Performance statement

The IFSL Wise Multi-Asset Growth Fund returned 9.7% over the 6-month reporting period, behind the CBOE UK All Companies Index (+12.3%) but ahead of its peer group, the IA Flexible Investment Sector (+5%). Over the period, the Fund was in the top 4% of funds in the peer group, highlighting how our differentiated positioning helped performance.

Over the 5-year time horizon we consider sensible to look at our performance, the Fund is up 48.9%, ahead of both the CBOE UK All Companies Index (+38.5%) and the IA Flexible Investment Sector (+28%). The Fund sits in the top 9% of funds in the peer group over that time horizon, which is a pleasing outcome given the challenges thrown at investors during the period (Covid, wars, political changes, dominance of large technology companies, sharp shifts in interest rates, etc…).

For more fund performance, please see the latest factsheet

Wise Multi-Asset Growth August 2024 factsheet

Market Review

Despite solid headline numbers for so-called risk assets (equities, bonds, commodities), the review period was a volatile one with economic data often wrong-footing investors. The overall direction of travel, however, is one where inflation increasingly looks under control and remains likely to stay so. For the past 6 monthly readings, headline inflation averaged 3.2% in the US (vs a post-Covid peak of 8.9%), 2.5% in the UK (vs a post-Covid peak of 11.1%) and 2.5% in the Eurozone (vs a post-Covid peak of 10.6%). A big driver of this reduced pressure on prices has been lower energy prices, which are volatile, but a sustained slowdown in price inflation is now apparent across all sectors. Meanwhile, growth indicators (particularly in the US, still the biggest driver of global growth) proved surprisingly resilient in the face of the highest interest rates since the Great Financial Crisis of 2007/09. Towards the end of the period, however, it became apparent that growth is finally slowing down although the consensus, for now, is that the slowdown will be moderate and that a recession will be avoided.

This environment is proving ideal for central bankers who, having been late to foresee how quickly and sustainably inflation would flare up, continue to err on the side of caution and are keen not to fuel inflation again by cutting interest rates too early. With inflation looking increasingly under control and without too much pressure to boost growth, central banks in the US, UK and the Eurozone have had time on their side. The European Central Bank (ECB) was the first to cut rates in June but did not feel the need to follow-up later in the period. The Bank of England (BOE) cut its rates in August but, equally, made it clear that the pace of future cuts would be cautious. As for the US central bank (the Federal Reserve or Fed), its chairman hinted at a first rate cut in September as a means of preventing growth from slowing down too much. With interest rates in these three regions having risen around 5% since 2021/22, central banks have managed to rebuild their rates buffer, allowing them to react more urgently if economies deteriorate.

