For Professional Clients Only

Macro & Market Update

Unusually for the month of December, so-called risk assets (equities, bonds, commodities) failed as a group to benefit from end-of-year optimism which often pushes prices higher around Christmas time. In part, this was because Santa came early, after the decisive victory of Donald Trump in the US presidential election, which led to record monthly inflows into US equities in November. Although generally thought to be market-friendly, Trump brings with him a heavy dose of uncertainty due to his unusual political style and often self-interest motivations. This convinced some investors to bank their profits for the year early in December. After the best two-year run since 1998 in US equities, this seemed like a sensible approach. Cautious profit taking was not the only reason for lacklustre performance, however. Stubborn inflation as well as strong employment numbers led the US central bank (the Fed) to indicate that the pace of interest rate cuts for the year ahead will be slower than initially anticipated. This did not prevent them from cutting rates by 0.25% at their December meeting, but this was already well priced in by market participants who assumed that the Fed wanted to get one last rate cut out of the way before Trump came into power in January. The less supportive rhetoric for the path of interest rates in 2025 pushed US government bond yields (which move inversely to prices) higher, as well as the US dollar (sensitive to rates differentials between the US and other countries) to a two-year high.

In the UK, data was not supportive either. Inflation for the month of November increased on the month before, both for the headline number and the core one which excludes volatile figures from food and energy prices. Wage inflation, in particular, increased more than anticipated by the Bank of England. Meanwhile, jobs numbers came down and the UK economy contracted month-on-month delivering a blow to the Labour government. Its recent budget, with increased National Insurance and minimum wages, was blamed for the sharpest drop in manufacturing confidence since the Covid crisis making it a challenging task from here for Labour. Despite the uncertain economic backdrop, stubborn inflation led the Bank of England to keep interest rates on hold at its December meeting and to leave investors without clear guidance for the months ahead. By contrast, the European Central Bank’s decision to cut by another 0.25% was a foregone conclusion since inflation is seemingly under control in the EU and growth remains a concern. This led sterling to its highest level versus the euro since the Brexit referendum. In China, subdued growth pushed the central bank to change its language for the first time since the Great Financial Crisis of 2008 and indicated that its policy will be “moderately loose” instead of “prudent” as an apparent recognition that more action than already announced in the past few months is needed to boost consumption.

Finally, it is worth noting how unstable the global political situation is and how much of a risk this will remain for investors in the months ahead. In December, governments collapsed in France and Germany and a motion of no-confidence seems likely to be pushed forward in Canada in a matter of weeks. The US government only averted a shutdown by agreeing its budget with hours to spare. Meanwhile, the South Korean president was impeached after his brief enactment of martial law and the end of the Al-Assad regime in Syria shows some apparent frailty in Putin’s Russia. All of these leadership crises ahead of further disruptions that Donald Trump will undoubtedly bring are a concern that investors will have to contend with in 2025.

Fund Performance

Wise Multi-Asset Growth

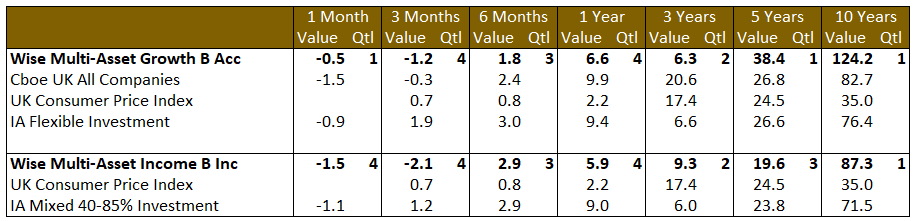

In December, the IFSL Wise Multi-Asset Growth Fund was down 0.5%, ahead of both the CBOE UK All Companies Index (-1.5%) and its peer group, the IA Flexible Investment Sector (-0.9%). Our healthcare names had a difficult period largely due to worries about what to expect from Robert F. Kennedy Jr. at the head of Health and Human Services in the upcoming Trump administration. His lack of expertise, anti-vaccine and conspiracist views are unnerving for investors in the sector. His appointment is yet to be confirmed by the US Senate, however, and, if appointed, while possibly disrupting for large pharmaceutical companies reliant on insurance payments, it would not be in his power or interest to jeopardize the innovative biotechnology sub-sector we invest in. Our infrastructure positions also struggled in a higher bond yield environment as they are often –wrongly so in our opinion- treated like bond-proxies.

On the positive side, our exposure to China helped performance following the new encouraging signals from its central bank. Our global equity names also performed well, particularly the more defensively positioned (Caledonia Investment and RIT Capital Partners). Our recently added position in Pershing Square also performed well despite difficult returns from the broader US equity market.

Wise Multi-Asset Income

In December, the IFSL Wise Multi-Asset Income Fund was down 1.5%, behind its peer group, the IA Mixed Investment 40-85% sector, which fell 1.1%. The biggest detractors to performance came from our most interest rate sensitive sectors, property and infrastructure. Company specific news flow was limited but where companies updated the market, the news was generally positive. HICL Infrastructure’s largest holding, Affinity Water, received a positive final regulatory determination from the OFWAT, the Water Regulator. A higher allowable return as well as total allowed expenditure over its next regulatory period should allow both for an uplift in net asset value as well as improved coverage of its dividend. Pantheon Infrastructure announced a positive quarterly net asset value return, which means the company has exceeded the top end of its annual targeted return range within 9 months. Despite this, discounts to net asset values widened across our infrastructure and property holdings as the market responded to higher bond yields. Despite inherent inflation protection, International Public Partnerships, Ecofin Global Utilities and Infrastructure, Empiric Student Property, Urban Logistics and Helical all fell. The second area of weakness was our commodity holdings, Blackrock World Mining and Blackrock Energy & Resources, as markets digested weak economic growth in China and the prospect of a more uncertain global economic outlook as monetary policy remains more restrictive and the threat of tariffs looms. In general, our equity funds performed well as did our private equity holdings, CT Private Equity and ICG Enterprise. Paragon provided an excellent full year results update although its share price was relatively unchanged over the month. There was, however, a notable widening in the discount at Middlefield Canadian Income as an activist investor who has been supporting the share price in recent months closed in on the natural limit of its allowable holding of close to 30% of the company. Whilst this removes the largest marginal buyer of the shares, we now wait to see how this situation develops and whether the intention is to force the board into a managed wind-down of the trust which has now returned to a greater than 10% discount to net asset value.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, we took some profits in our global names (AVI Global, Ruffer Equity & General), Japan (AVI Japan Opportunity), private equity where discounts have tightened somewhat and in Man Undervalued Assets Fund in the UK. These proceeds were recycled into the healthcare sector mentioned above where we believe the market’s knee jerk reaction to headlines should correct itself based on the strong fundamentals displayed in the sector. We thus added to Worldwide Healthcare Trust and RTW Biotech Opportunities. We also continued to build our positions up in the Premier Miton Strategic Monthly Income Bond Fund and the RIT Capital Partners Trust.

Wise Multi-Asset Income

Over the month, we switched within our commodity fund holdings due to their relative recent performance as well as their relative discounts and liquidity. We trimmed our holding in Polar Capital Global Financials, following a strong period of performance for the Trust, notably in the aftermath of the US presidential election, whilst topping up our holdings in the Aberforth Smaller Companies and Urban Logistics where performance has been weak.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.