For Professional Clients Only

Macro & Market Update

We mentioned in last month’s commentary that there had been a noticeable shift in market sentiment, with bond yields indicating investors increasingly believed that, on the back poor economic data and inflation showing signs of peaking, central bankers would be allowed some breathing space to slow the pace of interest rate rises. Indeed, bond markets had already begun to price in the possibility of interest rates having to be cut next year in response to developed world economies falling into recession. Jerome Powell, the Fed Chair, fanned the belief that the Federal Reserve could potentially pivot monetary policy away from its tightening trajectory when he described the position post the last interest rate rise as ‘neutral’, implying they were no longer playing catch up in the fight to tame inflation. Markets were further buoyed by his comment that the future pace of interest rates would now be determined by upcoming economic data in the belief that recent weak data was only likely to get worse.

These hopes were quickly dashed, however, as employment data at the start of the month showed not only had significantly more jobs been created than expected but that there had also been strong wage growth at over 5% year on year. The likelihood of another 0.75% increase in US interest rates grew as the fight to reduce inflation was likely to continue even at the cost of inflicting further pain on households, workers and companies. On the back of similar rhetoric from other members of the Federal Reserve over the course of the month, Jerome Powell used his speech at the annual Jackson Hole symposium to reiterate this was the unfortunate cost of reducing inflation. As a result, bad economic news was taken as bad news by markets since there was no longer any compensatory hope it might temper tight monetary policy. Over the course of the month, economic data highlighted the challenging backdrop faced by consumers and companies as the inflationary impact of the war in Ukraine continues to be felt. In the US, weak manufacturing surveys and signs rising mortgage rates and higher construction materials are negatively impacting the housebuilding sector were only partially offset by evidence supply chain disruption is easing and lower gasoline prices. Closer to home the energy price cap rise announced for October and natural gas prices spiking in Europe served to highlight the cost-of-living squeeze faced by consumers in the absence of any meaningful fiscal intervention whilst the new prime minister is chosen.

There were limited hiding places for investors, particularly in the second half of the month although Sterling’s worst month since Brexit mitigated the negative performance of many international asset classes once translated back into pounds. There was an extreme move in 2-year UK bond yields from 1.7% to over 3% by the end of the month (a clear indicator of where markets expect interest rates to rise to in the short-term), which came on the back of a 0.5% rate rise at the start of the month and the announcement that the Bank of England (BoE) would start active sales of its gilt holdings (quantitative tightening) in September. The monetary policy guidance that all actions necessary would be taken to return inflation to 2% in the medium term was accompanied by a particularly negative assessment for the UK economic outlook. The BoE now projects a recession which will see a peak-to-trough drop in quarterly GDP of 2.1%. This proved a poor backdrop for both domestic bond and equity markets, particularly the more domestically focussed mid cap index. Equity market weakness was felt across most geographies with the exception of emerging markets where valuations look relatively attractive, inflation is less of a problem and monetary policy is set to loosen. Indeed, lending rates in China were reduced during the month on the back of weak July activity data.

