For Professional Clients Only

Macro & Market Update

Weak manufacturing and employment data at the start of the month reinforced the market’s view that the US economy was slowing faster than expected and more urgent action was needed from the Federal Reserve (Fed) in cutting interest rates. Inflation held steady at 2.5% in the year to July, marginally below expectations, which paved the way for a more sizeable interest rate cut of 0.5% than the 0.25% widely pencilled in at the start of the month. Whilst there is now clear evidence that there are pockets of economic weakness in the US, Jerome Powell, Chairman of the Fed, was keen to stress that he does not believe they are behind the curve in reducing interest rates and that the overall level of unemployment, the strength of GDP growth, corporate earnings and consumer spending suggest the US economy remains in a good place. Markets, however, reacted to the weaker data by increasing the expected number of 0.25% interest rate cuts between now and the middle of next year from six to seven. As expected, the European Central Bank cut interest rates by a further 0.25% whilst a sharp fall in inflation in the Eurozone led investors now to expect an additional two interest rate cuts by mid-2025. Despite weakness in the construction and manufacturing sectors leading to stagnating GDP growth in July, the Bank of England kept interest rates on hold at 5% as inflation remained steady in August but indicated it may lower borrowing costs at its November meeting. The relative moves in US and UK interest rate expectations saw a consequent rise in sterling against the dollar of nearly 2% over the month. This extends its rise year to date to 5% which has seen the local performance of US assets fall as a result for UK investors.

China announced weak economic data for the month of August with industrial output and retail sales indicating the economy has lost further momentum. As a result, a swath of stimulus measures was announced. The aim is to provide liquidity to the economy in the form of lower interest rates as well as to directly underpin the flagging property market and to support the banking system and financial markets themselves. Further fiscal measures are also expected to provide a more direct stimulus to economic growth in the near future. Markets responded strongly with Chinese equities delivering one of their best weeks on record, when Beijing announced a similarly comprehensive stimulus package to boost the stock market. Strong performance was felt more widely among emerging market equities as well as in commodity markets which have been dragged down in recent months by fears over the strength of demand from the Chinese property sector. Oil, however, failed to participate in the wider commodity rally as investors became more concerned that supply of oil from OPEC (the Organisation of the Petroleum Exporting Countries), notably from Saudi Arabia, looked set to rise despite a weaker demand backdrop. International bond markets, both government and corporate credit, delivered positive returns over the month as rate expectations fell, however, it is notable that for sterling-based investors year to date these gains have been more than offset by the fall in the dollar.

Fund Performance

Wise Multi-Asset Growth

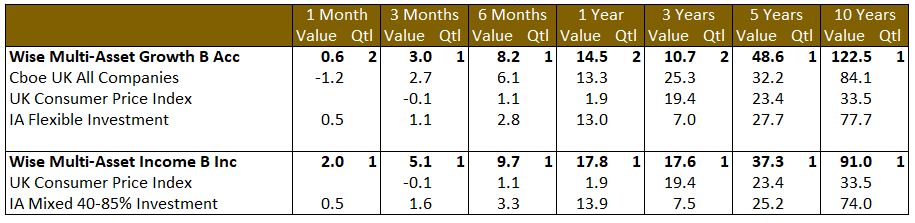

In September, the IFSL Wise Multi-Asset Growth Fund was up 0.6%, ahead of the CBOE UK All Companies Index (-1.2%) and in line with its peer group, the IA Flexible Investment Sector (+0.5%). For the third quarter, the Fund returned 3% beating both the CBOE UK All Companies Index (2.7%) and its peer group (+1.1%).

Unsurprisingly given the movement in Chinese equities mentioned earlier, our position in the Fidelity China Special Situations trust was the Fund’s top contributor. This position has been a difficult one to hold over the recent months, but we have always been fully aware of how volatile it could be and thus adjusted its weighting accordingly. While we think that the current price can show further upside from here given how depressed valuations remain despite the recent strong performance, it is also a position that we have actively traded and will continue to do so. Another strong contributor to performance was our position in the Jupiter Gold & Silver fund which continued to benefit from the strength in precious metals and consolidation in the mining sector.

On the negative side, UK equities showed some weakness after a strong run, hurting our UK equity funds. Another detractor was Worldwide Healthcare trust which suffered from a moderation of expectations with regards to sales of obesity drugs.

Wise Multi-Asset Income

In September, the IFSL Wise Multi-Asset Income Fund rose 2.0%, ahead of its peer group, the IA Mixed Investment 40-85% Sector which rose 0.5%. Last month we said that, despite benefitting from lower interest rates, it was perhaps surprising that certain defensive infrastructure names, such as GCP Infrastructure, HICL Infrastructure, Pantheon Infrastructure and International Public partnerships did not perform better. It appeared that they had been caught up in the wider weakness in the index of small and mid-sized companies with discounts widening as a result. September saw these infrastructure names deliver the strongest performance contribution for the fund reflecting this supportive interest rate backdrop and positive specific fund updates over the period. Pantheon Infrastructure announced a strong set of interim results with a net asset value (NAV) total return of 8.5% for the first half of the year. The profitability of the underlying holdings has grown an impressive 33% and the board is pointing to increased visibility of cashflows to underpin a dividend which grew 5%. International Public Partnerships extended its recent form in announcing another disposal in-line with its recent book value, thus underpinning the share price which continues to sit at a 12% discount to NAV. Ecofin Global Utilities & Infrastructure enjoyed strong performance driven by strong demand for electricity in the US, notably from AI data centres. Our property holdings were also strong contributors helped by the supportive backdrop of further sector consolidation and positive company specific news. Most notable was the announcement from abrdn Property Income that had agreed to sell all the fund’s assets bar one at a premium to the share price. We believe this represents favourable outcome for us as we will be receiving the proceeds as cash which allows us to reinvest selectively back into the sector on attractive terms. Urban Logistics announced a number of acquisitions at attractive yields reflecting their increased optimism that valuations in the industrials sector have bottomed and the certainty around financing costs that came with a group wide refinancing. There was more divergence in the performance of our equity funds with those funds exposed to emerging markets and the stimulus in China, such as abrdn Asian Income and Schroder Emerging Market Value, performing best whilst our UK equity investment trusts, Fidelity Special Situations and Aberforth Smaller Companies, fell following a strong period of performance year to date. The other area of strong performance came from our commodity funds, Blackrock World Mining and Blackrock Energy & Resources, on the back of the Chinese stimulus package.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

Over the month, we booked some profits in Jupiter Gold & Silver, Ecofin Global Utilities & Infrastructure, TR Property and TwentyFour Strategic Income Fund, all of which having benefitted from lower interest rates expectations in the past few weeks. We also reduced our allocation to JO Hambro UK Equity Income and ManGLG Undervalued Assets in the UK after a strong 12-month performance. We used some of these proceeds to top up BlackRock World Mining trust which fell to an abnormally wide discount after Chinese-inflicted weakness in the industrial metals complex. The attractive valuation and the correlation with Chinese growth where negative sentiment was extreme, led us to take a contrarian view and increase our position. This was before the announcement of the stimulus measures from China and the trust rebounded strongly subsequently.

Wise Multi-Asset Income

We took some profits in abrdn Property Income and reinvested into an existing basket of attractive income generating holdings. As such, we added to GCP Infrastructure, Pantheon Infrastructure and Urban Logisitcs. We trimmed our exposure to the Twenty Four Strategic Income Fund and added to our private equity holding, ICG Enterprise, which sits on a discount of 37% to net asset value.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.