Performance statement

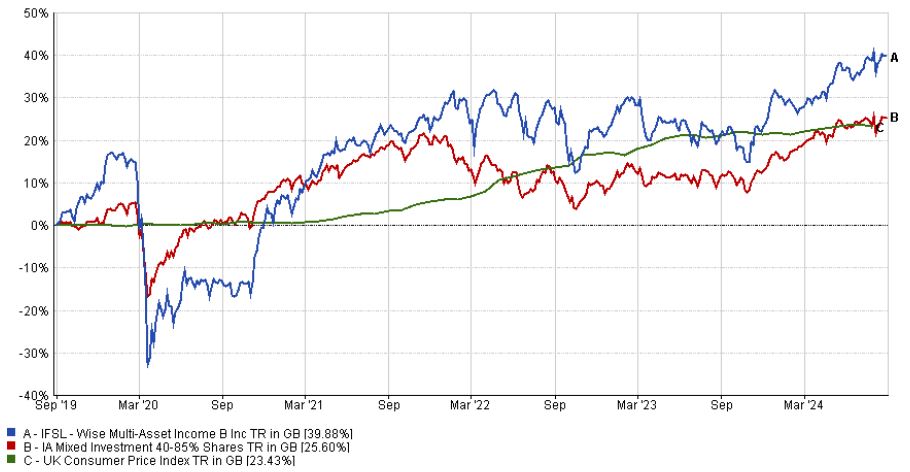

Over the six months of this report, to 31st August 2024, IFSL Wise Multi-Asset Income (the Fund) made a total return of +9.4% (B Income Shares). Over this time, we outperformed the Consumer Price Index (CPI), which measures inflation which rose by 1.1%. We also outperformed our comparator benchmark, the IA Mixed Investment 40-85% Sector, which rose 5.7%. As per our objective, over 5 years and on a total return basis, the fund has risen 39.9% compared to a rise of 23.4% for CPI, and ahead of the comparator benchmark, which has risen 25.6% over the same time period. The distribution per share for the six-month period fell 7% at 3.32p compared to 3.56p for the same period last year. This fall does not reflect our outlook for the dividend over the course of the full year, which we forecast to grow in line with CPI. Changes to the portfolio mean dividend payments in the second half of the fund’s year (August to February) will be ahead of last year.

For more fund performance, please see the latest factsheet

Wise Multi-Asset Income August 2024 factsheet

Market Review

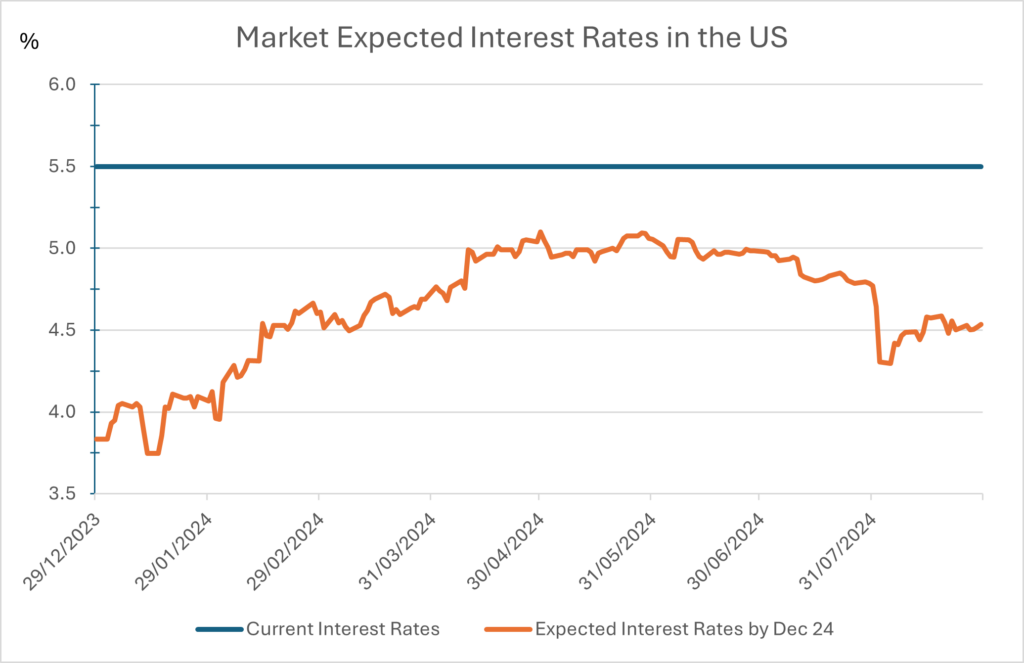

Investor expectations around the timing and quantum of interest rate cuts continued to dominate markets over the period. As time evolved, there was a notable shift in sentiment. Initial concerns over the persistence of inflationary pressures gradually subsided and were replaced towards the end of the period by worries that central banks might have kept interest rates too high for too long and now risked tipping economies into recession. Interest rates were cut in both the Eurozone and the UK with the Federal Reserve (Fed), the US central bank, giving investors a clear steer that there would be a cut in interest rates at their upcoming September meeting.

