For Professional Clients Only

Macro & Market Update

February was marked by the unpredictable nature of President Trump’s approach to politics, most notably when it came to the proposed application of tariffs as well as to his foreign policy interventions in the Middle East and Ukraine. Investors must decipher which of the many policy statements emanating from the White House are real and likely to be implemented and which represent a starting negotiating position from which to draw concessions from the other side. With regards to tariffs, the month started with the threat of blanket 25% tariffs against Canada and Mexico as well as 10% tariffs on all Chinese imported goods. In the case of the two US neighbours, the implementation of the proposed tariffs was delayed after both countries committed to enhancing their border security measures to address US concerns regarding illegal immigration and drug trafficking. However, this has proved to be only a temporary reprieve with the original tariffs being imposed at the start of March. As was the case with China, both countries have promised to respond with tariffs of their own thus threatening an escalation towards a tit-for-tat trade war. Although Europe has so far avoided any tariffs, plans have recently been announced to impose similar 25% tariffs with the indication these would be applied broadly. Whilst specific tariffs on the export of aluminium and steel also imposed in the month affect the UK, thus far the country has managed to avoid anything more draconian and a meeting between Trump and Kier Starmer even threw up the possibility of a trade deal being signed. Such policies are likely to slow global growth and increase inflation and signs emerged in February that these actions could compound existing trends affecting the US economy. Over the month, data pointed to the US economy growing slightly slower than previously expected whilst inflation was higher than forecast. Consumer confidence has slipped and housing sales have fallen, both of which point to a level of caution in the face of political uncertainty. In the UK, interest rates were cut by the Bank of England by 0.25%, as expected, however the accompanying halving of the estimated growth rate for the UK economy for this year and the expectation that inflation would rise to 3.7% in Q3 and only fall back to the 2% target by 2027 highlight the fiscal difficulties facing the Chancellor, particularly as pressure grows to increase defence spending. Attempts by Trump to bring about peace in the Middle East and Ukraine proved equally clumsy, with the vision of a Middle Eastern Riviera and withdrawal of US support for Ukraine leaving investors unsure of which traditional post-War alliances can be relied upon. The clear conclusion drawn, however, is that European defence spending will have to increase.

The shift away from the recent market winners continued over the month with US equities continuing to lag. Initially, investors had been buoyed by the prospect of a Trump second term and the expected boost this might deliver to the US economy, however, it is noticeable that since the end of November the broad index of US smaller companies (those most likely to benefit from a boost to the domestic US economy) has fallen nearly 11% with nearly half of that fall coming in February. Technology shares, which have seen stellar returns recently, also fell as heavyweight stocks in the sector saw slightly slower growth than expected or committed to heavy future capital investment. International equity markets performed better with the UK, Europe and Emerging Market equity indices all posting positive returns in the month. Bond markets delivered positive returns as fears over the persistence of inflation were trumped by concerns over global growth and benefitted from a flight to safety at a time of heightened political uncertainty.

Fund Performance

Wise Multi-Asset Growth

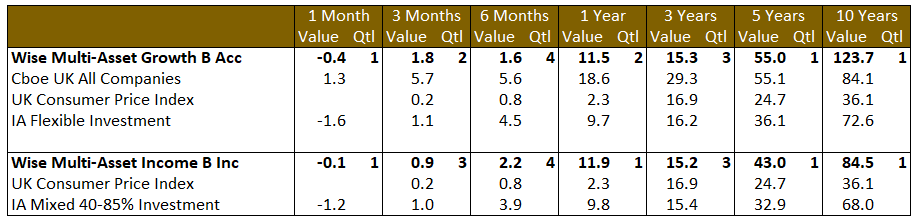

In February, the IFSL Wise Multi-Asset Growth Fund was down 0.4%, behind the CBOE UK All Companies Index (+1.3%) but ahead of its peer group, the IA Flexible Investment sector (-1.6%). For our financial year ending in February, our Fund returned 11.5%, behind the CBOE UK All Companies Index helped by large companies (+18.6%) and ahead of its peer group (+9.7%). Over the 5-year period we consider reasonable to be measured against, the Fund returned 55%, in the top quartile of funds in its universe.