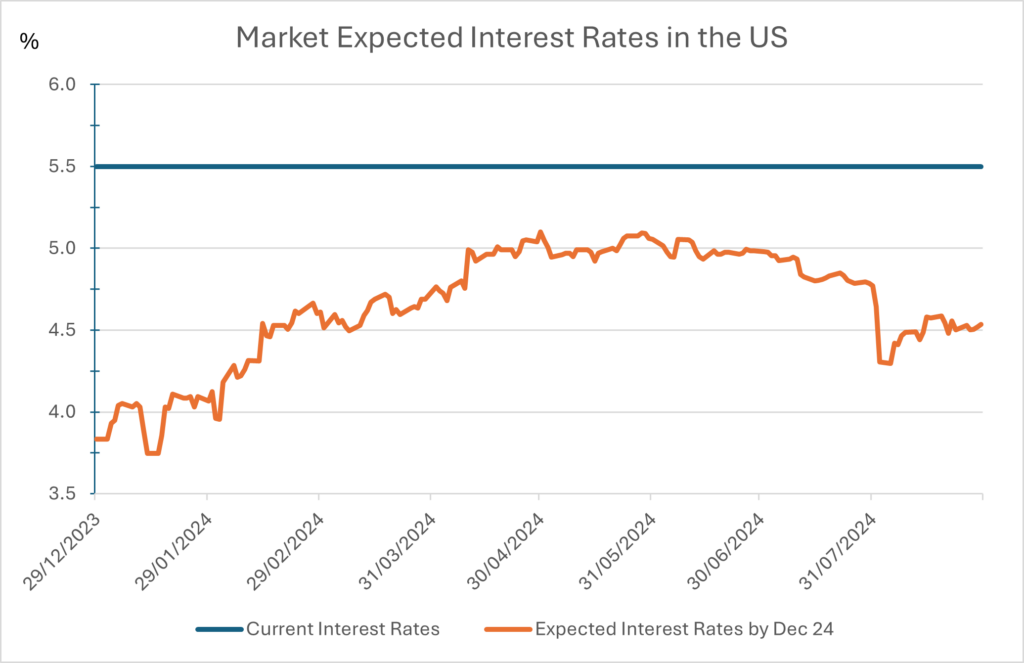

The path to this point was not smooth, however, and one can guarantee that the path from here will not be either. From one month to the next, markets continued to be driven by the monthly cycle of data releases and central bankers’ speeches. The changes in future interest rate expectations by the end of 2024 are a good illustration of how investor expectations evolved during the period. These changes are important because they dictate the general direction of markets by changing the interest rates used to value financial assets.

Central banks typically move interest rates in 0.25% increments, although bigger moves are possible

The biggest turbulence came in the middle of the summer after a weaker than expected employment report in the US triggered fears of recession and concerns that the Fed is behind the curve by keeping interest rates unchanged. In parallel, the Bank of Japan (BOJ)’s surprising decision to raise interest rates on the last day of July to their highest level in 15 years triggered the unravelling of a popular so-called “carry trade” which amplified market volatility. A carry trade is a strategy used by institutional investors that involves borrowing in a low interest rate currency (in this case, the Japanese Yen with rates of 0.1%) and reinvesting in a higher interest rate currency (in this case, the US dollar with rates of 5.5%). As long as the interest rate differential between the two currencies remains wide, the strategy should offer positive returns and cover the investment and exchange rate conversion fees. However, most of these trades are placed using a lot of leverage (i.e. debt) meaning that a small move in the differential rate can quickly lead to large losses. The unexpected rate hike from the BOJ did just that, causing a ripple effect across financial markets as investors scrambled to raise cash anywhere possible to cover their losses in the carry trade. Japanese equities were the worst affected, at one point in August falling more than 25% from their all-time high freshly printed in July, thus reversing all their gains for the year.

Meanwhile, large US technology companies entered a technical “correction” (a drop of more than 10%) with the broader US equities index only narrowly avoiding the same fate. Other main equity markets, such as in the UK or Europe, suffered too but displayed relative defensiveness thanks to more attractive valuations. Bonds, on the other hand, provided absolute protection and registered strong gains as investors priced in aggressive rate cuts from central banks in response to a seemingly quickly deteriorating economic outlook. In the US, the drop in government bond yields (which move inversely to price) implied five rate cuts of 0.25% by the end of the year, from only three at the end of July (and two at the beginning of July). Finally, gold was also sought after and provided a safe haven during the period of turbulence early in August. That period proved short-lived, however, and losses were broadly recovered by the end of the month, supported by strong inflows into equities by investors previously sitting in cash, and less worrying economic data in the subsequent weeks.

The reporting period was also an interesting one because of the change in market leadership it witnessed, with UK equities topping the leaderboard, both before and after exchange rate conversion. 6 months is a short time and, longer term, US equities are still outperforming other international equity markets, but we could be at a turning point where valuations start to matter again. The US technology sector is starting to show signs of fatigue with disappointing earnings and investors increasingly wary of overpaying for future promises while greater opportunities for more immediate value are available elsewhere. Investors have looked for such opportunities in UK equities, particularly amongst smaller companies which have also benefitted from a busy M&A (Mergers and Acquisitions) environment, as well as an earlier than expected general election which provided some political stability after an often-chaotic few years.