We started the period against a backdrop of stronger economic and inflation data than expected, pushing back optimistic hopes that meaningful interest rate cuts were imminent. Buoyant US jobs data and GDP (economic growth) growing faster than expected, coupled with unhelpfully strong core inflation data (after stripping out the more volatile components of food and energy) in the Eurozone, US and UK had already tempered growing hopes of an imminent end to the sharp increases in rates experienced over the prior 24 months. The strong economic data was particularly pronounced in the US and continued through until April, with Jerome Powell, Chairman of the Fed, stating it was likely to take longer than expected for inflation to return to their 2% target and so to justify future interest rate cuts. The stronger than expected data meant that investor expectations at the end of February of four 0.25% cuts in interest rates by the year end (2024) had reduced to less than two by the end of April. Whilst changes in interest rates most directly impact bond markets, movements are also keenly observed by equity investors as they both influence future expectations around economic growth and consequently corporate earnings as well as the rate used to discount back those future earnings to derive today’s estimate of value. Data highlighting changes to economic growth and inflation are carefully studied as they inform investor expectations of to where interest rates are likely to go. Over the summer months, investors drew some comfort that recent unhelpful inflation data in the US was no longer above expectations and this was reinforced by more supportive news that showed the US labour market was finally showing some signs of cooling. At the same time, consumer confidence showed signs of weakening, suggesting the strength in consumer spending that had been a key driver of US GDP growth compared to Europe and the UK was no longer likely to be sustained.

July saw a notable softening in language from the Fed around the prospect of interest rate cuts and markets concluded that a first rate cut in September was a near certainty. Commentary from members of Fed shifted away from the previous focus on fighting inflation towards a more balanced assessment of the risks to employment that a more restrictive monetary policy than necessary could cause. August witnessed levels of equity market volatility not seen since the depths of the Covid sell-off as markets started to worry that the Fed, having kept interest rates too high for too long, was at a greater risk of tipping the US economy into recession than delivering the soft-landing (an economic slowdown but not a severe recession) that had been expected since the start of the year.

Central banks typically move interest rates in 0.25% increments, although bigger moves are possible

Whereas the US has enjoyed relatively strong growth and expectations for full year growth have increased over the year, there has been a more subdued economic growth backdrop in the Eurozone and the UK. Consumers have been much more restrained in spending the savings built up over Covid and savings rates (the percentage of annual income saved) have stayed above historic norms as there has been more nervousness in the face of cost-of-living pressures and the more direct impact of the Ukraine/ Russia conflict on energy costs. Whilst growth forecasts for the year have steadily improved, notably in the UK, they remain well below the US. This divergence, however, looks set to narrow next year with economic growth predicted in the Eurozone and UK to increase year-on-year whilst the US is set to see growth moderate. Over the period, lower inflation allowed both the European Central Bank and the Bank of England, to cut rates once by 0.25%.

The picture of rising economic forecasts, inflation abating and central banks having started to cut interest rates or telegraphed that this was imminent was common across the Eurozone, UK and US economies. The picture in China and Japan, however, was slightly different. In Japan, monetary policy remains an outlier in that the level of interest rates remains extremely low. Interest rates started at -0.1% whilst strong wage growth of over 4% put increasing pressure on the Bank of Japan (BoJ) to return to a positive interest rate for the first time since 2015. As a result, the BoJ bucked the global trend and raised interest rates twice to 0.25%. The second rate rise in July was unexpected and had a significant impact on global markets coinciding as it did with signs that the US economy was slowing more than expected. In China, growth has not experienced the post-Covid recovery many were hoping for. Consumers are holding back as the housing market weakness is impacting confidence and businesses are reluctant to invest. Attempts to aggressively export its way out of its domestic problems are being met with an increase in trade tensions and tariffs from their US and EU trade partners.

