For Professional Clients Only

Macro & Market Update

Investors kicked off 2023 in a positive mood as confidence grew both that slowing inflation would allow central bankers to moderate the pace of interest rates increases and that the anticipated hit to global economic growth might prove less severe than feared. Annual inflation in the US fell in December to its lowest level in more than a year, strengthening the view that price pressures have peaked. The rate of increase in the consumer price index declined for a sixth consecutive month, registering an annual increase of 6.5 per cent. While still near a multi-decade high, this was the lowest level since October 2021 and represents a notable decline from the 9.1 per cent reached in June. Compared with the previous month, prices dropped 0.1 per cent. Investor expectations grew that US monetary policy would see two further 0.25% increases followed by a pause. Early in February the first of these was delivered and markets responded well to Jerome Powell, the Fed Chair’s comments that the ‘disinflationary process’ was underway and that he saw a path to bringing inflation down to its 2% target without a ‘really significant economic decline or significant increase in unemployment.’ Thus far US GDP growth and employment data has continued to surprise positively so it was helpful to hear that the Fed believes inflation falling does not have to come at the cost of a severe US recession. There were similarly encouraging inflation releases in the UK and continental Europe and more positive GDP data for the final quarter of 2022, which show that the impact of tighter monetary policy and high energy costs were less negative that feared. Whilst gas prices remain well ahead of their pre-Ukraine invasion levels, they are now more than 80% below their peak reached last summer. As a result of a mild winter, consumption cuts and replacement sources of supply for Russian gas European storage capacity has been replenished and the risks of a European energy crisis are receding. Interest rates rose by 0.5% both in the UK and Europe early in February, however, the Bank of England signalled it has now ended the period of automatic rises making further rate rises conditional on bad inflation news from here. Reflecting its lower level of interest rate, the ECB expect to increase rates by a further 0.5% in March.

This combination of a lower expected peak for global interest rates than feared last year and better than expected historic economic growth has led to upward revisions in growth projections for most regions across the world, the first such revisions we have had in several quarters. This has been further buoyed by the positive news flow coming out of China, which (with all the usual caveats) suggests that the recent Covid spike post the abandonment of the zero Covid policy has peaked and that there has been a sharp rise in tourism, hospitality and manufacturing activity compared to last year. Following a year of weak economic growth in 2022, the global economy would welcome a rebound in activity from this spluttering engine in 2023.

A better outlook for growth and valuations underpinned by lower interest rate expectations formed a positive backdrop for all global equity markets as well as bond markets. The strongest performers were European equity markets, which benefited directly from the more positive growth backdrop as well as hope that export growth to China can now pick up as the economy opens up following the relaxation of its Covid policy. Industrial Commodities, such as Copper and Iron Ore, were strong for the same reason. The US dollar continued its decline against other currencies that started in September last year.

Fund Performance

Wise Multi-Asset Growth

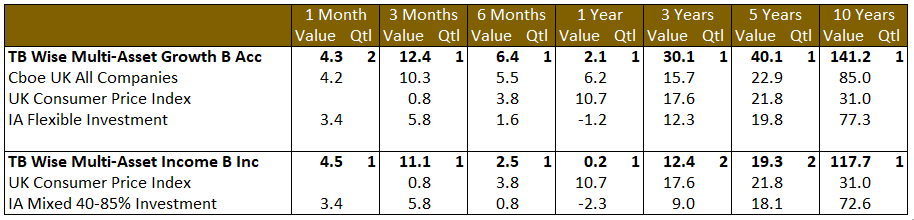

In January, the TB Wise Multi-Asset Growth fund was up 4.3%, ahead of both the CBOE UK All Companies Index (+4.2%) and its peer group (+3.4%). Generally, the positive market sentiment helped most of our holdings’ underlying performance as well as, for investment trusts, tighten their discounts. Our top contributors were, unsurprisingly, related to some of the themes mentioned earlier. Our managers with direct Chinese exposure performed strongly (Fidelity China Special Situations, Templeton Emerging Markets), as did the ones with indirect exposure, via commodities for example (BlackRock World Mining). Helped both by the positive developments in Europe and the exposure of the asset class to global growth (and thus China), the European Smaller Companies trust also performed well. Its performance was also boosted by an anomalously wide discount early in the month, which we took advantage of. Another strong performer, unrelated to broad markets developments was Oakley Capital Investments, a listed private equity trust. We have argued for a long time that discounts on private equity trusts are too wide, even accounting for lagged falls in their Net Asset Values (NAV). Oakley was the first trust in the sector to update its NAV for December and it continued to show how resilient its portfolio is, with a full year NAV growth of 24%, in sharp contrast to the performance of listed equities markets last year. Encouragingly, that performance was mainly driven by operational growth in its companies and was supported by exits at premiums throughout the year. As its discount tightened following those results, we took some profits in our position and recycled those into Pantheon International which continues to trade at a more than 40% discount.

Wise Multi-Asset Income

In January, the TB Wise Multi-Asset Income Fund was up 4.5%, ahead of the IA Mixed Investment 40-85% Sector, which rose 3.4%. The January xd (when income accrued is set to be distributed) marks the final dividend for 2022 giving a yield of 4.7% that year, making it the top monthly distributing fund in the sector. Our equity investment trust holdings performed well with strong performance across all geographies. Schroder Global Equity Income, CC Japan Income & Growth, Temple Bar and abrdn Asian Income were notably strong. Our two commodity exposed funds also performed well, reflecting underlying commodity markets. Despite significant reductions in Net Asset Values (NAV) for the December year-end to reflect increased interest rates, a number of our property holdings (eg Ediston, Urban Logistics, abrdn Property Income) performed strongly. Prior discounts to NAV more than compensated investors for the negative impact from higher interest rates whilst operational performance and rental growth remain strong. Subsequent falls in 10-year government bond yields since the year-end mean these valuations can hopefully form a base to build on rather than the start of further cuts to come. Despite positive performance from their lows, discounts still look attractive and wide compared to written down NAVs. Elsewhere, our direct holdings in the financials sector (Paragon, Provident Financial and Randall & Quilter) all provided encouraging trading updates and performed strongly. Finally, CT Private Equity rose as public markets rebounded, peers reported robust NAV updates and its extremely wide discount narrowed to a more reasonable level.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

Over the month we took some profits in strong performers BlackRock World Mining, Fidelity Asian Values, Odyssean, JO Hambro UK Equity Income, Schroder Global Recovery and Oakley Capital Investments. We also finished exiting our position in GCP Infrastructure. Some of those proceeds were kept in cash and the rest was recycled into relative underperformers (European Smaller Companies, Fidelity Special Values, Templeton Emerging Markets, Worldwide Healthcare, TR Property and Pantheon International). We believe it remains an environment where value discipline is key.

Wise Multi-Asset Income

During the month we slightly trimmed our direct equity and equity fund holdings. Given the strong rebound in equity markets since October we reduced our holdings in abrdn Asian Income, Man GLG Income and Paragon. We partially reinvested the proceeds into Temple Bar, where the discount looked attractive again. Finally, we took some profits in Blackrock World Mining, which has also performed very strongly since the Summer.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.