For Professional Clients Only

Macro & Market Update

The rapid shift in geopolitical and economic landscape that started since President Trump took office in January continued at pace last month. Tariffs dominated headlines once again as Trump intends on using them as his weapon of choice to extricate all sorts of concessions from his counterparts. In March, further tariffs were imposed or threatened on China, Mexico, Canada, the EU, aluminium and steel, autos and auto parts, Venezuelan oil importers, Russian oil importers, etc…leading, in return, to retaliations -or threats of- from the affected parties. With April 2nd dubbed “Liberation Day” when Trump announced the US will apply reciprocal tariffs globally, a full-on trade war is now taking place making it difficult to fully forecast given the chaotic and unpredictable nature of the various attacks launched by the US President. In parallel, the government spending cuts directed by Elon Musk, full of bravado but, so far, with little positive progress to show for his scorched earth approach to cost cutting, and the hard to comprehend series of U-turns from Trump with regards to his peace negotiations in Ukraine all leave a long trail of uncertainty. At the political level, the clear intent of the US to retreat from global affairs has so far led to an impetus for former allies to stand on their own two feet. In Europe, conversations are quickly taking place about increased -and possibly, pooled- spending on defence with the strongest shift in attitude observed in Germany. The new Chancellor managed to get up to 1 trillion Euro extra spending in defence and infrastructure over the next few years, a previously taboo subject given Germany’s reluctance to use debt as a financing tool. Similarly, in Canada, the Liberal Party benefitted from a regain in nationalism sprung from Trump’s attacks, making it the main topic of debate in the upcoming elections called by the new Prime Minister, Mark Carney.

Meanwhile, all this uncertainty created by Trump is also permeating the economic sphere with increasing fears of a stagflationary environment (a combination of low to no growth and high inflation) worrying consumers, financial markets and central bankers alike. A consumer survey from the respected University of Michigan showed that, for the first time in at least 50 years, a majority of consumers mentioned government economic policies without being solicited. Other surveys also show that fears of higher inflation are increasing while expectations that the US stock market will rise under Trump are falling. Indeed, most of the so-called “Trump trades” placed after his election in anticipation of strong returns (such as broad US equities and specific names like Tesla, smaller companies, the US Dollar, Bitcoin…) have now fully or substantially reversed their gains since last November. The US central bankers also mentioned this uncertainty as their reason to cut their growth forecast for 2025 while increasing their inflation forecast thus leaving the base interest rate unchanged. Although economic data itself remains robust in the US, the longer the uncertainty lasts and the more likely it will find its way into the economy.

This uncertainty was also mentioned outside of the US, for example in the UK where the Bank of England used it as a reason not to cut its rates further, despite inflation surprising to the downside during the month. The lack of clarity on the international front, as well as domestically, were also discussed by the Office of Budget Responsibility (OBR) when they reduced growth forecasts in the UK for 2025 ahead of the Spring Statement. At the event, the Chancellor Rachel Reeves used a number of tweaks to restore an eroded fiscal headroom, but it remains one of the smallest on record so more spending cuts and/or capital raises will likely be due in the annual October Budget.

Fund Performance

Wise Multi-Asset Growth

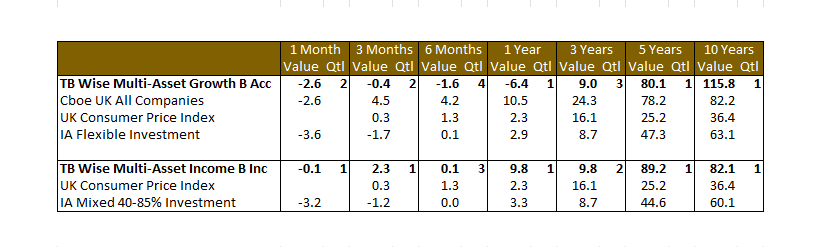

In March, the IFSL Wise Multi-Asset Growth Fund was down 2.6%, in line with the CBOE UK All Companies Index (-2.6%) but ahead of its peer group, the IA Flexible Investment sector (-3.5%). In what proved a tricky month for most developed equity markets, particularly for US equities where the change in sentiment over the past few weeks is the most dramatic given the lofty valuations on display until recently. They recorded their worst quarter in 3 years as a result, a sharp contrast with European equities which benefitted from opposite factors (cheap valuations and improving sentiment).

