For Professional Clients Only

Macro & Market Update

After the strong start of the year for most so-called risk assets, a change of tone started to appear in financial markets, particularly within bonds. On the macro-economic front, inflation, while continuing to abate, did so at a slower pace than anticipated by markets, particularly core inflation which strips out volatile energy and food components. Through the month, this led to a noticeable repricing of inflation expectations from the January low. Meanwhile, economic growth continued to surprise on the upside with the US reporting the lowest unemployment rate since 1969 and all three of Europe, the UK and Japan narrowly avoiding a recession so far and reporting stronger economic activity numbers. Sticky inflation and robust economic data are not conducive to central banks taking their foot off the hike pedal and bond markets pivoted sharply in February to correct recent optimistic forecasts of an upcoming pause in interest rates hikes and, even more extreme, of rate cuts in the US later in the year. The benign interest rate forecasts were, to some extent, fuelled at the start of the month by the US and UK central banks who hiked rates but hinted that their punitive financial tightening measures might be approaching the end. The inflation, employment and economic data that subsequently came out cast doubt on the probability of a “soft landing” taking place, however. This is the scenario by which central banks will manage to rein inflation in without engineering a recession. Faith in a “soft landing” was behind the strong markets performance in recent months as inflation showed signs of receding while growth remained strong. With recent data suggesting inflation possibly proving harder to fight off than previously thought and growth remaining solid, markets are now migrating towards a “hard landing” scenario again, by which central banks have to continue increasing rates to bring prices down and have no reason to hold back given the strength of the economy. Historically, sharp interest rates hikes led to recessions (the price to pay to keep inflation under control), hence causing a “hard landing”.

The transition from the soft to hard landing mentality was apparent in bond markets in February. Global investment grade (i.e. the best quality) government and corporate bonds, after recording their strongest ever start of a year in January, gave all their gains back. The yield (which moves inversely to price) on US 2-year government bonds returned to the high they reached last November, indicating that bond investors believe, once again, that interest rates will rise further thus requesting a higher margin of safety to justify holding bonds. At the beginning of February, markets were pricing in a 59% probability of a rate cut in the US by the end of the year. At the time of writing, that probability has dropped to 21% and a 70% chance of a rate hike is now priced in. Such moves in such a short period of time are wild and one would expect them to be reflected in equity markets too. The “hard landing” scenario would certainly not be a pleasant one for equities either and, if nothing else, higher interest rates would discount future cashflows further, reducing their present value and thus current securities prices. It was then surprising for equities to only record modest losses in February -if any- and to remain well ahead of where they started the year. Growth stocks, in particular, which performed very strongly to start the year, proved a lot more resilient than could have been anticipated since they are the ones where cashflows are the most at risk from higher discount rates.

The rapid shift in tone in bond markets suggests that volatility is here to stay and that risks remain on the horizon.

Fund Performance

Wise Multi-Asset Growth

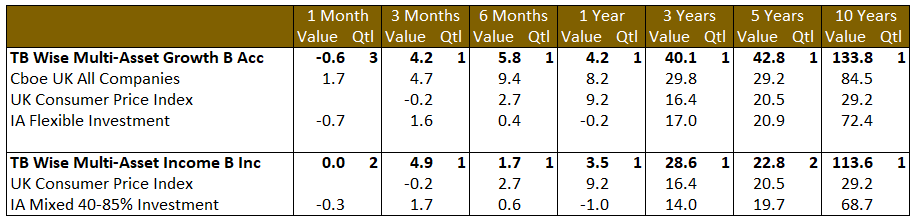

In February, the TB Wise Multi-Asset Growth fund was down 0.6%, behind the CBOE UK All Companies Index (+1.7%) but slightly ahead of its peer group, the IA Flexible Investment Index (-0.7%). Our worst performers were related to emerging markets, particularly China where the excitement of the post-Covid reopening lost some momentum. This affected our positions in Fidelity China Special Situations, as well as Templeton Emerging Markets and BlackRock World Mining given the dominant influence of China on commodity markets. In that space, our position in the Jupiter Gold & Silver Fund also gave back some of its recent gains, hindered by higher real interest rates (rates after inflation) which make holding precious metals less attractive compared to holding cash. On the positive front, our equity value strategies continued to perform well (Schroder Global Recovery, Lightman European, Fidelity Special Values), as well as Oakley Capital Investments which saw a further tightening of its discount.

In the same listed private equity space, our second largest holding, Pantheon International, a trust we have gradually been added to for the past few months, delivered good half-year results with continued strong revenue and earnings growth, as well as realisations well above the assets’ value in the trust. This indicates that their private assets remain robust despite fears that they would follow the lead from listed equities lower, that the trust’s valuations are conservative, and that the 45% discount on the trust remains unjustifiably wide.

Wise Multi-Asset Income

In February, the TB Wise Multi-Asset Income Fund was flat, ahead of the IA Mixed Investment 40-85% Sector, which fell 0.3%. Our UK equity funds performed strongly driven by positive performance from the Oil & Gas and Telecoms sector as well as bid rumours around Standard Chartered and an approach for John Wood Group. Our direct financial holdings performed strongly with encouraging updates from Numis and Randall & Quilter, with the latter announcing the sale of a US subsidiary. Despite a broader backdrop of bond market weakness, the fund’s bond positions delivered a positive return. Twenty Four Income demonstrated the attractions of the floating rate nature of its holdings (where the coupons it receives increase as interest rates rise as opposed to being fixed) as it announced it was able to increase its minimum dividend target from 7p to 8p, having already increased this target from 6p last September. Our Asian exposed holdings, including our commodity positions, detracted from performance reflecting the dollar headwind and as markets paused for breath following a strong China re-opening bounce.

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of activity, early in the month we rotated from recent outperformers into relative laggards by switching out of open-ended UK funds into Fidelity Special Values and taking profits in Fidelity China Special Situations to rotate into the KLS Corinium Emerging Markets Fund. Later on, growing increasingly concerned about the market reassessment of future interest rates, the strong recent performance, and the increasing divergence between bond and equity markets, we also raised cash from 2.1% to 4.8%. We did so by taking profits across European equities (European Smaller Companies Trust, Lightman European), China (Fidelity China Special Situations) and frontier markets (BlackRock Frontiers), UK equities (JO Hambro UK equity Income, Man GLG Undervalued Assets, Aberforth Smaller Companies) and technology (Herald). We continued to top up Worldwide Healthcare though as a defensive growth play trading at a wide discount.

Wise Multi-Asset Income

We used the continued relative strength in equity markets to slightly reduce our exposure, trimming our holdings in Blackrock Frontiers, CT Private Equity, Paragon and GLG Income. In addition, we exited our holding in Randall & Quilter as we were somewhat disappointed by the price achieved for their announced disposal and its timing. We partially reinvested the proceeds into Ediston Property and Fidelity Special Values but were happy to increase the cash position on the portfolio to 4.6% given recent market strength.

space gap

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the TB Wise Funds, including risk warnings, are published in the TB Wise Funds Prospectus, the TB Wise Supplementary Information Document (SID) and the TB Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our-funds The TB Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium-to-long term. Every effort is taken to ensure the accuracy of the data used in this document, but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No. 768269. T. Bailey Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 190293.