For Professional Clients Only

In this update, we will look to cover the following topics:

- Why we changed our objective and sector

- Changes within the portfolio

- How we have diversified the Income

We recently announced an upcoming change to the objective and policy for the TB Wise Multi-Asset Income fund. We currently aim to yield more than the Cboe UK All companies Index, however, last year the Cboe confirmed they were going to stop calculating a yield for this index. To remain compliant with regulation and to ensure the fund has appropriate targets, we were required to find an alternative target benchmark that also ensures we don’t change how we manage the fund. Since launch we have always sought to pay a good level of income, as well as grow that income and the capital in line with inflation. The new objective aims to capture these same principles, with a minimum target yield of 3% and to grow both income and capital in real terms (above inflation).

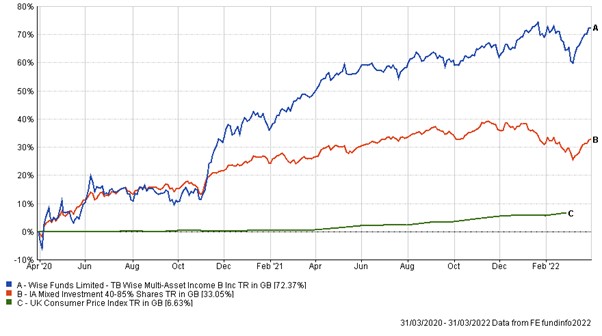

In addition, we have also decided to make a change in the sector classification in which the fund sits. Since launch we have always been in the IA Flexible Investment Sector but after careful consideration, we feel the IA Mixed 40-85% Investment Sector better reflects the way the portfolio is managed. Over the past 5 years, the Flexible Sector has seen an increase in non-multi-asset funds, which are often more growth orientated and a decrease in multi-asset income funds. We would again stress that this move in sector classification will not change our management approach but will provide a better comparison of the fund against a more representative group of peers. Whilst in theory this does add a constraint to the asset classes we can hold, in practice we have always managed the fund comfortably within the sector limits. Whilst these changes have been driven by external factors and will not impact the way in which the portfolio is managed we have independently been making changes to the portfolio make-up over the last 2 years in an effort to reduce the volatility experienced by investors previously as well as to improve the resilience of its dividend.

