For Professional Clients Only

Macro & Market Update

While headline performance numbers for global assets look relatively benign for April, it was as volatile a month as back to the worst of the Covid pandemic in 2020 or the Great Financial Crisis of 2007-09. The reason was the widescale tariff war launched by Donald Trump whose magnitude and many incoherences took investors, politicians and corporate management by surprise. The fact that Trump was considering tariffs should not have been a surprise. This was indeed well telegraphed during his election campaign and has been an obsession of his for decades (“Tariff is the most beautiful word in the dictionary”). Expectations, however, were that those tariffs would be justified and targeted. Instead, the tariffs announced on April 2nd are incoherent and global, muddying the message and creating uncertainty. Trump’s administration appears to use trade deficits (when a country imports more goods and services than it exports) as a proxy for unfair trade practices. While there are many unfair practices the US can claim to have been the victim of, particularly from China, which would justify some retaliation, trade deficits themselves are not unreasonable if goods cannot be manufactured domestically or if consumers want products that are more cheaply manufactured abroad. Equating deficit and unfairness is thus a gross simplification at best. If reducing trade deficits is the goal, in order for example to bring manufacturing back into the US (a laudable objective), it seems unlikely that a surprise tariff announcement on all the countries in the world at once would lead to the correct outcome given how complex global supply chains are and the length of time required to shift production from one country to another. Without the support of incentives to boost manufacturing in the US announced in parallel to the punitive measures, the probability is that corporates will try to “ride the wave” and wait until the next administration despite paying lip service to the President. Furthermore, if abolishing deficits is the goal, why target countries the US has a trade surplus with, like the UK? One other reasonable justification for the tariffs would be to hurt China and achieve a trade deal. If so, it seems that antagonising all the US trade partners at once is a strange strategy to bring them on side. With China appearing more consistent and predictable than the US at the moment, Trump’s approach might prove counterproductive. Finally, as this approach is described by some as a textbook Trump negotiating tactic, using the madman theory to create chaos and thus gain an advantage in negotiations, it is questionable how well it can work when the element of surprise is diminishing by the day, when all negotiations are done publicly and when the end goal seems shiftable and unclear to most.

A lot more could be written about the tariffs, as has been done in hundreds of news articles over the past month, but some of the questions above are the ones that sent volatility soaring in April. As the month progressed, pauses, industry and country-specific concessions, and hints that Trump is willing to make quick deals appeased investors. US equities fell 15% peak-to-trough in the 3 days following the tariffs announcement, before rebounding another 15% into the month-end. This illustrates how difficult it is to navigate markets driven by tweets from a notoriously mercurial US President, and the importance of not over-reacting. It is notable, however, that it was not the drop in equities that led to a more conciliatory tone from Trump, unlike what would have been expected from his first mandate where equity performance was usually dictating his willingness to pursue or abandon a policy. In this case, it was the weakness in the bond market, leading to higher bond yields and thus higher debt servicing costs for the US government that triggered a softening of the approach. Normally, bonds act as a safe haven when equities fall sharply, as does the US dollar, but the simultaneous weakness in US equities, bonds and dollar following the tariffs announcement suggest a nervousness from global investors about the future role of the US on the global stage. If the perception of the US being an unreliable partner deepens, one should expect geopolitical and economic alliances to be redrawn over the next few years. In the shorter term, we will pay attention to hard economic data out of the US to monitor the impact of tariffs and uncertainty on employment, inflation and consumption. The US GDP figure at the end of the month was weak but this was due to a sharp increase in imports as companies increased inventory ahead of tariffs being implemented. So far, the underlying economy has remained robust, so future datapoints will be crucial.

Fund Performance

Wise Multi-Asset Growth

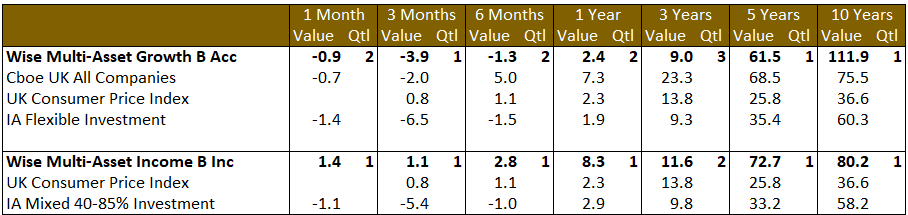

In April, the IFSL Wise Multi-Asset Growth Fund was down 0.9%, behind the CBOE UK All Companies Index (-0.7%) but ahead of its peer group, the IA Flexible Investment sector (-1.4%). In a very volatile month, our strongest contributors were assets seen as the less at risk from the threat of tariffs. These were UK equities, thanks to the conciliatory tone of the conversations between Trump and Starmer so far. This even benefitted the smaller companies which often suffer more in down markets but which, this time, got support from being more domestically oriented and thus insulated from tariffs. In a similar vein, TR Property performed well (buildings are not exported or imported). Our infrastructure positions, which tend to be domestically driven and localised, also had a positive month. Finally, although volatile, our position in the Jupiter Gold and Silver Fund helped performance as gold was seen as the ultimate safe haven in April sending the precious metal to a new all-time high of $3,500 per ounce. The Jupiter fund was up almost 20% trough-to-peak intramonth.

While our portfolio direct sensitivity to tariffs is low due to a low allocation to US equities, low direct consumer exposure and, generally, high pricing power from our underlying companies, the uncertainty and the weaker US dollar impacted our positions in private equity and healthcare. Our position in China also suffered as it is unclear how the standoff with the US will evolve.

Wise Multi-Asset Income

Despite intra-month volatility for both the fund and its benchmark, the performance over the month highlights the merit of remaining calm in times of market stress and the reassurance that can be derived from an investment process with a focus on valuation underpinned by a high level of covered income. In April, the IFSL Wise Multi-Asset Income Fund rose 1.4% ahead of its peer group, the IA Mixed Investment 40-85% sector, which fell 1.1%. The best performance came from the infrastructure and property sector, supported by highly visible future earnings and another possible bid for our largest property holding, Urban Logistics. We have increased the fund’s exposure to infrastructure, notably to renewables at the beginning of March, as wide discounts look at odds with the net asset values (NAV) which now reflect higher bond yields. The emergence of activist investors in the property sector forcing boards to crystallise discounts to NAV either by selling assets or the companies themselves will no doubt also be seen in the infrastructure sector if discounts persist.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

We believe that our Fund remains well positioned for the months ahead despite the uncertainty, benefitting from diversification at the asset class and geographical levels, as well as valuation support which is critical when future growth forecasts are unclear. Changes in the portfolio have thus been limited last month, and we are encouraged to hear from our underlying managers that they too remain on the front foot as opposed to being reactive to headlines. As markets suffered the most in the first half of the month, we took some profit in strong performers (Pacific G10 Macro Rates, TwentyFour Strategic Income, AVI Japan Opportunity, Jupiter Gold and Silver) and took the opportunity to top some positions up at attractive prices (RIT Capital Partners, Odyssean, International Biotechnology, ICG Enterprise). Strong future performance is built in periods of stress and, while we cannot know whether the worst of this crisis is over yet or not, we believe that it is a good time to be invested.

Wise Multi-Asset Income

We took advantage of the significant falls in certain assets during the month to increase our holdings. International Biotechnology trust was notably weak as was Helical, despite announcing the disposal of a development building which will generate a healthy profit. We also added to our holding in the Renewables Infrastructure Group funding these purchases from positions (TwentyFour Strategic Income and Urban Logistics) which have held up well and where there is less near-term upside.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds. The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard your investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.