Aside from the UK election, we are in the middle of an extraordinary year with around half of the global population heading to the polls for a national election. In the period, such elections were held in major economies such as India, Mexico and South Africa in emerging markets, as well as in the EU. The strong performance of far-right parties in the parliamentary elections in the latter region led to surprising snap elections in France, which added some uncertainty, still ongoing at the time of writing as a government there is yet to be appointed. The upcoming elections in the US in November are already dominating headlines as well as investors’ minds, given the varying impact either candidate and party could have on domestic and international growth. The surprising exit of President Biden from the race in favour of Vice-President Harris has made the outcome in November much closer to call keeping investors on their toes.

Fund performance review

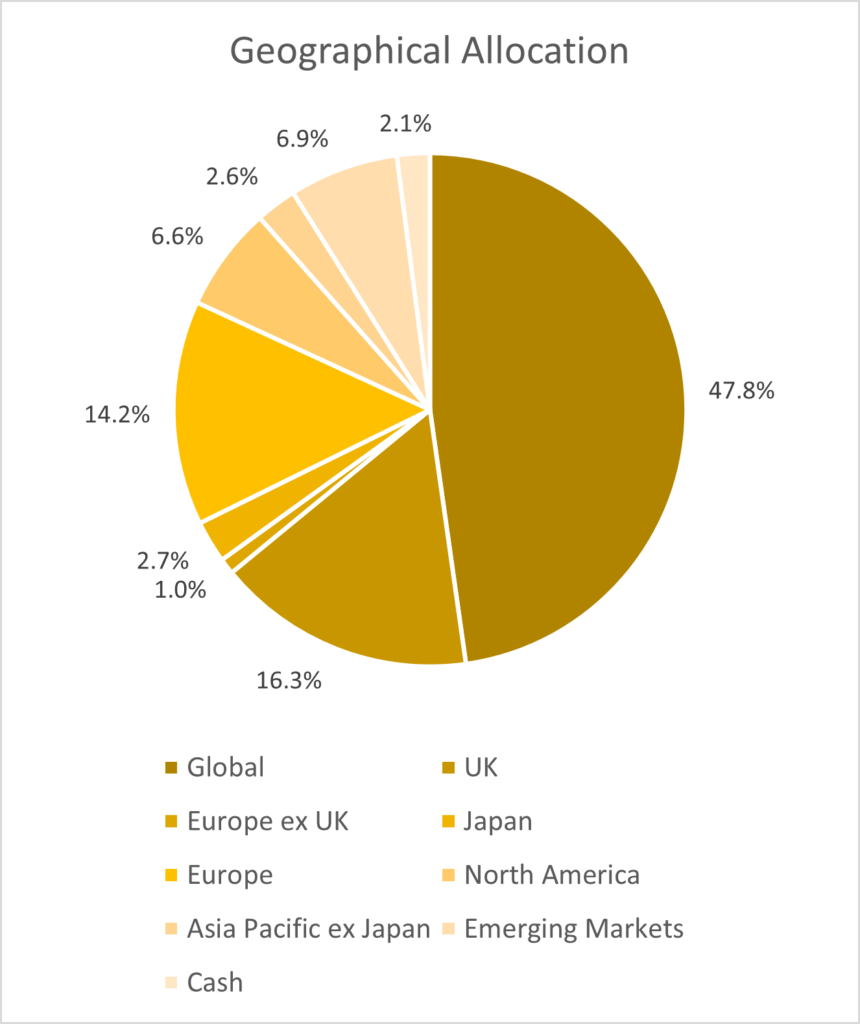

The Fund delivered a strong return of 9.7% over the period. Part of this can be attributed to an improving outlook for the UK equity market which, thanks to better economic resilience than anticipated, hope for a more stable political landscape and attractive valuations, started to show positive momentum after years of being ignored by investors. These factors seem to have finally started unlocking capital from companies and private equity funds to invest. As a result, M&A (Mergers and Acquisitions) deals in the UK were 66% higher in the first half of 2024 than in the previous year and, thanks to often very attractive premiums to the share price for listed target companies, equity investors took notice. Flows into UK equities remain in the early stages of a recovery after years of outflows and could easily be derailed from here but, for the interim period, they helped push the UK towards the top of the league table of returns. This was particularly the case for smaller companies which present the doubly attractive characteristics of offering more direct access to the resilient domestic growth story and the cheapest valuations relative to both their own history and larger companies.