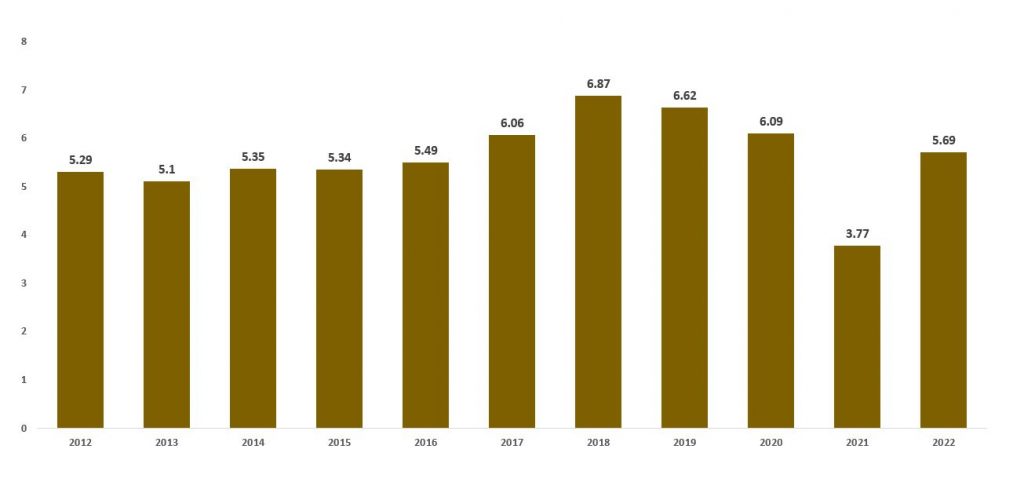

Over the 3 years to the end of March 2022 the TB Wise Mult-Asset Income fund has delivered a total return of 25.3% compared to a return of 22.4% for the IA Mixed 40-85% Investment Sector. During this period, markets have had to navigate a number of significant obstacles, each of which at the time made the delivery of such future returns seem improbable. Boris Johnson’s decision to prorogue parliament in August 2019, the global lockdown Covid restrictions in the Spring of 2020 and more recently the return of inflation to levels not seen for 40 years compounded by the invasion of Ukraine did not seem to be the ideal backdrop for indices to have delivered such decent returns. However, the annualised performance delivered by the sector over the last three years have been the best three years out of the last five and on a par with annualised returns over the rest of the last decade. Throughout this period, it has been critical for investors to hold their nerve through some of the choppiest investment waters we have experienced and at one point to ride out the fastest ever equity bear market on record. Whilst we are happy to have delivered total returns in excess of our comparator index over this time, we are very aware that the volatility investors experienced investing in the Multi-Asset Income Fund during this period was higher than we both expected or want to deliver in the future. Furthermore, the 43% drop in the fund’s income in 2020 was a huge source of disappointment and has led to a thorough review of how the portfolio was constructed to better position it for the future.

The key question we faced in the summer of 2020 was how to rebuild the fund’s dividend without sacrificing the significant capital upside available in equity markets at the time. We also debated what level of distribution we considered it was possible to recover back to, whilst also being able to deliver on the other objectives of the fund, namely to grow that dividend and the fund’s capital in real terms over future 5 year rolling periods. Finally, we sought a way to diversify the fund’s sources of income and thereby the dividend’s future sustainability. We believed greater diversity at an asset allocation level should also reduce the volatility of the fund’s capital as we increased exposure to assets less correlated to equity market performance, as well as bringing broader geographic diversification to the portfolio.

In retrospect we have been forced to acknowledge the fund’s dividend had been allowed to grow too fast in the period immediately post the Brexit vote in 2016. Over the subsequent two years the distribution per unit on the fund grew 25% as the allocation to equities, and particularly UK direct equities, grew significantly as a percentage of the fund. Whilst the capital upside opportunity within this part of the market looked exceptionally attractive at the time and the yields highly attractive, the portfolio became too heavily skewed to one particular asset class and geography. Whilst we have seen the dividend per share recover more strongly than we expected from the lows of 2020 we do not believe it is sensible to try and fully recover the level of dividend paid by the fund in the period immediately prior to the Covid crisis. Our expectation now is the dividend paid in our fund year to February 2022, will mark the level from which we will look to grow in real terms. The current historic yield for the fund is 4.4%* which we believe is an attractive level of income.

