Performance Statement

Over the 12-month period, the IFSL Wise Multi-Asset Income Fund rose 11.9% (B Income shares). Over this period, we outperformed the Consumer Price Index (CPI), which measures inflation and remains above the Bank of England target, up 2.3%. We also outperformed the comparator benchmark, the IA Mixed 40-85% Investment sector, which rose 9.8%. Over the 5-year time horizon we consider sensible to look at our performance and as per our objective, the Fund is up 43%, ahead of both CPI which rose 25% and our comparator benchmark, which rose 33%. The distribution per unit fell slightly by 3% from 6.3p to 6.1p over the year, affected in part by one of our highest yielding holdings paying its dividend the week after the financial year end rather than before. It remains the objective of the fund to increase the distribution per unit over 5 year rolling periods and we anticipate strong double-digit growth over the forthcoming year. As we have discussed previously, we elected to rebase the distribution per unit lower in the aftermath of Covid and as such the distribution has remained flat over the last 5 years, lagging the growth in CPI. From here, we expect to grow the distribution once again in line with inflation over 5-year rolling periods. The historic yield on the fund remains attractive at 5.0%, particularly given the strong growth outlook ahead.

Market Review

Whilst global equities delivered consistently strong performance across nearly all markets over the year, the period was nonetheless characterised by significant regional divergence in economic growth, fluctuating inflation expectations and major changes to the global political backdrop. The clearest economic shift in the period was to monetary policy and the ability for central bankers to start cutting interest rates as inflation fell from its recent spike. The European Central Bank (ECB) led the way making its first cut to interest rates in June and has cut most, reducing rates from 4.0% at their peak to 2.75%. The UK followed suit at the start of August, however, more persistent inflation has meant the Bank of England (BOE) has only been able to cut three times from 5.25% to 4.5%, leaving monetary policy still at restrictive levels. The US started to reduce rates in September and has cut three times from 5.5% to 4.5%. All three regions experienced stronger economic growth in 2024 than expected at the start of the reporting period, however, this growth outperformance was only expected to be sustained into 2025 in the US whilst both the UK and Eurozone, led by Germany, have seen growth forecasts for this year noticeably reduced. Whilst US growth has been underpinned by the strength of consumer spending, European and UK consumers have been much more restrained in spending the savings built up over Covid and savings rates (the percentage of annual income saved) have stayed above historic norms as there has been more nervousness in the face of cost-of-living pressures and the more direct impact of the Ukraine/ Russia conflict on energy costs. Elsewhere, official growth forecasts in China of 5% were hit, although underlying data points to an economy struggling to shrug off weak consumer confidence following the collapse of its property market. In Japan, monetary policy stood out as an outlier with the Bank of Japan (BOJ) continuing with negative interest rates at the end of February. Strong wage growth and inflation in the period put pressure on the BOJ to return to a positive interest rate for the first time since 2015. As a result, the BoJ bucked the global trend and raised interest rates three times to 0.5%.

