For Professional Clients Only

Macro & Market Update

The re-election of Donald Trump dominated the month as investors attempted to determine what a second term as President might mean for financial markets. Despite starting to factor in the prospect of a return to office over the course of the summer, markets are now faced with the real challenge of trying to work out which of the policies announced over the last few months are likely to be implemented and which represent a position from which to negotiate. A clean sweep of the presidency, the House of Representatives and the Senate in theory gives Trump a free run at implementing economic policies that could range from lowering corporate taxes, extending existing loose government spending, imposing stringent tariffs on global trading partners, combatting illegal immigration and altering the course of US foreign policy, notably towards the Ukraine and in the Middle East. However, it is worth noting that unlike in his first presidential term when the economy was recovering, interest rates were low and there was some scope to increase the fiscal deficit, this time round there is more limited room for manoeuvre whilst as a result the scope for market volatility is greater in the event of a policy mis-step. The immediate impact of the election has been to see the US dollar strengthen, especially against those currencies where higher tariffs are most likely to be imposed. US equity markets have taken the result well, with notably strong performance from smaller US companies which are deemed to be the largest beneficiaries of an ‘America First’, lower tax economic policy. Financials, particularly US banks also performed strongly as the market bets on stronger economic growth, a favourable tailwind from higher interest rates and less stringent regulation. Looking beyond the policy speculation to the reality of political appointments, these have been at once eye-catching, sometimes concerning and other times reassuring but fulfilling the expectation that Trump 2.0 will continue to be unpredictable. A vaccine-denying former Democrat put forward as choice to lead the US health department and a lawyer investigated for sex-trafficking to run the justice department proves either that Trump is unconcerned about ruffling feathers or is one step ahead of everybody else, knowing that these candidates are unlikely to make it through the selection process which will make any alternatives more palatable by comparison. Elsewhere, whilst loyalty has been favoured over experience, the important nominations for Treasury Secretary and Secretary of State are considered less controversial.

Against this political backdrop, the Federal Reserve elected to cut interest rates by a further 0.25% in the immediate aftermath of the election. Despite Trump’s stated policies widely anticipated to be inflationary and likely to make future monetary policy loosening harder to deliver, the Federal Reserve responded to the current reality of lower inflation and signs of a cooler labour market. Higher US government bond yields over the period suggest markets are more optimistic about near-term economic growth but recognise this will come at the expense of higher inflation and higher medium-term interest rates.

Elsewhere, the Bank of England also cut interest rates by 0.25% and outlined its assessment of the recent budget, which it forecasts will add 0.75% to GDP and 0.5% to inflation in a year’s time. Businesses, notably in the retail sector, added their verdict on the national insurance and minimum wage changes with a group of leading retailers expecting these changed to cost the sector over £70bn which is likely to be mitigated through a combination of higher prices and job losses. In Europe, political disruption spread with the German chancellor ending its coalition which heralds elections in the New Year whilst in France the government sits on the brink of collapse in response to the recent budget. Finally, in China an underwhelming fiscal package to bail out local governments was announced with investors hoping that this reflected a need to keep powder dry in case a new US administration imposed further import tariffs.

Fund Performance

Wise Multi-Asset Growth

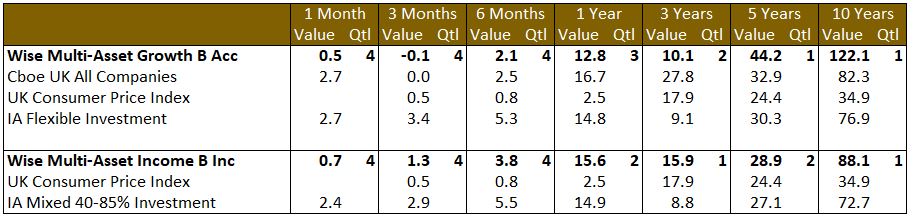

In November, the IFSL Wise Multi-Asset Growth Fund was up 0.5%, behind both the CBOE UK All Companies Index (+2.7%) and its peer group, the IA Flexible Investment Sector (+2.7%). The month was one of contrast between the perceived winners under the upcoming Trump regime and the losers. As such, US equities performed the strongest, which hurt us compared to our peer group because we are underweight the region due to its high valuation and concentration risk. Our holdings exposed to countries at risk of new tariffs suffered, mostly in Asia and Emerging Markets, as well as BlackRock World Mining due to concerns about China and the impact of tariffs on global growth. The Jupiter Gold & Silver Fund was also a detractor, following gold lower after the result of the US election. Finally, UK equities, particularly smaller companies, struggled in the aftermath of the Budget, hurting our positions in Aberforth Smaller Companies and Odyssean. It is worth noting that mergers and acquisitions (M&A) are accelerating in the UK though post-Budget as international and private buyers try to take advantage of attractive valuations. This should benefit our positions in the region over time.

Wise Multi-Asset Income

In November, the IFSL Wise Multi-Asset Income Fund was up 0.7%, behind its peer group, the IA Mixed Investment 40-85% Sector, which rose 2.4%. US equities, where the fund is underweight given high valuations and low yields, rose strongly over the month as perceived winners from the US election. Strong local market performance was compounded by the strength of the dollar. By contrast, European and emerging market equities lagged as markets digested the prospect of higher tariffs. Similarly, Blackrock World Mining suffered as investors were unconvinced by the fiscal stimulus package in China and concerns over the economic outlook. The performance of our UK equity holdings also struggled in the wake of the budget, particularly our position in Aberforth Smaller companies, which saw discount widening on top of lacklustre net asset value growth. Despite fears that the budget could lead to lower growth and higher inflation in non-governmental areas of the UK economy, there have been a continued number of corporate bids which reflect the discounted valuation of the UK stock market. These twin pressures of lower growth and higher inflation also impacted our property and infrastructure holdings over the month despite the high discounts that would appear to already reflect these concerns. Bright spots were found in our private equity positions, ICG Enterprise and CT Private Equity, our financials holdings, Polar Capital Global Financials and Paragon as well as Middlefield Canadian, where an activist shareholder has built a material stake.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

It was a busy month in terms of portfolio activity. We added two new positions in misunderstood investment trusts which should eventually see their strong returns in Net Asset Value (NAV) complemented by a tightening of their wide discounts. Firstly, Pershing Square, a concentrated portfolio of quality, predictable and attractively valued large US companies trading at 35% discount despite an exceptional 21-year track record. The idiosyncratic drivers of the portfolio, away from the expensive technology companies driving the US market, and the wide discount create an interesting means of adding to our US equity exposure with some margin of safety. The second new position is RIT Capital Partners, a portfolio of global public and private companies combined with some downside protection strategies. The trust suffered in the past from a lack of transparency and concerns about valuations of its private portfolio but we believe changes in management over recent months should reassure investors and lead to a normalisation of the discount to reflect the consistent NAV performance.

Wise Multi-Asset Income

Over the month, we sold out of our holding in Abrdn Property Income following the announcement of its wind-down related asset sale as well as reduced our holding in Abrdn Asian Income and Middlefield Canadian Income. The latter has performed strongly as its net asset value has recovered and the discount has narrowed materially. We topped up our holding in Empiric Student Property as well as built on our holding in the Premier Miton Strategic Monthly Income Bond Fund. Finally, we took advantage of weakness in International Biotechnology Trust following the nomination of Robert Kennedy Jr as US Health secretary to add to our position.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.