Annual Pence per Share distribution

2022 data uses estimated dividends

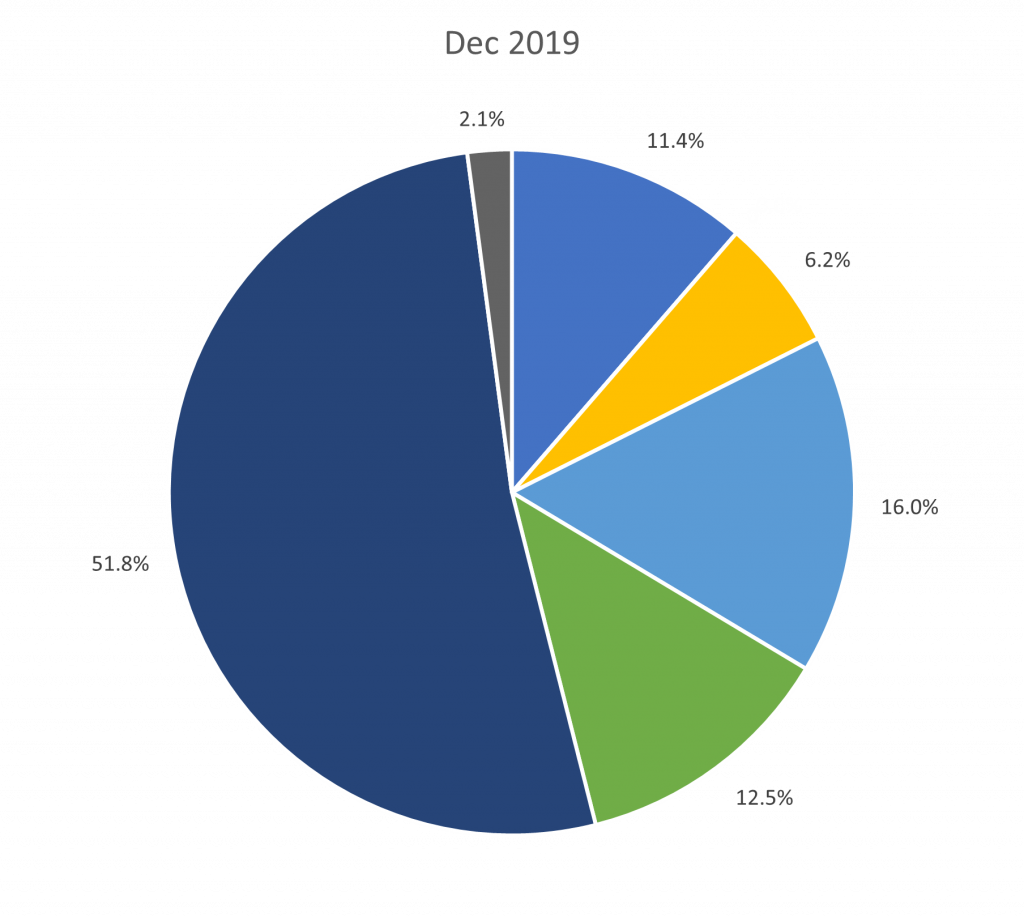

Since the summer of 2020 we have taken several steps that we believe should make the portfolio and its dividend more resilient in the future than it was at the end of 2019. Within our overall equity allocation we have significantly reduced our holdings of direct equities in favour of investment trusts. Whilst companies elected or in some cases were forced to cut their dividends by regulators in 2020, investment trusts were able to continue paying dividends throughout the Covid crisis given the high levels of revenue reserves they had built up over previous years, which their structures allow them to do. Switching from direct equities to investment trusts allowed us to maintain our exposure to the exceptional capital upside we felt equities offered at the time whilst restoring income for the fund. Furthermore, in every case, these investment trusts themselves traded at abnormally wide discounts to their net asset values making them an even more attractive proposition. To put this into context, at the end of 2019 we held close to 70% in direct equities compared to 16% held now. We have taken the decision to further wind down our exposure to direct equities over time both to align the strategy with that of our Multi-Asset Growth fund and in the belief that the greater underlying equity diversification and commitment to paying dividends should improve the proforma volatility of both the capital and the sustainability of the dividend. As existing direct holdings reach fair value they will, therefore, be sold down and new direct equity holdings will not be added to replace them.

Within our overall equity allocation, both third party funds and direct equities combined, we have diversified our geographic exposure away from the previous heavy concentration towards the UK. Whilst we continue to believe that the UK equities represent good value in a global context, we also recognise this value is not driven by geographic factors alone (most notably Brexit) but also by the fact UK equity indices have greater exposure to particular sectors (such as banks, commodities, energy and telecoms) that represent good value irrespective of which country the companies are domiciled in. It has been possible to diversify equity exposure internationally whilst also maintaining exposure to ‘value’-style managers whose funds are delivering yields comparable to those delivered by similar funds in the UK. As examples we have increased or initiated holdings in Murray International, Schroder Global Equity Income, CC Japan Income & Growth and Blackrock Frontiers. In most cases these have further increased the fund’s exposure to investment trusts, however, there have been specific examples where we have only been able to access certain managers through open-ended funds. This has moved our UK equities (funds +direct) allocation from 65% at the end of 2019 to the end of March. Overall, however, the allocation to equities (UK direct equities, UK and International funds) has fallen from 67% to 49% over the same period.