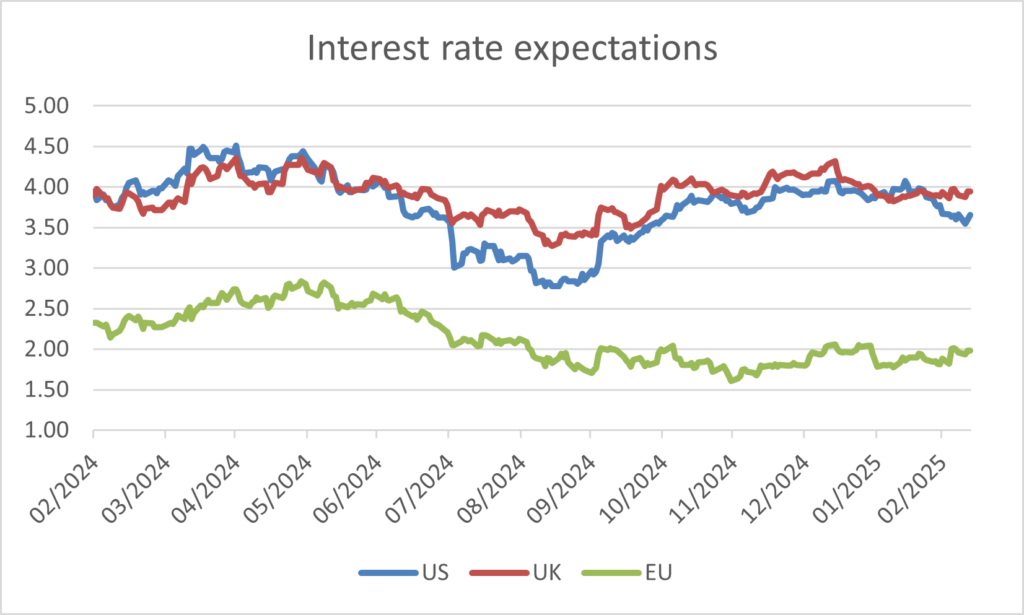

Whilst the overall direction of travel for interest rates was generally lower, the period under review can be split down into four distinct phases which saw investor expectations around the timing and quantum of interest rates cuts fluctuate considerably. The pressures facing the US, the Eurozone, the UK and China were all different reflecting the relative strength of their economic growth, their inflationary backdrop and the outlook for their fiscal deficits.

We started the period against a backdrop of stronger economic and inflation data than expected, pushing back optimistic hopes that meaningful interest rate cuts were imminent. Buoyant US jobs data and GDP (economic growth) growing faster than expected, coupled with unhelpfully strong core inflation data (after stripping out the more volatile components of food and energy) in the Eurozone, US and UK had already tempered growing hopes of an imminent end to the sharp increases in rates experienced over the prior 24 months. The first phase saw a continuation of this trend with particularly strong economic data in the US through until April, with Jerome Powell, Chairman of the Federal Reserve (Fed), stating at that point that it was likely to take longer than expected for inflation to return to their 2% target and so to justify future interest rate cuts. The stronger than expected data meant that investor expectations at the end of February of four 0.25% cuts in interest rates by the year end (2024) had reduced to less than two by the end of April.

Over the summer months, investors drew some comfort that inflation data in the US was no longer surprising expectations on the upside and this was reinforced by supportive US labour market data that finally showed some signs of cooling. At the same time, consumer confidence weakened, suggesting the strength in consumer spending that had been a key driver of US GDP growth compared to Europe and the UK was unlikely to be sustained. August witnessed levels of equity market volatility not seen since the depths of the Covid sell-off as markets started to worry that the Fed, having kept interest rates too high for too long, was at a greater risk of tipping the US economy into recession than delivering the soft-landing (an economic slowdown but not a severe recession) that had been expected since the start of the year. During this phase, lower inflation allowed both the ECB and the BOE to start to cut interest rates. Weak US manufacturing and employment data at the start of September reinforced the market’s view that the economy was slowing faster than expected and more urgent action was needed from the (Fed) in cutting interest rates. Inflation holding steady paved the way for a more sizeable interest rate cut of 0.5% than the 0.25% widely pencilled in at the start of the month. Having started this second phase expecting interest rates to reach 4.5% (a cut of only 1.0%) by the end of 2025, such was the weakness in the data in the interim that investors ended this phase betting interest rates would fall to 2.75% by the same point. At the same time, China announced weak economic with industrial output and retail sales indicating the economy had lost further momentum. As a result, a swath of stimulus measures was announced with the aim of providing liquidity to the economy in the form of lower interest rates as well as to directly underpin the flagging property market and to support the banking system and financial markets themselves. Further fiscal measures were subsequently announced to provide more direct stimulus to economic growth.