In addition to this evolving economic backdrop, the period has seen significant political developments. 2024 is set to be an extraordinary year with around half the global population taking part in a national election. In the last six months, elections were held in India, Mexico and South Africa, as well as in the EU. Strong performance from the Marine Le Pen’s National Rally Party in France led to a surprising snap election being called with ongoing uncertainty over the prospects for the appointed government. The UK saw the Labour Party win a landslide majority, largely as expected. Despite the threat of higher taxes, markets appear to have discounted a change in administration and international investors appear to welcome the political stability this should bring over the next five years. In the US, the outcome of the upcoming election remains finely balanced. The assassination attempt on Donald Trump, followed by the Democratic party’s decision to unite around Vice-President Harris as an unopposed replacement for President Biden, has made the outcome of November’s election a close call.

Global equity markets produced strong returns over the period helped by the benign backdrop of improving economic growth and the prospect of looser monetary policy. Helped by low valuations, improving investor sentiment and M&A (Mergers and Acquisitions), UK equities led the way whilst the continued strength in US equity markets was tempered for UK investors by the 4% fall in the value of the dollar against sterling. Although the six-month performance for equity markets globally looks strong, it belies the significant volatility seen in certain markets. This was most notably seen in the performance of US technology companies and the broader Japanese equity index in August. The unexpected decision by the BoJ to increase interest rates caused the Yen ‘carry trade’ to be unwound putting pressure on risk assets elsewhere. A carry trade is a foreign exchange trade in which investors borrow money in one currency at a low interest rate and use it to make investments in assets in another currency. In the Yen carry trade, traders have borrowed Yen at low interest rates and invested either in higher-interest-rate assets elsewhere or into equities where they saw an opportunity for capital gain. With higher borrowing costs and the prospect of lower returns, investors scrambled to unwind this trade, which saw Japanese equities falling more than 25% in July as well as US technology shares suffer a technical ‘correction’ (a fall of more than 10%). Bond markets produced steady returns in local currency terms with the higher interest rates enjoyed by corporate bonds and a benign backdrop for corporate profits meaning returns were stronger for corporate credit than for government bonds over the period.