nds

Fund Performance

Wise Multi-Asset Income

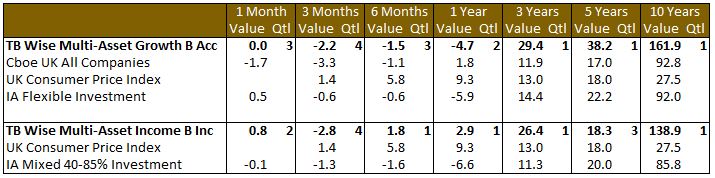

In August, the TB Wise Multi-Asset Income Fund rose 0.8%, ahead of the IA 40-85% Mixed Investment Sector which fell 0.1%. Our commodity related funds and those with exposure to increasing power prices performed well. Blackrock World Mining and Blackrock Energy & Resources saw continued recovery from a particularly weak performance in June whilst John Laing Environmental announced strong net asset value growth in the second quarter that is likely to increase further once forecast inflation assumptions are reviewed. Both Aberdeen Asian Income and Black Frontiers performed strongly partially helped by FX translation but also highlighting the benefit of international diversification within our equity allocation. We were encouraged by strong half-year results from both Legal & General and CT Private Equity, where the strong operational delivery in the period sits at odds with recent share price performance and attractive valuations. The weakest two areas of performance were UK focussed equity funds and property. In both cases, concerns over the cyclical outlook and the negative impact of rising bond yields on valuation outweighed the significant buffer offered by cheap valuations. Within equity markets there was a noticeable tension between weak performance from companies on the back of disappointing trading updates and continued corporate activity. The former suggests in the short-term markets have not priced in the more challenging economic conditions whilst the latter provides comfort that valuations look attractive for patient investors prepared to take a longer-term view.

Wise Multi-Asset Growth

In August, the TB Wise Multi-Asset Growth fund was flat, ahead of the CBOE UK All Companies Index (-1.7%) but behind the IA Flexible Investment sector (+0.5%). As we mentioned, there were few places to hide last month but some of those could be found in emerging markets whose economies, in many cases, are behaving differently from the developed countries struggling with rampant inflation and dismal growth. A lot of emerging countries, particularly the frontiers ones (i.e. the smallest in the universe) are either used to high inflation or not seeing current inflation anywhere near past records. Their growth is also often idiosyncratic and somewhat insulated from broader macro-economic trends. In the larger countries, we mentioned Brazil a couple of months ago, which presents strong fundamentals, cheap valuations and has been in a tightening interest rates cycle for the past 18 months already. It was one of the strongest markets in August, up more than 6% in US Dollar terms. Those factors helped take our emerging markets holdings to the top of the contributors’ list in August, particularly Somerset EM Discovery, Blackrock Frontiers Investment Trust and Mobius Investment Trust. Other notable contributors were Blackrock World Mining Trust and Ecofin Global Utilities and Infrastructure Trust which continue to play well in the inflation theme. Finally, Pantheon International, which we added to recently because of the, in our view, unjustifiably large discount, saw the latter tightened and also helped our performance.

On the negative front, Oakley Capital Investments, unlike Pantheon above, suffered from a discount widening despite its recent solid results and announcements of cash deployment into new acquisitions which should support future growth. Caledonia Investments also saw discount volatility impacting its share price and Aberforth Smaller Companies Trust was weak alongside the broader UK smaller companies sector.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Income

From a trading standpoint we have remained cautious choosing to slightly build the cash position preferring to sit on our hands. We took advantage of some relative valuation opportunities, switching Schroder Midcap into Aberforth Smaller Companies and some Blackrock World Mining into Blackrock Energy & Resources. We took some profits in Ecofin Global Utilities & Infrastructure and John Laing Environmental, partially reinvesting the proceeds into GCP Infrastructure. Finally, we exited our holding in Standard Chartered and initiated a holding in Twenty Four Strategic Income, an unconstrained fund that seeks value from across global bond markets.

Wise Multi-Asset Growth

Given the doubts we expressed about the equity rebound in July, we refrained from participating in the excitement and took a cautious approach. As such, we increased our cash from 3.6% at the start of the month to 4.4% at the end, through inflows and by taking some profit in Caledonia Investments before its discount widened (it had tightened from 30% in July to 22% mid-August, before widening again to 28%). Otherwise, we continued to build our position in the VPC Specialty Lending we mentioned in last month’s commentary. Finally, we took advantage of some price volatility to switch some of our positions. For example, we exited our position in the Polar UK Value Opportunities to switch into the Fidelity Special Values Trust, back at an 8% discount. We also took some profit in the Ecofin Utilities and Infrastructure Trust which benefitted in recent months from both strong Net Asset Value and price performance, and switched some of our exposure into the Premier Miton Global Infrastructure Income Fund, which gives us access to the same theme but, being an open-ended fund, hasn’t seen the same price increase recently.

Thanks to our increased cash buffer, we will be ready to take advantage of opportunities as and when those present themselves over the next few weeks.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.