No sooner had the Fed cut interest rates by a larger than normal 0.5%, subsequent strength in the economic data in October surprised markets and led to a reassessment of the likely path for monetary policy over the course of the next year. Having interpreted the large interest rate cut as a sign that the underlying strength of the US economy must have been worse than expected, investors were forced to recalibrate their outlook. The extent to which this third shift in interest rate expectations was purely down to stronger than expected economic data, however, was unclear as November also saw the election of President Trump whose stated policies of lower taxes for businesses and individuals, higher tariffs on imported goods and a reversal of immigration were deemed likely to be inflationary and to increase federal debt levels, both of which would put pressure on the Fed to keep interest rates higher for longer. US equity markets initially took the result well, with notably strong performance from smaller US companies which were deemed to be the largest beneficiaries of an ‘America First’, lower tax economic policy. Financials, particularly US banks also performed strongly as the market bet on stronger economic growth, a favourable tailwind from higher interest rates and less stringent regulation. Economic news elsewhere was less buoyant. The ECB cut interest rates against a backdrop of weaker prices whilst the UK economy stagnated over the summer. Interest rate expectations for the two economies diverged, however, over this period with investors concerned the UK faced the prospect of stagflation (stagnant economic growth coupled with high inflation) whilst the Eurozone at least was seeing weaker growth accompanied by more benign inflation. The UK budget from the incoming Labour government exacerbated these fears as very significant tax increases (£40bn), primarily through an increase in national insurance for employers, were accompanied by an even more significant increase in government spending (£70bn). Whilst well-trailed in advance, bond markets were surprised by the extent of the spending increases which saw longer-dated borrowing costs increase back towards the levels seen around the time of the Truss mini-budget.

The final phase set in over the course of February. Markets had initially been encouraged that threats made to impose blanket 60% tariffs on Chinese imports during the election campaign were scaled back to 10% and took heart that perhaps the threat of a full-scale global trade war was merely a means to extract concessions, such as Canadian and Mexican military personnel to protect the US border. However, as the year has developed uncertainty has continued over whether 25% tariffs will or will not be applied to Mexican imports, tariffs on aluminium and steel imports have been imposed and a belief has developed that a second Trump presidency might be prepared to risk tipping the US economy into recession as a consequence of its trade policy. These fears have only been increased by the administration’s clumsy attempts to bring about peace in the Middle East and Ukraine. Whereas fears of a self-inflicted economic slowdown significantly reduced the outlook for US interest rates, those in Europe and the UK have remained relatively stable, in part a reflection of the expected increase in government defence spending as the US tears up traditional post war alliances.

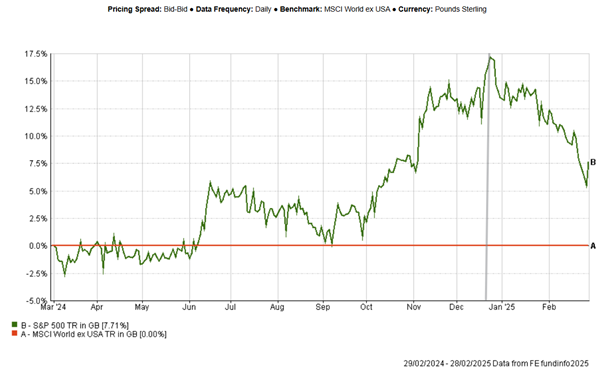

Despite the ebbs and flows in sentiment outlined above, the period under review proved to be a strong one for global equity markets. US equity continued to deliver exceptionally strong performance led once again by the small group of leading technology companies. It was notable, however, that as we entered the new year market leadership shifted away for the US as concerns grew over the damaging impact trade policies could have on the US economy and investors were attracted by significantly cheaper valuations elsewhere. Despite weaker economic growth, European and UK equity nearly kept pace as the pessimistic expectations factored into low valuations at the start of the year were exceeded. Emerging markets equities also delivered decent but slightly lower returns as markets were encouraged that the Chinese authorities were taking action to stimulate the economy out of its recent malaise. Japanese and Indian equities (in sterling terms) were the two major markets that delivered negative returns impacted by tighter monetary policy and high valuations respectively. Finally, smaller companies failed to keep pace with their larger peers. This was a feature of the UK market where the smaller companies index underperformed larger companies by 10% over the reporting period as concerns grew over the impact of the budget on the earnings of these more domestically focussed companies. Despite the volatility described above, bond markets delivered positive but subdued returns. Positive returns for government bonds were delivered via the high starting coupon rather than through capital growth (ie from yields falling). Credit performed more strongly, helped by higher initial yields and an improving economic picture which led to credit spreads (the yield premium of corporate bonds over government bonds) tightening. Finally, commodity markets were mixed. Gold was the standout performer as markets used it as a source of safety against an uncertain US monetary, fiscal and tariff backdrop. Copper performed well, helped by demand from energy transition and supply constraints whilst iron ore and oil both fell on the back of weak Chinese property demand, tariff concerns and less favourable supply dynamics.