Unsurprisingly in a challenging month, our best contributors to performance were our more defensive positions, particularly Jupiter Gold & Silver which continue to benefit from record high gold prices and strong related performance in gold miners. Our infrastructure (Ecofin Global Utilities and Infrastructure) and bond names (TwentyFour Income) also played a positive role in this environment. On the negative side, our positions in biotechnology and healthcare remain challenged, as do our smaller companies managers in the UK and private equity.

Wise Multi-Asset Income

In March, the IFSL Wise Multi-Asset Income Fund fell marginally (-0.2%), ahead of its peer group, the IA Mixed Investment 40-85% sector, which fell 3.2%. The fund’s strongest performance came from two sectors, property and infrastructure, where share prices have become most dislocated from their underlying net asset value (NAV). Such wide discounts mean the look-through returns on offer to shareholders more than compensate for recent increases in the cost of money. Investors are getting increasingly active in expressing their dissatisfaction given how long these discounts have persisted and, in the absence of corporate activity, are putting pressure on boards to take action to realise asset value. Within the property sector the fund benefitted from a bid for Care REIT, a nursing home landlord, from a US based competitor at a 33% premium to its previous share price. In addition, a group of activist shareholders have requisitioned an Extraordinary General Meeting (EGM) to replace the board at Urban Logistics following an ill-thought-through proposal to bring an external management team in-house. The shares moved higher in anticipation that they will be successful in refreshing the board and a consequent strategic review will lead to disposal of the portfolio close to stated NAV. Our two other holdings, Empiric Student Property and Helical, both trade at substantial discounts and are similarly under pressure as the status quo is untenable. Helical was boosted by a successful planning approval for a change of an asset’s existing use from office to student accommodation. Both HICL Infrastructure and International Public Partnerships committed to further asset disposals and share buybacks whilst INPP changed the basis on which fees are charged to a more shareholder friendly structure. Corporate activity in the batteries renewables space provided support to the wider infrastructure sector over the month. Despite widespread equity market weakness over the month, our focus on value managers and not holding US equities helped relative performance. Schroder Emerging Market Value performed strongly partially offsetting weakness from International Biotechnology Trust, Middlefield Canadian Income and our private equity trusts.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

It was a busy month from a portfolio activity standpoint. Firstly, we added a basket of listed infrastructure names where we think the pain suffered over the past couple of years could be starting to come to an end. Many of the trusts in the sector over-issued shares at a time when they were seen as the only place to get a reliable income when government bond yields were low. In a higher rate environment, valuations had to be adjusted, and these trusts now need to prove their worth to investors faced with more income-generating choices. Asset sales over recent weeks suggest that the Net Asset Values (NAVs) can now be trusted, while discounts of 25-35% and attractive dividend yields provide a margin of safety. From a timing standpoint, the sector has attracted interest from private buyers and activists recently, and boards are under pressure to show willingness to address the wide discounts. We think this could provide an interesting entry point into the sector. A similar argument could be made in the property sector where we topped up our holding in TR Property. We also used the increase in risk aversion to add to some of our positions on weakness, namely Pershing Square, Odyssean and ICG Enterprise.

These additions were financed by full exits in some of our small positions with less upside potential after good performance (European Smaller Companies Trust, Fidelity Asian Values, Polar Capital Financial Trust) as well as some profit taking across a number of other positions, including Jupiter Gold & Silver mentioned earlier.

Wise Multi-Asset Income

The largest change to the portfolio over the month came from the addition of the Renewables Infrastructure Group, Bluefield Solar and Greencoat UK Wind. The renewables sector has seen NAVs under pressure from higher bond yields, lower power prices and a poor year of wind and sunshine. Beyond this, shares have further diverged from fundamental value with discounts reaching extreme levels and now offer high, well-covered dividend yields and attractive rates of return. We funded these new positions by trimming TwentyFour Income and TwentyFour Strategic Income. Elsewhere, we exited our Care Reit holding and reduced our holding in abrdn Asian Income whilst adding to Aberforth Smaller Companies, Helical and International Biotechnology Trust.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.