From an asset allocation standpoint, we have also sought to diversify the fund’s exposure away from equity and broaden out towards other asset classes. However, we have been mindful of two factors whilst doing this. Firstly, against a backdrop of recovering economic growth we believed equities and property offered the best combination of yield as well as income and capital growth. Considering where we were in the cycle, a greater allocation to risk rather than defensive assets was warranted. Secondly, within a more defensive allocation there has been a twin challenge of finding defensiveness that delivers an acceptable level of yield but also that is protected against inflation. For much of the period post the Global Financial Crisis, bonds have offered unattractive levels of yield, particularly when compared to inflation. Even during periods of benign inflation real yields were negative, driven lower by central banks quantitative easing (bond purchase programmes) and provided no protection against any possible rise in inflation. Despite this backdrop we have managed to increase our allocation to fixed income from 0% in 2019 to 10% today. The funds we have added in this area share similar characteristics – they offer an attractive initial yield, the income is well-underpinned by a variety of assets that back the underlying loans, the funds benefit from an improving credit backdrop, discounts to net asset value had moved out to unusually attractive levels and importantly there is some sort of inflation linkage to the coupons that the companies receive. We have added holdings in the TwentyFour Income Fund, a fund invested in asset backed securities (eg residential and commercial mortgages), Starwood European Real Estate Finance, a pan-European lender to commercial property companies, and GCP Infrastructure, a lender to European infrastructure and renewable companies. Encouragingly, whilst global bond markets have delivered the worst quarterly performance in Q1 2022 for many decades, as monetary policy has tried to catch up with inflation, our allocation to fixed income within the portfolio has not detracted to performance given these attributes.

Renewables and Infrastructure itself was an area within the alternatives space that we were keen to increase exposure to, however, most investment trusts had traded at significant premiums to net asset values (NAV) for many years. 2021 offered an opportunity to add new position as valuations moved closer to NAV or if some cases discounts. Attractive levels of yield, exposure to renewables growth, defensiveness and upside exposure to depressed power price forecasts at the time have allowed us to increase our exposure to this alternative asset class from 2.6% at the end of 2019 to 6.4% today. We have added to our holding in Ecofin Global Utilities and Infrastructure as well as initiating new holdings in JLEN Environmental Assets and Pantheon Infrastructure.

The final major asset allocation within the portfolio has been to property. We believe the yields from property remain attractive and in contrast to equity markets valuations do not reflect a recovery in markets back to pre-Covid levels. We have holdings across office, retail park and student property markets that should benefit from a return to more normal patterns of behaviour and economic recovery. These all continue to trade at substantially wider discounts to asset values than they did pre-Covid. As such, Standard Life Investment Property Income, Palace Capital, Ediston Property and Empiric Student Property form a core element of our property holdings. In addition, we have added new holdings in areas benefitting from strong structural growth tailwinds, where rents proved resilient during the Covid crisis, and have been able to grow either due to direct inflation linkage or on account of favourable supply-demand dynamics. Urban Logistics and Impact Healthcare REIT have both been added to the portfolio, further diversifying the exposure within the property allocation.

Since the lows of 2022 equity markets have recovered strongly with valuations now better reflecting the outlook for earnings. Wide valuation dispersion exists within equity markets, whilst regional opportunities also present opportunities for active managers. Within our equity allocation we are still heavily weighted towards managers or direct equities where valuations remain attractive but recent strong performance has allowed us to diversify the portfolio away from equities towards other asset classes where we see similar opportunity for future returns. We believe these changes position the portfolio well for the more uncertain outlook we currently face, both from an income resilience standpoint and for the Fund’s ability to grow capital and income going forward.

