Wise Multi-Asset Income

Fund Ratings

Investment Objective

The Fund aims (after deduction of charges) to provide:

- an annual income in excess of 3%: and

- Income and capital growth (after income distributions) at least in line with the Consumer Price Index ("CPI"), over Rolling Periods of 5 years.

Fund Attributes

- A flexible, diversified portfolio that can invest in all asset classes.

- Targets an attractive and growing level of income.

- The portfolio invests both direct and through open and closed-ended funds.

- Adopts a value biased investment approach.

- Pays monthly

Investor Profile

- Seek an attractive level of income and the prospect of long term capital growth.

- Accept the risks associated with the volatile nature of an adventurous multi-asset investment.

- Plan to hold their investment for the long term, 5 years or more.

Key Details

| Target Benchmark | UK CPI |

|---|---|

| Comparator Benchmark (Sector) | IA 40-85% Investment Sector |

| Launch date | 3rd October 2005 |

| Fund value | 71.7 million |

| Holdings | 35 |

| Historic yield | 4.0% |

| Div ex dates | First day of every month |

| Div pay dates | Last day of following month |

| Valuation time | 12pm |

- Past performance is not a guide to the future and outperforming target benchmarks is not guaranteed.

- The historic yield reflects distributions over the past 12 months as a percentage of the price of the B share class as at 30th November 2025. Investors my be subject to tax on their distributions.

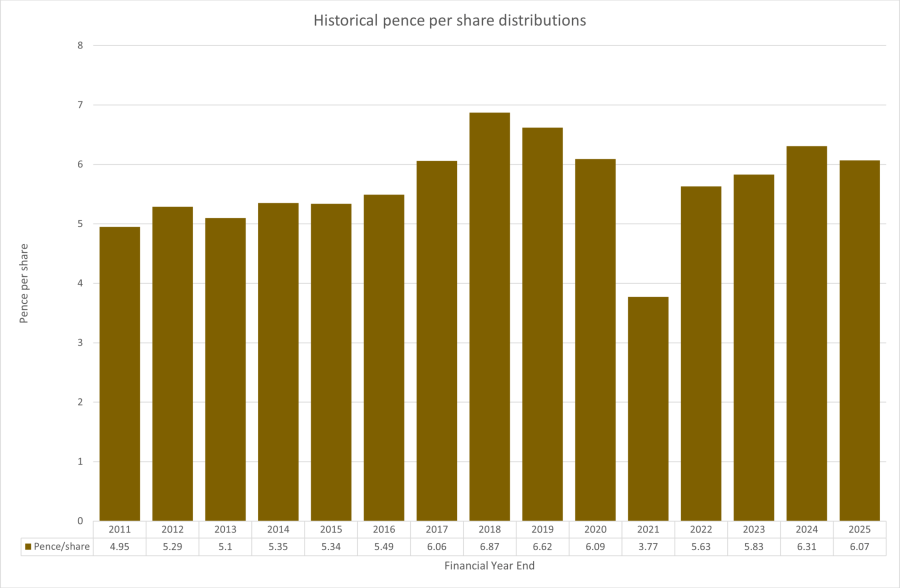

Dividend Information

Pence/share figures relate to the fund’s financial year ending in February of the relevant year.

