingly being directed into cheaper parts of the market and reflecting a possible change in the “US exceptionalism” mindset. Bonds, meanwhile, remained volatile, particularly government bonds driven by regular changes in interest rates expectations and concerns about levels of indebtedness in developed countries. Credit continues to provide solid returns, however, thanks for low default rates and attractive levels of yield (the interest paid by borrowing companies to investors in exchange for their money). Commodities were generally well supported, despite ongoing weakness in China, the world’s largest consumer. In a sign of general concerns bubbling under the surface though, gold, a traditional safe haven, was the strongest commodity for the year.

Fund Performance Review

The Fund delivered a return of 11.5% over the period, strong in absolute terms but behind the CBOE UK All Companies Index. As mentioned earlier, UK equities had a good year, helped by a broadening of performance globally away from US equities. The outlook for the UK equity market also improved, thanks to better economic resilience than anticipated, a more stable political landscape after the general election in July and attractive valuations. It thus started to show positive momentum after years of being ignored by investors. These factors seem to have finally started unlocking capital from companies and private equity funds to invest. As a result, M&A (Mergers and Acquisitions) deals in the UK were 37% higher in 2024 than in the previous year and, thanks to often very attractive premiums to the share price for listed target companies, equity investors started to take notice. Flows into UK equities remain negative after years of outflows but could easily turn from here on the back of strong performance and increasing appetite from private and trade buyers. Smaller companies, to which we have the most exposure, continued to lag, however, despite historically cheap valuations. The smaller companies index underperformed the large companies one in the UK by10% over the year, highlighting how much more upside there could be in that part of the market which traditionally exhibits higher growth and lower macroeconomic sensitivity.