Performance Review

The Fund delivered a total return of 11.9% over the period, strong in absolute terms and ahead of our peer group, the IA Mixed 40:85% Investment sector. Pleasingly the contribution to return was delivered from a diverse set of sources. Given the strength in global equities, it is no surprise to see both our equity funds and direct equity positions delivering some of the strongest returns over the period. As with the broader equity indices, the fund enjoyed strong returns from both international equity funds and UK equities. UK equity performance was led by Fidelity Special Values, whose value- based approach that looks for a positive change catalyst led to strong outperformance whilst Man GLG Income also performed well. Cheap valuations and a more certain political backdrop post the election has led to strong market support from corporate takeovers during the year with M&A (mergers & acquisitions) activity up 37% in 2024 compared to the prior year. Our holding in Aberforth Smaller Companies lagged as the performance of UK domestic shares fell in the aftermath of the general election. The valuation discount on the underlying companies trade versus larger and international peers coupled with the wide discount of the trust itself continues to make this an attractive opportunity, particularly against of a backdrop of increased takeover activity. Middlefield Canadian Income led the performance of our international equity funds boosted by the narrowing of its anomalously wide discount at the start of the as an activist fund appeared with a significant 30% stake on the register and demanded the board take action to allow investors exit closer to the fund’s net asset value. This discount narrowing compounded underlying strong portfolio performance as the fund’s Real Estate, Financial and oil & gas pipeline holdings benefitted from lower interest rates, decent economic growth and low starting valuations. This strong performance from financials was seen elsewhere via our holdings in the Polar Capital Financials Trust and through our direct holding in Paragon Banking Group. Positive US bank earnings have helped the former thanks to better revenues, strong capital market performance and benign loan losses. Paragon Banking Group has continued to deliver consistently strong loan and profit growth that has allowed it to increase its dividend and its share buyback. Elsewhere, Schroder Global Equity, Murray International, Schroder Emerging Market Value, abrdn Asian Income and the International Biotechnology Trust all delivered positive returns. In addition to the strong equity market performance, we also saw positive returns from our private equity holdings. Whilst the economic backdrop has been favourable and there has been strong performance in quoted equity markets in those sectors favoured by private equity markets during the period, this has not translated yet into strong net asset value growth. Performance, however, has been helped by the wide discounts we have seen starting to narrow and underlines the uncorrelated return that can be achieved from investing into investment trusts by successfully exploiting opportunities that arise from wide discounts. We believe the continued wide discounts of over 30%, strong underlying operational performance of their holdings and a noticeable pick-up in realisation activity as the year evolved, positions both CT Private Equity and ICG Enterprise well for the year ahead. Our commodity holdings also contributed positively to returns despite the negative sentiment towards China and the weakness of its property market. Blackrock Energy & Resources was the stronger performer helped by the performance of its holdings exposed to the energy transition theme and electricity demand in the US. Blackrock World Mining had a tougher year although still delivered positive returns helped by its exposure to copper, uranium and gold miners.