The main contributors to performance in February were in the regions we mentioned earlier, namely China and Europe. Fidelity China Special Situations continued its strong run since the start of the year, adding another 10% in February thanks to strong net asset value (NAV) underlying performance as well as discount narrowing, thanks to an increasing number of investors keen not to miss a rebound in the region. There is still a long way to go to return to the 2021 highs (i.e. before the crisis in the Chinese property market created a debt and negative sentiment spiral), but the current signs could be indicating that a valuation floor is being set. Similarly, after years of tepid growth and structural issues, European equities performed well despite the geopolitical noise, helping the Lightman European Fund. More defensive holdings such as the Jupiter Gold & Silver and the TwentyFour Income funds also performed well.

Our main detractors were in the healthcare sector which continues to struggle to attract the interest we believe its fundamentals and valuations deserve, as well as in UK smaller companies for the same reasons.

Wise Multi-Asset Income

In February, the IFSL Wise Multi-Asset Income Fund fell 0.1%, ahead of its peer group, the IA Mixed Investment 40-85% sector, which fell 1.6%. For our financial year ending in February, our Fund returned 11.5% ahead of its peer group (+9.7%). Our fixed income holdings delivered positive returns led by TwentyFour Income, which continues to deliver consistent growth in net asset value (NAV) and GCP, which announced a stable NAV and some progress in its commitment to realise assets, reduce equity-like exposure and return capital to shareholders. With a supportive backdrop from government bonds it is somewhat surprising not to see stronger performance from our infrastructure holdings. There was a noteworthy bid in the core infrastructure sector for BBGI, a direct competitor to our two holdings (International Public Partnerships and HICL Infrastructure), at a premium to its stated NAV. We believe this underpins the valuation of both our holdings which sit on an average discount of 28% and were surprised not to see the shares re-rate higher in sympathy. Both companies have subsequently announced it is their intention to continue with the strategy of realising assets and increasing their share buybacks given the valuation anomaly that persists. Performance within our property holdings was mixed. Urban Logistics provided a positive lettings update, which saw void properties reduce and rents achieved ahead of valuers forecasts whilst Helical announced it had signed a development financing facility and building contract for its King William Street development. Both saw their shares respond positively whilst Empiric Student Property and Care Reit, where there was no news flow, both drifted lower. Again, it is notable there have been a couple of bids for companies in the property sector as well as the IPO of an activist investment trust targeting the value on offer in the sector, both of which we see as supportive to current valuations. Elsewhere, International Biotechnology Trust and our commodity holdings both detracted to performance over the month as did CT Private Equity, which saw its discount widen back out from tight levels at the start of the month.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, we added a new position in the newly launched Achilles Investment Company. This small investment trust (£54m) will target other investment trusts in the alternatives space (property, infrastructure, private equity) which trade at wide discounts and where an activist strategy could help maximise value for shareholders. The managers are well known in the industry and to us, being part of a joint venture with Odyssean Capital we own. We believe that Achilles’ approach to working alongside existing investors to realise value in a small number of investment trusts without a hidden agenda should benefit our shareholders. They have proven the worth of the strategy in a few high-profile cases in the past couple of years and we trust they can replicate previous successes in this new vehicle.

This new position was financed by exiting Fulcrum Diversified Core Absolute Return. We also continued to tilt the portfolio towards the most attractive risk-returns by switching some Pantheon International into Oakley Capital, and some Caledonia into RIT Capital.

Wise Multi-Asset Income

Over the month we reduced holdings that have performed strongly, most notably CT Private Equity, abrdn Asian Income, Paragon Banking, Polar Capital Global Financials and TwentyFour Income.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.