For Professional Clients Only

Macro & Market Update

The month of August started with the biggest bout of volatility since the midst of the Covid pandemic in 2020. A weaker than expected employment report in the US at the beginning of the month, which saw unemployment rate jumping from 4.1% to 4.3%, triggered fears of recession and concerns that the Federal Reserve (Fed) is behind the curve by keeping interest rates unchanged. In parallel, the Bank of Japan’s surprising decision to raise interest rates on the last day of July to their highest level in 15 years triggered the unravelling of a popular so-called “carry trade” which amplified market volatility. A carry trade is a strategy used by institutional investors that involves borrowing in a low interest rate currency (in this case, the Japanese Yen with rates of 0.1%) and reinvesting in a higher interest rate currency (in this case, the US dollar with rates of 5.5%). As long as the interest rate differential between the two currencies remains wide, the strategy should offer positive returns and cover the investment and exchange rate conversion fees. However, most of these trades are placed using a lot of leverage (i.e. debt) meaning that a small move in the differential rate can quickly lead to large losses. The unexpected rate hike from the Bank of Japan did just that, causing a ripple effect across financial markets as investors scrambled to raise cash anywhere possible to cover their losses in the carry trade. In addition to the two factors above (US recession fear and carry trade losses), disappointing earnings from large companies such as Intel and Amazon, as well as low liquidity in markets in the middle of summer completed the perfect storm for risk assets.

Japanese equities were the worst affected, at some point intra-month falling more than 25% from their all-time high freshly printed in July, thus reversing all their gains for the year. Meanwhile, large US technology companies entered a technical “correction” (a drop of more than 10%) with the broader US equities index only narrowly avoiding the same fate. Other main equity markets, such as in the UK or Europe, suffered too but displayed relative defensiveness thanks to more attractive valuations. Bonds, on the other hand, provided absolute protection and registered strong gains as investors priced in aggressive rate cuts from central banks in response to a seemingly quickly deteriorating economic outlook. In the US, the drop in government bond yields (which move inversely to price) implied five rate cuts of 0.25% by the end of the year, from only three at the end of July (and two at the beginning of July). Finally, gold was also sought after and provided a safe haven during the period of turbulence early in August.

That period proved short-lived, however, and losses were broadly recovered by the end of the month, supported by strong inflows into equities by investors previously sitting in cash, and less worrying economic data in the subsequent weeks. In the US, retail sales surprised on the upside to their highest level in a year and a half, suggesting that consumer-led recession fears might be overdone. Inflation also came down more than anticipated making it easier for the Fed to intervene forcefully if the economy did indeed deteriorate. Similarly, in the UK, inflation came out lower than expected, particularly on the wage growth front which has been the Bank of England (BoE)’s largest headache for months. With a better inflationary outlook, the BoE cut rates for the first time since 2020 by 0.25% to 5% being careful, however, to caution against expectations of it being the first step in an aggressive rate cut campaign, like their counterparts at the European Central Bank did after their cut in June. In the US, it took until the last week of August for a clear message from the Fed chairman Jay Powell who explicitly opened the door for a rate cut at their September meeting, driven by weaker dynamics in the labour market more than inflation considerations. As such, the next employment data released on 6th September will be key for investors in assessing the future path of interest rates in the US.

Fund Performance

Wise Multi-Asset Growth

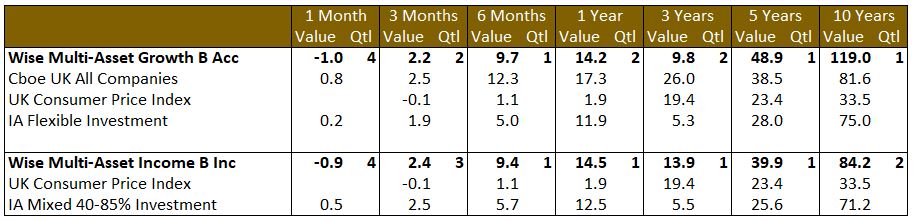

In August, the IFSL Wise Multi-Asset Growth Fund was down 1%, behind both the CBOE UK All Companies Index (+0.8%) and its peer group, the IA Flexible Investment Sector (+0.2%). As August marks the end of the first 6 months of our reporting year, the Fund is up 9.7% versus +12.3% for the CBOE UK All Companies Index and +5% for the IA Flexible Investment Sector.