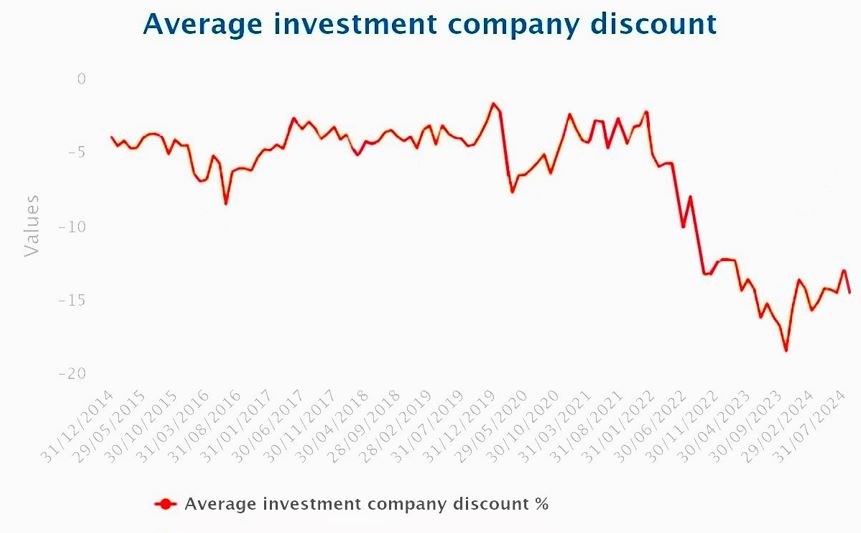

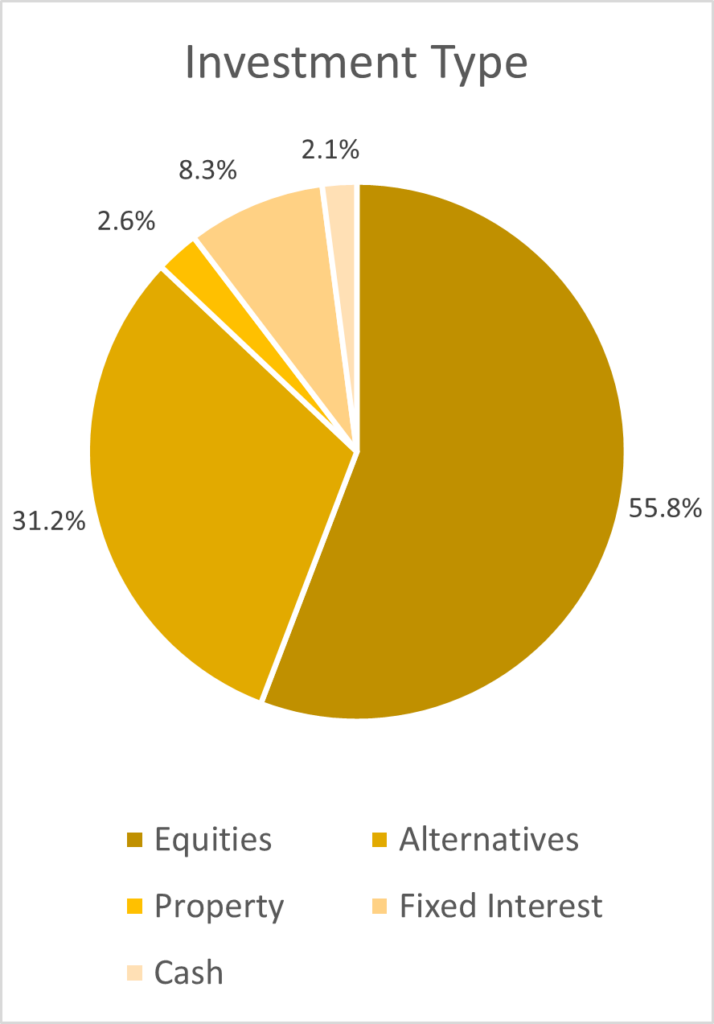

While the Fund is by no means a UK fund, we have been attracted by the cheapness of UK equities for years and have had an average of 17% exposure to UK strategies for the period. Managers targeting smaller companies and using a value style (as opposed to growth) were our strongest contributors, like Aberforth Smaller Companies and Fidelity Special Values. Both these investment trusts combined strong Net Asset Value (NAV) growth, as well as a tightening of their discount. Narrower discounts across the portfolio was another contributor to our performance and another reason why a more in demand UK equity market plays in our favour. With two thirds of the portfolio invested in investment trusts listed on the London Stock Exchange, healthier flows into UK equities generally helps lift all boats in the investment trusts world, even those invested in unrelated asset classes. As an illustration, the average discount for the investment trusts we own in our Fund moved from 16.1% at the start of the period to a narrower 13.6% by the end.

This move was in line with the dynamics in the sector as a whole where, after reaching a record wide average discount last October, things have started to improve. Extreme valuations can sometimes be their own catalyst as investors look at assets that become too good to pass on. The board of investment trusts have also been very active in buying back their own shares, reaching a record level of activity in 30 years during the period. This is a strong signal that the managers themselves believe their own funds offer great value.

Another example of how powerful the combination of improving NAV and tightening of discount can be was the Ecofin Global Utilities and Infrastructure trust’s performance. On the NAV front, after a difficult period last year where the sector traded in lockstep with long-term bonds (which struggled in a rising interest rates environment), the trust’s holdings started performing in 2024 thanks to the perceived