For Professional Clients Only

Macro & Market Update

What a month! The UK took centre stage in September, transitioning swiftly from the appointment of Liz Truss as new Prime Minister to the sad death of Queen Elizabeth II and the ensuing dignified period of national mourning, before the new government’s “mini” budget unleashed mayhem in bond, currency and equity markets. The magnitude of the moves observed in financial markets last month is hard to exaggerate: in the few days following the raft of unfunded tax cuts announced by the new chancellor, Kwasi Kwarteng, sterling fell to its lowest level ever against the US Dollar, 2-year UK government bond yields (which move inversely to price) rose by about 50% (one of the -if not the- worst weekly performance for such bonds on record), mortgage markets froze, interest rates expectations for next year moved to 6% from 2.25% currently, the Bank of England was forced to intervene to calm markets, and UK equities fell close to 6% (CBOE UK All-Companies). No doubt this isn’t the way Liz Truss envisaged her first month in office to go. It is all-the-more astonishing that the above market reaction came on the back of a seemingly pro-growth, market-friendly budget combining direct help to consumers facing a cost-of-living crisis, income tax cuts, changes to stamp duty thresholds and reversals of both national insurance levies and the planned increased in corporation tax. Through naivety or ideologic principles, the government misjudged the extent to which inflation concerns, past periods of austerity, and rising inequality have left no room for unfunded tax cuts anymore. The government’s obstinance in refusing to publish how those cuts will be financed until November 23rd and pushing for tax cuts for the wealthiest at a time of crisis for the average household did not go down well. As we write, Kwarteng just announced a U-turn on the 45p top-rate income tax cut in an effort to calm markets and his own Party, but the government’s credibility will take more (either action or time) to be restored. For now, the country remains on fragile grounds. It is now expected that the Bank of England will raise interest rates by a full 1% at its next meeting on 3rd November, compared with 0.5% previously expected, illustrating how hard the Bank now has to work to contain the aftermaths of an ill-conceived budget.

Meanwhile, in the rest of the world, tightening of financial conditions remained the order of the day, with the US Central Bank not only raising rates by yet another 0.75% (the third consecutive such rate hike) but also making it abundantly clear that controlling inflation will involve some pain and thus increasing expectations of a recession. A similar 0.75% move, unprecedented so far, was also made by the European Central Bank.

Finally, the situation in Ukraine did not show any signs of abating, despite encouraging news of Ukrainian forces pushing back and regaining some of the ground they lost in the early days. Rather than caving in, however, Putin appears keen to double down, announcing a partial mobilisation of its forces during the month and a full annexation of 4 regions, thus giving him excuses to retaliate were Western forces to intervene.