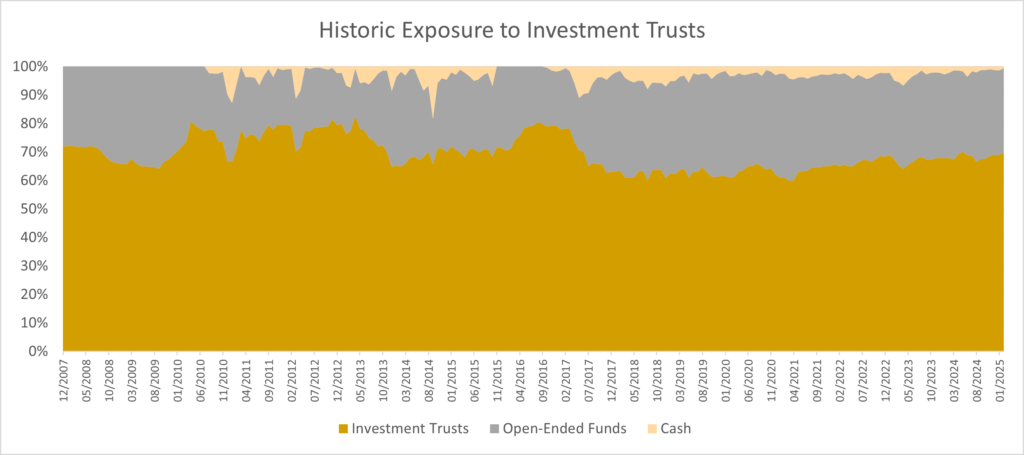

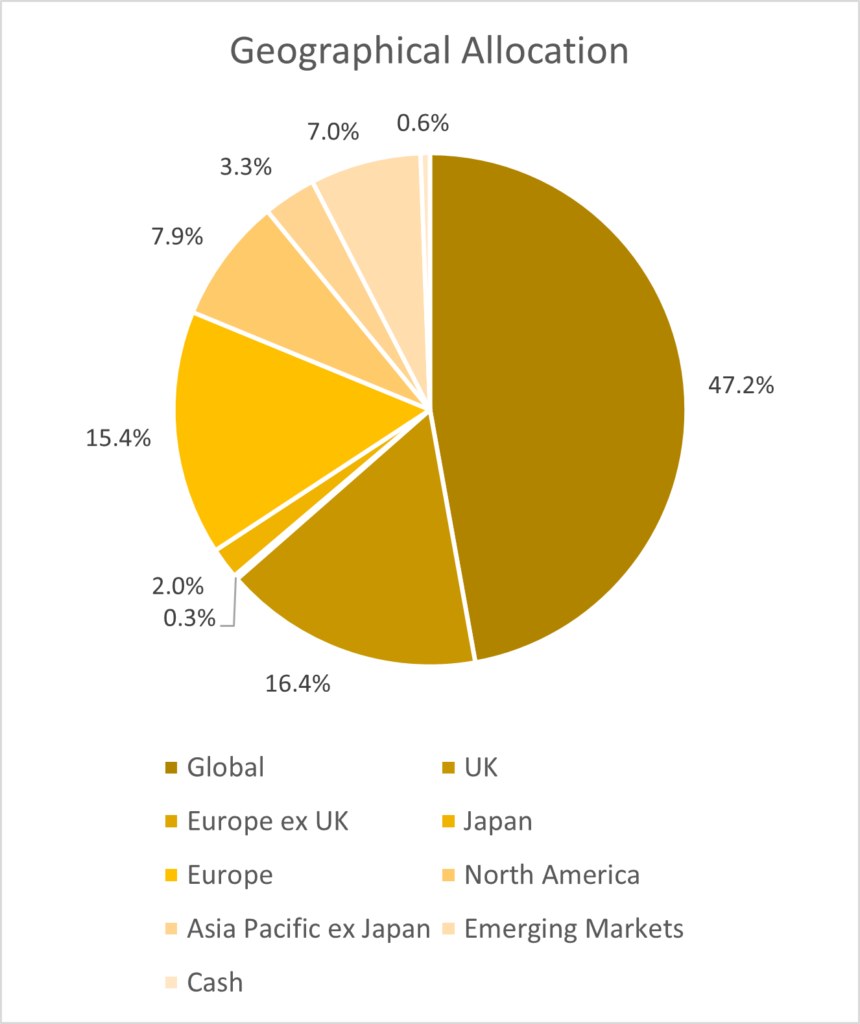

Our Fund is by no means a UK fund, although we have been attracted by the cheapness of UK equities for years and have had an average of 16% exposure to UK strategies for the period. Given the above comment about the underperformance of smaller companies relative to larger ones, it is no surprise that our best performers in that sector were managers investing across the market capitalization spectrum, namely Fidelity Special Values, JO Hambro UK Equity Income and Man Undervalued Assets. Our smaller companies managers found it more difficult, particularly Odyssean Investment Trust which, after a few years of strong performance suffered from stock specific issues in its concentrated portfolio. Similarly, because only a handful of them are part of the large companies index, investment trusts in general continued to face headwinds. Given that they represent 70% of our allocation, the difficulties faced by the sector over the past couple of years have hindered our performance. We mentioned those headwinds in the past but, as a reminder, the sector suffered a sustained widening of average discounts due to the combination of outflows from UK-listed equities, consolidation in the wealth manager sector limiting the number of potential buyers, repricing of alternative income strategies (such as infrastructure and property) due to higher interest rates, and changes to the cost disclosure rules. As a result, the average discount in the sector widened significantly over the past 4 years and, despite some improvement since its worst historical level in October 2023, stagnated over the reporting period at ~15%. We believe a lot of those discounts are too wide and, as such, the average discount of the investment trusts we hold in our Fund reflected the same picture, having started the year at 16.1% and ended at 14.7%, only a minor improvement and still 3 percentage points wider than the average since 2017. The last time our average discount was in single digit was more than 2.5 years ago. At his tightest, in November 2021, it was at 6% showing how distorted valuations currently are. We are hopeful, however, that we may be close to the point where such extreme valuations create their own catalyst with public as well as private investors sensing investment opportunities and boards taking interesting measures. Under pressure from shareholders, there was a record number of corporate actions in the sector in 2024. These included share buybacks (sending a strong message that the managers themselves believe their own funds offer great value), reductions in fees, mergers (in order to achieve critical size and remain relevant for larger shareholders), liquidations (when shareholders voted that the trust is no longer viable) and strategic reviews (when the board reviews various options for the trust). All these measures are the result of greater engagement between shareholders and boards, thus resulting in improved corporate governance. These decisions are not always proposed willingly by boards though and the arrival of activist investors in the investment trusts scene (including from overseas) also helped focus boards’ attention and address the root causes of wide discounts in their trusts. While a painful process to go through which will lead to a shrunken investment trust sector, we believe that it will make the sector stronger and better able to revert to the strength it has displayed for the past 150 years in the years to come. We thus believe that we are close to the point where investors take notice of the positive action in the sector in addition to the extreme valuations and start showing interest again.