peak in interest rates (utilities are often seen as an income play and thus “compete” with other income assets like bonds), but also thanks to being seen as an indirect play on the growth in Artificial Intelligence (AI). The explosion in AI resources requirements is having a significant impact on electricity demand for data centres. The companies involved are increasingly wanting to use renewable sources of energy to meet that demand but need a reliable source, independent of whether the sun shines or the wind blows. This benefitted a couple of nuclear energy holdings in the Ecofin’s portfolio as nuclear is increasingly accepted as a necessary stepping stone in the transition from fossil fuel to clean energy. A similar theme also helped our other investment in the space Premier Miton Global Infrastructure Income. The strong NAV performance combined with better general sentiment from investors attracted more demand for the Ecofin trust which had been trading at extreme valuations and saw its discount narrow from ~20% to ~10% over the period. We benefitted from this move, having materially increased our position in the trust since last autumn.

Last but not least, our strongest contributor was the Jupiter Gold & Silver Fund. Supported by ongoing purchases from central banks looking to diversify their assets away from the US dollar as well as by its safe haven status in an uncertain geopolitical world, gold returned more than 20% over the period setting a new all-time high. Meanwhile, the Jupiter fund, by investing in gold and silver mining companies, doubled the return of the precious metal. Mining companies are always an amplified play on the underlying metals, but this is particularly true in precious metals where the scarcity of investable companies made the movement even starker. This holding proved its worth as a defensive asset in our portfolio during the market volatility of the summer but, thanks to valuations that remain attractive in a sector that is highly profitable, it is also a position we are happy to hold on a standalone basis.

