For Professional Clients Only

Macro & Market Update

January saw the inauguration of Donald Trump and with it considerable uncertainty over what a second Presidency will entail. Investors as well as central bankers have been faced with the challenge of trying to decipher which policies are likely to be enacted and which represent a negotiating position and then determine what the economic impact of those policies might be. Trump’s second presidential term hit the ground running with a series of executive orders announced that reversed policies of the previous Biden regime. $300bn of potential Federal infrastructure spending that formed part of the Inflation Reduction Act was put at risk, the US withdrew both from the Paris Climate Pact and the World Health Organisation, people convicted for the US Capitol riots in 2021 were officially pardoned and all Federal Diversity, Equity and Inclusion staff were put on leave. Whilst this flurry of activity was significant, the two key areas markets are focussed on are what level of tariffs will be imposed on the US trading partners and how the Federal budget deficit will evolve over this presidential term. Over the month investors were encouraged that threats made to impose blanket 60% tariffs on Chinese imports during the election campaign were scaled back to 10% and took heart that perhaps the threat of a full-scale global trade war was merely a means to extract concessions, such as Canadian and Mexican military personnel to protect the US border. Uncertainty, however, prevails over the question of tariffs with the month ending with threats of 25% tariffs on Mexican and Canadian imports and 10% on those from China.

The US continues to perform strongly with the economy delivering GDP growth in 2024 just shy of that delivered in 2023 (2.8% vs 2.9%). This was far stronger than expected at the start of the year driven by healthy labour markets and strong consumer spending. Payroll figures at the start of the month did not show any sign of weakness and with inflation sitting well above the Federal Reserve’s target rate of 2%, it came as little surprise that the central bank kept rates on hold and signalled rates would remain so until they had had time to assess the potential inflationary impact of raising trade barriers, cutting taxes and limiting immigration. This was a marked contrast to both the Eurozone and the UK. The Eurozone economy stagnated in the fourth quarter of 2024 and, despite some stickier than expect inflation data, drove the ECB to cut interest rate by a further 0.25%, their 5th cut since last summer. The situation facing the Bank of England is somewhat trickier. Despite clear signs the UK economy is weakening, persistently high levels of inflation are restricting the Bank of England’s ability to inject a boost to the economy by cutting interest rates whilst higher levels of government borrowing than expected are pushing up yields on longer-dated government debt. GDP figures announced showed the UK economy barely grew (0.1%) in November and payrolled employment fell whilst retail sales unexpectedly contracted in December. The prospect of imported inflation from US tariffs and higher UK borrowing than expected in December pushed up long-term borrowing costs with 30-year government bond yields surpassing the level seen in the aftermath of the Liz Truss budget. There was, however, some respite towards the end of the month as inflation data for December came in slightly below expectations and provided some optimism that the Bank of England will be able to cut rates at its upcoming meeting. Elsewhere, Japan increased interest rates as economic activity, inflation and wage growth no longer justified abnormally loose monetary policy. China announced that it had hit its target of 5% GDP growth in 2024, however, subdued price growth both for consumers and manufacturers points to an economy struggling to grow.

Beyond economic news, a ceasefire was agreed between Israel and Palestine. In addition, from a corporate standpoint investors were surprised by an announcement from Chinese Artificial Intelligence company, Deepseek, that its AI model was able to deliver comparable results to US rivals, OpenAI and Meta, but at a fraction of the cost. This spooked investors given the narrowness of recent market performance and saw many AI-exposed names fall significantly as the validity of the company’s claims are interrogated.

Fund Performance

Wise Multi-Asset Growth

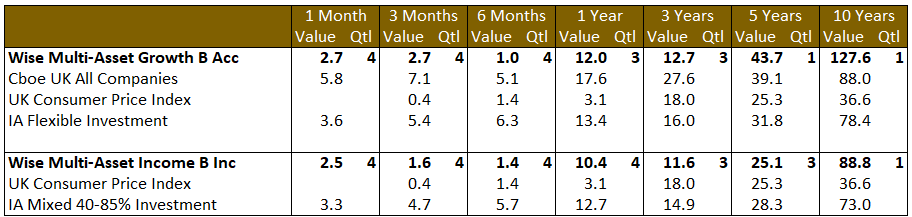

In January, the IFSL Wise Multi-Asset Growth Fund was up 2.7%, behind both the CBOE UK All Companies Index (+5.8%) and its peer group, the IA Flexible Investment sector (+3.6%). In the main UK equities market, larger companies which tend to be the most sensitive to global macroeconomic factors lifted the benchmark higher while small and medium-sized companies languished. This detracted from our relative performance because small companies are where we find the most valuation upside and we think are the most likely to benefit from the revival in corporate activity (mergers and acquisitions or M&A) which is showing the first signs of emerging.