nds

Fund Performance

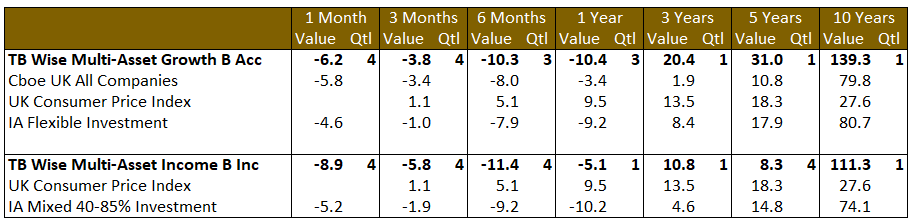

Wise Multi-Asset Growth

In September, the TB Wise Multi-Asset Growth fund was down 6.2%, behind both the CBOE UK All Companies Index (-5.8%) and the IA Flexible Investment sector (-4.6%). This closes a difficult quarter for our Fund, down 3.8% in Q3 and 12.9% year-to-date. At the broad level, being a growth strategy, our Fund suffered from the increased volatility and sharp moves lower in so-called risk assets last month. Those moves were amplified by our investments in investment trusts. While those have helped us outperform our benchmarks over time, and continue to be our main focus, discounts tend to widen when markets fall, hurting performance in the midst of a crisis. An investment trust’s Net Asset Value (NAV) represents the value of the underlying assets in the trust. Investors might be more or less eager to acquire those assets, however, meaning that the price of the trust can differ from the NAV. That difference results in a discount or a premium to NAV. When a panic sets in, fundamentals matter less and investors tend to sell first and ask questions later. This could be due to the desire to protect their portfolios from further downside, or to meet redemptions from their clients. Discounts thus tend to widen. This is exactly what we observed last month: our Fund’s aggregated discount (i.e. the weighted average discount of all of our holdings, or the discount our Fund would trade at if it was an investment trust itself) widened from 8.6% at the end of August to 10.2% at the end of September. At the start of the year, that discount was 4.3%. This illustrates the moves that we have seen in our markets. Historically, those moves are short-lived and, as seen as recently as in 2020 post-the Covid lows, while investment trusts can amplify losses on the way down, they tend to amplify rebounds too.

Other than moves in the discounts, liquidity was also a factor for our worse detractors with the smaller names being more impacted by panic selling like, for example, Baker Steel Resources Trust. Finally, with bond yields rising so sharply and being the basis for discount rates for so many strategies, some of our income-paying trusts like TR Property were particularly badly affected last month.

Wise Multi-Asset Income

Against this backdrop, the TB Wise Multi-Asset Income fund suffered its worst monthly performance since the Covid Crisis. In September, the TB Wise Multi-Asset Income fund fell 8.9%, behind the IA Mixed 40-85% Investment sector which fell 5.2%. Our property holdings were the biggest negative contributors to performance over the month. Whilst higher interest rates and borrowing costs will undoubtedly lead to pressure on valuations in the physical property market as will the weaker outlook for tenant demand, dividend yields for the sector are now touching the levels seen in the depths of the Covid pandemic. At that point offices and shops were unable to open and rents were not being paid. Whilst we are not blind to the fact higher bond yields make property less attractive by comparison, we believe the current discounts to net asset value (in some cases approaching 50%) more than reflect the recent step-up in bond yields. Structural supply-demand dynamics in many property subsectors should be supportive for rents and we take comfort from the fact all of our holdings have reduced their borrowing significantly since Covid. Nonetheless our property holdings fell on average 14% over the month. Given the turmoil in the mortgage and life insurance market, it is unsurprising our direct financial holdings also saw heavy selling in the panic that immediately followed the ‘mini-budget’. As examples, Legal & General and Paragon fell 26% and 14% respectively, reminiscent of the period post the start of the Covid pandemic. We believe these companies are much more resilient than these falls suggest and were encouraged to see Legal & General report early in October that, notwithstanding increased volatility in the second half of the year, this has limited impact on their business. They have no direct exposure to the parts of the pension market that caused the emergency intervention by the Bank of England, the group’s annuity portfolio, that funds payment obligations to pensioners continues to perform well and is set to grow, and recent moves in markets has seen their ability to meet their long term debts and financial obligations improve. Similarly, Paragon have continued to buy back shares in the company as part of the £75m programme announced in June suggesting they do not see current market turbulence as a cause for concern. More broadly we have seen sharp widening in discounts to net asset value in many of our investment trust holdings suggesting there has been an element of panic within markets as investors seek to derisk their portfolios or have been forced to sell to meet redemptions.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Income

During the month, we reduced our holding in Man GLG Income, an open-ended fund and initiated a holding in Fidelity Special Values, an equity investment trust with a similar value approach that sat on a wide historic discount. We took advantage of higher bond yields to add to our holding in the Twenty Four Strategic Income Fund and partially switched our holding in Ecofin Global Utilities into GCP Infrastructure given relative recent performance.

Wise Multi-Asset Growth

As mentioned in last month’s commentary, we had built up our cash reserves over the summer and we used the volatility in September to put some of that cash to work. We remain cautious, however, so the biggest addition to the portfolio was to the TwentyFour Strategic Income Fund which we think is an attractive way to lock-in very attractive yields in bond assets with relatively low duration and low risk of default. We also took some profits in the Ecofin Global Utilities and Infrastructure Trust after a continued strong absolute and relative run.

Thanks to our increased cash buffer, we will be ready to take advantage of opportunities as and when those present themselves over the next few weeks.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.