Fund performance review

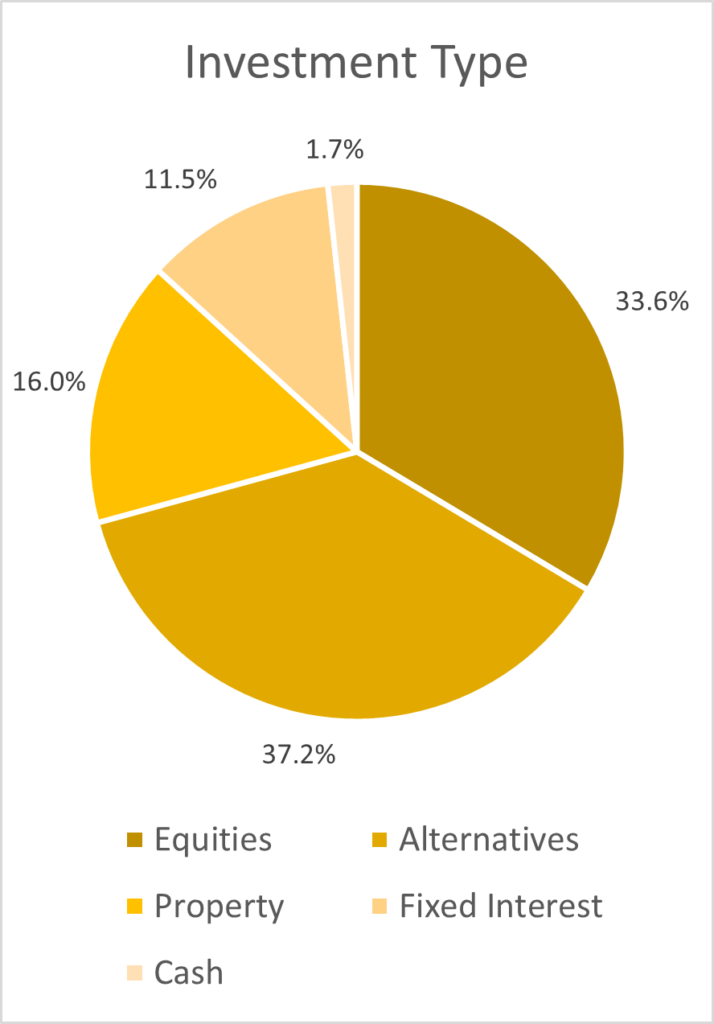

The fund delivered a strong return of 9.4% over the period. The best performance came from our UK equity funds, particularly from our investment trust managers focussed on investing into smaller companies at attractive valuations. Having been out of favour for some time, these funds benefitted from improving investor sentiment toward the UK, an increased level of M&A activity and a tightening of discounts (the difference between the share price and the net asset value) which were anomalously wide. Aberforth Smaller Companies, Fidelity Special Values and Man GLG Income all performed well as did our direct UK holding, Paragon Banking Group, which has seen continued operating momentum throughout the period translate into earnings and dividend forecast upgrades. This improved sentiment towards the UK and increased flows into UK equities also helped the performance of our investment trust holdings more broadly given they are listed on the UK stock market. Three quarters of the portfolio is invested in investment trusts and having lamented the widening of discounts across the investment trust sector in our latest annual report, it is encouraging to be able to report the anomalously wide discounts we reported at that point have in many cases narrowed. Our infrastructure names, notably Ecofin Global Utilities and Infrastructure, which invests into quoted equities and GCP Infrastructure, which invests mainly in loans to infrastructure businesses, both performed well and saw a meaningful reduction in discounts. Whilst these have now rebounded from unprecedentedly wide previous levels, it remains the case that the discounts on our broader allocation to the sector, including HICL infrastructure, International Public Partnerships and Pantheon Infrastructure remain extremely attractive and are now set relative to net asset values which reflect the higher interest rate environment. The discount tightening, however, was not uniformly felt across the portfolio with the Twenty Four Income Fund and International Biotechnology Trust, for example, facing a headwind of discounts moving wider.

The broader backdrop of falling bond yields and benign outlook for corporate credit helped the performance of our fixed income holdings, the Twenty Four Strategic Income Fund and the Twenty Four Income Fund. Our interest sensitive property holdings were meaningful contributors to performance although there were diverse drivers of return within our holdings. Impact Healthcare Reit, Empiric Student Property and Urban Logistics continue to enjoy strong occupational demand and increasing rents within the care home, student and industrial sectors respectively. This has translated into increased or stabilising net asset values against which discounts have narrowed. Helical and abrdn Property Income on the other hand have seen further falls in asset values although these fell well short of the extremely pessimistic levels implied by the discounts at the start of the period. Abrdn Property Income saw its proposed merger with Custodian Reit voted down in favour of a managed wind-down (sale) of its portfolio and announced in August it was assessing the potential sale of most of the portfolio in a single transaction, at a discount.

Despite the weak outlook for economic growth in China and mixed performance from the underlying commodities, our holdings in Blackrock World Mining and Blackrock Energy & Resources performed well. Increased M&A activity in the sector, a resilient copper price and strong performance from precious metals, notably gold, coupled with tighter discounts were sufficient to more than offset weaker iron ore and oil prices.

There were a limited number of detractors over the period. Our international equity funds, Schroder Global Equity Income and Murray International, delivered more muted returns, albeit positive. Similarly, our private equity holdings, ICG Enterprise and CT Private Equity made limited headway despite the broader backdrop of more positive performance from risk assets. The same was true for International Biotechnology Trust, where the discount widened despite rebounding confidence in the sector.