There were only a few detractors over the period, none of them particularly significant. One of them was VPC Specialty Lending Investments, a private lender to predominantly US start-ups. The trust suffered from volatility in its NAV as well as a dearth of new investors since its board announced it would wind-down the strategy. As a result, the discount on the trust broadly doubled to 40% since the start of the year.

The other small detractors were found in emerging markets, predominantly driven by the weakness in Chinese equities. China remains in a difficult position post-Covid with its economy plagued by a property market crisis and slow consumption. So far, the government has been unable to stimulate the economy back to growth, leaving its stock market to struggle. We only own a small direct exposure to Chinese equities via the Fidelity China Special Situations trust, but the malaise in China also impacted broader emerging markets over the period.

Portfolio Activity

Given some of the price action in financial markets over the reporting period, we were active in recycling the portfolio in order to tilt it towards the more attractive opportunities. At the sector level, one such opportunity remains in biotechnology, an area we have increasingly been focusing on for the past couple of years. After a post-Covid “hangover” where the sector struggled to attract new capital due to a lack of interest from investors and increased financing difficulties caused by higher interest rates, the sector is now showing signs of a revival with a rebound in acquisitions, a return of IPOs (when private companies raise capital via public markets) and exciting new innovations. With valuations remaining attractive, we increased our allocation to both International Biotechnology Trust and RTW Biotech Opportunities during the period. The sector represents more than 11% of the portfolio at the end of the period.

Within UK equities, a strong performing sector for the period as highlighted earlier, we took some profits in Aberforth Smaller Companies, Fidelity Special Values and JO Hambro UK Equity Income, and rotated into the Amati UK Smaller Companies fund which lagged behind the more value-oriented strategies.

We exited three positions fully during the period. The first one is the VPC Specialty Lending Investments trust mentioned above. Although the board of the trust is committed to returning capital to shareholders as soon as practical, which should help narrow the discount again, we believe that this process will take some time given the illiquidity of its investments, thus presenting a big opportunity cost if we wait for the cash to be returned to us. We also exited two holdings in emerging markets, starting with BlackRock Frontiers Investment Trust, a trust investing in smaller emerging markets which had performed strongly over the past few years and had become a small position after a few rounds of profit taking. The second one, the KLS Corinium Emerging Markets Fund, was regrettably closed by its manager. In their place, the only new position we added over the period was the Schroder Emerging Markets Value Fund, an emerging markets equity strategy managed by the same value team which manages the Schroder Global Recovery Fund that we already own. We know the team’s process well and think that their approach should deliver positive and differentiated returns when applied to emerging markets.

Investment Outlook

After a strong period of performance since the last quarter of 2023, it is becoming more and more apparent that the leadership of financial markets is being challenged (for example with large technology companies prone to disappointment) and that some vulnerabilities are starting to appear. As we enter a new phase in the economic cycle with growth slowing down and interest rates being cut, the environment will remain uncertain and a challenging one to navigate. Luckily, despite main indices looking increasingly expensive, many parts of the market remain attractively valued, across regions (UK, emerging markets), asset classes (infrastructure, listed private equity, biotechnology) and styles (smaller companies, value), presenting opportunities we are excited about. Accessing those will require both nimbleness and discipline in order to safeguard gains which can quickly evaporate on the back of some economic data release, speech from a central banker or a political leftfield event. It will also require diversification as returns and protection will both continue to come from many different areas.

With our experience, valuation discipline and the breadth of strategies investment trusts give us access to, we believe we are well positioned to take up this challenge.

As always, I would like to take this opportunity to thank our investors for their ongoing support. The whole Wise Funds team is at your disposal should you have any questions or would like to talk to us.

Vincent Ropers

Fund Manager

Wise Funds Limited

September 2024

TO LEARN MORE ABOUT THIS FUND , PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.

This presentation is for Professional Clients only and not for re-distribution.

All data is sourced by Wise Funds and any third party data is detailed on the specific page.