For Professional Clients Only

Macro & Market Update

September 2025 was a strong month for global markets, with equities, bonds, and commodities all advancing. This came despite a challenging backdrop of slowing growth, sticky inflation, and ongoing political uncertainty. Investors found reassurance in resilient company earnings, expectations of further monetary support from the Federal Reserve (Fed), and enthusiasm for structural themes such as technology and artificial intelligence.

The United States remained the central focus. Revised GDP data confirmed the economy had grown faster earlier in the year than first reported, helped by resilient consumer spending. However, this strength is increasingly reliant on higher-income households benefitting from stock market gains, while broader consumer confidence weakened. Labour market indicators softened, with September’s employment report disappointing and previous figures revised sharply lower, pointing to a less robust jobs market than previously thought. Inflation pressures persisted, with tariffs pushing prices higher and the Fed’s preferred gauge remaining above its 2% target. Balancing weaker employment data against sticky inflation, the Fed cut interest rates by 0.25% to 4.0–4.25%, its first move lower this year. The widely expected decision gave further support to equities and strengthened expectations of additional cuts ahead. Bond markets responded to changes in monetary policy. Shorter-dated yields (more directly impacted by interest rate expectations) fell on the back of the Fed’s rate cut and expectations of additional easing, while longer-dated yields (a function of longer-term inflation, growth and government spending expectations) also drifted lower. Somewhat counter-intuitively, gold simultaneously rose to record highs as investors sought to protect themselves against long-term uncertainties (high debt levels, persistent inflation risks, and a more volatile political environment) that bond markets appeared to downplay. On the last day of the month, the inability of Congress to agree a budget triggered the first U.S. government shutdown in seven years.

In Europe, the outlook remained weak. Activity indicators continued to soften, while inflation stayed above target. The European Central Bank left interest rates unchanged for the second consecutive meeting, and markets now assume the easing cycle has run its course. Political instability added to the noise, with yet another change of Prime Minister in France highlighting the challenges of governing without a majority. Even so, European equities gained, supported by resilient earnings, optimism around U.S. growth, and expectations of lower U.S. interest rates. The UK also faced difficulties. Growth remained sluggish while inflation was higher than in most other advanced economies. The Bank of England kept rates at 4%, with investors cutting back expectations for rate cuts through to mid-2026. Attention turned to the Labour Party conference, where speculation of a potential leadership challenge to Keir Starmer unsettled sentiment. A shift toward more expansive government spending could weigh heavily on the UK’s fiscal credibility, a key concern given already high deficits and sensitivity in the government bond market.

With the Autumn Budget due in November, markets will be focused on whether fiscal discipline can be maintained. UK equities gained modestly but underperformed global peers, while gilt yields were steady. Elsewhere, China remained under pressure. Industrial activity contracted for the sixth consecutive month, reflecting weak demand and ongoing stress in the property sector despite repeated stimulus measures. Chinese equities rose but lagged other Asian markets. Japan, by contrast, delivered strong equity performance, supported by corporate reforms and steady foreign investor inflows. Elsewhere, emerging markets benefited from a softer U.S. dollar, which eased financial conditions and supported capital flows.

Commodities also performed strongly in September. Gold surged to record highs on safe-haven demand. Copper strengthened as well, with supply disruptions at major mines, including Freeport-McMoRan’s Grasberg operation, limiting output at a time of structurally strong demand from electrification and renewable infrastructure. Oil was more subdued as investors worried that OPEC+ might add supply into a market already showing signs of excess.