Portfolio Activity

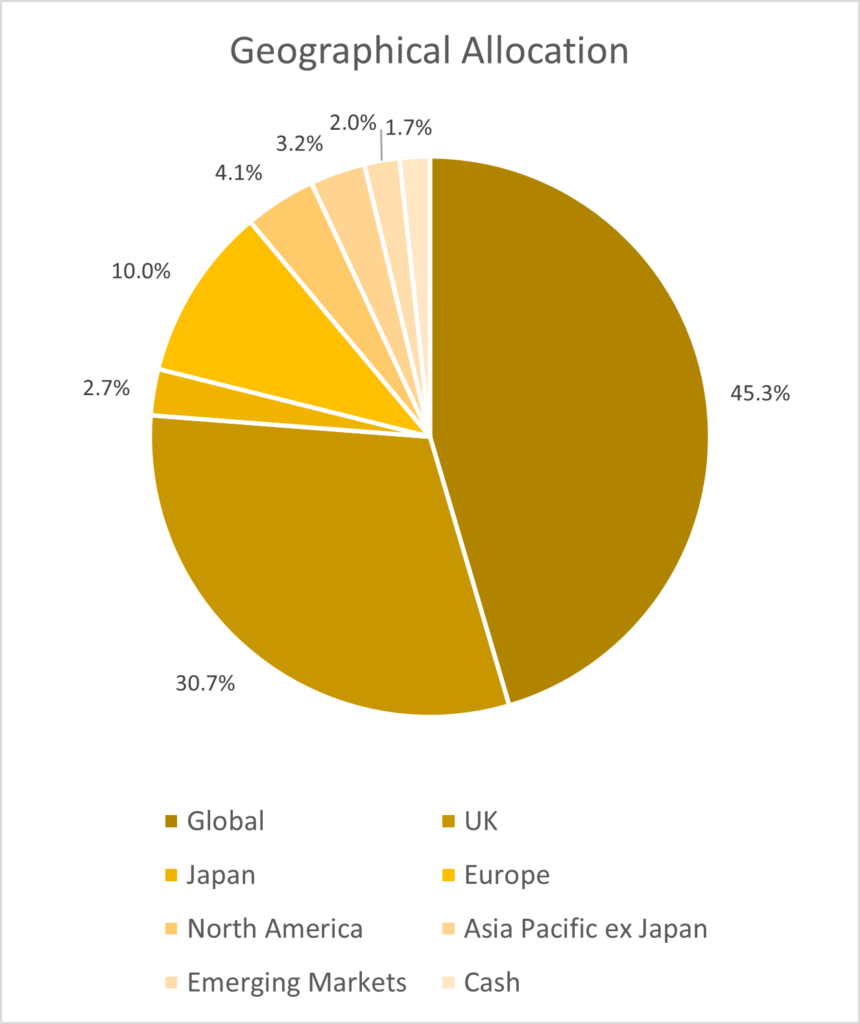

We actively recycled out of the strongest performing parts of the portfolio, taking profits in our equity funds and direct equity holdings which have performed strongly in the period. Within the UK we have taken profits in Aberforth Smaller Companies and Fidelity Special Values who enjoyed strong underlying performance but also saw their discounts reach the narrowest levels seen since 2021, when investors were enthused about a strong recovery in the domestic economy out of Covid. We partially reinvested into the Man GLG Income Fund, an open-ended unit trust, which maintained our exposure to the attractive valuations on offer within UK equities but without the risk that investment trust discounts reverse their recent tightening.

Within our international equity funds, we exited our holding in Murray International following the departure of the manager and reduced our holding in abrdn Asian Income in order to fund a new holding in the Schroder Emerging Market Value fund. The fund is managed by the same team which manages the Schroder Global Equity Income fund that we already own and we believe the team’s process should deliver positive, differentiated returns in emerging markets.

The largest asset allocation change over the period was to increase our weighting in infrastructure. With longer dated government bond yields falling, the yields offered from infrastructure assets look increasingly attractive. The sector is exposed to defensive underlying assets and the boards have recognised the significant value on offer in their own shares, choosing to sell assets at or above book value, to reduce debt and committing to buy back shares at attractive discounts. As a result, we increased our holdings in GCP Infrastructure, Ecofin Global Utilities and Infrastructure and HICL Infrastructure in the period. In part this was funded by reducing our exposure to the more cyclical property sector where we reduced our holding in Urban Logistics and exited TR Property.

Investment Outlook

Markets have become more nervous about the prospects for economic growth towards the period end, however, there are good reasons to believe this may be a moderate tempering of expectations rather than a collapse. The employment backdrop remains healthy on both sides of the Atlantic and strong balance sheets serve as buffers against downside risks for households and businesses. Governments are stepping up investment and financial institutions are mostly well positioned and ready to lend. However, the volatility markets experienced in August serve as a warning that central banks may not succeed in fighting inflation without a causing a recession. Concentrated portfolio positioning, notably towards a small handful of US technology names, are a risk for future global equity market returns. Whilst US market valuations are high in a historic context, the Fund is built around the more attractive valuations that exist among UK, European and emerging market equities. Bond markets are now discounting a series of interest rate cuts between now and the year end and risk disappointment if growth or inflation come in higher than expected. Nonetheless, yields remain high and give investors a cushion if central banks are unable to cut rates as aggressively as hoped. Against this backdrop we have further diversified the exposure of the Fund and maintain the discipline of recycling out of assets that have performed well. We are valuation focused and believe the discounts we can access via investment trusts provide an extra layer of valuation protection that should supplement returns for investors over the medium term. Finally, we believe the historic yield on the Fund of 5.1% remains attractive, is well diversified by source of income and has the capacity to grow as per our objective in line with inflation over the medium term (rolling 5 year periods).

As always, I would like to take this opportunity to thank our investors for their ongoing support. The whole Wise Funds team is at your disposal should you have any questions or would like to talk to us.

Philip Matthews

Fund Manager

Wise Funds Limited

September 2024

TO LEARN MORE ABOUT THIS FUND , PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.

This presentation is for Professional Clients only and not for re-distribution.

All data is sourced by Wise Funds and any third party data is detailed on the specific page.