In what was a turbulent month, our more defensive assets contributed the most to performance. These were found in utilities and infrastructure (Premier Miton Global Infrastructure Income, Ecofin Global Utilities and Infrastructure), bonds (TwentyFour Strategic Income) and gold (Jupiter Gold & Silver). On the other hand, some holdings with strong recent performance (European Smaller Companies, RTW Biotech Opportunities, International Biotechnology Trust, AVI Global Trust, Fidelity Special Values, Aberforth Smaller Companies) all detracted to performance last month. We have been active in booking profits in all of these names for the past few months, however, thus limiting the downside. BlackRock World Mining was also a detractor mainly due to ongoing weakness in the iron ore market on the back of concerns about Chinese growth.

Wise Multi-Asset Income

In August, the IFSL Wise Multi-Asset Income Fund fell 0.9%, behind its peer group, the IA Mixed Investment 40-85% Sector which rose 0.5%. August marks the end of the first six months of our reporting year and over this time period the Fund is up 9.4% versus 5.7% for the IA Mixed Investment 40-85% Sector. In a period of heightened volatility for risk assets, it is unsurprising that our most defensive assets performed strongly. The Twenty Four Strategic Income Fund, Twenty Four Income Fund and Ecofin Global Utilities and Infrastructure all delivered positive returns. Despite benefitting from lower interest rates, it was perhaps surprising that certain other defensive infrastructure names, such as GCP Infrastructure, HICL Infrastructure, Pantheon Infrastructure and International Public partnerships did not perform better. It appears that they have been caught up in the wider weakness in the index of small and mid-sized companies with discounts widening as a result. We saw this as an anomaly and added to these less cyclical names as selling pressure appeared indiscriminate. Our property holdings held up relatively well helped by positive results at Impact Healthcare Reit and Empiric Student Property, and a net asset value update from abrdn Property Income that stated a possible sale of the entire portfolio for cash was being considered. A number of our equity and private equity holdings reversed the recent trend of discount narrowing and saw share prices fall more than would have been expected looking at the performance of the underlying asset classes. Notably ICG Enterprise, CT Private Equity and International Biotechnology Trust have seen attractive discounts open up again and Blackrock World Mining, Aberforth Smaller Companies and Fidelity Special Values have seen recent narrow discounts reverse.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

Over the month, we continued to be diligent in booking profits in strong performers. As last month showed, in period of volatility, those are likely to be the most vulnerable to the downside, so staying disciplined is key. As such, on the first day of the month, we sold the shares we had bought in May to top up RTW Biotech Opportunities, 22% higher than we had initially paid for them. This is quicker than our usual holding period but this is a market where nimbleness is required. We also trimmed our positions in Aberforth Smaller Companies, Fidelity Special Values and Caledonia Investments. Conversely, we continued to build our position up in the Schroder EM Value Fund and increased our position in the Amati UK Smaller Companies Fund.

Wise Multi-Asset Income

We have been reducing exposure to strong performing areas in the fund over the last few months and continued this process over the course of the month. We have reduced Paragon, Polar Capital Global Financials as well as some of our funds exposed to small and mid-sized UK companies, switching out of Aberforth Smaller Companies and Fidelity Special Values (where discounts were no longer obviously attractive) into Man GLG Income. At the same time, we felt the market sell-off intra month failed to discriminate between those companies with greater cyclicality and those that should hold up better if the economy does weaken further from here. We therefore reduced our holding in Urban Logistics and added to the infrastructure allocation in the portfolio across three existing holdings. Towards the end of the month, we reduced our holding in Twenty Four Strategic Income as investor expectations over the quantum of expected interest rate cuts grew, preferring to raise cash and keep our powder dry.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.