Whilst the performance of our more GDP sensitive allocation above was encouraging, it was equally pleasing to see good performance from our more defensive, interest rate sensitive holdings. Our bond holdings produced returns in excess of 10% over the year, well ahead of the global government and corporate bond indices. Our two holdings managed by TwentyFour, the TwentyFour Income Fund and theTwentyFour Strategic Income Fund both performed well helped by their allocation towards asset backed securities, such as mortgages, as well as bank debt. These have benefitted from the benign economic backdrop as well as higher coupons than equivalent corporate bonds and have been less affected by fluctuations in interest rate expectations given their coupons are floating rate (ie move up and down with interest rates) rather than fixed. There was a notable divergence in performance with our Infrastructure allocation between HICL Infrastructure and International Public partnerships, which invest directly into core infrastructure assets (such as transportation systems, communication networks, sewage, water, schools and hospitals), compared to Pantheon Infrastructure and Ecofin Utilities & Infrastructure, which invest alongside private equity sponsors or directly into quoted equities. Ecofin was the strongest performer helped by strong performance from holdings exposed to US electricity demand as AI data centre growth highlighted the value of US baseload capacity. Pantheon saw strong net asset value growth in the period as operational performance from its holdings exceeded their original business plan whilst the successful first exit of US gas-fired generator, Calpine, to a trade buyer at a premium to holding value highlighted the conservativeness of the valuation process and the opportunity that the 20% discount offers. Both HICL and INPP have seen their discount widen in sympathy with longer dated UK government bonds. However, we believe the average discount of over 25% does not reflect the very attractive yields over and above government bonds the underlying assets are valued against as well as evidence from the companies themselves that they are able to sell these holdings in the open market at or above their holding value. Both companies have sold assets during the period to reduce expensive debt and embarked on share buybacks as they believe the current share prices materially undervalue the companies. It was encouraging therefore to see close comparator, BBGI Global Infrastructure (not held), bid for at a premium to net asset value just before the year end.

A similar valuation anomaly resides in the property sector where implied yields on the underlying property holdings appear highly attractive, particularly when they are adjusted for the discounts on which the companies trade. On average, the four property companies we hold (Care REIT, Urban Logistics, Helical and Empiric Student Property) continue to trade on an average discount to net asset of 35%. Given the level of corporate activity that has occurred in the sector over the last 24 months, it is surprising not to have seen these discounts narrow rather than increase as they have done. Performance from our holdings in the sector was mixed. Abrdn Property Income saw strong returns as it executed a managed wind-down and sold the bulk of its assets to a single buyer at a good premium to the share price. Elsewhere, Care REIT and Urban Logistics delivered positive returns whilst Empiric and Helical fell despite rising a rising net asset value and positive development news.

Portfolio Activity

Given the dispersion in performance over the period, we have continued to recycle the portfolio out of those areas which have performed most strongly and where valuations have returned closer to long run averages into areas where we continue to see significant upside. The change in asset allocation over the period was an increase in our exposure to alternatives, most notably Infrastructure. Given the widening of discounts in the core infrastructure, we added to our holding in HICL Infrastructure, as well as increasing our holdings in Ecofin Global Utilities and Infrastructure and Pantheon Infrastructure when discounts were particularly wide. Within our Fixed Income allocation, we added to GCP Infrastructure, which predominantly lends to projects across a variety of infrastructure sectors yet suffers from a greater discount to net asset value than its equity peers. We also added a new position in the Premier Miton Strategic Monthly Income Bond Fund, a differentiated, high quality corporate bond fund where sensitivity to interest rates is kept minimal and trading is active as opposed to the buy-and-hold strategies of many other competitors.