Despite our large allocation to investment trusts and the general headwind faced by the sector, in addition to the UK funds mentioned earlier, it is encouraging to see how varied our list of contributors is, highlighting the benefits of diversification. Our top contributor was the Jupiter Gold & Silver Fund, up more than 70% during the year. Supported by ongoing purchases from central banks looking to diversify their assets away from the US dollar as well as by its safe haven status in an uncertain geopolitical world, gold returned 37% over the period setting a new all-time high. Meanwhile, the Jupiter fund, by investing in gold and silver mining companies, almost doubled the return of the precious metal. Mining companies are always an amplified play on the underlying metals, but this is particularly true in precious metals where the scarcity of investable companies made the movement even starker. This holding proved its worth as a defensive asset in our portfolio during the volatile times experienced in the period. Thanks to valuations that remain attractive in a sector that is highly profitable and likely to see increased M&A, it is also a position we are happy to hold on a standalone basis.

Other strong contributors were our infrastructure names, namely Ecofin Global Utilities and Infrastructure and the Premier Miton Global Infrastructure Income Fund. After a difficult period last year where the sector traded in lockstep with long-term bonds (which struggled in a rising interest rates environment), these holdings started performing in 2024 thanks to the perceived peak in interest rates (utilities are often seen as an income play and thus “compete” with other income assets like bonds), but also thanks to being seen as an indirect play on the growth in Artificial Intelligence (AI). The explosion in AI resources requirements is having a significant impact on electricity demand for data centres. The companies involved are increasingly wanting to use renewable sources of energy to meet that demand but need a reliable source, independent of whether the sun shines or the wind blows. This benefitted some nuclear energy holdings in both funds as nuclear is increasingly accepted as a necessary stepping stone in the transition from fossil fuel to clean energy. The strong net asset value (NAV) performance combined with better general sentiment from investors attracted more demand for the Ecofin trust which had been trading at extreme valuations and saw its discount narrow from ~20% to ~10% over the period. Delivering overall returns of 31%, this is a good illustration of how powerful the combination of strong NAV and discount tightening can be, one that we think can be replicated with many of the trusts in the portfolio.

Lastly, we also had strong contributions from Japan (AVI Japan Opportunities) where the theme of improving corporate governance has gathered pace and is paying off, as well as from China (Fidelity China Special Situations) where multiple rounds of stimulus from the government to tackle its property market crisis combined with developments in AI led to a regain of interest from global investors. On the more defensive side, our position in the TwentyFour Income Fund which invests in credit positions backed by collaterals such as mortgages also performed well, thanks to an attractive yield of 11% at the end of the period.

Portfolio activity

Given some of the sharp discrepancies observed in asset performances over the reporting period, we were active in recycling the portfolio in order to tilt it towards the more attractive opportunities. At the sector level, one such opportunity remains in biotechnology, an area we have increasingly been focusing on for the past couple of year. After a post-Covid “hangover” where the sector struggled to attract new capital due to a lack of interest from investors and increased financial difficulties caused by higher interest rates, the sector started showing early signs of a revival with a rebound in acquisitions, a tentative return of IPOs (a means to raise capital via public markets) and exciting new innovations. Given the sensitivity of the sector to changes in the political landscape, these early shoots paused ahead of the US election (where most of the biotechnology companies are listed). Trump victory and the appointment of Robert F. Kennedy Jr., a controversial figure with past anti-vaccine views, as the Secretary of Health and Human Services created renewed uncertainty towards the end of the period. We remain confident, however, that the new administration, like during Trump’s first term, will see merits in supporting innovation in the sector as a means of bringing overall drug costs down. It is also more likely to be supportive of M&A which should be an additional driver for performance due to most large pharmaceutical companies being in dire need of replenishing their stock of patents ahead of upcoming expiries. With very attractive valuations, we increased our allocation to all three of our holdings, Worldwide Healthcare Trust, International Biotechnology Trust and RTW Biotech Opportunities during the period, all of which trading on abnormally wide discounts on top of cheap NAV. The sector represents more than 12% of the portfolio at the end of the period.

Our weighting to utilities and infrastructure also increased as we are attracted to the defensiveness and predictability of the underlying assets in the sector, as well the cheap valuations after a difficult period last year. As mentioned earlier though, those assets are not purely defensive but also offer a direct play on the energy transition and an indirect play on the rise of AI. These are the types of positions we favour where we can participate in an attractive theme without getting caught in the hype and overpaying for the privilege.

