Wise Funds, the value-oriented multi-asset specialist based in Oxfordshire, has altered the objective and moved the sector of its TB Wise Multi-Asset Income fund, which now seeks to grow both its income and capital in real terms whilst delivering investors a minimum target yield of 3%. The fund currently yields 4.4% and marks the level of distribution from which they aim to grow in real terms, with the income now deriving from an increasingly diversified asset allocation.

The change to its objective has been driven by the fund’s former benchmark, the Cboe UK All Companies Index, last year confirming it will stop calculating a yield for the index. The fund is also switching its sector classification from the IA Flexible Investment Sector – which the fund has been classified by since its launch in 2005 – to the IA Mixed 40-85% Investment Sector.

The fund’s managers, Philip Matthews and Vincent Ropers, have implemented the change to provide a better comparison of the fund against a more representative group of peers, with the IA Flexible Investment Sector seeing an increase in more growth-oriented, non-multi-asset funds over the last five years. However, the changes will not impact the process by which the fund’s portfolio is managed.

Over the three years to the end of March 2022, the TB Wise Multi-Asset Income fund has delivered a total return of 25.3% compared to a return of 22.4% for the IA Mixed 40-85% Investment Sector, despite the UK market facing numerous macroeconomic headwinds.

Greater fund alignment

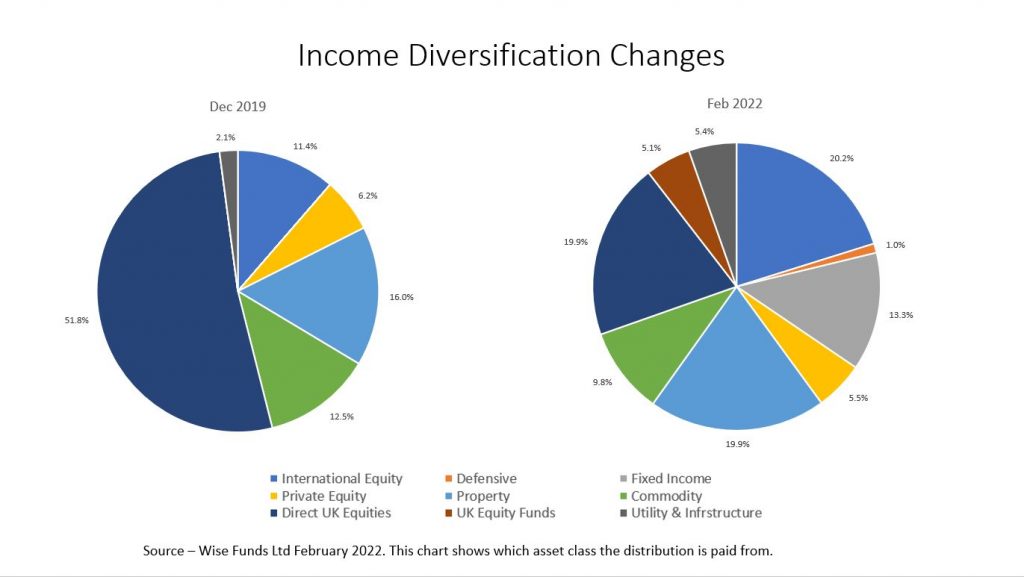

The new changes build on several portfolio measures implemented by the fund’s managers since mid 2020, which initially were aimed at restoring the portfolio dividend without sacrificing the significant capital upside in markets at the time. More recently these changes have been focussed on ensuring the portfolio and its dividend are more resilient moving forward. Within its overall equity allocation, the fund has significantly reduced its holdings of direct equities in favour of investment trusts, which were able to continue paying attractive dividends even throughout the Covid-19 pandemic. At the end of 2019, the fund held 63% via direct equities compared to 16% today. This move aligns the strategy closer with that of the TB Wise Multi-Asset Growth fund.

From an asset allocation standpoint, the fund has also sought to diversify the sources of income away from equities, which accounted for 63% of the income in 2019. The changes made within the fund were aimed at broadening out the sources of income towards other asset classes, whilst being mindful of valuation and the outlook for economic recovery post-Covid. The fund has been very selectively adding exposure to fixed income, holding 10% today, mainly via corporate loans or asset-backed securities (e.g. mortgages) where coupons are linked to interest rates and thereby provide a hedge against inflation. In addition, its exposure to renewables and infrastructure has risen to 6.4%. Finally, the fund has increasingly allocated to property over the last few years, with its exposure to the asset class rising to 17% held today.

Regarding its overall equity allocation, the fund has diversified geographically, increasing or initiating holdings in Murray International Trust, Schroder Global Equity Income, CC Japan Income & Growth Trust, and BlackRock Frontiers. With these changes, the funds income is now sourced from a variety of different asset classes.

Breakdown of portfolio by asset class as of 31st December 2019 vs 28th February 2022. Source – Wise Funds

This chart demonstrates the greater diversification of the fund’s income today both by asset class and geographical allocation.

Philip Matthews, co-portfolio manager of the TB Wise Multi-Asset Income fund, says: “Whilst the changes to the fund’s objective and sector have been driven by external factors and will not impact the way in which the portfolio is managed, we have independently been making changes to the portfolio make-up over the last two years in an effort both to reduce the volatility experienced by investors previously as well as improve the resilience of its dividend.

We believe a well-diversified portfolio both by geography and asset allocation positions the portfolio well to navigate further bouts of market volatility amid escalating geopolitical tensions, rising inflation and rapidly shifting central bank policies. The fund’s dividend has recovered strongly since the depths of 2020 and now looks well-underpinned by a much more diverse set of sources.”

John Newton, business development manager at Wise Funds, adds: “Since the fund’s inception, we have always sought to pay a good level of income. Currently we are yielding 4.4% which we believe is at an attractive level in the current market plus we aim to grow both the income and the capital in line with inflation

“These changes align the fund closer to that of the TB Wise Multi-Asset Growth fund, while positioning the portfolio for the more uncertain investment landscape we currently face.”

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.