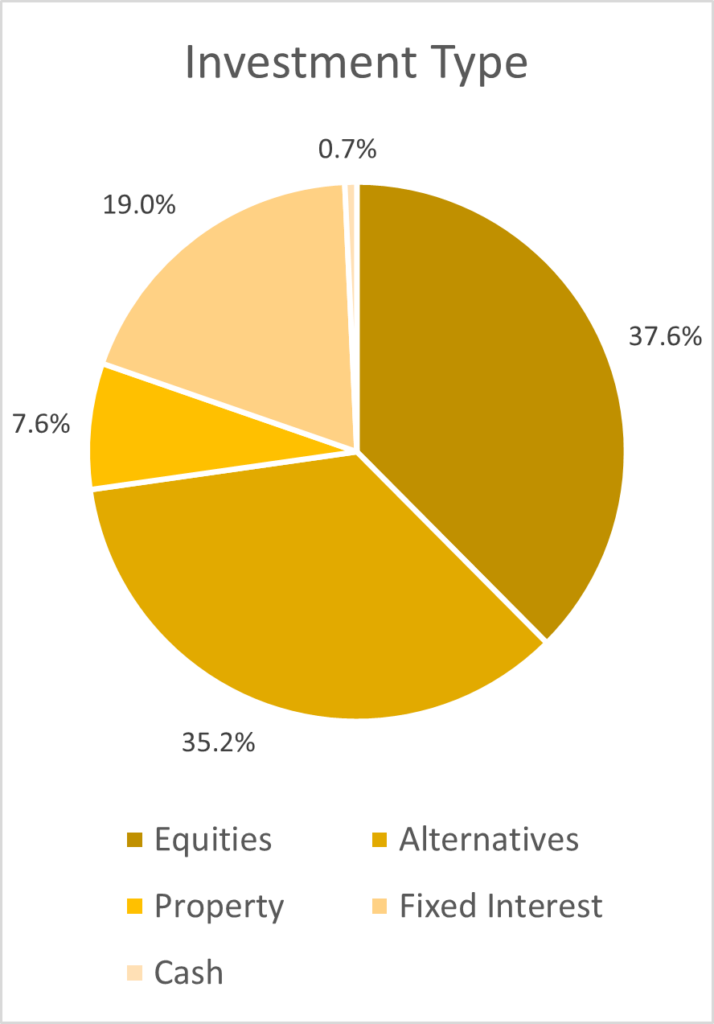

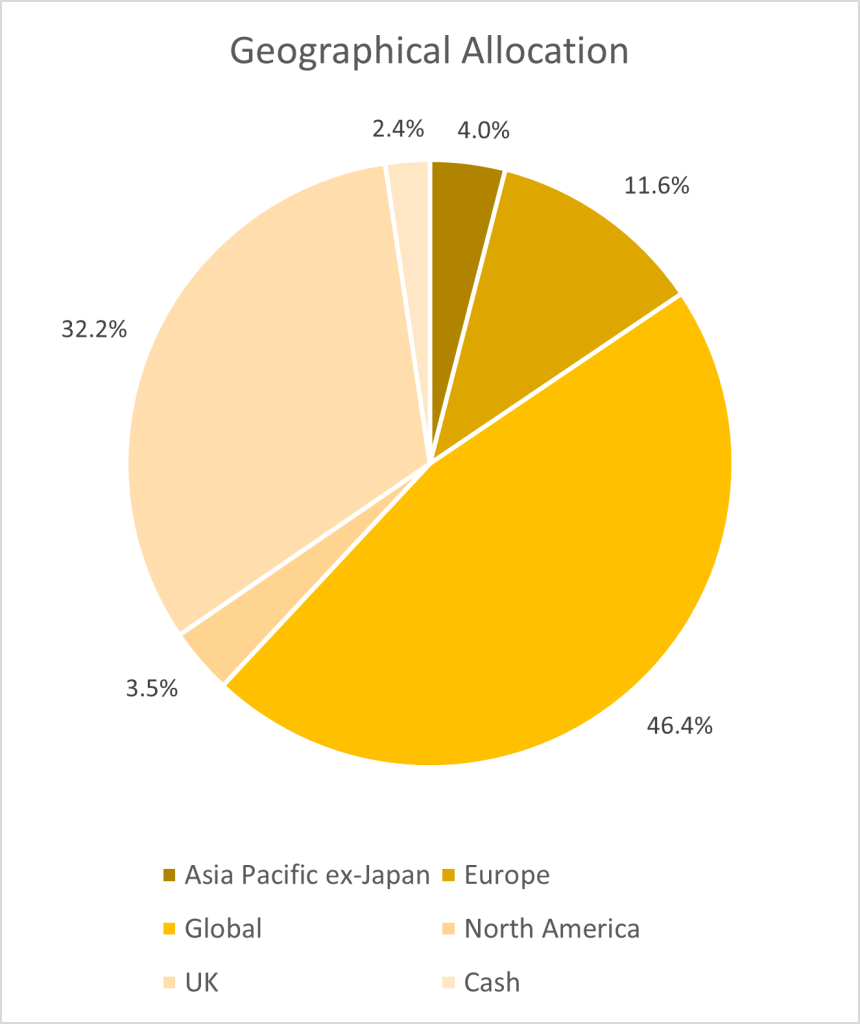

Breakdown of portfolio by asset types as of 28th February 2025

The equity exposure of the fund reduced slightly driven by a reduction in our financials holdings, Polar Capital Financials Trust and Paragon Banking Group, both of which delivered stellar performance over the period. We increased our holding in International Biotechnology Trust where we believe the combination of strong demand drivers, increased innovation, low valuations and M&A activity as large pharmaceutical companies need to replenish their pipelines will support the sector. Finally, we added a new position in the Schroder Emerging Market Value Fund, an emerging markets equity strategy managed by the same value team which manages the Schroder Global Recovery Fund that we already own. We know the team’s process well and think that their approach should deliver positive and differentiated returns when applied to emerging markets. This was funded by a reduction in the abrdn Asian Income Fund.

The largest reduction in allocation came within our property holdings. This was driven by a sale of our holding in TR Property and the sale of abrdn Property Income following the announcement that it had agreed a sale for the large majority of its assets.

Outlook

The global economic outlook is particularly hard to predict given the erratic announcements from President Trump both from a trade perspective as well as his approach to Ukraine and the Middle East. Markets have struggled to assess whether the threat of blanket tariffs which ultimately get deferred are ever likely to be implemented or whether they merely reflect an initial bargaining position. Were 25% tariffs to be imposed on Mexico and Canada and 20% tariffs on China as well as tariffs on the EU, this would have a negative impact on economic forecasts which currently anticipate another similar level of global growth in 2025 to 2024. In the US, the resilience of the US consumer will be key whilst Trump’s desire to cut taxes will be tempered by the current high fiscal deficit unless Elon Musk can make successful inroads into cutting government spending. In Europe, a change in leadership in Germany looks likely to see a significant relaxation of government spending, particularly on defence, which should boost growth but also push government borrowing costs higher. In the UK, the government finds itself in a tricky position having committed to a significant increase in spending whilst it has already increased taxes at a point when economic forecasts and therefore tax receipts are falling and inflation remains sticky. Finally, China remains challenged as global supply chains are already shifting post Covid and now the country faces the prospect of further tariffs and a stagnant property market.