For a breakdown of the dividends, please click here

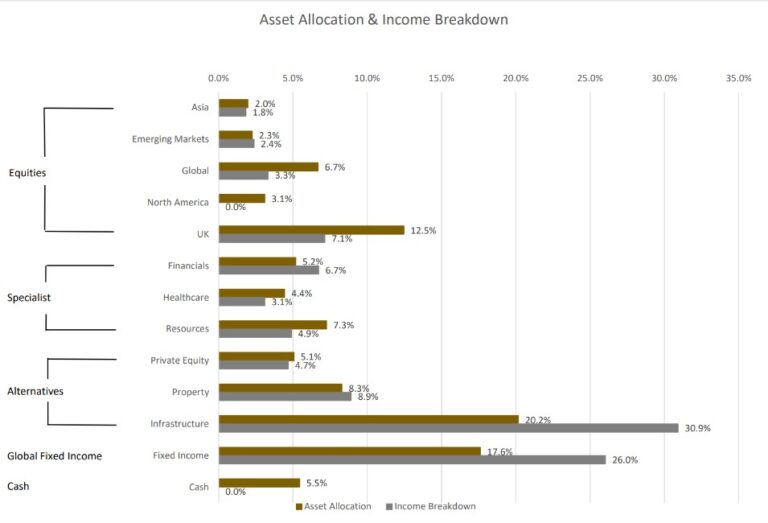

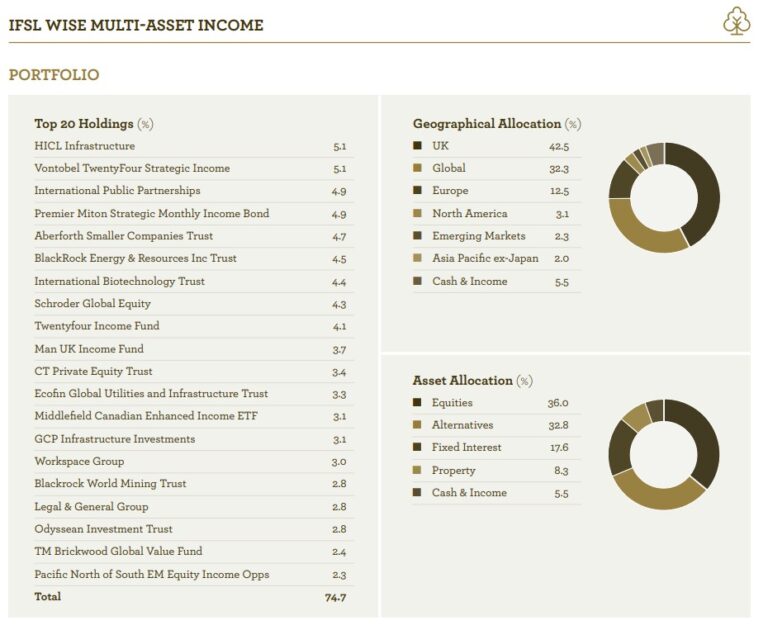

Investment Portfolio - November 2025

Source – Wise Funds Limited as at 30th November 2025.

The asset allocation is derived from the full portfolio holdings and the income data shows where the the current yield is being accrued from by asset class.

- Past performance is not a guide to the future

- Data as at 30th November 2025

Share Class Information

| | B Acc (Clean) | B Inc (Clean) | W Acc (Institutional) | W Inc (Institutional) |

|---|---|---|---|---|

| Sedol Codes | B0LJ1M4 | B0LJ016 | BD386V4 | BD386W5 |

| ISIN Codes | GB00B0LJ1M47 | GB00B0LJ0160 | GB00BD386V42 | GB00BD386W58 |

| Minimum Lump Sum | £1,000 | £1,000 | £50 million | £50 million |

| Initial Charge | 0% | 0% | 0% | 0% |

| IFA Legacy Trail Commission | Nil | Nil | Nil | Nil |

| Investment Management Fee | 0.75% | 0.75% | 0.50% | 0.50% |

| Operational Costs | 0.16% | 0.16% | 0.16% | 0.16% |

| Look-through Costs | 0.16% | 0.16% | 0.16% | 0.16% |

| Ongoing Charges Figure 12 | 1.07% | 1.07% | 0.82% | 0.82% |

All performance is still quoted net of fees.

- The Ongoing Charges Figure is based on the expenses incurred by the fund for the period ended 28th February 2025 as per the UCITS rules.

- Includes Investment Management Fee, Operational costs and look-through costs.

The figures may vary year to year

Fund Commentary - November 2025

Financial markets experienced another volatile month. Global equity markets fell in the first half of the month, driven by shifting interest-rate expectations and renewed concern over Artificial Intelligence related technology spending, was followed by a recovery into month-end. Equity volatility rose to levels last seen around the “liberation day” shocks earlier in the year when President Trump announced sweeping tariff measures.

In the US, the main question was whether the Federal Reserve (Fed), the US central bank, would cut rates again this year. Early in the month, expectations for a rate cut in December fell after minutes from the Fed’s October meeting were released highlighting a larger than expected group of members were more worried about persistently high inflation than the need to further reduce interest rates. When employment data, delayed because of the recent government shutdown, was released, it showed a firmer rebound in hiring than expected, reinforcing the case for patience. Towards the end the month, however, public remarks from influential policymakers signalled support for further action, increasingly the likelihood of another 0.25% rate cut in December and supporting markets in the process. In the UK, the Budget dominated sentiment. Comments in the run-up to the budget by the Chancellor around weaker productivity affecting future economic growth forecasts coupled with the need for higher welfare spending steered voters and investors to conclude the government was set to break manifesto promises and increase income tax. This was subsequently abandoned causing concern in bond markets over how the proposed increased government spending was to be funded. This uncertainty pushed government bond yields higher and weighed on the shares of domestically-focussed companies. In the end the Budget itself confirmed that the overall level of taxation will rise over the coming years to cover increased spending, although with much of the fiscal pain pushed into the later part of the parliamentary term. Across Europe, economic data were steady and expectations remain that interest rates are unlikely to reduce any more in the near future. A broader issue affecting markets was a reassessment of the artificial-intelligence (AI) investment cycle. Several large US technology companies announced further increases in AI-related capital expenditure. While this underlined the long-term structural story, it also raised questions about the pace of future cash flow generation and whether these investments would generate sufficient returns. This contributed to the mid-month pullback in growth-oriented parts of the market.