Income Diversification Changes

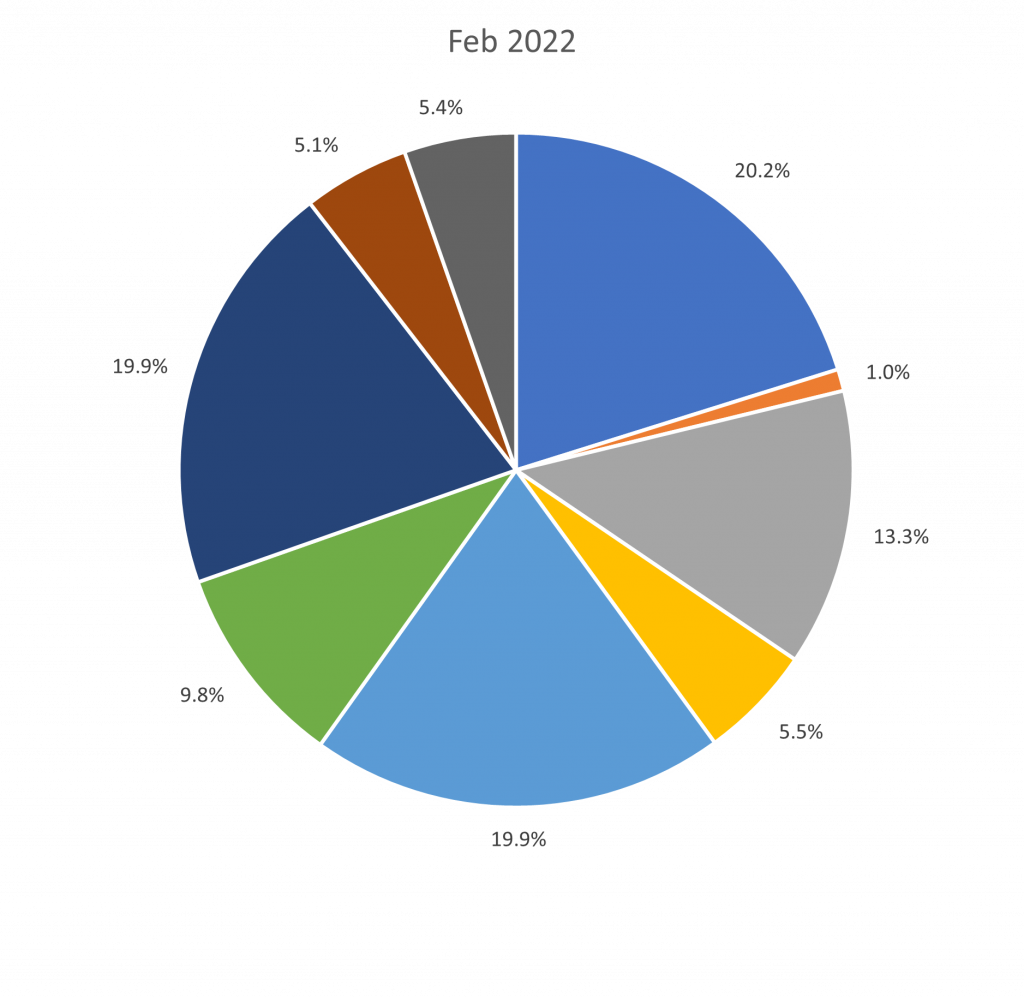

Breakdown of portfolio by asset class as of 31st December 2019 vs 28th February 2022. Source – Wise Funds

This chart demonstrates the greater diversification of the fund’s income today both by asset class and geographical allocation.

*The historic yield is the previous 12 months distributions and is not guaranteed. The income can go up and down along with the capital value.

All Data quoted in this article is sourced by Wise Funds Ltd as of the 31st March 2022