Whilst this does not sound like a hugely favourable starting point, we prefer to look for areas to invest where the market has already factored in these risks and valuations look attractive. This builds in a margin for error as on the whole the downside risks have been considered already and there is scope for upside if things develop more favourably than expected. Encouragingly, there remain plenty of such areas that we believe are aligned with the objectives of the fund and offer the opportunity to invest at attractive starting yields that should be able to grow in line with inflation over time. As highlighted above, many companies in the investment trust sector trade at historically attractive discounts to net asset value, most notably in the property, infrastructure and private equity sectors.

Boards of these trusts have been forced to sit up and address these persistent discounts as activist investors have been attracted to the space. Asset disposals have been undertaken to realise net asset value in order to pay down debt or buy back shares and in certain circumstances companies have been subject to corporate takeovers. We expect this to continue and can point to the appearance of an activist shareholder on the Urban Logistics register and a recommended offer for Care Reit post the financial year end as evidence pressure to close the gap between share prices and asset values will not abate. In a similar vein, the board of Middlefield Canadian Income is under pressure to realise net asset value. Many wealth managers have retreated from the investment trust universe and the market cap threshold below which they are not prepared to invest has increased, which again puts pressure on boards to consolidate in order to remain relevant. Despite the strong performance of our equity holdings in the period, we believe the valuations of UK, European and Emerging Markets remain attractive in absolute terms, particularly among smaller companies and those managed with a value process. There are signs emerging that the dominance of US equities and the technology sector, in particular, could be abating and any reversal of the one-way traffic of flows into this area towards a more balanced global allocation would be welcome given the fund’s positioning.

US equities relative to the Rest of the World

I would like to take this opportunity to thank our investors for their ongoing support. The whole Wise Funds team is at your disposal should you have any questions or would like to talk to us.

Philip Matthews

Fund Manager

Wise Funds Limited

March 2025

TO LEARN MORE ABOUT THIS FUND , PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.

This presentation is for Professional Clients only and not for re-distribution.

All data is sourced by Wise Funds and any third party data is detailed on the specific page.