Against this backdrop, developed-market equities weakened into the middle of the period before recovering part of their losses as comments from the Fed and corporate earnings helped to stabilise confidence. Asia ex-Japan saw only a modest rebound, while Japan lagged more clearly given the upward pressure on local bond yields. Bond markets were comparatively stable, with small moves in US and Eurozone yields and a more pronounced rise in Japan. UK government bond yields finished broadly flat after an initial pre-Budget rise.

In November, the IFSL Wise Multi-Asset Income Fund rose 0.2%, ahead of the IA Mixed Investment 40–85% sector, which fell -0.5%. Portfolio performance showed wide dispersion. Biotechnology, commodities, private equity and certain of our UK equity holdings contributed positively while infrastructure, renewables and some property exposures detracted. Biotechnology was the clearest positive, with International Biotechnology Trust extending its recent strong performance as sentiment towards the sector continued to recover. Our commodity and private-equity holdings also performed well, driven mainly by underlying net asset value (NAV) gains. Industrial-metals, such as copper, benefited from higher prices later in the month reflecting supply constraints, whilst the gold price moved higher after a pull-back at the end of last month. CT Private Equity’s well-received results helped its discount to narrow whilst ICG Enterprise Trust delivered another portfolio realisation. Within listed equities, our UK holdings (notably domestically focussed companies and financials) were supported by attractive valuations, solid company updates and a modest improvement in sentiment once the Budget removed some uncertainty. By contrast, the renewables sector was one of the weakest performers. The main pressure came from the government’s consultation on changing how older renewable projects are allowed to increase their subsidy revenues with inflation. Many of these assets operate under long-standing support schemes designed to provide inflation-linked income. At present, those payments rise each year in line with the Retail Price Index (RPI), which has grown faster than the Consumer Price Index (CPI). The consultation proposed switching from RPI to CPI—or freezing increases until CPI “catches up” with RPI. Whilst these proposals would permanently reduce the expected long-term inflation-linked income from existing projects for these companies and reduce the net asset values, longer term they also undermine investor confidence in the subsidy support needed to fund future investment.

At the same time, the sector was grappling with strategic setbacks. Bluefield Solar’s proposal to internalise its management and pivot towards a more growth-oriented model, funded in part by changes to its dividend policy, was met with strong shareholder resistance. The board withdrew the plan and instead launched a formal sale process, but not before the shares had fallen sharply. Soon afterwards, the proposed merger between HICL Infrastructure and The Renewables Infrastructure Group (TRIG) also met investor opposition. Although presented as a way to create a larger, more diversified platform, the terms were widely viewed as favouring TRIG shareholders and the manager. HICL investors raised concerns around valuation, strategy and governance, and the deal was ultimately abandoned. Performance from our property holdings was mixed. Flexible office operator, Workspace, detracted as the market focused on a NAV reduction in its half-year results. However, underlying operational trends were more encouraging, with improving enquiry conversion and better tenant retention offering early signs that occupancy may be nearing a trough whilst further disposals of non-core assets at prices in line with book value. Given the deep discount at which the shares trade, we see these operational improvements as more important for long-term value than a single valuation adjustment. Elsewhere, Picton Property Income delivered steady interim results with modest NAV growth supported by buybacks and reversion potential.

During the month, we initiated a new holding in Picton Property Income, a diversified UK property company with a strong bias to industrial assets. The company is looking to drive value by increasing rental income as vacant space is let up and underlying rents increase. We added also to more domestic UK businesses, such as Workspace, London Metric, LifeScience Reit and Aberforth Smaller Companies. Given the recent strength in performance, we reduced our holding in International Biotechnology Trust, which has nearly doubled since its lows in April.