For Professional Clients Only

Macro & Market Update

July was month full of significant political and economic news that saw markets reassess their outlook for the timing of US interest rate cuts and a rotation in sector leadership.

Political news was dominated by the assassination attempt on Donald Trump, which resulted in greater party unity and was followed by the announcement of JD Vance as his running mate. A temporary boost in the polls narrowed following President Biden’s eventual decision to step aside in the presidential race after a poor performance in a televised debate. The Democratic party’s decision to coalesce around Vice-President Harris as his unopposed replacement has made the outcome of November’s election a closer call than expected at the start of the month. The snap election in France saw the country head towards a hung parliament with President Macron using the Olympics as an excuse to buy time before deciding who will lead the next government. The UK saw the Labour Party win a landslide majority, largely as expected. Despite the threat of higher taxes, markets had already discounted a change in administration and international investors appear to welcome the political stability this should bring over the next five years.

On the economic front, July saw a notable softening in language from US Federal Reserve around the prospect of interest rate cuts. Markets concluded that a first US rate cut in September was a certainty despite GDP growth for the second quarter coming in stronger than expected as this was seen as unlikely to be sustained in the second half of the year. Weaker consumer confidence data, signs the strength in the labour market is starting to soften coupled with June inflation data that came in weaker than expected, saw the commentary from members of Federal Reserve shift away from the previous focus on fighting inflation towards a more balanced assessment of the risks to employment that more restrictive monetary policy than necessary could cause. The impact on markets of this shift in stance was to see a second 0.25% interest rate cut baked into economic forecasts by the year end. In Europe, the European Central Bank kept interest rates on hold after their initial cut last month. Weaker economic data, however, suggests pressure will grow for rates to be cut further over the remainder of the year. In the UK, economic data has been more nuanced as far as the Bank of England is concerned. Whilst headline inflation has returned to its target level and the current level of interest rates is deemed to be restrictive, GDP growth performed stronger than forecast and inflation surprised marginally higher than expected. Nonetheless, investors have tipped in favour of a rate cut at the meeting on the 1st of August. Elsewhere, markets were disappointed by the outcome of the third plenum in China, a 5-yearly meeting to map out the country’s long-term social and economic policies. GDP growth in the second quarter missed forecasts and the hoped for stimulus from this event and a cut to interest rates were insufficient to excite investors. Finally, the Bank of Japan surprised markets with a hike in interest rates which accompanied a strong rally in the Japanese Yen.

UK equities, led by more domestically focussed small and mid-sized companies, were notably strong in the month. The combination of political stability, the prospect of looser monetary policy, the continued drum beat of M&A (mergers and acquisitions) activity and international investors attracted by relatively cheap valuations saw strong returns over the month. Conversely, the relentless march higher of US equity markets, driven by a small group of technology stocks, paused for breath as company results disappointed and investors questioned the extent to which increased technology spending on Artificial Intelligence could be monetised. There was a notable outperformance from US smaller companies in the period as investors were attracted by cheaper valuations and an economic outlook that suggests an economic recession can be avoided yet which also allows interest rates to be cut. Reflecting the weaker economic growth in China, Emerging Markets were weaker as were commodities. Bond markets as well as interest rate sensitive property and infrastructure sectors performed strongly.

Fund Performance

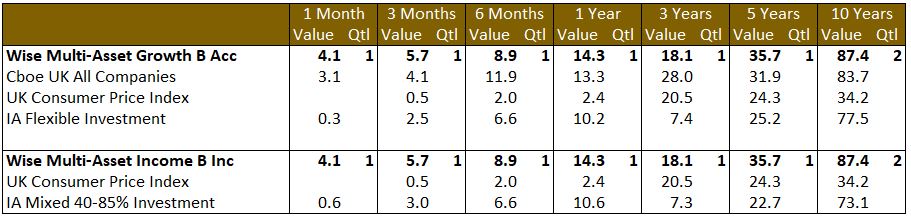

Wise Multi-Asset Growth

In July, the IFSL Wise Multi-Asset Growth Fund was up 3.5%, ahead of the CBOE UK All Companies Index (+3.1%) and its peer group, the IA Flexible Investment Sector (+0.3%). Our relative performance illustrates how differently we are positioned versus our peers, many of which are heavily exposed to large US technology companies via index trackers. Our top contributors for the month, Fidelity Special Values and Aberforth Smaller Companies, are exposed to the parts of the market that performed well last month, i.e. UK smaller value companies. In addition, the increase in interest from investors in UK assets saw a scramble to gain exposure to that part of the market, which led to a discount narrowing in our UK investment trusts. Another strong contributor was International Biotechnology Trust which continued to benefit from the recovery in the biotechnology sector. Fidelity China Special Situations was our only detractor of note, hurt by the ongoing weakness in the Chinese economy and the absence of meaningful governmental intervention to stimulate growth again.

Wise Multi-Asset Income

In July, the IFSL Wise Multi-Asset Income Fund was up 4.1%, ahead of its peer group, the IA Mixed Investment 40-85% Sector (+0.6%). Our UK equity allocation, notably our investment trust holdings Aberforth Smaller Companies and Fidelity Special Values, were our strongest performers against this backdrop, benefitting from strong underlying net asset value (NAV) growth as well as discount narrowing. Our private equity holdings, CT Private Equity and ICG Enterprise, similarly benefitted from discounts to their NAV reducing from anomalously wide levels. Our property and Infrastructure funds produced strong returns as investors responded well to the wide discounts on offer and were reassured by the prospect of lower interest rates that should support valuations. Whilst company specific news flow was limited, HICL Infrastructure produced a trading statement stating operational performance across the portfolio was in line with expectations as well as citing transactional evidence in direct markets that support its latest portfolio valuation. With the shares still trading at a near 20% discount and given the inherent defensiveness of the portfolio assets, we continue to believe this represents excellent value. Among a broad spread of positive contributors to performance International Biotechnology Trust stood out, driven by strong NAV growth as investor sentiment towards the sector continues to improve. Negative contributors were limited over the month and were centred on holdings with exposure to Asian Emerging markets. Abrdn Asian Income, Schroder Emerging Market Value as well as our two commodity focussed funds delivered marginally negative returns in the period.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

Over the month, we continued to actively bank profits across a number of equity, private equity and property funds. This is part of our valuation discipline but also a way of protecting the portfolio after what has been a strong period for financial markets and our Fund. We used some of this cash to add a new position in the Schroder Emerging Markets Value Fund, an emerging markets equity strategy managed by the same value team which manages the Schroder Global Recovery that we already own. We know the team’s process well and think that their approach should deliver positive and differentiated returns when applied to emerging markets.

Wise Multi-Asset Income

We added a new holding in the Schroder Emerging Markets Value Fund, an emerging markets equity strategy managed by the same value team which manages the Schroder Global Equity Income Fund that we already own. We know the team’s process well and think that their approach should deliver positive and differentiated returns when applied to emerging markets. We funded this holding from abrdn Asian Income and Murray International. We reduced our holdings in Aberforth Smaller Companies and Fidelity Special Values given the tightness of the discounts and strong recent performance. This was partially reinvested into Man GLG Income after the period end. Elsewhere we trimmed our holdings in Urban Logistics and the Twenty Four Strategic Income Fund whilst topping up our holding in Pantheon Infrastructure.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.