Fund Performance

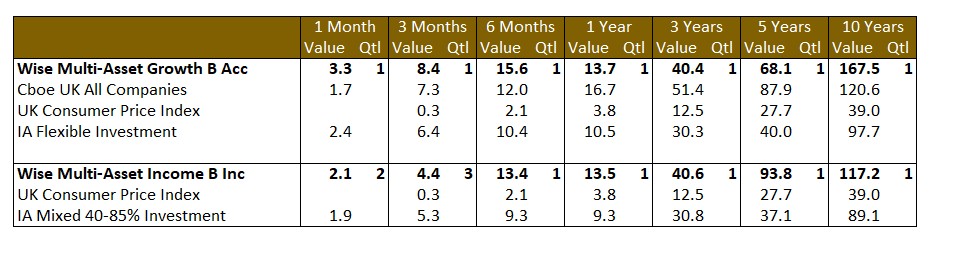

Wise Multi-Asset Growth

In September, the IFSL Wise Multi-Asset Growth Fund was up 3.3%, ahead of the CBOE UK All Companies Index (+1.7%) and its peer group, the IA Flexible Investment sector (+2.4%). Our performance drivers were a good illustration of the dynamics we described above where both riskier assets and defensive ones performed strongly at the same time. Our positions in gold, via the Jupiter Gold & Silver Fund and the BlackRock World Mining Trust (about 30% of its assets) continued to be strong contributors with gold pushing to new all-time highs but, more importantly and the basis of our investment case, with gold miners outperforming the move in the underlying metal. The sector remains very cheap and with cash generation extremely high thanks to record gold prices, these miners are starting to attract generalist investors’ attention. We would expect this trend to continue even if gold were to plateau from here, given how wide the miners’ margins currently are. Through the Jupiter fund, we also get exposure to silver which has lagged gold and has a lot of upside potential from here.

Wise Multi-Asset Income

Against this backdrop, the IFSL Wise Multi-Asset Income Fund rose 2.1%, ahead of the IA Mixed Investment 40–85% sector, which gained 1.9%. The fund benefitted from strong performance across resources, infrastructure, biotechnology, and a broad range of equity strategies. Resources were a clear highlight. BlackRock World Mining and BlackRock Energy & Resources delivered strong gains, helped by discount narrowing and commodity price strength. Infrastructure also performed well. International Public Partnerships reported solid interim results, with Net Asset Value (NAV) growth supported by buybacks, disposals, and robust dividend cover. Its commitment to projects, such as the Sizewell C nuclear facility, underscored the long-term growth potential of the trust. Pantheon Infrastructure was another strong contributor, with interim results showing NAV gains, portfolio revaluations, and a new investment commitment. Inclusion as a constituent in the FTSE 250 Index and a dividend increase further underpinned confidence. HICL Infrastructure also advanced, supported by stable operations and reliable income. Biotechnology was another bright spot. International Biotechnology Trust rose strongly, helped by a wave of high-profile M&A (mergers and acquisitions). Roche acquired 89Bio at an 80% premium to the prevailing share price, Pfizer agreed to buy Metsera at up to a 110% premium, and Genmab announced a deal for Merus at a 41% premium. All three were held in the portfolio, crystallising value. At the same time, uniQure delivered highly positive trial results in Huntington’s disease, which drove its shares sharply higher. These developments highlighted two themes long central to the trust: breakthrough innovation and large pharmaceutical companies using acquisitions to replenish pipelines as patents expire. Equity fund holdings also contributed positively, reflecting broad-based market strength. Accordingly, Man GLG Income, Fidelity Special Values, Middlefield Canadian Income, Schroder EM Value, and Aberdeen Asian Income all delivered strong gains over the month. The weaker areas of performance were UK property and financials, where stubborn inflation, slow growth, and political uncertainty weighed on sentiment.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, we maintain a cautious view of markets in the short term and thus continued to take profits in some of our strongest performers, namely Jupiter Gold & Silver, BlackRock World Mining, Lightman European, Templeton Emerging Markets and Fidelity Special Values. This helped raise our cash modestly to above 4.5%, leaving some powder dry to be redeployed if volatility picks up. We also topped up our holding in RIT Capital Partners where the persistently wide discount seems unjustified to us.

Wise Multi-Asset Income

Over the month, we took some profits in our holding in Blackrock World Mining following strong performance. We added to HICL Infrastructure and International Public Partnerships given the persistently wide discounts, attractive valuations and reduced sensitivity to UK economic growth. We increased our holding in the Odyssean Investment trust, a fund with a concentrated exposure to undervalued UK mid-sized companies where there is an opportunity to unlock value via strategic, operational or managerial improvements. The sector exposure is tilted towards technology and industrials with a weighting towards overseas rather than domestically generated revenues. We also topped up the Renewables Infrastructure Group, Bluefield Solar, Workspace and Helical on weakness.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds. The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.