On the positive side, however, our strongest absolute performer was the Jupiter Gold and Silver Fund, helped by a new all-time high in the gold price driven by fears that it might be impacted by tariffs from the Trump administration. Our strongest contributors to performance were our healthcare names, to which we have been adding on weakness for the past few months. Robert F. Kennedy Jr’s appointment as the head of Health and Human Services is not yet confirmed but his hearing in front of the Senate committee was, at times, intense. He appears to have downplayed his most controversial views such as his past anti-vaccine stance and it looks increasingly likely that, if confirmed to the role, his main preoccupation will be on the food side of his mandate rather than drugs. This helped with the general sentiment in the healthcare sector but the key performance driver for our names over the month was positive specific news flow. International Biotechnology Trust had his top holding ITCI (7% of the portfolio) acquired by Johnson & Johnson at a 40% premium, illustrating not only the strength of the stock selection from the managers but also a restart of M&A activity after a hiatus pre-US election. RTW Biotech Opportunities also announced strong results from clinical trials in one of its obesity drugs as well as in a cirrhosis drug. We continue to expect that the strong level of innovation, the cheap valuations on offer, and a sector-wide appetite to acquire competitors will deliver further attractive returns from our holdings in healthcare and biotechnology.

Wise Multi-Asset Income

In January, the IFSL Wise Multi-Asset Income Fund rose 2.5%, behind its peer group, the IA Mixed Investment 40-85% sector, which rose 3.3%. Hopes that Trump’s bark was going to be worse than his bite when it came to tariffs as well as more confidence that the European Central Bank and the Bank of England were in a position to cut interest rates buoyed global equities. Our financial holdings were notably strong helped by a more optimistic assessment for the outlook for global growth as well as positive trading update from Paragon, a specialist lending company, which pointed to healthy new business volumes and better than expected margins and arrears. This positive sentiment was shared more broadly by our equity, private equity and commodity funds. Sentiment, however, towards UK smaller companies remains weak given the economic pressures faced by domestic companies, notwithstanding a pick-up in mergers and acquisitions seen in recent months. We received positive news from our specialist biotech holding, International Biotechnology Trust, which announced a bid for its largest holding, Intra-cellular Therapies, at a 40% premium. This is the third time in recent years the trust has seen its largest holding subject to a takeover and reflects the pressure faced by large pharmaceutical companies to replenish their pipelines as existing drugs face the expiry of patent protection. Similarly, Pantheon Infrastructure announced its first portfolio disposal of electricity generator, Calpine, at a healthy premium to net asset value. The main drag on performance over the month came from our core infrastructure holdings where intra-month volatility in 30-year bonds saw shares in the sector fall but not recover despite bonds having recovered all their losses by the month end.

All data is in a total return format

Past performance is not a guide to future performance

Portfolio Changes

Wise Multi-Asset Growth

In terms of portfolio activity, the only change of note was some profit taking in our position in European Smaller Companies Trust after a sharp tightening of its discount.

Wise Multi-Asset Income

Over the month we trimmed a number of holdings which have performed strongly. Notably we trimmed abrdn Asian Income, CT Private Equity, Blackrock Energy & Resources, Middlefield Canadian Income and Polar Capital Global Financials.

TO LEARN MORE ABOUT THESE FUNDS, PLEASE CONTACT

01608 695 180 OR EMAIL JOHN.NEWTON@WISE-FUNDS.CO.UK

WWW.WISE-FUNDS.CO.UK

Full details of the IFSL Wise Funds, including risk warnings, are published in the IFSL Wise Funds Prospectus, the IFSL Wise Supplementary Information Document (SID) and the IFSL Wise Key Investor Information Documents (KIIDs) which are available on request and at wise-funds.co.uk/our funds The IFSL Wise Funds are subject to normal stock market fluctuations and other risks inherent in such investments. The value of your investment and the income derived from it can go down as well as up, and you may not get back the money you invested. Capital appreciation in the early years will be adversely affected by the impact of initial charges and you should therefore regard y our investment as medium to long term. Every effort is taken to ensure the accuracy of the data used in this document but no warranties are given. Wise Funds Limited is authorised and regulated by the Financial Conduct Authority, No768269. Investment Fund Services Limited is authorised and regulated by the Financial Conduct Authority, No. 464193.