We added a higher than usual number of new positions over the period. The first one was Schroder Emerging Markets Value Fund, an emerging markets equity strategy managed by the same value team which manages the Schroder Global Recovery Fund that we already own. We know the team’s process well and think that their approach should deliver positive and differentiated returns when applied to emerging markets. We also instigated a new position in the Premier Miton Strategic Monthly Income Bond Fund, a differentiated, high quality corporate bond fund where sensitivity to interest rates is kept minimal and trading is active as opposed to the buy-and-hold strategies of many other competitors. Around the US election in November, we added two new positions in misunderstood investment trusts which should eventually see their strong returns in Net Asset Value (NAV) complemented by a tightening of their wide discounts. Firstly, Pershing Square, a concentrated portfolio of quality, predictable and attractively valued large US companies trading at 35% discount despite an exceptional 21-year track record. The idiosyncratic drivers of the portfolio, away from the expensive technology companies driving the US market, and the wide discount created an interesting means of adding to our US equity exposure with some margin of safety. The second new position at that time was RIT Capital Partners, a portfolio of global public and private companies combined with some downside protection strategies. The trust suffered in the past from a lack of transparency and concerns about valuations of its private portfolio, but we believe changes in management over recent months should reassure investors and lead to a normalisation of the discount to reflect the consistent NAV performance. Finally, at the end of the period, we added a new position in the newly launched Achilles Investment Company. This small investment trust (£54m) will target other investment trusts in the alternatives space (property, infrastructure, private equity) which trade at wide discounts and where an activist strategy could help maximise value for shareholders. The managers are well known in the industry and to us, being part of a joint venture with Odyssean Capital we own. We believe that Achilles’ approach of working alongside existing investors to realise value in a small number of investment trusts without a hidden agenda should benefit our shareholders. They have proven the worth of the strategy in a few high-profile cases in the past couple of years and we trust they can replicate previous successes in this new vehicle. Their approach is well-aligned with our view that many discounts in the sector are too wide and ripe for tightening through corporate action.

Those new additions were financed by taking some profit in some strong performing areas such as the UK equity names mentioned in our top contributors (JO Hambro UK Equity Income was exited fully), our position in the Jupiter Gold & Silver Fund, as well as in the Polar Global Financials Trust, up by a third during the year. We exited another four positions fully during the period. The first one is the VPC Specialty Lending Investments trust. The trust is in wind-down and although the board of the trust is committed to returning capital to shareholders as soon as practical, which should help narrow the discount again, we believe that this process will take some time given the illiquidity of its investments, thus presenting a big opportunity cost if we wait for the cash to be returned to us. We then exited two holdings in emerging markets, starting with BlackRock Frontiers Investment Trust, a trust investing in smaller emerging markets which had performed strongly over the past few years and had become a small position after a few rounds of profit taking. The second one, the KLS Corinium Emerging Markets Fund, was regrettably closed by its manager. Finally, we closed our position in the Fulcrum Diversified Core Absolute Return Fund, which performed well for us as an absolute return strategy, but we think there are better return opportunities in the positions we added or increased, with limited risk given the current valuations.

Investment Outlook

Prior to the US election, we were picking up signs that the leadership of financial markets was being challenged (for example with large technology companies prone to disappointment) and that some vulnerabilities were starting to appear. Donald Trump victory and his America First agenda initially restarted the US equities engine but, as it became clear towards the end of the period that Trump 2.0 will lead to much greater uncertainty economically and geopolitically than Trump 1.0, this US exceptionalism trade is being questioned again. It is worth remembering that, despite the US offering probably the strongest ecosystem for growth and innovation in the world, the strong outperformance of US equities versus other markets is a relatively new phenomenon over the past decade or so, fuelled primarily by the success of technology companies and compounded by incessant flows into passive strategies which push winners to ever greater heights. This phenomenon is not inexorable, however, and could get into reverse if earnings disappoint and/or uncertainty takes hold. We are thus content to stay away from expensively valued consensus parts of the market, especially because opportunities to access attractive growth potential with substantial margins of safety abound under the surface. This is true at the asset class level (specialist healthcare, UK smaller companies, European equities, private equity for example) and even more so when using investment trusts to access those. The past couple of years have been gruelling for the sector but we are now at the stage where, if things do not improve by themselves, market forces and corporate actions will force a return to a more normalised situation. We are thus optimistic about the prospect for our future returns. As always though, the road ahead will undoubtedly be bumpy at times but the diversification within our portfolio should act as a shock absorber.

I would like to take this opportunity to thank our investors for their ongoing support. The whole Wise Funds team is at your disposal should you have any questions or would like to talk to us.

Vincent Ropers

Fund Manager

Wise Funds Limited

March 2025

TO LEARN MORE ABOUT THIS FUND , PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.

This presentation is for Professional Clients only and not for re-distribution.

All data is sourced by Wise Funds and any third party data is detailed on the specific page.